March 17, 2025 —– Greg Nolan

After a tumultuous week that rattled those with significant exposure to general equities, particularly tech, the precious metal, which initially took a hit during the extreme market volatility, snapped right back and went on to storm all-time highs. Again. But this time, the assault was on the loftiest of round numbers—$3k.

Gold and silver are serving as a meaningful hedge during these periods of intense economic uncertainty… as Trump’s trade war and recession anxiety dominate trade in most other arenas.

One might find it intriguing—or even pleasing—to observe that the US Dollar Index has erased its post-Trump victory surge, trading at its lowest level since Oct. 2024. If you were to quiz the likes of Peter Schiff on the subject, he’d say the Greenback is due for a further decline of 10% to 15% by year-end (with continued downside into 2026).

Gold Equities

While the S&P 500 broke decisively below its 200-day moving average (a major concern among market analysts), the big miners are successfully challenging multi-year highs (GDX chart below)…

Further down the food chain, the breakout in the smaller-cap gold miners, as measured by the GDXJ, appears even more impressive…

In what has been a non-stop conveyor belt of grief and torment in the junior exploration arena, the hope is that this positive divergence among the Bigs signals an imminent across-the-board re-rating. We’re already seeing signs of a revival among some of the higher-quality names we follow.

A couple of examples among the names followed in these pages…

Collective Mining (CNL.V) – (CNL.NY)

- 77.85 million shares outstanding

- $938.9M market cap based on its recent $12.06 close

- Corp Presentation

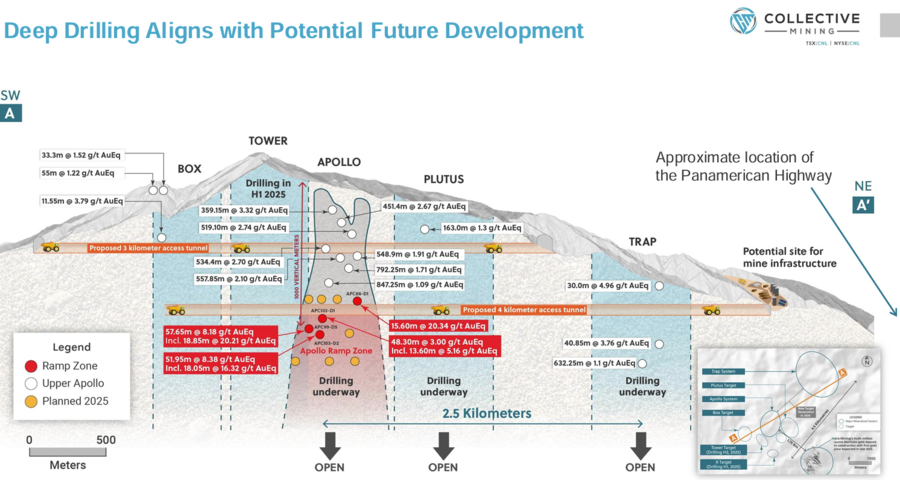

“Best Hole Ever” and “Best Intersection to Date” are becoming common themes as Collective continues to exceed even the loftiest expectations as it aggressively pushes its multi-target Guayabales Project in Colombia along the exploration curve. An ongoing 60k meter, six-rig campaign is generating substantial assay-related newsflow, much to the delight of shareholders.

On Wednesday, March 12, the company dropped another stellar round of assays from Guayabales – Collective Mining Drills its Best Hole to Date at the Recently Discovered Ramp Zone by Intersecting 75.80 Metres at 8.01 g/t Gold Equivalent.

The drill hole values highlighted in the text of the above headline flow from ‘Ramp’—a new zone located in a deeper portion of the company’s Apollo system discovery.

Drill hole highlights from this round:

- Drill hole APC105-D1, collared from mother hole APC-105D (Pad 18), was designed to test the Ramp Zone in a northeasterly direction. The hole intercepted continuous and high-grade mineralization within the Apollo host breccia body and consisted of veinlets of pyrite, pyrrhotite and minor amounts of bismuth and tellurium sulphides. APC105-D1 is the best hole and widest intercept drilled to date into the Ramp Zone on a grade accumulation basis (grams x metres) with assay results as follows:

- 75.80 metres @ 8.01 g/t gold equivalent from 469.60 metres including:

- 21.00 metres @ 24.16 g/t gold equivalent from 487.60 metres

- 75.80 metres @ 8.01 g/t gold equivalent from 469.60 metres including:

