If you have been a follower of my work, I have been saying that stock markets will only be moving higher, as they are the only place to chase yield in this world. Have stated that we are setting up for a parabolic move higher. At time of writing, markets are seeing a sell off as we begin trading for this week, and the idea of a bullish market seems far fetched. However, I must stress that the fundamentals propping markets (cheap money and accommodating monetary and fiscal policy) remain the same.

The past two full trading days (Thursday and Friday), saw big drops on the US equity markets…amusingly, the perma bears came back, and the financial media quickly shifted their stance to “beginning of a bear market”, when they were bullish just days before. A good example of why financial media is REACTIONARY. If what the financial media and mainstream media told you was true, then everyone would be rich! But the markets make their moves way before…and in my humble opinion, adheres to market structure, which is the way I approach all markets.

After the S&P 500 broke out into new highs, we saw money chasing the breakout. Perfectly normal. Likely a lot of day traders, but you can make a good case that domestic funds started increasing their allocation of US stocks as the bond market was telling us that money was leaving the safety of the bond markets. Following the asset allocation model of stocks and bonds that funds utilize, we can predict that this money cannot remain in cash forever, and that it will be going into stocks eventually.

Certain fund managers did not chase US stocks higher, because they believed the bottom in equities was not in. That there was another leg lower coming which would take us below February lows. Well, the stock market officially ended its shortest bear market in history, and started a new bull market with the new highs. If you were a fund manager who did not participate in that rise, you really have no excuse now. This money will enter US stocks, and I argue foreign money too, which will cause a parabolic move higher.

