Ashley Gold Corp. engages in the acquisition, exploration, and development of mineral properties in Canada. It has an option to acquire a 100% interest in its principal project comprising the Ashley gold property that includes 115 mineral claims covering an area of approximately 1,759.6 hectares located in northeastern Ontario. The company also holds 100% interests in the Santa Maria property that consists of 1554 hectares located in the southeast of Dryden, Ontario, as well as holds interests in the Howie Lake property that includes 64 claims in approximately 1,000 hectares located in the Dryden, Ontario; and the Alto-Gardnar property, which comprises 15-claim blocks in approximately 315 hectares located in Dryden, Ontario.

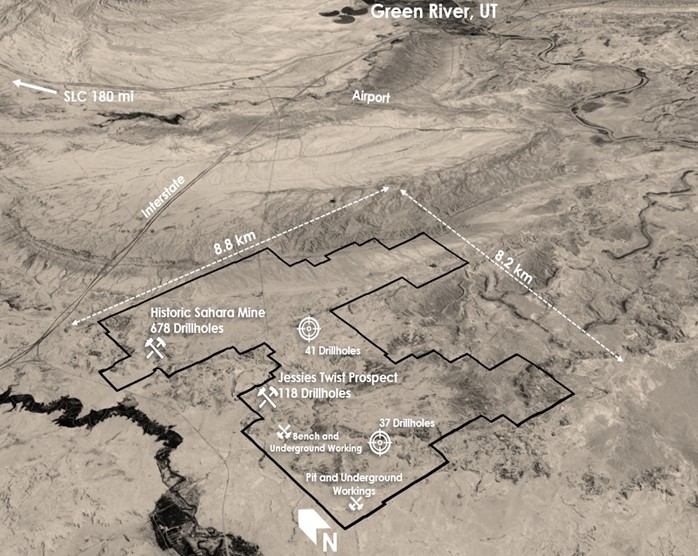

Ashley Gold Corp, traditionally focused on gold exploration, has made a strategic entry into the uranium sector with the acquisition of a uranium property. The junior signed a non-binding Letter of Intent (LOI) to enter into an Option Agreement for the 100% acquisition of the Sahara Uranium-Vanadium Property located in Emery County, Utah. The property is located 12 miles away from the town of Green River, Utah where Western Uranium and Vanadium (WUC) is in the process of permitting a processing facility for its San Rafael and Sunday Mine complex resources as well as third party processing. First ore processing for the facility is expected in 2026. The Company is looking to rapidly advance the asset to provide future feed to the new proposed processing facility.

Today, the Company announced a Letter of Intent (LOI) for processing of Sahara Uranium-Vanadium ore at the future Green River Utah processing facility being constructed by Western Uranium and Vanadium. The LOI highlights the intent for Ashley to produce 100,000 tons of Uranium-Vanadium ore per year approximating 500,000 lbs of Uranium* and 750,000 lbs of Vanadium.

This news comes a few days after the Company announced a 82.3 g/t gold sample.

Darcy Christian, CEO of Ashley comments “It is my pleasure to announce the beginning of a productive relationship between Western and Ashley. By working with George Glasier and Western we are being benefitted with a significantly reduced capital expenditure and timeline to move to a production company. We will benefit from Western’s patented kinetic separation technology for lower cost processing and Western will have additional local ore for processing to maximize profitability of the mill.”

In summary:

- nitial tolling or sale of 100,000 tons per year of ore with potential to increase

- Represents ~500,000 lbs of U3O8 and ~750,000 lbs of V2O5 per year

- Initial processing expected 2026

The LOI is the first step in establishing an offtake agreement between Ashley and Western for processing of the Sahara Uranium-Vanadium ore located approximately 16 km (10 mi) from the Green River production facility. Both tolling agreements and sale of ore to Western are being considered with terms to be finalized in a future Definitive Agreement.

The stock is up 6.25% at time of writing on today’s news.

Now this is a reversal chart to keep an eye one. We have a double bottom pattern in play with the break and close above $0.065. This neckline has even seen a retest with buyers stepping in. We had nice price action and a pop on the news of the 82.3 g/t gold sample. Look at that large wick taking price up to $0.15.

Looking to the left, we see more wicks at $0.15, so this is a strong resistance level for the stock. The stock has been attempting to get a candle body close above $0.09 but has not been able to do so. A close above $0.09 would be a bullish breakout, and confirm a higher low in an uptrend. This would take us up to $0.12 and then $0.15.