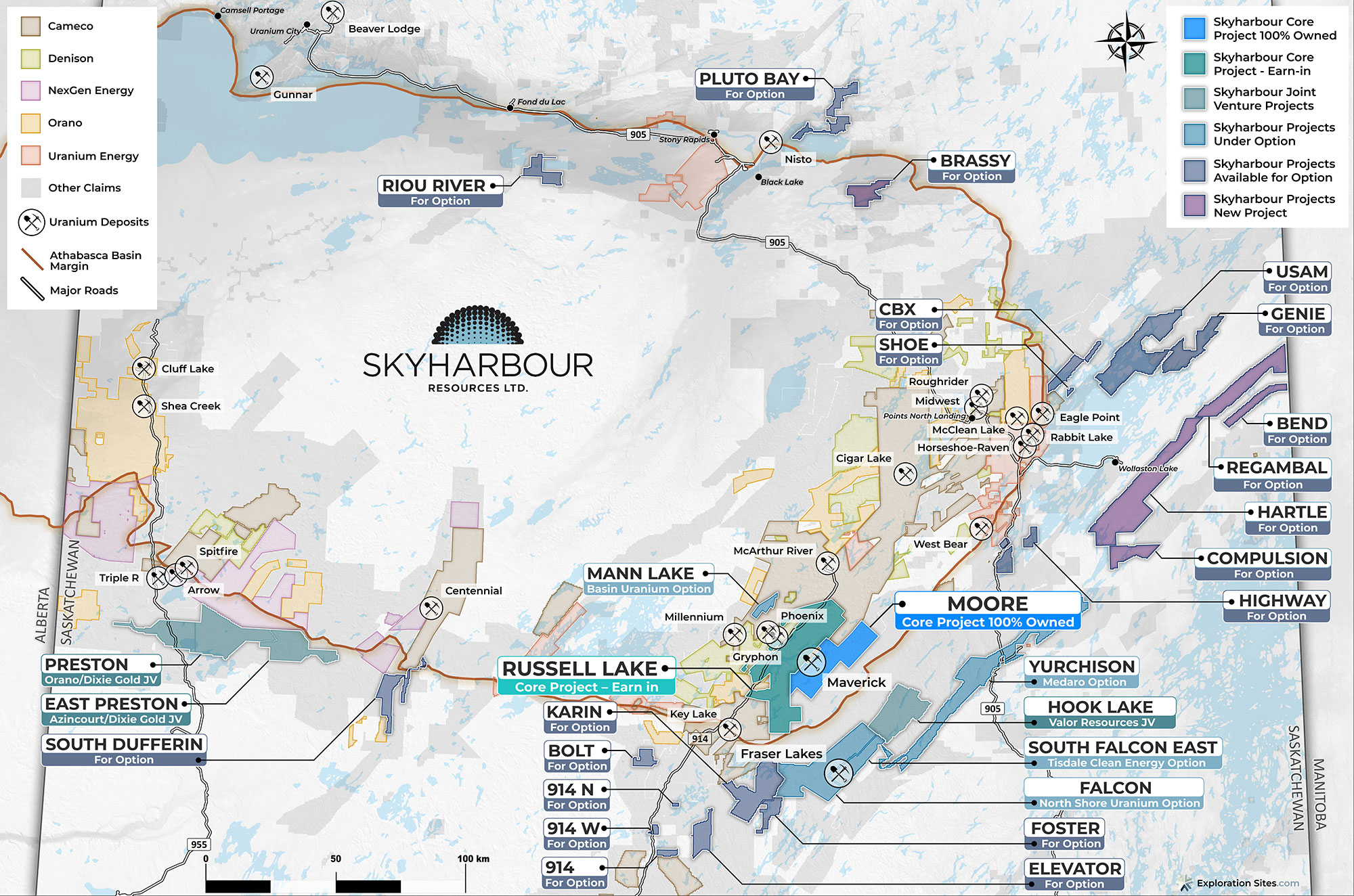

Skyharbour Resources (TSX-V: SYH), a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With twenty-five projects covering over 587,000 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

Today, Skyharbour Resources announced that it has acquired by low-cost staking new prospective uranium exploration claims in northern Saskatchewan, increasing Skyharbour’s total land package that it has ownership interest in to 587,364 ha (1,451,408 acres) across 29 projects. These 100% owned claims add an additional 64,267 ha to Skyharbour’s existing holdings in and around the Athabasca Basin.

As the Company remains focused on its co-flagship Russell Lake and Moore uranium projects, these new claims will become a part of Skyharbour’s prospect generator business as the Company will seek strategic partners to advance these assets.

List of New Properties:

- Bend Project – two mineral claims covering 9,114 hectares

- Compulsion Project – two mineral claims covering 10,451 hectares

- Genie Project – five mineral claims covering 16,930 hectares

- Hartle Project – ten mineral claims covering 52,518 hectares

- Regambal Project – five mineral claims covering 24,208 hectares

The recently staked minerals claims are all located in Wollaston Domain just outside of the Athabasca Basin sandstone. The properties are prospective for both basement-hosted unconformity-related U and pegmatite-hosted U-Th-REE, with additional potential to host base metals and other critical minerals. Some of these properties have historical pegmatite-hosted U-Th and base metal showings and historical EM conductors, with partial coverage of the properties by modern EM, magnetics, and radiometric surveys.

The stock rejected resistance around the $0.58 zone and then broke below the psychologically important $0.50 zone. The stock is testing the major support zone at $0.42. A few days ago, the price actually broke below this support level, but bulls came in to defend yesterday and confirm a false breakdown. The stock seems like it wants to range around here as the battle between the bulls and the bears continue. Watch for a range to indicate consolidation for a run back up to $0.50 as this support zone is defended.