There have been some serious changes in the world of crypto this week.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

Bitcoin

market cap $217,110,573,083

The United States government seized almost $2 million in Bitcoin and other types of cryptocurrency from accounts that had been otherwise attached to financing schemes for three terrorist organizations: Al Qaeda, ISIS and Hama’s paramilitary arm, the Al Quassam Brigades.

Law enforcement caught up to 300 cryptocurrency wallets held by banklike institutions, and blacklisted privately held accounts containing several million dollars of virtual currency, which will make it hard for folks holding onto those funds to use financial institutions to cash them out.

You’re going to have that. In the end, technology and its uses never really changes.

The same technology that allows us to bypass Western Union’s assault on our wallets is the same technology that can be used to fund our enemies.

But that’s changing as we can see above.

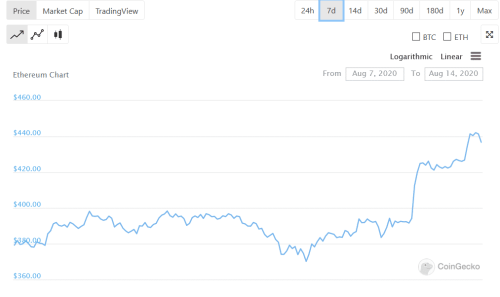

Ethereum

market cap $49,277,453,765

A year ago, capital locked in decentralized finance (DeFi) protocols ranged around $459 million. Today, it’s $4.93 billion.

The rising popularity of these platforms may have hit a snag, though, as they’re causing transaction fees to go skyward. The network charged $6.87 million fees, which was an all time high, and some users have reported paying upwards to $99.

The average transaction fee for Ethereum-based applications was roughly $6.62, which is up from $5.52 in July of 2017.

“In the last three months, we’ve gone from an environment where DeFi was expensive to use and a little bit slow, to now, [where] for a lot of people it’s prohibitively expensive,” according to Kain Warwick, founder and chief executive of Synthetix, in an interview with CoinTelegraph.

XRP/Ripple

market cap $13,606,341,327

Ripple has expanded their cross-border transactions to include accesibility via well-known messaging apps like Telegram, Discord, Matrix or Slack.

Facebook’s (FB.Q) Libra was originally intended to be sent through Whatsapp and other Facebook properties, so this isn’t a novel idea. It is, however, a positive step for mass-adoption.

Here’s RiPay developer Kuyawa Kata:

Powered by the Ripple network and the XRP Ledger, it allows you to send money around the world in seconds with nothing more than a simple message like ‘Pay 10 to George,’ and now thanks to the PayID protocol, you can send payments to external users without knowing their Ripple address, ‘just Pay 10 to george$ripay.me’ and the money moves like a message in just a second.

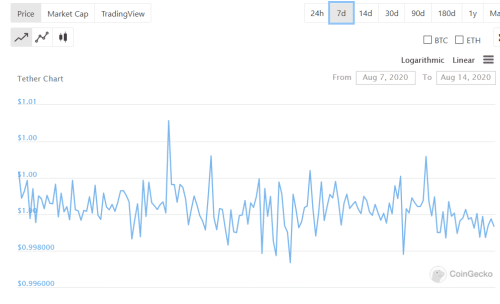

Tether

market cap $12,013,972,391

Factor report author Peter Brandt doesn’t like Tether.

“Tether is an accident waiting to happen. Tether is just another fiat currency.” Brandt’s August 10th tweet, was in response to a post comparing USDT’s market cap with the total crypto industry’s market cap in line with overall digital asset volume. ”

What isn’t immediately clear is why Brandt feels the way he does. Does the risk lie in its fiat currency status or its past as a stablecoin.

If there’s a reason to distrust tether, it could be that, as many have asserted, that the company doesn’t have sufficient US dollars in store to back their coin. That, and maybe the number of different lawsuits lawsuits and regulatory attention over the years.

Chainlink

market cap $6,374,369,242

Chainlink was clearly the biggest winner in the crypto-sphere this week, making an appearance in the top-five and toppling long-time also-ran Bitcoin Cash down to sixth space. Chainlink is an ethereum-based crypto token that powers a decentralized network designed to connect smart contracts to external data.

The price has shot to the moon, leaping over 80% over the past seven days, adding to their gains of 120% this month and a nearly 600% increase over the last year.