- APC103-D3 was drilled from mother hole APC-103D (Pad 16) and orientated in a southwesterly direction across the Ramp Zone. The hole initially intersected an interval of modest mineralization at a shallower elevation above Ramp. Further down hole, the Ramp Zone was intersected before being cut-off prematurely by a post mineral dyke. Assays results for APC103-D3 are as follows:

- 13.25 metres @ 3.13 g/t gold equivalent from 127.90 metres (Upper Zone)

- 20.30 metres @ 6.68 g/t gold equivalent from 247.45 metres (Ramp Zone)

- 13.25 metres @ 3.13 g/t gold equivalent from 127.90 metres (Upper Zone)

Two days later, after the market closed for the weekend on March 14, the company announced Agnico Eagle’s keen interest in their flagship asset – Collective Mining Announces Investment and Early Exercise of Warrants by Agnico Eagle for Gross Proceeds of C$63.4 Million.

The additional $63.4 million will buy a lot of exploration. Once the dust settles on this offering, Agnico’s interest in the company will increase to roughly 14.99%.

The share price is nearly triple what it was when I featured it in these pages last October. The prospect of this level of multi-bagger price action is why we’re here—it’s what spurs our wanderlust in this Wild West arena...

Aurion Resources (AU.V) – (AIRRF.OTC)

- 148.89 million shares outstanding

- $105.71M market cap based on its recent $0.71 close

- Corp Presentation

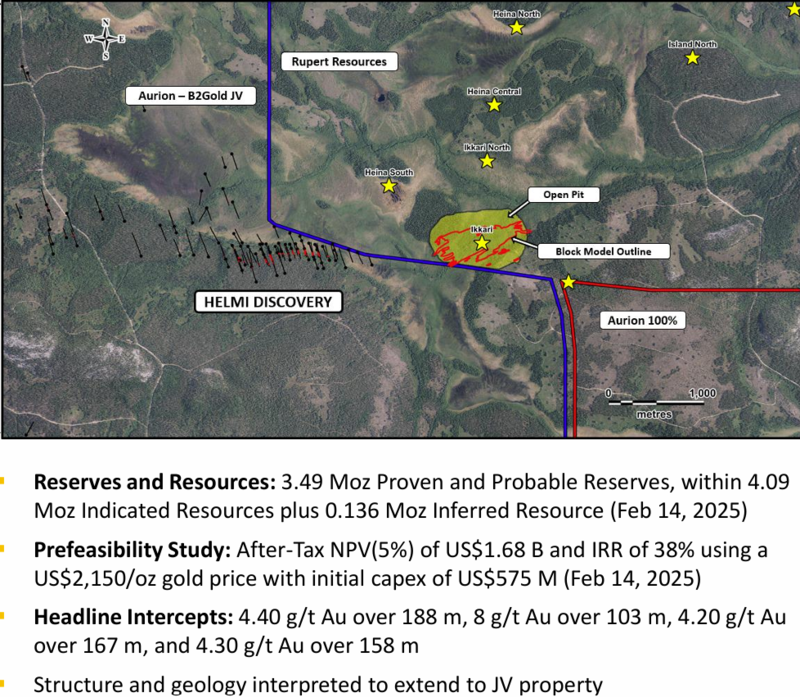

Aurion is a name often trotted out whenever Rupert Gold (RUP.TO) and its high-grade Ikkari deposit in Finland’s Central Lapland Greenstone Belt are discussed (Rupert is worth delving into if you’re looking for an advanced-stage development company with tier-1 potential in a mining-friendly jurisdiction).

The thinking among analysts like Brent Cook is that Rupert will likely get acquired by a resource-hungry producer, but before that can happen, a deal will need to be worked out with Aurion.

Aurion’s Helmi project shares a common boundary with Rupert’s Ikkari deposit (Helmi is a joint venture between Aurion—30% and B2Gold—70%). A part of Rupert’s deposit (and possibly a weighty swath of mineralization) runs onto Aurion’s JV claims. Rupert will need to acquire that chunk of ground before they can proceed with open pit development of Ikkari to minimize the negative (economic) impacts of a sub-optimal pit design.

Last year, Rupert offered B2Gold $102.8 million in RUP paper for its 70% stake in the Helmi JV, but the deal fell through.

The clock is ticking on this one if Rupert wants to continue pushing Ikkari towards development – Rupert Resources Completes Pre-Feasibility for Ikkari Confirming a High-Margin Project Net Present Value of USD1.7 Billion and IRR of 38%.

