In Canada, if you look backwards over the timeline, you’ll often find public companies have been other things back in the day. Risen, fallen, tapped out, rolled back, reemerged as a whole new thing. Sometimes this happens several times before a business model catches. Revive Therapeutics (RVV.C) is that rare Canadian smallcap that, while it has been up and down, and up and down again, it hasn’t tapped out. It has evolved.

While some months have been rocketry in motion and others have been gravity-heavy, there’s not come a moment where the boss, Michael Frank, has decided to just sell off his piece for what he can get and throw the keys on the floor of the office on his way out. And that’s come at some personal cost.

People who rode his stock the wrong way like to kick him about for it. Those who rode it up the other way and got rich, keep to themselves.

“When this was originally a pharma company way back in the day, people said we were too small and inexperienced to take a drug through trials,” Frank says. “Then cannabis came around, and we saw a way to embrace that industry while staying true to our calling – there are a lot of ways cannabis compounds can help patients, and presently do, but people laughed because I guess weed is funny.”

Then psychedelics came around and Revive explored that space.

“We’re still there,” says Frank. “It wasn’t a pivot, it was another opportunity to create pharmaceutical products in keeping with our business model, by using a new and evolving sector, but people said we were just chasing the next hot thing – again.”

Revive was still working on psychedelic options and cannabis options when Covid hit, and brought an old asset into a new opportunity.

“We looked at what we had in our IP pool and Bucillamine was right there,” he says. “We already had this asset that we’d started out with years before on another path, but it looked like it could be used to treat Covid, so we talked with experts and they agreed there was something worth exploring, so we jumped on it.”

FDA trials are never easy, and they’re never cheap, but this was a ‘dare to be great’ moment and whatever you think of Revive, you have to agree they punched above their weight class. They were right there in the most important race of the last several decades.

At each of these phases of the Revive business model, critics yelled at Michael Frank for ‘chasing’. They laughed that he had the balls to think his little company, that hadn’t found a big success so far, believed it could be legitimate enough to be in the Covid fight.

PHASE 3 IS NO JOKE

But a funny thing happened while those critics were yelling at him for having the temerity to suggest Bucillamine might be the answer to Covid; he got trial partners and he got money and he got Bucillamine a look-see with the US FDA, and people noticed all of this happening and they bought his stock. They bought a LOT of it.

The whole world was desperate for a vaccine or a cure or a treatment, and loads of dollars went into that race and Bucillamine was RIGHT THERE in the middle of that fight, just like he said it would be.

From 2019 through 2021, Revive went from a $0.03 stock to a $0.50 stock, at times spiking as high as $0.93 as it rolled through FDA trial phases. At the third phase, with vaccines finally emerging and global pandemics drawing down, Bucillamine faltered. It just didn’t have the juice to beat out the mega millions being put into other options all over the world by governments and Big Pharma and military and investors.

In 2022, Revive couldn’t support its by-then massive market cap, and came back to rest where it started. If you’d bought in at $0.50, it was a horrible failure. If you’d bought in at $0.03, and got out over the several years you were in a massive profit position, it was a life changing success.

Final judgement, however, is yet to be known because, as I noted earlier, Mike Frank is still at the plate. The crowd may have gone, but the game isn’t over, and if he can get on base once more, he’s fairly certain ‘people will come.’

WHAT’S NEXT

If any company symbolizes the value of taking a sideways step in the search for a better way forward, Revive does, and that sideways step is not in preventing Covid, which others now do fairly well, but in the diagnosis and potential treating of long Covid, which nobody has got a handle on and which is costing millions of people years of their productive working life..

I had Covid a couple of times, and the impact on my brain was horrible. For months I couldn’t look at a computer screen, couldn’t focus, couldn’t stand for long periods. It’s a real issue and nigh impossible to detect, diagnose, and treat. So if anyone could help in that respect, they’d have a massive war chest quickly enough.

Revive Therapeutics Ltd.’s newly formed subsidiary, Revive Diagnostics Inc., has entered into a licence agreement with Lawson Health Research Institute for the worldwide exclusive rights to novel blood biomarkers that characterize long COVID. The discovery of the biomarkers identified by a research team at Lawson, led by Dr. Douglas Fraser, was recently published in the journal, Molecular Medicine.

