Falcon Gold (FG.V) is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon’s flagship project, the Central Canada Gold Mine, is approximately 20km southeast of Agnico Eagle’s Hammond Reef Gold Deposit which has currently estimated 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold) mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold).

The Company holds multiple additional projects:

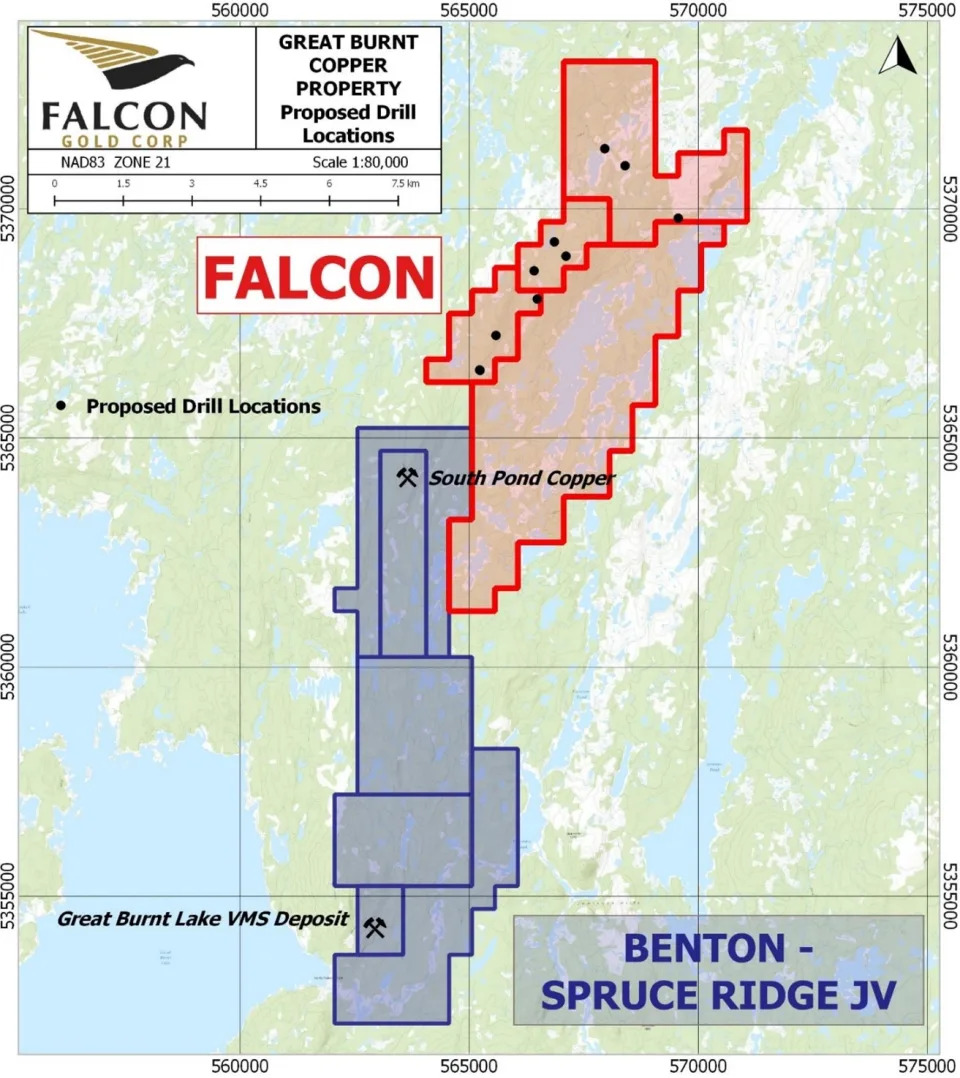

The Company has announced that it is to commence drilling at its 100% owned Great Burnt Copper Project in Central Newfoundland. The Company plans to test up to ten geophysical anomalies with a maximum of 1100 metres of drilling.

Karim Rayani, Chief Executive Officer, commented; “We are very excited to move forward on our first phase of drilling at our Great Burnt Copper Project. Drilling along the Great Burnet copper trend by neighbour Benton Resources has shown significant success. We believe that Benton’s recent success at Great Burnt is a testament to the untapped VMS potential of the Great Burnt area, and we are thrilled to hold an extensive strike extent of this unexplored, never-drilled horizon.”

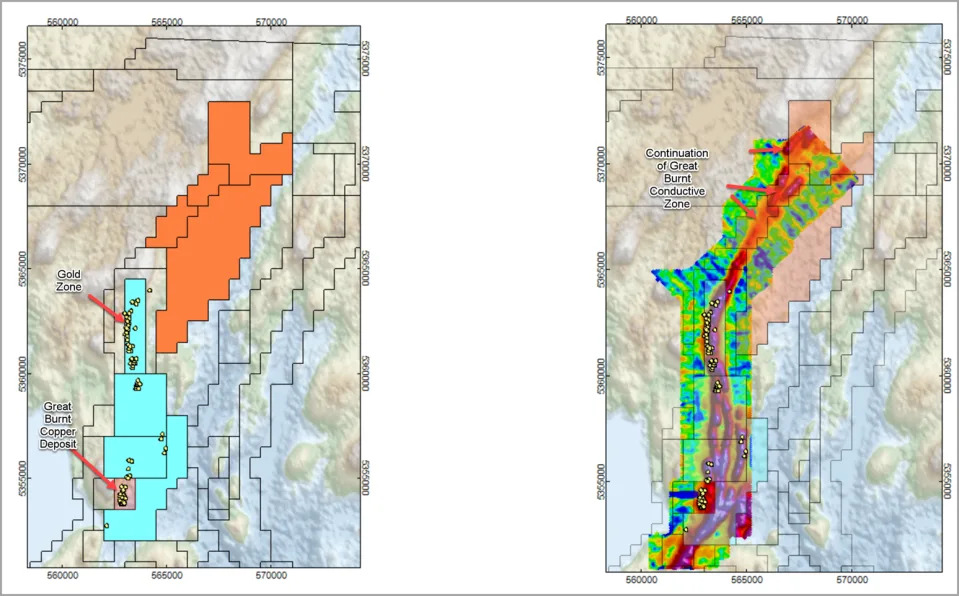

Falcon holds 2,275 hectares in the Great Burnt camp, with licenses located north of, and contiguous to, Benton Resources Inc. – Spruce Ridge Resources Ltd. Great Burnt Copper-Gold joint venture. Benton Resources Inc. recently optioned the Great Burnt Copper-Gold Project from Spruce Ridge Resources Ltd. in an agreement that allows Benton to earn a 70% interest in the property. The Benton-Spruce Ridge property is host to the Great Burnt Copper Zone, a deposit with an indicated resource of 381,300 tonnes at 2.68% Cu and inferred resources of 663,100 tonnes at 2.10% Cu.

The Great Burnt Greenstone Belt is prospective for copper and gold, and further hosts the South Pond A and South Pond B copper-gold zones, and the End Zone copper prospect along a 14 km mineralized corridor. The mineralized corridor occurs along a conductive trend, and this conductive trend continues into Falcon’s Great Burnt Copper Property.

In March 2024, the stock cleared a downtrend line increasing the probabilities of a trend reversal. We did form our first higher low at $0.035 and the stock subsequently came back down to retest the higher low level. According to market structure, the stock remains in an uptrend as long as it remains above the current higher low. This means Falcon Gold is technically still in a new uptrend reversal. The $0.05 zone is also a key support level which the stock is testing currently. Watch for this zone to hold for further momentum higher.