The bandwagon effect is in full swing in the cryptosphere as Bitcoin takes aim at surpassing it’s 2017 all-time high. The rest of the coins, understandably, are along for the ride.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

Bitcoin

market cap $345,789,547,897

I’m a bit more than a little amused at the bandwagon behaviour that’s going on that now Bitcoin’s started performing well again. Yes. Sure. They’re within four digits of their all-time high, and set to beat that resistance point at this rate possibly by early next week. Now people who were shitting on it when it was touching on $3,000 this time a year and a half ago are talking about how they’ve always been believers.

Sure.

Regardless, here we are, closing in on all-time numbers courtesy of a pandemic, and a lack of confidence in existing systems of wealth resulting in record amounts of quantitative easing. Kind of a double-edged sword, isn’t it?

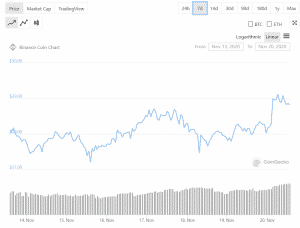

Ethereum

market cap $57,843,995,599

The excitement for Ethereum 2.0 may be a little early, as Vitalik Buterin took to Twitter this week to remind his faithful that Ethereum 2.0’s rollout won’t be arriving all at once on December 1. Instead, it’s a two year transformation arriving in multiple stages.

Highlighting a comment I made in the reddit AMA yesterday that got buried but I think expresses something important: pic.twitter.com/NR2Y7GWY9U

— vitalik.eth (@VitalikButerin) November 19, 2020

This suggests that we’ll have to wait for a gradual rollout to see if the changes to Ethereum’s ecosystem have any discernible effect.

Tether

market cap $18,193,754,872

Last week, they were the subject of a mass-exodus of cryptocurrency wherein people bailed on Huobi for Binance after they acquired China’s attention, now some whale has surfaced and blown $400 million out of its porthole back into Huobi. It sounds like someone’s covering some variety of shortfall here. Two of these transactions came from an unknown address for a total of $304 million, while another $100 million came from Bitfinex.

XRP/Ripple

market cap $14,547,570,462

Most free floating cryptocurrencies tag along with Bitcoin when it goes on a run, and XRP isn’t exempt from this. But that’s not enough for Brad Garlinghouse, the CEO of XRP’s parent company. He says that the reason why XRP isn’t doing as well as anticipated is because of regulatory uncertainty.

There’s no even playing field for all cryptocurrencies in this regulatory climate, Garlinghouse offered.

“Bitcoin was the only one with the hall pass” and cryptocurrencies like XRP, which have to get along without Bitcoin’s clarity, performed worse if at all.

“Are they gonna choose a platform where there is regulatory clarity, like Bitcoin, or something that has uncertainty like XRP. So it has been a huge challenge. […] The regulatory clarity allowed investment to flow in Bitcoin […] But here in the US, when you talk about what JPM or Goldman Sachs is doing, they start with Bitcoin. Or even Square is an example, Square has said they support Bitcoin and Bitcoin Cash, well, do I think this it where they will be in 1 year, 2 year or 3? I’m doubtful on that. […] I think the regulatory uncertainty has people allowed to focus on Bitcoin at the expense of some of the other technology platforms,” said Garlinghouse.

It’s a fair assessment. If Bitcoin had a backing company to muddy the waters regarding whether or not their token was a commodity or a security, maybe it wouldn’t have attracted the attention it has.

Chainlink

market cap $5,596,181,885

It shouldn’t come as a surprise to anyone involved or paying attention to the cryptocurrency ecosystem that decentralized finance platforms get hacked. There’s money changing hands in a digital atmosphere, where digital security offers both challenge and reward. It’s the technical equivalent of a toreador flashing a red flag in front of a bull—a signal to charge, to challenge and to the winner go the spoils.

In this case, it’s Value DeFi, a yield farming protocol which lost $6 million on Saturday when someone shot a hole in their unaudited, centralized price oracle. Now they’ve gone to Chainlink, with their decentralized oracles, presumably to close the security weakness and ensure it doesn’t happen again.

Decentralized finance has a lot of the same problems as … well, everything else in the cryptocurrency atmosphere… if it hasn’t been hacked, it will be. That’s annoying for exchanges, but we can avoid it. It’s absolute death for DeFi if they don’t solve it.