The Helmi JV is just one component of the company. According to Aurion’s website, its flagship asset is the 25k hectare, wholly-owned Risti and Launi West Projects which spans an ~80 kilometer stretch of the Sirkka Shear Zone along the highly prospective Central Lapland Greenstone Belt in northern Finland.

Aurion has made multiple gold discoveries at its Risti Project since 2015 that have been subject to mapping, geophysics, trenching and core drilling. Significant gold discoveries include: Aamurusko, Aamurusko NW (NoNiin), YNOT, Notches, A2 and Risti NW. The Kaaresselkä gold prospect discovered by GTK in the 1980’s also occurs on the Risti Property.

There’s a lot of gold under the hood here if you’re new to the name—note the high-grade drill hole assays from the multiple discoveries highlighted throughout their corp deck.

Late last month, Aurion reported additional assays from Risti – Aurion Intersects 7.92 g/t Au over 13.60 m in a Step-out Hole at Kaaresselkä, Risti Property.

The highlight interval from a series of six holes drilled into the Kaaresselkä area of the property is featured in the text of the above headline—7.92 g/t Au over 13.60 meters from 162.10 meters, including 57.60 g/t Au over 1.00 meter from 168.35 meters. These values extend the mineralized system 40 meters along strike.

It’s interesting to note that Chairman Dave Lotan has been accumulating stock in the open market. He currently owns roughly 15.6 million shares, representing a 10%-plus stake in the company.

Wanting exposure to Aurion’s gold discoveries along the Central Lapland Greenstone Belt, including the possibility of a monetization event covering its Helmi JV ground, I purchased shares late last week (consider me especially biased on this one).

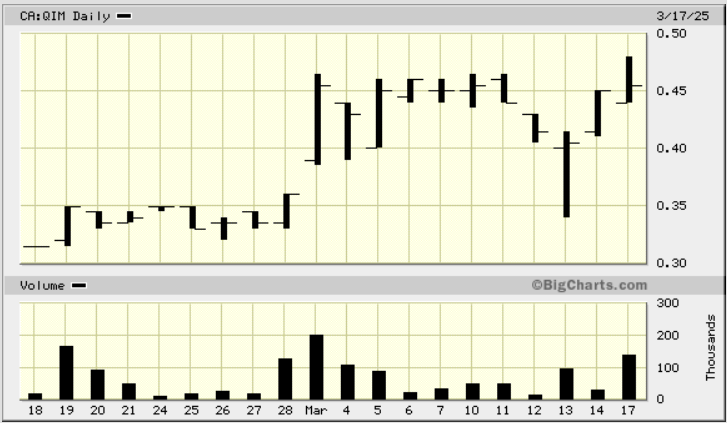

Quimbaya Gold (QIM.C) – (QIMGF.OTC)

- 34.8 million shares outstanding

- $12.53M market cap based on its recent $0.36 close

- Corp Presentation

With the market looking for the next great Colombian success story, Quimbaya has entered the radar.

Featured for the first time in these pages in early March, I finally had the opportunity to buy Quimbaya when a determined seller entered the fray late last week (March 13)…

As noted on October 3, the company controls three projects in the mining-friendly department of Antioquia, Colombia: Segovia (Tahami Project), Puerto Berrio (Berrio Project), and Abejorral (Maitamac Project).

The company’s Tahami (South) project, on trend with Aris Mining’s high-grade Segovia project (M&I ounce count = 3.6 million ozs), is now teed up for a first pass 4k meter drill campaign – Quimbaya Gold & Independence Drilling Secure 4,000m Drill Deal – 100% Share-Based Partnership.

As per the guts of this early March press release, this first pass probe of Tahami’s subsurface layers is designed to:

- Unlock high-grade gold mineralization potential;

- Leverage local expertise with top-tier partners;

- advance its flagship projects in Colombia’s prolific Segovia district.

Under the terms of this initial work order, Quimbaya Gold has agreed to compensate the Drilling Contractors 100% in shares through the issuance of units at $0.30, with each Unit consisting of one common share at $0.30 and one common share purchase warrant exercisable at $0.40 for a period of two years (“Consideration Units”). The total cost of the anticipated 4000-meter drilling campaign is expected to be approximately $1.2 million CAD. To align with project milestones, it is anticipated that the Consideration Units will be placed into an escrow account with Olympia Trust Company and will be released periodically as drilling services are completed throughout the campaign.

