Ashley Gold Corp. engages in the acquisition, exploration, and development of mineral properties in Canada. It has an option to acquire a 100% interest in its principal project comprising the Ashley gold property that includes 115 mineral claims covering an area of approximately 1,759.6 hectares located in northeastern Ontario. The company also holds 100% interests in the Santa Maria property that consists of 1554 hectares located in the southeast of Dryden, Ontario, as well as holds interests in the Howie Lake property that includes 64 claims in approximately 1,000 hectares located in the Dryden, Ontario; and the Alto-Gardnar property, which comprises 15-claim blocks in approximately 315 hectares located in Dryden, Ontario.

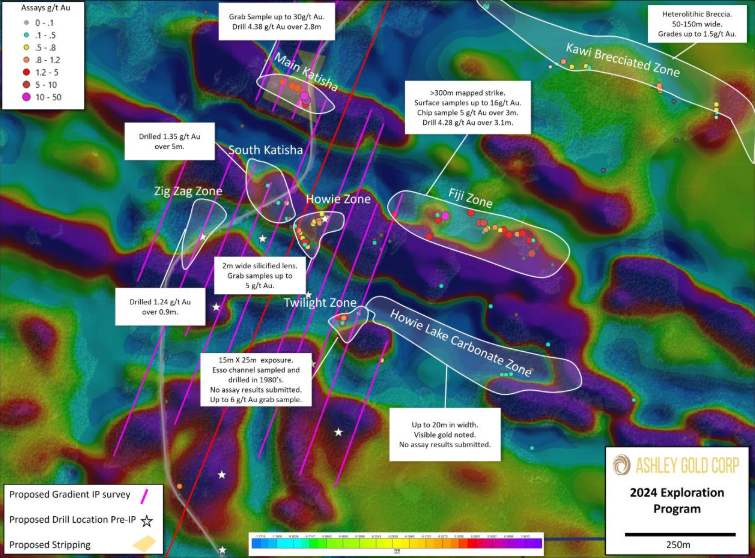

Today the Company announced it is currently acquiring the Gradient Induced Polarization survey at Howie to determine potential drill targets. In addition, Ashley has preliminary drill locations defined for the Maiden Burnthut drill program.

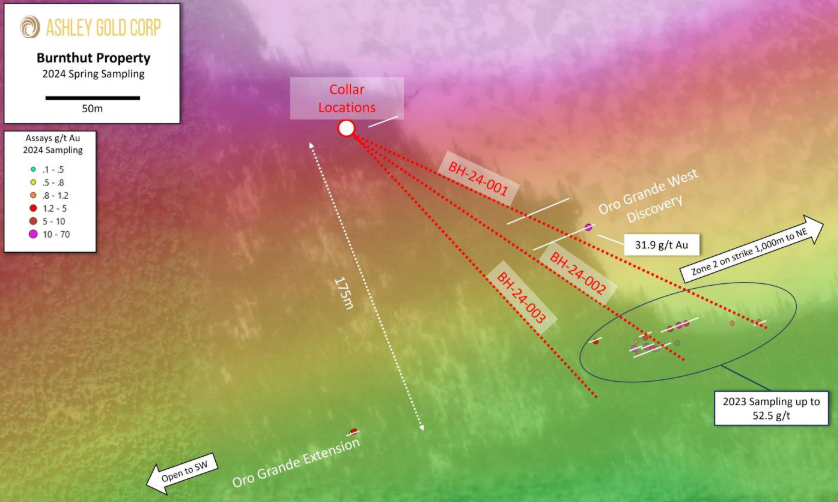

Darcy Christian, CEO of Ashley comments “The acquisition of IP over Howie will be a fantastic tool to understand the deeper mineralization at Howie. We are optimistic that this survey will lead to an intelligent drill-program this year. Burnthut continues to shine and we are ready to test this with a maiden drill program this summer. With over 175m of mineralized potential we are optimistic this program will open-up a new discovery for Ashley.”

The Burnthut Property is situated in the Central Volcanic Belt and along strike of the Goldlund and Miller gold deposits currently being explored by Treasury Metals.

Abitibi Geophysics has begun the survey with installation of the AB current line and have completed over two line kilometers of the survey. Progress is on estimate and initial data quality is very good. Acquisition should conclude within the next week.

The acquisition of data from this gradient IP survey will be extremely beneficial in our drill targeting strategy. There have been no previous ground geophysical surveys of any kind carried out on the Howie Property. The gradient IP survey will aid in the delineation of mineralized bodies to a depth of 300 m from surface.

To date the highest-grade gold values on the Howie Property are found in highly mineralized silicified gabbroic rocks in contact with these felsic intrusive dykes that stem from the Thundercloud unit next door.

Last week the resident geologist from Kenora Ontario Geological Survey (OGS) was onsite to sample the newly discovered Oro Grande West as well as various other showings on the property. Multi-element assays and thin section analysis will be performed by the OGS to better understand the mineralization and timing. Numerous gold bearing deformation zones up to 30 m in width occur in close proximity to one another over a 175 m wide corridor. Individually a number of these prominent shear zones host numerous newly discovered high grade stacked veins. As none of these parallel zones have ever ben drilled, the company is optimistic on defining a new discovery in the area. Three holes are planned in a fan configuration to test the continuity and grade of the system at depth. Holes will be drilled at 45-degree dip and will be between 150-200m in length.

An exciting discovery story is seeing the stock move big last week. The double bottom pattern with the breakout above $0.065 remains intact, meaning a new trend is in play. The stock had a nice pop a few days ago on news of a 82.3 g/t gold sample. Price went up to the resistance zone at $0.15 before pulling back as profits were taken.

Now, the stock is beginning to range between $0.09 as resistance and $0.07 at support. Wait for a candle break to give the next direction.