More hacks this week, but now there’s more of a reaction from exchanges to shut down and curtail the misbegotten gains before it gets out of the ecosystem.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

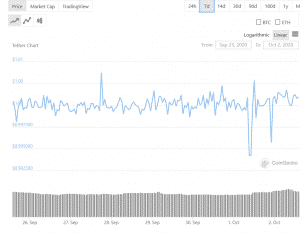

Bitcoin

market cap $195,208,857,139

Romania is a country of extremes. It bears the scars of its history. Backed the wrong horse in the second world war, followed by decades of corrupt and incompetent soviet style communism.

I’ve been over there a few times. It’s simultaneously a place of out of control opulence living next door to despair and extreme poverty. Oligarchs cavort on the top floor of buildings in downtown Bucharest while in the basement, the disenfranchised eke out a meagre existence.

And then there’s the crime. There’s a town there called Ramnicu Valcea. I’ve been there. Most of the country looks like one long stretch of skid row, and after a short drive you leave the countryside and drive into the Romanian version of Anytown, U.S.A.

The streets are clean. There’s no homeless. Everything looks cookie-cutter. Yeah. These are probably the proceeds of crime, but you’ll have that in these countries. Criminal behaviour is the last bastion of the perpetually poor. It’s the city of a thousand hacks.

And sometimes they get caught.

“On Oct. 2, the National Agency for the Management of Seized Assets (ANABI) announced its forthcoming auction of the confiscated Bitcoin (BTC) and Ether (ETH), as required by a ruling from the Prosecutor’s Office in Ploiesti Court.”

I read something like that and immediately think to myself that someone tried to rob the wrong person, or someone’s not keeping up with their bribes.

Ethereum

market cap $38,840,739,091

Hive Blockchain Technologies (HIVE.V) is getting ahead of the ethereum 2.0 rollout by padding their ETH stores in time for staking. They’ve achieved a record amount of ETH production in the present quarter, driven by continued strong usage, and specifically the push around decentralized finance (DeFi).

Admittedly, if this continues, then when ETH goes live on staking, it’s going to be one of those circumstances where the little and medium sized player gets pushed out of the market for getting this coin anywhere but an exchange. Granted, it won’t really be a change. It’s not like you’ve been able to mine ETH for years anyway.

More of the same, I suppose. But if their sharding protocol does solve their scaling issue, then maybe that’ll be an avenue to make some cash. Maybe things are looking up?

Tether

market cap $15,562,107,729

As I’ve said time and time again, there are only two types of exhanges: those that have been hacked and those that will be hacked. Now we can add Kucoin to the list of successful hacks as they had $150 million in bitcoin and ERC20 tokens jacked from their hot wallets on Saturday.

But wait. Issuers of USDT immediately froze about $33 million worth of USDT expected to be part of the cash stolen in these hacks, indicating that it’s getting harder for hackers and other malcontents to get away with their loot. If this works then it’ll send a message to hackers to reconsider their exit strategy while they’re planning their hacks.

What’s most interesting about this whole debacle is Kucoin’s response to all of this:

XRP/Ripple

market cap $10,503,623,747

Apparently there’s a rumour going around that now that Ripple’s foundered their XRP Ledger Foundation (XRPLF), they won’t be contributing to the proliferation of XRP anymore.

Well here’s Bharath Chari, the spokesman of the newly founded XRP Ledger Foundation (XRPLF) on the subject,

“We don’t see this as being the case at all, even though this question is better answered by Ripple. As in the case of many open-source projects, stakeholder companies invest time and resources in helping develop it. The XRPLF sees Ripple in a continued role as a key developer on both the technical and business aspects of the XRPL. Furthermore, the XRPLF is only an entity that promises to act in the best interests of the XRPL. There is no question of controlling an open, decentralized ecosystem like the XRPL.”

Too bad.

Bitcoin Cash

market cap $4,057,781,425

It’s hard to not be amused by all the backbiting that goes on behind the scenes in cryptocurrency. Someone’s always trashing another coin, its projects and trying to offer up their cape-wearing messiah of a crypto in its place as the balm of everything that’s wrong with the world.

Seriously.

Most of it is tired and transparent. Take Roger Ver, Bitcoin Cash’s creator, who’s still butthurt that nobody takes him or his coin seriously. Every time he opens his mouth and someone’s close by to write it down, he touts how terrible Bitcoin is and how great BCH is and how it’s so misunderstood, and if folks were smart they’d be BCH.

