Thoughtful Brands (TBI.C) completed their acquisition of Kentucky-based American CBD Extraction Corp today, according to a press release.

The acquisition brings the ability to process more than 1,200 pounds of hemp per day to produce winterized crude. Thoughtful Brands intends on transitioning to a vertically integrated model, which will let them control every aspect of their supply chain, including production, logistics and its own value chain.

“The acquisition of American CBD marks a promising new phase for the Thoughtful Brands. With vertical integration taking effect immediately, we look forward to the entire business benefitting through reduced costs, additional expansion opportunities and product innovation,” said Ryan Dean Hoggan, CEO of Thoughtful Brands.

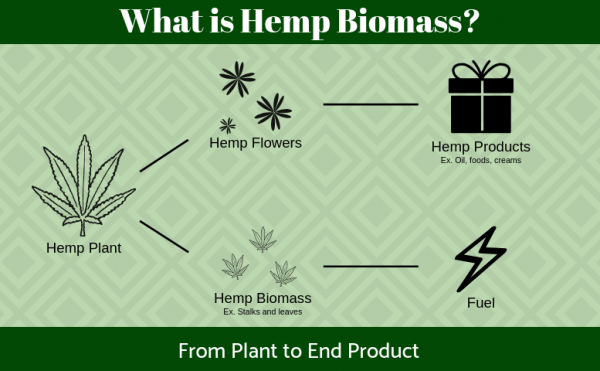

The acquisition includes an equipped and licensed 41,000 square foot facility wherein they will produce their daily hemp requirements. This gives Thoughtful Brands the ability to develop across multiple means of production, including launching CBD brands from hemp they’ve extracted and produced themselves, cutting out the need for a middle-man, as well as becoming a supplier of hemp biomass. American CBD also brings their technological and scientific expertise to the table, giving the company the ability to enhance the formulations of their direct-to-consumer to consumer CBD brands.

The acquisition came about as an amalgamation between the company, one of their subsidiaries and American CBD. The agreement had American CBD join with the subsidiary, which then became a wholly-owned subsidiary of Thoughtful Brands. This cost Thoughtful Brands 110,000,000 shares, given to shareholders of American CBD.

The company also entered into an operating agreement with a numbered company in Quebec for the operation of American CBD assets in Jenkins, Kentucky. The company paid the operator a $1.3 million bonus, settled through 13,000,000 shares, and a future entitlement of CAD$2 million, payable when their sales exceed $1 million produced from the Kentucky facility.

—Joseph Morton