But these changes maybe temporary as well. Especially given that Zeus Capital contentions that Chainlink is little more than a vaporware pump and dump scheme. One thing is certain, it’s almost guaranteed that lots of folks are going to be paying an awful lot of attention to Zeus’s comments now, and also to how the coin performs in the near future.

-

Source: coingecko.com

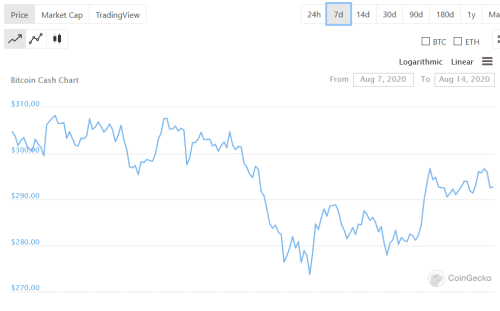

Bitcoin Cash

market cap $5,421,110,221

Even though BCH has lost their space in the top five, it doesn’t necessarily mean they’re down and out. Instead, they’re trying to back down from their potential nerd-fight from last week, and act like reasonable, rational adults.

Amaury Sechet, the lead developer of Bitcoin Cash, announced plans for the network’s November upgrade that will lead to finding a compromise between the two opposed camps—specifically proponents of the ‘Bitcoin ABC’ and ‘BCHN’ proposals.

The changes to the difficulty adjustment involve the implementation of something called ‘Aserti3-2d.’ We’re stepping well into the weeds and well out of my wheelhouse in terms of cryptocurrency knowledge, but this involves an algorithm upgrade that makes fundamental changes to the difficulty rate of mining BCH.

-

Source: coingecko.com

Cardano

market cap $4,318,154,006

Input Output Hong Kong (IOHK), the development behind Cardano, is already hard at work on developing the next phases of the coin’s roadmap. The company announced yesterday, the launch of the decenralized governance program called “Project Catalyst” as the fifth and final phase of Cardano, Voltaire, through Twitter.

Voltaire’s primary goal is the transformation of Cardano into a self-sustaining system. It will include the introduction of a voting and treasury system, and network participants will have the ability to influence future network development with shares and voting rights.

-

Source: coingecko.com Bitcoin SV

market cap $3,912,954,467

CYBAVO, the digital currency security and asset management firm, today officially announces support for Bitcoin SV (BSV) across its suite of enterprise products.

Digital currency security and asset management firm, CYVBAVO, announced that they were now supporting Bitcoin SV across its portfolio of enterprise products.

Their services include secure storage and custody, as well as enterprise level banking support. CYBAVO provides clients access to BSV infrastructure across their product ranges.

“CYBAVO is one of the few enterprise-grade wallet providers that implement MPC with threshold signature scheme, which echoes the wallet security approach as seen in the Bitcoin SV ecosystem. Now with CYBAVO’s support of Bitcoin SV, businesses and enterprises have a new option for secure and user-friendly key management solution,” according to Ella Qiang, Bitcoin Association Southeast Asia Manager.

-

Source: coingecko.com

Litecoin

market cap $3,714,183,441

Litecoin’s jumping into the credit-card business again. They tried it once, and the previous one failed.

Here’s Charlie Lee, Litecoin founder:

“We previously worked with LitePay on a debit card but that failed when LitePay went out of business.”

The distinction between this card and other cards that support Litecoin, according to Lee, are that other crypto debit cards only support funding with LTC while this card would be natively LTC, so funds stay in LTC until you use the card.

We’ve heard this all before, haven’t we? Again – nothing really changes.

-

Source: coingecko.com

Binance Coin

market cap $3,371,672,307

Since we’re talking about changes, we can’t disregard Binance Coin.

Due to Chainlink’s leapfrog performance, bounding into the top-five cryptocurrencies by market capitalization, Binance Coin now finds itself riding the edge of the top ten. It presently has a market cap of $3.3 billion and is only a few million ahead of Crypto.com coin in eleventh with a market cap of $3 billion.

Given how particular these coins tend to be, and how there’s the looming accusations of Zeus Capital hanging like a sword of Damocles over Chainlink’s head, there’s a strong probability that we’ll see a return to the status quo in the coming weeks.

-

Source: coingecko.com

In the interim, stay tuned to equity.guru. The coin collector’s guide won’t be returning for another four weeks while it’s author is taking some well needed rest time.

Keep hodling until then.

—Joseph Morton