In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

AAPKI Ventures (APKI.CN)

Market Cap ~ $4 million

AAPKI Ventures Inc. focuses on technology ventures worldwide. The company was formerly known as Pushfor Tech Inc. and changed its name to AAPKI Ventures Inc.

The stock is up 233% on no news.

The stock has been in its range phase after a long downtrend. The range is set to break with today’s price action, however, we would want to see a nice strong candle with strong volume. Volume is not consistent with this stock, but today is seeing a volume of over 268,000.

Blockchaink2 Corp (BITK.V)

Market Cap ~ $3.4 million

BlockchainK2 Corp. engages in investing in blockchain technology solutions for capital markets and other sectors. The company operates a RealBlocks, a technology platform for fundraising and investing in real estate, as well as private equity and credits; Amplify gaming platform, a blockchain-powered service that manages the sales and promotion of video games; and iRecover Coin App to implement the findings and principles of behaviorism, social neurodevelopment, and behavioral economics in a blockchain-based application to support individuals recovering from addiction.

The stock is up 60% on no news.

This stock is also in its range phase but the chart structure looks intriguing. We seem to also have a bit of a inverse head and shoulders pattern which is stretched. A close above $0.19 triggers the reversal and begins a new uptrend.

Loop Energy (LPEN.TO)

Market Cap ~ $6.9 million

Loop Energy Inc. develops, manufactures, and supplies hydrogen fuel cells to vehicle original equipment manufacturers and power generation system manufacturers in Europe, North America, China, and rest of Asia-Pacific. It offers its fuel cell systems for the electrification of commercial vehicles and mobile equipment, such as buses, trucks, logistic and delivery vans, material handling equipment, tractors, port stackers, and transport machinery.

The stock is up 33% on no news.

A reversal pattern is in play and today’s close could lead to the trigger. Watch for a close above $0.20.

SouthGobi Resources (SGQ.V)

Market Cap ~ $148 million

SouthGobi Resources Ltd., together with its subsidiaries, operates as an integrated coal mining, development, and exploration company in Mongolia, Hong Kong, and China. The company primarily explores for coking and thermal coal. Its flagship project is the Ovoot Tolgoi open pit coal mine located in the Umnugobi Aimag of Mongolia. The company also holds interest in Zag Suuj and Soumber Projects. In addition, it engages in the logistics and trading of coal in Mongolia and China.

The stock is up 28% on no news.

A breakout above recent highs and the continuation of the current uptrend. We are testing the $0.50 zone, but if we can get a close above this psychological important zone then resistance comes in at $0.63.

Canada Nickel Company (CNC.V)

Market Cap ~ $190 million

Canada Nickel Company Inc., together with its subsidiary, engages in the exploration, discovery, and development of nickel sulphide assets. It owns a 100% interest in the Crawford Nickel-Cobalt Sulphide project located in northern Ontario, Canada. The company serves electric vehicle, green energy, and stainless-steel markets.

The stock is up 17% on news of the completion of a private placement consisting of 19,600,000 units of the Company at a price of C$1.77 per Flow-Through Unit, with each unit consisting of one flow-through common share of the Company and 0.35 of one flow-through common share purchase Warrant for aggregate gross proceeds of C$34,692,000.

A nice gap up pop with the stock trending on message boards after this news. A close above $1.30 would be bullish, but even if the stock fails to do so, it still is bullish unless it fills the gap.

Top 5 Losers

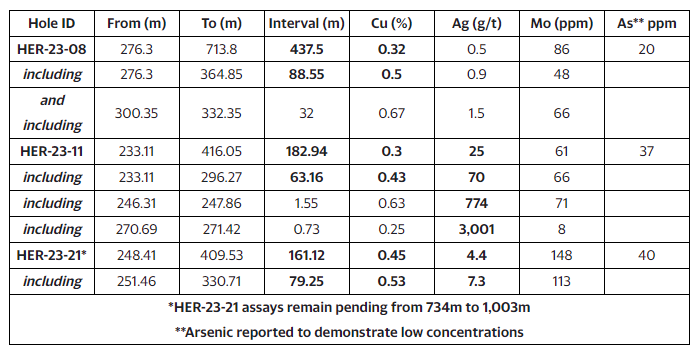

Hercules Silver Corp (BIG.V)

Market Cap ~ $203 million

Hercules Silver Corp., a junior mining company, engages in the acquisition, exploration, and development of resource properties in the United States. The company explores for silver, lead, and zinc deposits. Its flagship property is 100% owned Hercules Silver Project located in Washington County, Idaho.

The stock is down 36% on news of assay results from the latest holes drilled into the new Leviathan Porphyry Copper discovery at its Hercules project located in western Idaho.

Quite the gap down after the stock was in a strong uptrend. It seems like a double topping pattern is about to trigger. For the stock to reverse this, a close above $1.05 is required.

Bell Copper (BCU.V)

Market Cap ~ $13 million

Bell Copper Corporation, together with its subsidiaries, engages in the acquisition, exploration, development, and evaluation of mineral properties in North America. The company explores for copper and molybdenum deposits. It has interests in the Perseverance project that covers an area of approximately 14,100 acres; and the Big Sandy porphyry copper-molybdenum project that comprises approximately 5,733 acres of mineral tenures located in northwestern Arizona.

The stock is down 20% on no news.

The stock is within a range and is rejecting resistance. Watch for a close above $0.14 for a move upwards. A close below $0.085 would be bearish.

Regulus Resources (REG.V)

Market Cap ~ $125 million

Regulus Resources Inc. operates as a mineral exploration company. Its flagship project is the AntaKori copper-gold-silver project comprises 20 mineral concessions that cover an area of 438 hectares located in the Yanacocha-Hualgayoc mining district in the Department of Cajamarca, Northern Peru.

The stock is down 15% on no news.

The stock is pulling back and is now retesting the $1.00 psychological level. The stock remains bullish above $0.90.

Reyna Silver (RSLV.V)

Market Cap ~ $29 million

Reyna Silver Corp. operates as a silver exploration company in Mexico and the United States. The company explores in silver and gold properties. Its flagship property includes 100% owned Guigui Property, which consists of 7 concessions covering an area of 4,553.7034 hectares located in Chihuahua, Mexico.

The stock is down 13% on no news.

A breakdown after the stock began printing higher lows and higher highs. The close below $0.22 is bearish and the next support zone comes in around $0.18.

Abitibi Metals (AMQ.CN)

Market Cap ~ $37 million

Abitibi Metals Corp. engages in the acquisition, exploration, and development of base and precious metal properties in Canada. The company primarily explores for gold deposits. Its flagship project is the 100% owned Beschefer project located in Quebec.

The stock is down 7.6% on no news.

Just a pullback or profit taking in a strong uptrend. As long as price remains above $0.50, the uptrend can continue.