Beyond Lithium (BY.CN) engages in the acquisition, development, and exploration of mineral property assets in Canada. The company primarily has a focus on Lithium, a commodity with great fundamentals given the increasing demand for Electric Vehicles. With 64 lithium properties in Ontario covering over 150,000 hectares, Beyond Lithium is the largest greenfield lithium exploration player in the Province.

Today, Beyond Lithium announced it has entered into a mineral property purchase agreement with Patriot Lithium Limited, an Australian based mineral exploration company listed on the Australian Stock Exchange (ASX:PAT), pursuant to which the Company will transfer to Patriot an undivided 100% interest in the 61 mining claims comprising the Company’s Borland East and Borland North projects located approximately 60 km northwest of Frontier Lithium’s PAK project in Northwest Ontario.

As consideration for the Borland Claims, Patriot will issue to Beyond Lithium on closing, 1,100,000 fully paid ordinary shares in the capital of Patriot, subject to certain contractual escrow requirements. Additionally, Patriot shall pay Beyond Lithium a cash payment of C$2,500,000 for an initial mineral resource estimate filed or announced by Patriot declaring any JORC, NI 43-101, or SK-1300 compliant, as applicable, deposits or orebodies contained exclusively in any part of the Borland Claims exceeding 20 million metric tonnes of contained Li2O with an average grade equal to 1.0% Li2O or greater.

“We are pleased to announce the first of many expected transactions to maximize the value of our large lithium exploration portfolio in Ontario for the benefit of our shareholders. When looked at a price per hectare, this transaction values Beyond Lithium’s 198,000-hectare portfolio at $33 million,” commented Allan Frame, President and CEO of Beyond Lithium. “We adopted the project generator business model to maximize funds available for the exploration of our most advanced projects, while minimizing shareholder dilution. During our very successful 2023 exploration season, we generated significant amount of geological data on over 50 of our projects, making them attractive candidates for both companies which want to enter the lithium market or wish to consolidate existing land positions. These results will allow us to accelerate our deal-making activities.”

“The deal with Patriot Lithium is consistent with our priorities of partnering with reputable companies and retaining an interest in a potential lithium discovery, in this case in the form of milestone payments. The Borland Claims will form a part of a large and significant land package with better potential for development by Patriot Lithium.”

Completion of the transactions contemplated by the Purchase Agreement remains subject to certain conditions, including:

- completion of customary due diligence investigations to the satisfaction of Patriot;

- Patriot obtaining all necessary consents and approvals to issue the Purchase Price Shares;

- no material adverse change occurring with respect to Patriot;

- the Purchase Agreement not having been terminated; and

- standard closing conditions for transactions of this nature.

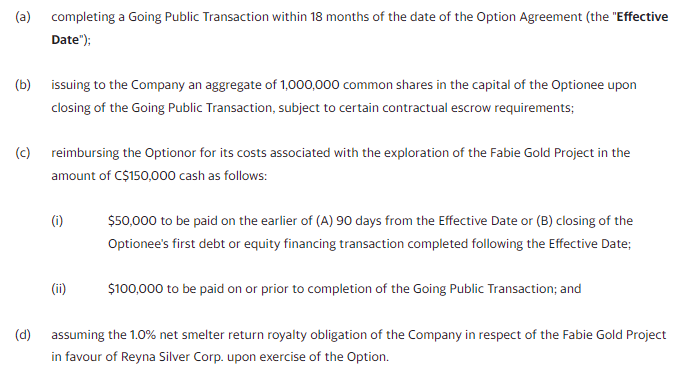

Beyond Lithium also announced that it has entered into a mineral property option agreement with Extreme Exploration Inc. pursuant to which the Company has granted the Optionee an exclusive option to acquire an undivided 100% interest in its non-core Fabie Gold project located approximately 35 km northwest of Rouyn-Noranda, Quebec.

Exercise of the Option by the Optionee is subject to the Optionee satisfying the following conditions:

“The transaction with Extreme Exploration is in line with Beyond Lithium’s strategy of monetizing its non-core mineral property and developing a portfolio of marketable securities. Beyond Lithium will continue to concentrate on advancing its exploration on its lithium property portfolio in Ontario with a focus on its most advanced and promising projects. The combined cash and securities value of the two transactions announced today totals about C$575,000 in non-dilutive financing. We look forward to announcing other similar transactions,” concluded Mr. Frame.

In terms of technical analysis, the stock failed to hold above the $0.42 support zone. What was once support has now become resistance. The stock retested $0.42 as resistance and saw the sellers jump in, leading to a drop. Naturally, the target would be support. This has played out with the stock falling to the major support zone at $0.27.

Support is where one would expect buyers to jump in. Watch price action here as we close out the year. Investors ideally want to see a range develop here, or large wick and large bodied green candles indicating that the buyers are stepping in strongly.

The stock is ranging at this zone. A candle close above $0.36 gets this stock hitting the $0.44 resistance zone.