Smallcap resource explorers go through phases. Everyone likes to think investors jump on and never get off, riding one ticker all the way to production, but that’s just not true in practice.

Smallcap resource explorers go through phases. Everyone likes to think investors jump on and never get off, riding one ticker all the way to production, but that’s just not true in practice.

Some investors like the early ‘roulette wheel’ stages, where share prices move in half cent increments that offer 20+% gains.

Some don’t want in until drilling has been done, and we have an idea of what’s lying in wait underground.

Some are just hear for the pump – see Bayridge Resources (BYRG.V) as an example, running on nothing but marketing – and plan to be all out by the time the dump hits (see Neotech Mining (NTMC.V) as an example, from the same crew, only three months earlier in the timeline.

But investors coming and going through the various phases of mining exploration aren’t a bad sign. Indeed, they’re the sort of ‘fresh growth after the fire’ process that keeps forests – and mineral resource explorers – green and growing.

Alaska Energy Metals (AEMC.V) has admittedly had a fire run through its stock recently, and I’m okay with that because what that fire left behind was fertile ground and fresh shoots.

Here it is:

Yep, that’s a fall off. No denying it. No disputing it.

In November of last year, folks were buying AEMC at $0.67.

Today you can grab shares in the same company, with essentially the same projects, for $0.16, good for a $12m market cap.

I say ‘essentially’ the same projects because some old projects from the Millrock Resources days have been recently sold off, and a new project, the Bambino nickel-copper property, has been brought in.

Alaska Energy Metals Corp. has entered into an agreement pursuant to which it will be granted an option to acquire 100-per-cent interest in the 57-claim, 3,320-hectare Bambino nickel-copper-platinum group element (Ni-Cu-PGE) property located in the Temiscaming region of western Quebec, from a Quebec prospecting syndicate. The Property is located directly adjacent to the Company’s 100%-owned Angliers-Belleterre (Angliers) property acquired in 2023.

This is another bet in nickel, copper, and platinum group metals, which AEMC has been making regularly recently.

“Our Nikolai nickel project in Alaska, which hosts the Eureka deposit, already contains one of the largest known nickel resources in the US. We intend to acquire Bambino so that we can further expand our contribution of nickel and other strategic metals to the rapidly growing lithium-ion battery industry and also the long-term energy storage industry in North America,” says Gregory Beischer, CEO of Alaska Energy Metals. “We are excited and ready to begin exploration in Quebec as we know these projects could further position AEMC as a leading producer of critical minerals in the North American market at a time when these commodities are going to be in even higher demand than they are today.”

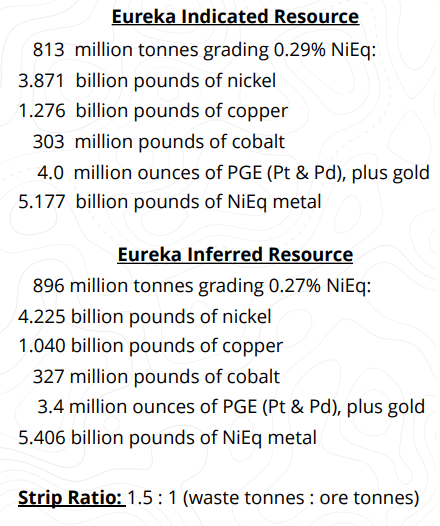

The Nikolai is a bit of a beast, truth be told.

Here’s what our proprietary platform says about it:

Project #1: Nikolai Nickel Project

- Metals: Nickel (Ni), Copper (Cu), Cobalt (Co), Chrome (Cr), Iron (Fe), Platinum Group Elements (PGE)

- Location: Interior Alaska, USA

- Acres on Trend: 9,454 hectares

- Exploration $: Over $30 million spent by historical workers on the project

- Historic Holes/Permitted: Data includes results from multiple drill programs

- Recent Work: Drilled eight holes in summer 2023; extensive geophysical and geochemical surveys conducted

- JV Partners: No current JV partners listed; historical partnerships with major explorers like INCO Ltd and Anglo American

- Compliant Resource Details:

- Inferred: 4.225 billion pounds of nickel

- Indicated: 3.871 billion pounds of nickel

- Measured: Not specified

- Feasibility Details:

- PEA Details: No Preliminary Economic Assessment mentioned

- Production Tonnage: Not specified

- Project Origin: Project initially explored by INCO Ltd in the late 1990s; acquired and further explored by Alaska Energy Metals with subsequent data purchases.

So here you have ground that is considered “one of the largest known nickel resources in the US,” with $30 million already spent on working it, a compliant resource estimate with 3.7 billion lbs indicated, with showings of multiple metals in a mining-friendly jurisdiction, and that’s bringing just a $12 million market cap?

That’s before you even get to the Angliers Nickel-Copper Project, and the newly acquired Bambino.

LET’S BE FRANK:

Could it go lower? Of course.

But it hasn’t, despite several months prior to this one when it was down every day, being sold off by folks who were racing each other out the door without care for what the price was.

AEMC has been beaten hard, put away wet, and treated like trash BUT IT FOUND ITS BASE.

When we first talked about it, we didn’t make a lot of friends in the markets. We mentioned it had been set adrift, we mentioned it had scars and stigma, and that it was going to need a minute to find its feet again before folks should consider buying back in for the value of the actual projects it held.

Well I defy you to look at that price action and not believe AEMC has found its base.

Sure, that chart makes clear someone with a large position was selling at a price of $0.15, and had no interest in going lower, and that others have been happy to relieve that person of their shares at that price.

Churn, baby, churn.

For all we know, that person may still have some stock left to shift, but if all I’m looking at is the Nikolai Project, with $30 million already invested, decent company liquidity of $1 million or so in hand, plans to do more exploration and a market cap right here of nearly 1/3 of the amount spent on the project, I like that as a buy-in level, regardless of whether that buy is at $0.15, $0.17, or $0.20.

The guy leaving can leave. The guys coming in are just getting started establishing a position.

— Chris Parry

FULL DISCLOSURE: Equity Guru has been hired by Omni8 Communications Inc. to analyse AEMC.