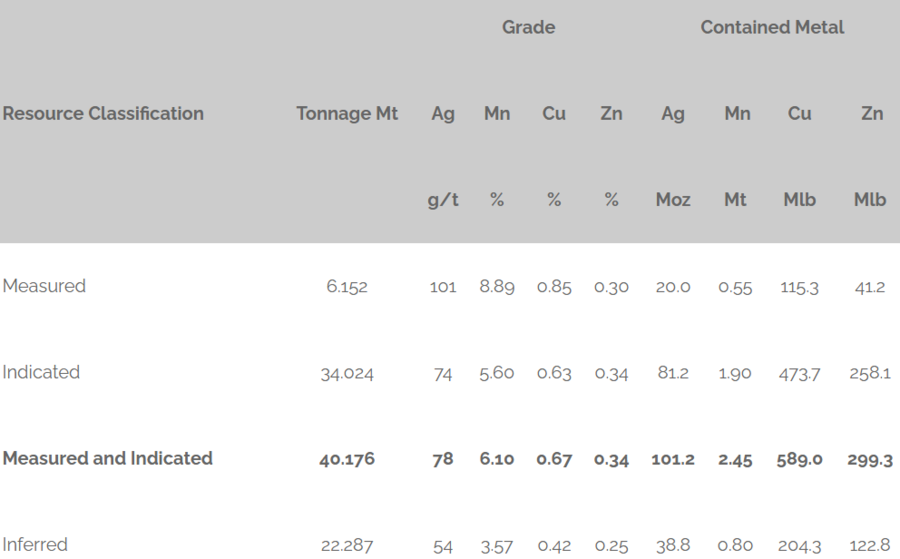

Aftermath Silver (AAG.V) – (AAGFF.OTC)

- 289.69 million shares outstanding

- $139.05M market cap based on its recent $0.48 close

- Corp Presentation

A final note in my last report shed light on a company that delivered a solid round of assays that were initially ignored by the market – Aftermath Silver Reports 156m From Surface of 290g/t Ag, 1.12% Cu and 7.3% Mn In Eastern Zone Step Out.

These stepout results from a phase-2 drill program at the company’s Berenguela project in southern Peru struck me as decent, but the stock closed in the red the day they were released (Feb. 27).

The market has apparently taken a closer look at the results, gained an appreciation and bid the stock higher…

If you’re looking for exposure to silver, Aftermath might be worth taking a closer look at. The polymetallic Berenguela project carries a resource that includes 140 million ozs of Ag, mostly in the higher confidence M&I categories…

>>>Note that the final installment of this report is in collaboration with Forum Energy Metals (Highballer is compensated by the company for this content)<<<

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 309.35 million shares outstanding