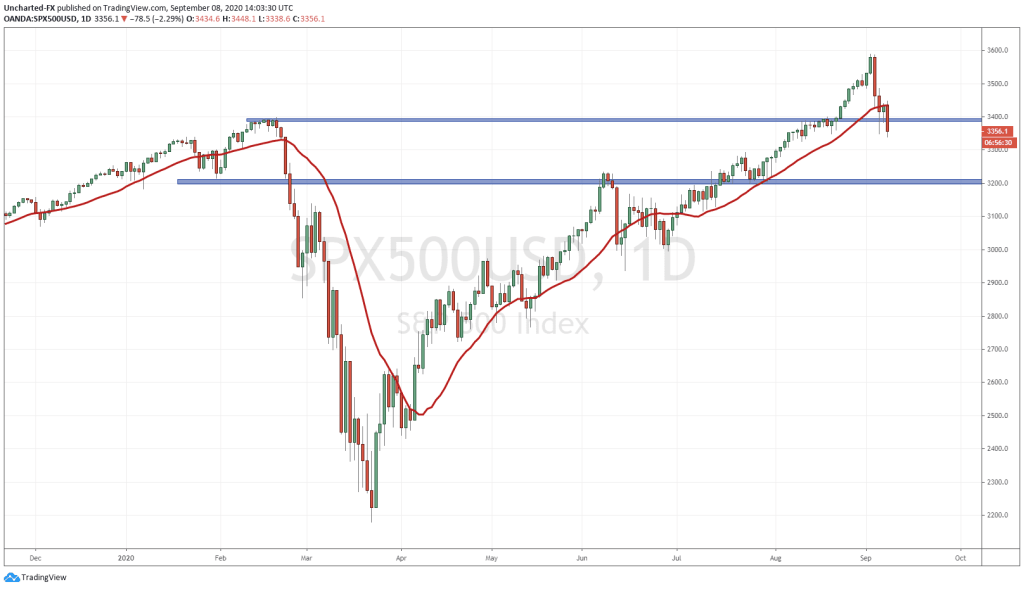

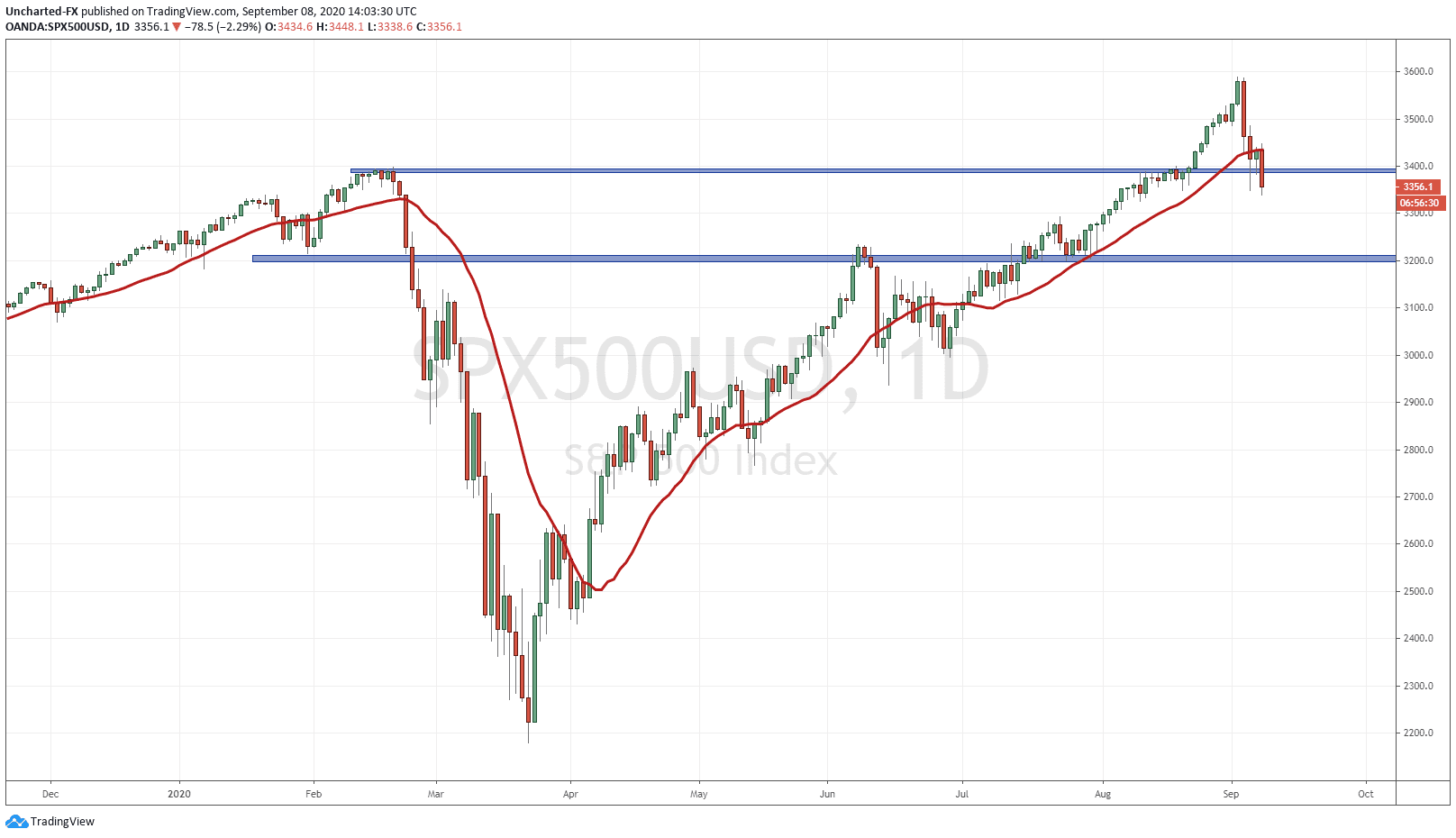

Back to the chart. After days of moving higher, you could just feel the euphoria and the FOMO. It just felt a pullback was necessary. My followers know that nothing moves up or down forever, we do get pullbacks as market participants take their profits. In fact, this move down to me is just that. A pullback. Remember: when break outs occur, it is perfectly normal for price to retest the breakout zone before continuing higher! Ideally we want this to happen a few days after the breakout, but there are times when momentum carries price higher to another resistance level BEFORE selling off to retest the breakout zone.

Notice price action on Friday. We had a large red day which broke below a major support level on the longer term charts. Many traders chased this move lower. They thought this was the big sell off. Look at how the candle closed. A large wick candle with the body closing ABOVE support. This is a fake out, or a bull trap. As time of writing, and as you can see from today’s daily candle, we are back below this major support zone. The way this candle close today will be crucial going forward. Would not be surprised to see this market being propped higher near the close.

