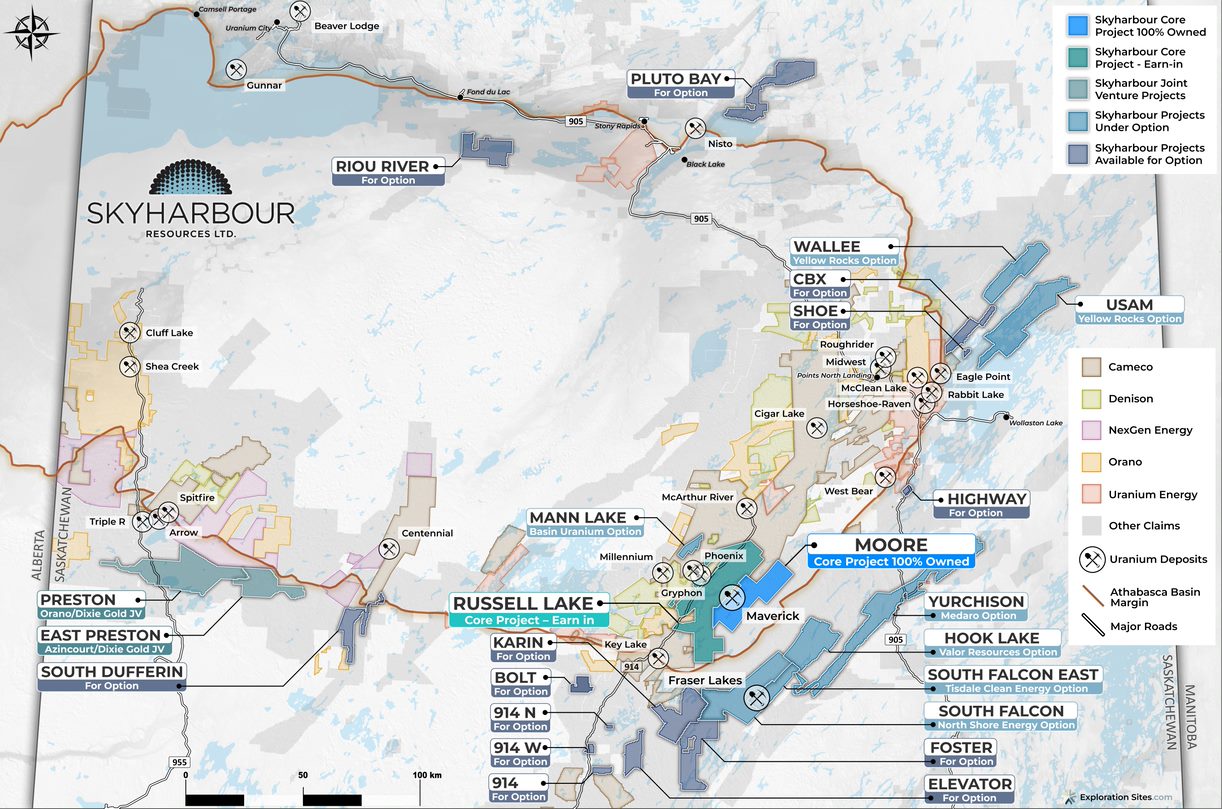

Skyharbour Resources (TSX-V: SYH), a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With twenty-five projects covering over 523,097 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