- $13.92M market cap based on its recent $0.045 close

- Corp Presentation

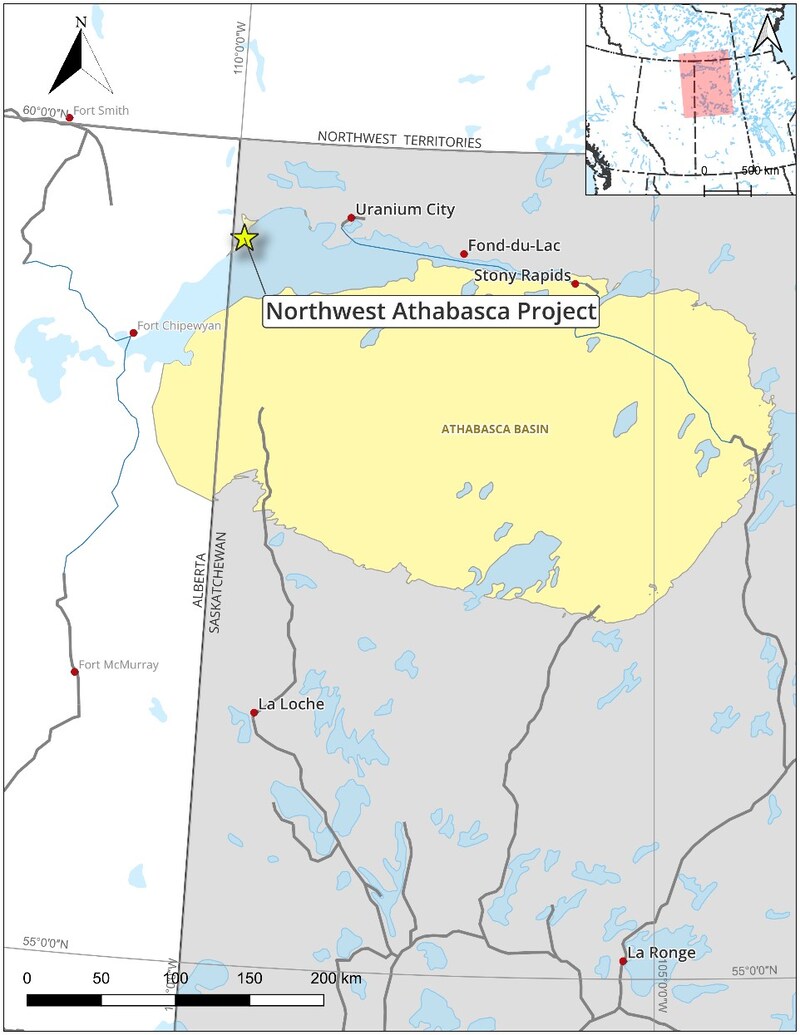

Aside from Forum’s wholly-owned Aberdeen Project in the Thelon Basin of Nunavut, the company controls an extensive pipeline of projects in the prolific Athabasca Basin of Saskatchewan, nine of which are drill-ready.

The company’s Northwest Athabasca Joint Venture (NWA), where the ownership split currently stands at 45.4% Forum, 25.3% NexGen, 18.0% Cameco and 11.3% Orano, has been teed up for drilling. According to CEO Rick Mazur, an ice road has been pushed across Athabasca Lake, the camp is up, and a drill rig is being mobilized to the site.

To finance this current push along the curve, Forum granted Global Uranium (GURN.C) an option to earn up to 75% of its 45.4% interest in the project by spending $20M on exploration (details of the earn-in deal can be perused here).

Pushing ice roads into these projects presents challenges. Along the way, the company encountered two pressure ridges that had to be knocked down and smoothed over to allow a drill rig and equipment to pass. Pictured below is one such pressure ridge. For scale, Forum’s Logistics Manager, Kevin Milledge, stands six feet tall.

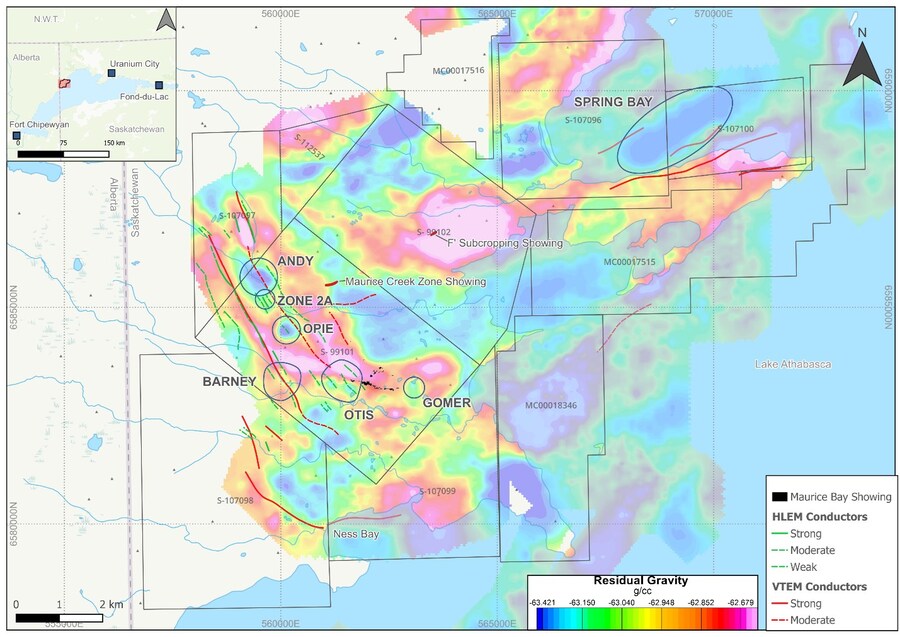

I suspect the next press release from the company will announce the commencement of drilling at NWA. This campaign could include up to 3,000 meters, prioritizing multiple targets—Andy, Zone 2A, and Opie (plus Gomer and Spring Bay, if time allows).

Forum’s VP of Exploration, Dr. Rebecca Hunter, characterizes NWA as the ‘second-best’ project in their project pipeline. Along with its lineup of twenty-plus high-priority drill targets, the project has a historical (non-NI 43-101 compliant) 1.5 million lb resource grading 0.6% U3O8.

END

– Greg Nolan

Full disclosure: Forum Energy Metals is a Highballer client. The author, Greg Nolan, owns stock in Forum Energy Metals (FMC.V), Quimbaya Gold (QIM.C), and Aurion Resources (AU.V). The author reserves the right to trade these holdings at any time without notice.