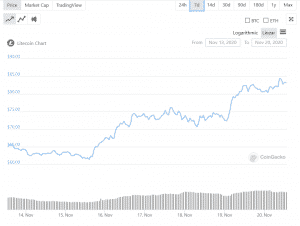

Litecoin

market cap $5,504,977,149

Back when I was first being introduced to all things crypto, over tacos in a mall food court while I was trying to study for something completely different, I was told that the key investments that would serve me best over time were Bitcoin and Litecoin. The ratio as it was communicated to me was 80-20 BTC to LTC. Ignore the other coins. Ethereum’s only good if you’re a programmer, Bitcoin Cash is a pointless waste of space because nobody will want to hold it or use it like Ver says they will because of its volatility, and XRP will be tamped down by government soon enough.

They’re prejudices I still hold to some extent. Litecoin’s gotten its bell rung over the past few years courtesy of the rise of the hype surrounding ICO’s and DeFi, but it’s really a back-to-basics coin with a quirky, but unusually reliable ecosystem backing it.

And some nine years into its existence, it still tags along with big brother Bitcoin on Bitcoin’s bullish adventures, as we can see from this week’s price fluctuations. Three weeks ago their year to date was in the red. Now they’re up 50%, and while they’re still $200 away from their all-time high, if you bought in when they were in the red, then congratulations.

For those of us who aren’t programmers, and may be a little tired of waiting for Buterin to roll out his master plan with ETH 2.0, this may be the go-too coin for the next year. Back to basics.

Polkadot

market cap $4,969,399,621

Crypto.com revised its rewards program for Uniswap and Polkadot this week, giving them a 5% increase in earnings to stake them on their site. Staking and passive earning are what everyone’s talking about in the crypto space, courtesy of one of the top five, in this case Ethereum, dumping electricity consumption heavy proof-of-work consensus mechanism for proof-of-stake.

Crypto.com allowed for staking on a few different assets, including their own CRO (Crypto.com coin) but now they’re capitalizing on the chatter by opening up the notion of staking for other such tokens.

My problem with crypto.com is that their centralized and based in Hong Kong, and while they’re not exactly under China’s greater purview in terms of crypto-regulations, there’s so much strife and instability regarding the ongoing China question that your assets could easily be in jeopardy at any moment.

Bitcoin Cash

market cap $4,742,169,138

Bitcoin Cash forked again this week, the final block mined at #661647 before forking off on two different directions as the people behind the coin grabbed onto both sides and pulled until it ripped in half.

The latest upgrade came from a group of developers calling themselves BCH ABC led by Amaury Sechet, who wanted to implement a new rule stating that 8% of the mined BCH should be redistributed to them. Antoher group, calling themselves the Bitcoin Cash Node disagreed, and removed the levy from the source code, leading to the split.

The biggest problem with Bitcoin Cash isn’t the coin itself. There’s nothing particularly wrong with it in theory as a secondary store of value. Roger Ver is still off his rocker if he thinks it’s going to be the coin everyone uses for purchases—the volatility isn’t going away. The problem is the people behind BCH, including Roger Ver, who have proven to be venal, difficult and whiny.

Maybe now BCH will be worth looking into, but somehow I doubt it.

Binance Coin

market cap: $4,269,892,256

Binance launched a lawsuit against Forbes Media for a story printed last week in which they stated the exchange was engaged in regulatory arbitrage.

Here’s what Investopedia says about regulatory arbitrage:

“Regulatory arbitrage is a corporate practice of utilizing more favorable laws in one jurisdiction to circumvent less favorable regulation elsewhere. This practice is often legal as it takes advantage of existing loopholes; however, it is often considered unethical.”

Good to know.

The suit was filed in U.S. District Court in new Jersey, and alleges harm against Binance for the story last month, which ‘contains numerous false, misleading and defamatory statements.’ Binance is seeking punitive damages and for the article to be taken down.

Cardano

market cap $3,513,832,992

Charles Hoskinson is a strange and unusual character for the crypto-sphere. During an interview earlier this week he advocated for ethical and moral behaviour—suggesting that high moral standards assist development and why the cryptosphere should try to be better than the cutthroat world of traditional finance.

He started by making a decent case for interoperability.

“Well, I mean, it’s like common sense in every other industry. Could you imagine Wi-Fi, if your WiFi only worked with a particular manufacturer? You’d be like, ‘Oh, I’m sorry, your Samsung phone is only going to work with the Samsung Wi-Fi router, or your iPhone is only going to work with the Apple router? Like what kind of a mess would that be?”

That’s actually a decent point.

—Joseph Morton