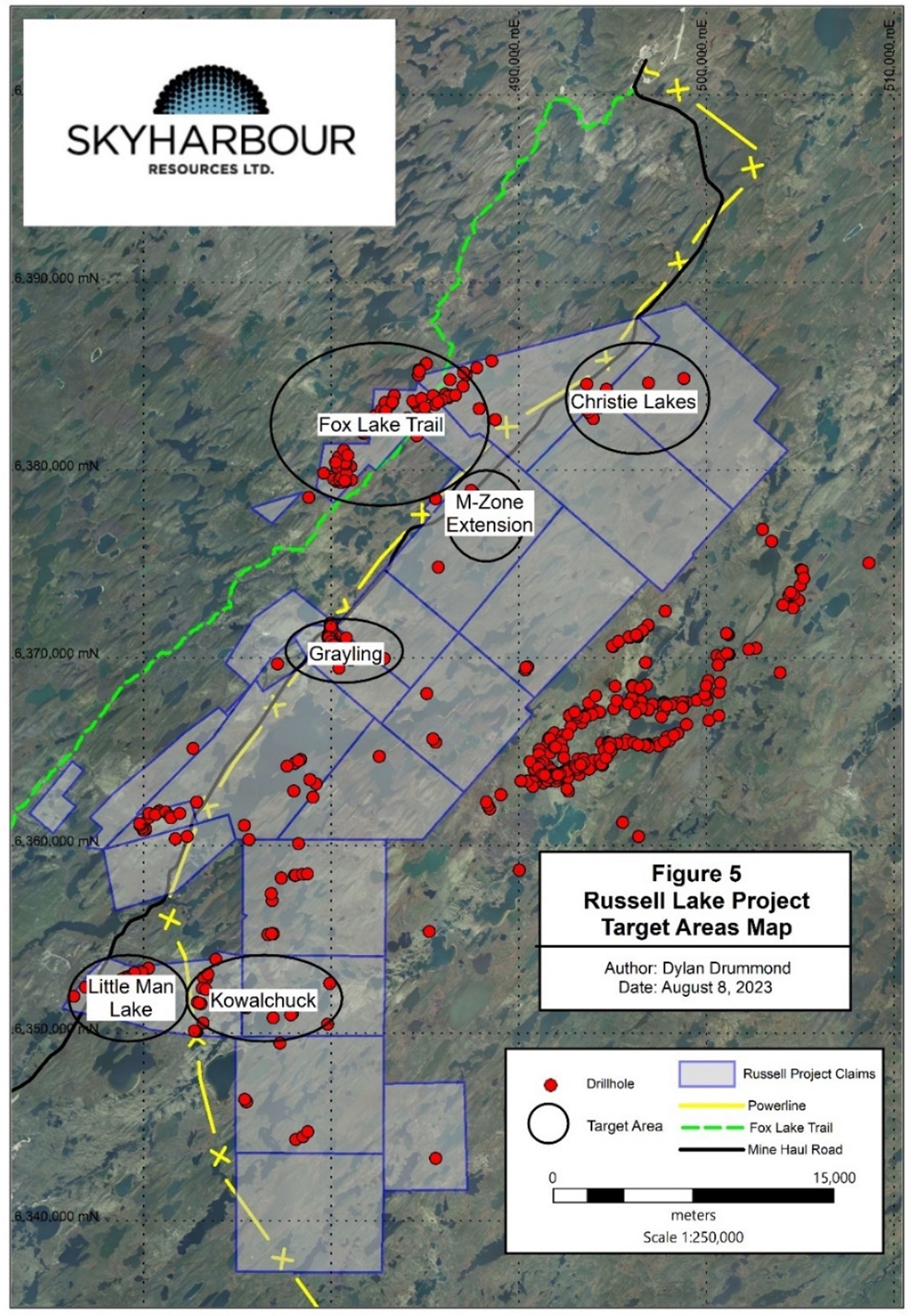

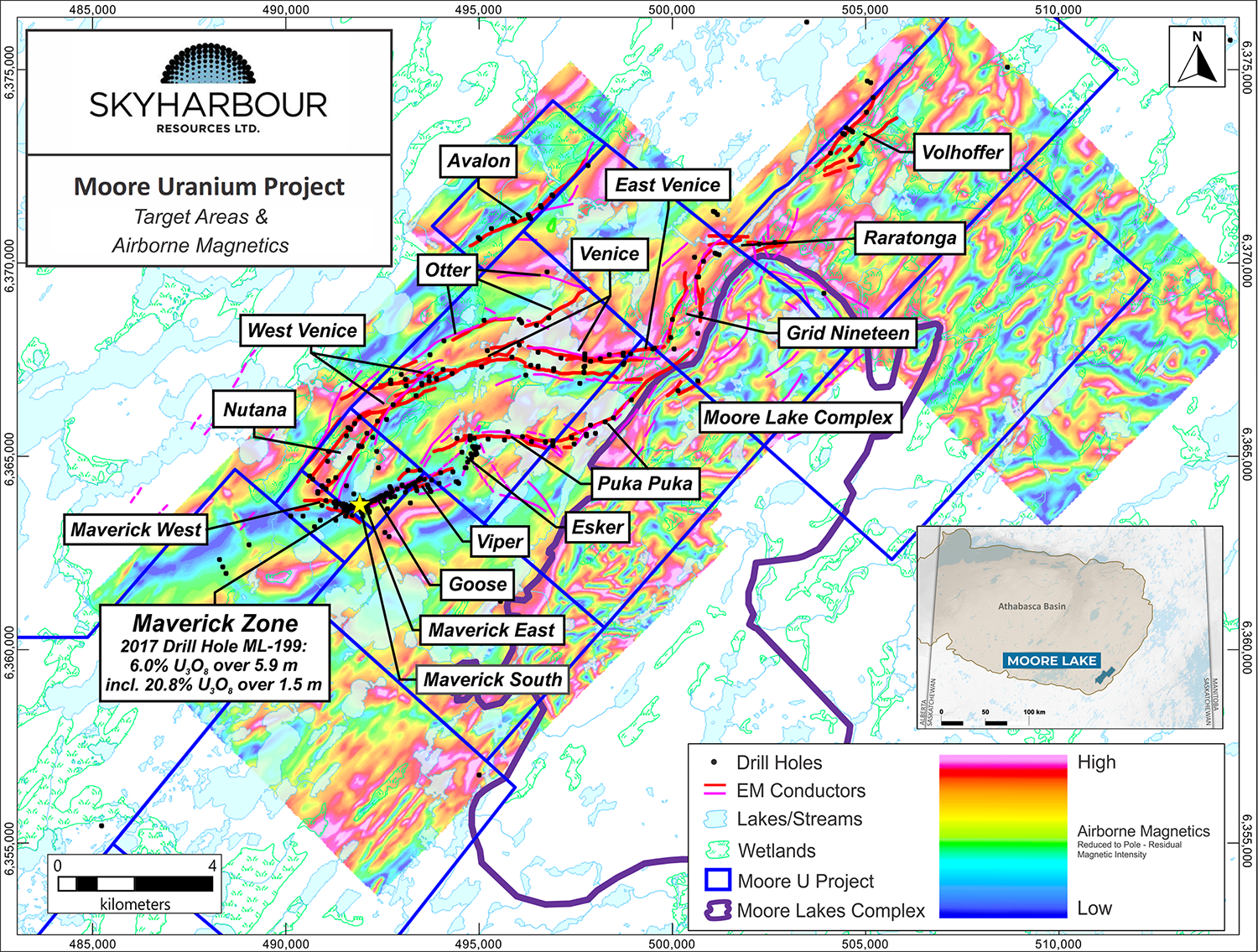

Today, Skyharbour announced it has commenced its 8,000 metre winter drill campaign at its recently optioned 73,294 hectare Russell Lake Uranium Project strategically located in the central core of the Eastern Athabasca Basin of northern Saskatchewan. Skyharbour is planning 5,000 metres of diamond drilling in ten to twelve holes at Russell and then plans to move the drill rig over to its adjacent 35,705 hectare high-grade Moore Uranium Project, to complete 3,000 metres of drilling in eight to ten holes.

The Company is fully funded and permitted for this winter drill campaign, as well as for future drilling and other exploration programs later in 2024 at Russell and Moore.

Jordan Trimble, President and CEO of Skyharbour, stated: “We are thrilled to begin the winter drilling at our co-flagship Russell and Moore Projects and anticipate plenty of news flow with ongoing, fully-funded programs right through the year. We are confident in the discovery potential and exploration upside at both projects given the high-grade mineralization in historical drill holes along with the many highly prospective target areas hosting the geology necessary for high-grade uranium deposition. Furthermore, for the first time in several years, we are infill and definition drilling at the high-grade Maverick Main Zone at Moore. With the uranium spot price around $100 / lb and the very compelling fundamentals underlying the commodity, this drill campaign and its potential catalysts could not come at a better time.”

Drilling at Russell will be focused on the Fork and Grayling East targets within the broader Grayling target area as well as the M-Zone Extension target; drill testing several uriniferous conductors that extend from Denison’s adjacent Wheeler River Project onto Russell.