Someone needs to pull him aside and tell him that his coin’s had a great week – bouncing back to fifth place – but it doesn’t have the brand recognition of Bitcoin, the utility of Ethereum, the use-value of Tether, or the backing of XRP, and maybe he should just be happy that his second rate Bitcoin is where it is.

Take this tweet from cryptocurrency expert Sydney Ifergan,

“No Matter what the Bitcoin Cash (BCH) ideals for propaganda are people are now looking to get more yield. Ultimately, they look at more money.”

Right now, that’s not Bitcoin Cash.

Binance Coin

market cap $4,023,265,072

Binance CEO Changpeng Zhao recognizes the inherent contradictions and short-term damage from getting involved in decentralized finance (or DeFi), mostly because it means that in the long run it could spell bad things for his cryptocurrency exchange. What he stands to gain by getting involved is … just about everything if DeFi manages to fulfill its promises.

The short term losses in designing the Binance Smart Chain are elements of decentralization in order to compete against Ethereum. The smart chain is controlled by 21 nodes, which are elected by Binance Coin holders. Naturally, though, they have the largest vote, because they’re one of the largest holders of BNB.

What the Binance Smart Chain is trying to do is siphon off the discontentment that some developers feel from Ethereum’s scaling issues, onto their own DeFi platform.

Here’s an interview with Coindesk in which he talks about this, and other items of interest.

Polkadot

market cap $3,769,846,197

The definitely some questions to be asked about Polkadot since its arrival onscene not long ago. It seems to be making hay while the sun’s shining, and that’s particularly smart for everyone involved. It’s hard to tell whether or not this is a temporary issue yet, but there are folks out there building projects on top of its blockchain, so as long as it continues with that trend, then it’ll definitely be around.

For example, Equilibrium, a Polkadot-based, cross-chain DeFi project raised $5.5 million this week.

They raised the money courtesy of their new ‘token swap’ method, which gives investors the ability to exchange their old tokens for new ones.

The Native Utility Token (NUT), an EOS-based product from Equilibrium could be swapped for a new Polkadot-based token called EQ. Venture firms BKEX Capital, CNYX Ventures and Taureon also got in on the token swap.

Chainlink

market cap $3,580,903,780

Earlier in this spread, we talked about KuCoin, the Singaporean exchange in which $150 million in cryptocurrency was jacked not too long ago. Apparently, the coin denominations in these hacks were Bitcoin, Chainlink, Ethereum and some of the other minor altcoins.

Now it’s beginning to look like hackers are trying to offload some of their stolen Chainlink tokens, which means that we could see some interesting inflows of selling pressure. The number we’re looking at is roughly $2 million worth of LINK.

It’s curious to see what the response will be for LINK in the coming week due to these hacks.

Is that enough to spur the drop in price that LINK’s seen over the past few days? Yes. Actually, it’s likely a decent indication as to how LINK’s performing, when there’s the prospect of a large scale selloff from a hack.

Crypto.com Coin

market cap $3,005,139,196

Beyond price fluctuations, there isn’t really any news on CRO for this week. And honestly, given cryptocurrency’s general volatility, I don’t put much faith in fluctuation predictions or discussions about how the price moved. I don’t do them as a rule because everything I’ve written about today could easily be gone tomorrow.

But there has been a fair amount of curiosity about what CRO is, in fact. It’s a cryptocurrency, of course, or else we wouldn’t be featuring it, but what is its function? Well, it’s the cryptocurrency put forth by Crypto.com, which styles itself as a crypto bank with its own blockchain ecosystem. It offers a metal crypto Visa, an integrated app for your phone or tablet, an exchange, a wallet with DeFi options, lending services, and a crypto deposit earning.

The exchange even sports limited FDIC protection of up to $250,000. Given that most hacks are in the millions of dollars range, there’s a good chance that once crypto.com is hacked, your money’s gone if the hacker is smart enough to hodl and not try to sell right away. Keep in mind that last week they were more or less hacked and their price’s manipulated in favour of opportunistic sellers. The hacks were questionable, I should concede, as it was technically a power outage and there’s no proof of tampering, but it did mean some folks made some quick money off the turnaround.

Bitcoin SV

market cap $2,964,496,170

Bitcoin SV edges Litecoin out of the top ten by market cap this week, rounding the top ten out at number ten.

BIGG Digital Assets (BIGG.C) subsidiary Netcoins, itself an online brokerage based on Vancouver, has added Bitcoin SV to its growing list of digital assets. The announcement came shortly after the closure of a USD$525,000 investment from Indigo IP Holdings.

—Joseph Morton

Hi there! Thank you so much for your post

You’re very welcome.

Nice Content.