In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top Stocks

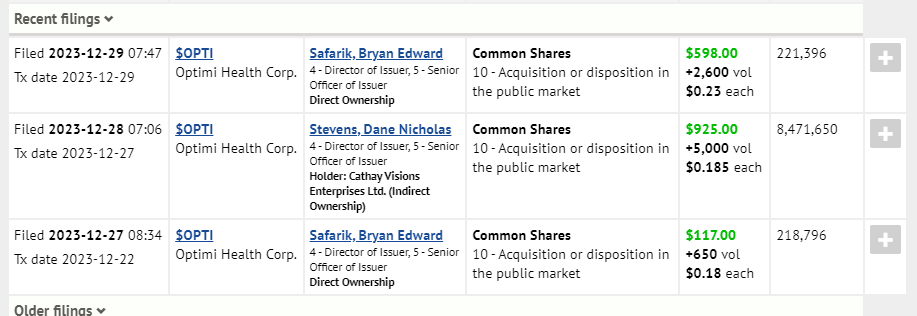

Optimi Health (OPTI.CN)

Market Cap ~ $20 million

Optimi Health Corp. engages in the research, cultivation, processing, extraction, and distribution of psilocybin, psilocin, other psychedelic substances, and functional mushrooms for health and wellness markets in Canada and internationally. The company offers a range of fungi varieties, which include Lion’s Mane, Reishi, Turkey Tail, and Cordyceps.

The stock is up 31% on no news, but there was a SEDI document:

Very interesting price action. The downtrend seems to be over and the stock has printed a double bottom pattern. The next resistance comes in around $0.27.

Red Light Holland (TRIP.CN)

Market Cap ~ $28 million

Red Light Holland Corp. engages in the production, cultivation, and sale of functional mushrooms and mushroom home grow kits to the recreational market in the Netherlands. It is also involved in the selection, distribution, and export of truffles, cannabidiol products, cannabis seeds, headshop products, cannabis bake house muffins, cookies, and cakes.

The stock is up 27% on no news.

The stock is printing a double bottom pattern and reversal traders should watch this. Watch for a strong daily close above $0.07.

BTQ Technologies (BTQ.NE)

Market Cap ~ $88.6 million

BTQ Technologies Corp. engages in the development of computer-based technology related to post-quantum cryptography.

The stock is up 26% on news that the Company announced its participation and sponsorship at CfC St. Moritz, a premier digital assets and blockchain conference for investors and decision-makers in the Swiss Alps.

This stock was mentioned in yesterday’s article. I discussed the breakout above $0.45. The close was strong and today’s momentum is strong on that close.

Verde Agritech (NPK.TO)

Market Cap ~ $81 million

Verde AgriTech Ltd, an agricultural technology company, produces and sells fertilizers in Brazil and internationally. The company offers multi-nutrient potassium fertilizer under the K Forte, BAKS, and Super Greensand brand names. It holds a 100% interest in the Cerrado Verde project, which is the source of potassium silicate rock, a glauconitic siltstone material that includes 30 granted exploration permits covering an area of 45,734 hectares located in the Alto Paranaiba region of Minas Gerais State, Brazil.

The stock is up 25% on no news.

A very strong pop with a new trend beginning after the breakout above $1.20. Next resistance comes in at $2.00.

Razor Energy (RZE.V)

Market Cap ~ $8.1 million

Razor Energy Corp. engages in the acquisition, exploration, development, and production of oil and natural gas properties in western Canada. The Company produces primarily light oil, natural gas, and natural gas liquids in Alberta.

The stock is up 24% on no news. Two days ago, the Company announced an update and a production update.

The stock is in a downtrend and today’s price action can be deemed a correction or pullback in a downtrend. To reverse things, the stock needs to close above $0.30.

Top 5 Losers

Hut 8 Mining (HUT.TO)

Market Cap ~ $1.54 billion

Hut 8 Corp. provides digital asset mining and high-performance computing infrastructure solutions in Canada. It operates computing infrastructure sites mines Bitcoin, as well as delivers cloud, colocation, and computing services to enterprise customers.

The stock is down 17% on news filed in the Celsius Network LLC bankruptcy proceedings was approved by the United States Bankruptcy Court for the Southern District of New York. The plan provides for the transfer of Celsius Network LLC’s mining operations to a newly-created “MiningCo,” with Hut 8 managing MiningCo’s mining operations under a four-year mining management agreement.

A major drop BUT the stock is falling to retest a broken out support zone around $16. Watch to see if buyers step in here.

DynaCERT (DYA.TO)

Market Cap ~ $59 million

dynaCERT Inc. engages in the design, engineering, manufacture, testing, and distribution of transportable hydrogen generator aftermarket products in North America and internationally. Its patented and patent-pending retrofit product provides performance enhancements by injecting hydrogen and oxygen into the air intake manifold resulting in fuel efficiency and reduced carbon emissions.

The stock is down 17% on no news. Yesterday, the Company announced Q4 2023 highlights.

Choppy price action here with the stock failing to make momentum above $0.17. Watch for support here to be tested.

HIVE Technologies (HIVE.V)

Market Cap ~ $515 million

HIVE Digital Technologies Ltd. operates as a cryptocurrency mining company in Canada, Sweden, and Iceland. The company engages in the mining and sale of digital currencies, including Ethereum Classic, Bitcoin, and other coins. It also operates data centers; and offers infrastructure solutions.

The stock is down 14% on no news. Yesterday, the Company announced the closing of a $28.75 million financing.

Another crypto chart showing price falling back to retest a broken support. Support comes in at $5.50 and the higher low comes in at $4.50.

SATO Technologies (SATO.V)

Market Cap ~ $38 million

SATO Technologies Corp., a blockchain company, engages in the cryptocurrency mining in Quebec, Canada. The company operates a data center to support blockchain infrastructure cryptocurrency mining, AI deployments, and other computationally intensive processes.

The stock is down 13% on no news.

After a breakout, the stock has failed to carry the momentum. It appears we have a false breakout which is bearish.

Minehub Technologies (MHUB.V)

Market Cap ~ $12 million

Minehub Technologies Inc. develops and operates block-chain technology platform for digital trade in the mining and metals supply chain and related enterprise solutions. The company’s MineHub platform connects the buyers, sellers, and financiers, which are involved in physical commodities transactions in a digitally integrated workflow.

The stock is down 14% on news of a $2.5 million financing.

A major support zone has broken. The stock is now printing new all time record lows. It must regain the $0.20 zone to turn things around.