Defense Metals Corp. is a mineral exploration and development company focused on the development of its 100% owned Wicheeda Rare Earth Element Deposit located near Prince George, British Columbia, Canada.

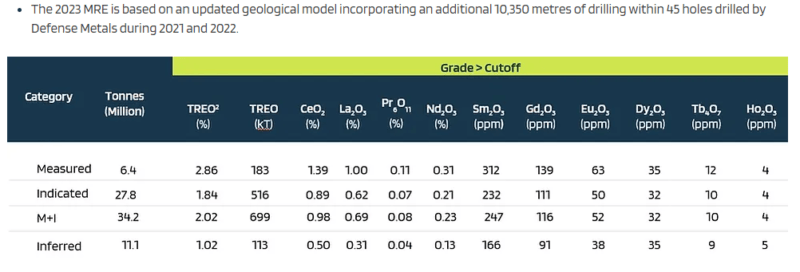

Wicheeda is a 100% owned, BC-based, high quality, open-pit rare earth asset at the pre-feasibility study stage (due in Q2), accessible by road, nearby rail, power, gas, and a major deep sea port. The company has $7m in the bank as of September, and as of August of this year had a resource estimate showing 27.8 million tonnes indicated, 11.1 million inferred.

Today the Company announced an update on the metallurgical work programs undertaken by SGS Canada and the ongoing Preliminary Feasibility Study (PFS) work by SRK Consulting and Hatch Limited for its wholly owned Wicheeda Rare Earth Project.

Highlights of both of these points include:

- The metallurgical test work required for the PFS has been completed. Multiple bench-scale flotation and flotation pilot plant test work resulted in the production of a high-grade mineral concentrate containing 50% Total Rare Earth Oxide (TREO) with an 80% recovery rate, which will be included in the PFS for the first 8 years of mine-life.

- Bench-scale and hydrometallurgical pilot plant test work shows that the planned acid bake process will deliver approximately 90% TREO extraction from the mineral concentrate to a Mixed Rare Earth Carbonate product.

- The PFS plant flowsheets are completed, based on the metallurgical test work, and equipment specifications have been issued to vendors for cost quotations.

- The field-based geotechnical, geochemical and environmental test work required for the PFS has been completed and lab-based studies are in progress.

- Other PFS tasks, including open pit mine design and tailings storage trade-off studies, are well advanced.

- Economic evaluation and cashflow modelling are in progress.

- PFS report completion in the second quarter of 2024 is on schedule.

- Eleven mixed rare earth precipitate samples from the hydrometallurgical test work have been sent to potential partners, processors or end-users.

- Over the past 5 years, Defense Metals drilled 58 core holes totalling 12,073 metres (m; ~39,610 feet) to define the Wicheeda Rare Earth Element (REE) deposit and provide samples for metallurgical test work. This work resulted in measured and indicated (M+I) resources of 34.2 million tonnes, averaging 2.02% TREO1, inclusive of 17.8 million tonnes of high-grade dolomite carbonatite averaging 2.92% TREO, in addition to inferred resources of 11.1 million tonnes, averaging 1.02% TREO. This represents a 260% increase over the Defense Metals initial 2019 mineral resource estimate, and a conversion to M+I of 101% of the prior 2021 mineral resource estimate.

- Total expenditures on the Wicheeda REE Project since 2019, including costs for mineral resource estimate definition, all metallurgical test work, earlier studies and the remaining PFS-related costs are in excess of CAD $17.5 million.

- Defense Metals has entered into a strategic Co-Design Agreement with the McLeod Lake Indian Band (MLIB), the First Nations community having the traditional territory on which the Wicheeda Project sits.

Craig Taylor, CEO of Defense Metals, stated:

“Continuing positive results from our technical studies suggest that our wholly-owned Wicheeda REE Project has the potential to become the next producer of rare earth elements in North America accounting for a significant amount of the rare earths needed for the western world’s future magnet metal production. We look forward to completing and filing the PFS for the Wicheeda REE Project in Q2-2024 and, subject to financing, moving directly into our feasibility study.”

Metallurgical Test Work

Extensive comminution, beneficiation, hydrometallurgical, and environmental tests have been completed and the resulting data have been applied in the PFS. These tests have studied development and optimization of milling and hydrometallurgical processes and the response of twenty-one variability samples representing different REE grades, lithologies and locations within the deposit.

Thirty-one samples of deposit material, flotation and hydrometallurgical products have been subjected to detailed mineralogical examination. Twenty-one samples have been subjected to Bond milling index and SMC comminution tests.

PFS Plant Design

Results from the metallurgical test work have been used to develop flowsheets for the planned comminution, beneficiation and hydrometallurgical plants. These flowsheets have been completed, reviewed and used to generate major equipment specifications for grinding mills, kilns, etc., which have been issued to equipment suppliers for quotes.

The metallurgical process design, engineering and costing is on track to allow completion of the PFS in Q2 of 2024.

Geotechnical investigation work for the mine design and pit optimization was performed by SRK and completed in December 2023. This work included sixteen geotechnical drill holes totaling 225.5 m, and twenty excavated overburden geotechnical test pits.

Tradeoff studies are being performed on the various options being considered for tailings management and infrastructure locations are being determined.

Environmental and geochemical test work has been performed on both flotation and hydrometallurgical plant products and mixtures thereof. Data have been used by SRK in the design of facilities.

The stock is currently breaking below some support here at $0.23 on today’s news.

Recently, the stock confirmed a very strong breakout. A wedge/channel was broken which ended the current downtrend. The stock is set to go from lower highs and lower lows, to making higher highs and higher lows. The first higher low could be forming around the $0.20 zone but requires a close above the $0.28 zone.

The stock did pullback to retest the large gap zone and was very close to the trendline it broke. This could potentially be tested once more.

As long as the stock remains above $0.18, the new uptrend is in play. Watch for a break above $0.28 to confirm the first higher low in a new uptrend.