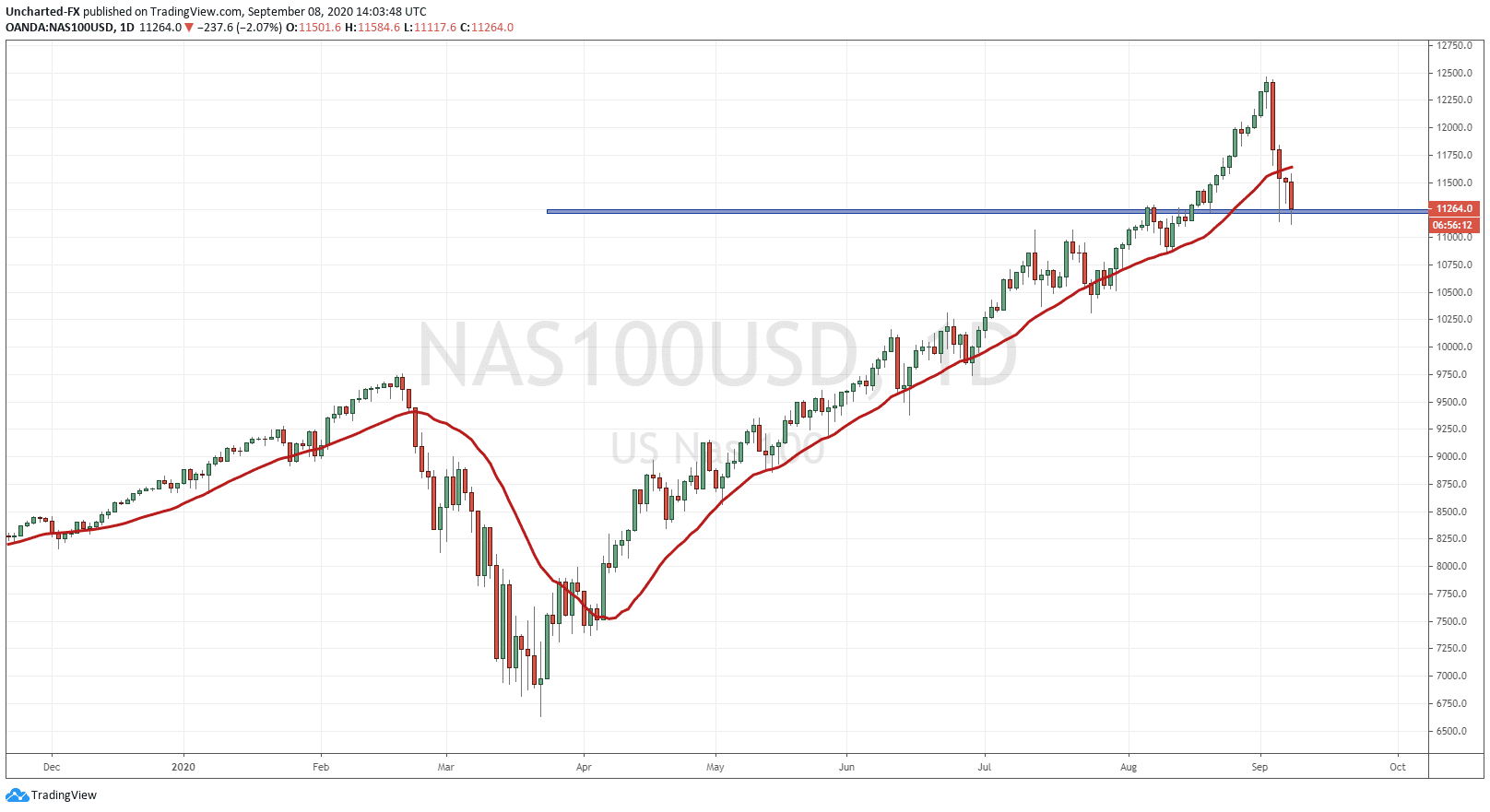

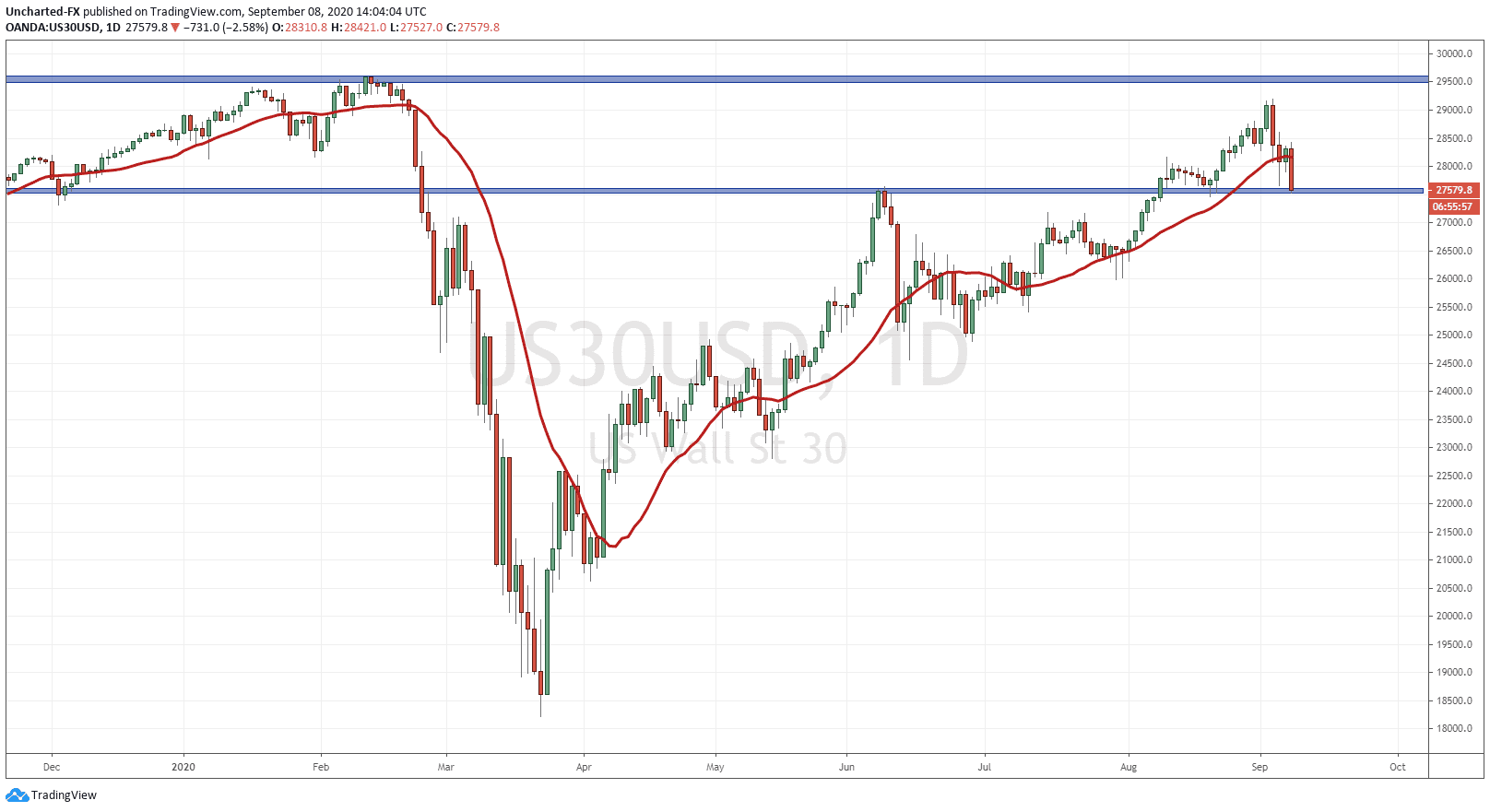

Look at the Nasdaq and the Dow too, which share similar analysis:

The Nasdaq is seeing a bounce at this support, whereas the Dow is back at retesting our major support/flip zone.

Two important takeaways here:

1) This is why we look at the long term charts to spot market structure trends and key zones.

2) We wait for candles to CLOSE before entering positions or determining whether a break down/out is happening. This is very important as you many traders lost money thinking this was the large stock market crash.

I have said many times that stock markets are the only place to go for yield. The fundamentals have not changed. The real economy does not matter. There will be more cheap money for a very long time. In fact, the Fed and other western central banks cannot hike interest rates anymore. The amount of debt that government and citizens have had to incur, means a slight rise in interest rates will destroy them. Interest rates will remain close to 0 for a very long time, and it is much more likely we cut interest rates to the NEGATIVE (following Europe and Japan and others) which would allow government to service the debt, as it is likely more spending programs and benefits will be coming. Essentially, the monetary policy side has used all their ammunition. Sooner than later, the Fed will announce they are actively buying stocks to keep markets propped. Now the onus is on the fiscal policy side, and we can deduce that governments will announce more programs to try and spur the economy and keep people afloat.

With all these things in mind, it is safe to say the party is not over…yet. Will there be a time when markets crash? Yes. And it will be the largest wealth transfer in human history. Wall Street knows the party is not over. Central Banks will do whatever they must, to keep markets propped, but there will be a time for the