The Fork target is a newly identified target to the west of the Grayling Zone and on-strike with Denison’s M-Zone at their adjacent Wheeler River Project, which has seen renewed interest by Denison in recent years.

Skyharbour has also refined additional drill targets in the M-Zone Extension area, along trend from the Grayling Zone and Denison’s M-Zone, where historical drilling intersected basement hosted uranium (up to 0.70% U3O8 over 5.8 m at 374.0 m depth). More recent drilling by Denison in 2020 at the M-Zone encountered uranium mineralization with significant faulting, core loss, geochemical anomalies, and radioactivity encountered in other drill holes. Like the Grayling Zone, the mineralization is hosted by a graphitic thrust fault within a significant magnetic low.

Drilling at the Maverick Corridor is planned within the Maverick Main and East Zones to further delineate and expand the currently identified mineralized zones. The Maverick Main Zone is characterised by basement- and unconformity-hosted mineralization, with a best interval drilled previously by Skyharbour of 6.0% U3O8 over 5.9 metres at 265.0 metres depth including 20.8% U3O8 over 1.5 metres in hole ML-199, and historical results of 4.03% eU3O8 over 10.0 metres, including 20.00% eU3O8 over 1.4 metres at a depth of 265.0 metres in hole ML-61. At the Maverick East Zone, Skyharbour previously drilled a high-grade uranium intercept of 1.79% U3O8 over 11.5 metres at 270.0 metres depth, including 4.17% U3O8 over 4.5 metres and 9.12% U3O8 over 1.4 metres in hole ML-202.

Skyharbour Resources has had a strong bounce from support around the $0.45 zone back to a major resistance zone around $0.58. This is a very significant zone for the stock and you can see this by the price action to the left. Skyharbour failed to close above this resistance indicating that the sellers are still defending resistance. $0.50 is providing some interim support here and the stock may attempt to breakout above the $0.58 resistance zone once again.