reversal. For signs of a crash, our eyes will be on the bond markets. One day, bonds will sell off which will cause interest rates to spike (likely into double digits). This will be our signal for a stock market crash. Right now, most central banks are buying bonds and suppressing interest rates. When they are ready for the culling and an implementation of a new system, they will sell.

The other possibility comes from a black swan event. I think this will come mainly from some sort of geopolitical news regarding US and China. Although Turkey and India and China are other hot spots. If some sort of shooting war begins…markets would not like that. Maybe a second wave of Covid? I am not too sure, since we are seeing a lot of questions being raised about the testing and deaths being wrongly attributed. Also, a vaccine would cause markets to pop… we found out the Chinese have had one since July and have been inoculating the military, health professionals, and border guards.

Finally, what about the US elections? I do think that whatever side wins, the losing side will not accept the results. There will be major violence on the streets of America. This plays in with my confidence crisis scenario (a confidence crisis in central banks, governments, and the fiat money) and why you want to be holding hard assets like Gold and Silver . But the fact is, regardless of who wins, more cheap money is not going to change. I would even argue markets would shoot higher on a Biden victory because it would mean even MORE cheap money.

It is really going to be crazy times ahead, and I still do not think we have seen the parabolic move in equity markets yet. Once the Dow breaks out into all time new highs, we are closer on that road. But going forward, unless we see some sort of topping pattern from here, such as a double top or head and shoulders, or a confirmed break and close below major support here, I would NOT short these markets!