This is a BIG deal, if Revive can pull it off. Long covid hits around 10% of Covid patients, which is a massive and growing market. And Bucillamine is right there to work into the diagnostic tech as a kicker.

Here’s what Revive is working on right now.

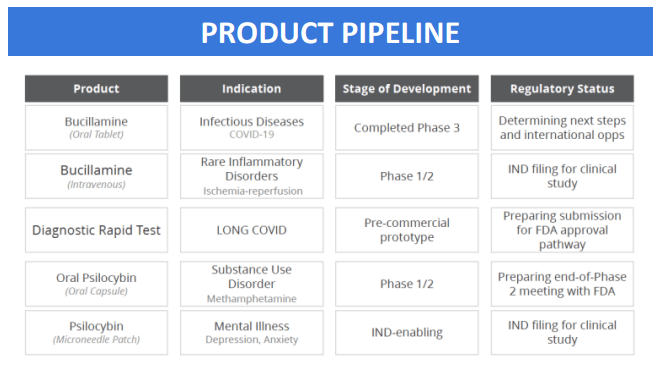

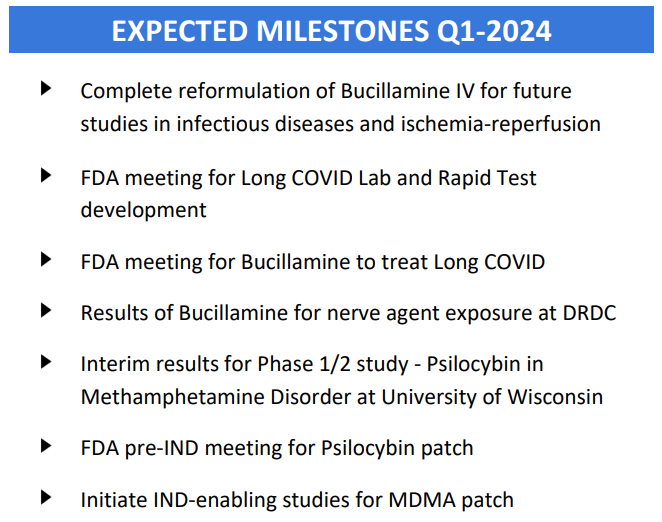

- Bucillamine for COVID-19 and Long COVID: In the near future, Revive plans to reformulate Bucillamine for intravenous (IV) use, targeting infectious diseases and ischemia-reperfusion injuries (damage caused when blood supply returns to tissue after a period of lack of oxygen).

- Psilocybin Development: Psilocybin, commonly known for its use in psychedelic therapy, is being explored for novel applications. This includes a patch delivery system and its use in treating Methamphetamine Disorder. They are working towards an FDA pre-Investigational New Drug (IND) meeting for the Psilocybin patch and are in the midst of a Phase 1/2 study at the University of Wisconsin to investigate its effects on Methamphetamine Disorder.

- MDMA Patch: Revive are initiating studies to enable an Investigational New Drug (IND) application for an MDMA patch. MDMA is typically known for its psychoactive effects, but it is also being researched for potential therapeutic uses such as PTSD, and government is increasingly sympathetic to that opportunity.

On the long covid front, here’s more detail on the deal.

- Exclusive License Agreement: Revive Diagnostics Inc. has acquired worldwide exclusive rights to novel blood biomarkers for characterizing long COVID, which were discovered by a research team at Lawson Health Research Institute led by Dr. Douglas Fraser.

- Significance of the Biomarkers: The biomarkers are crucial because they can potentially provide a clear biological basis for diagnosing long COVID. Currently, long COVID is a diagnosis of exclusion, meaning it’s based on ruling out other conditions, and it lacks a defined biological basis.

- Potential Diagnostic Solutions: The goal is to commercialize a diagnostic solution for long COVID. This could be groundbreaking as there is currently no FDA-approved clinical diagnosis for long COVID, which is estimated to occur in at least 10% of SARS-CoV-2 infections. The diagnostic solution aims to help in correctly diagnosing long COVID, enabling appropriate medical interventions and treatments.

- Economic and Health Impact: The CDC estimates that 7.5% of adults in the United States experience long COVID symptoms. The total economic cost of long COVID could be substantial, with estimates reaching as high as $3.7 trillion.

- Development of Diagnostic Tests: Revive Therapeutics and Lawson will collaborate to develop a qELISA laboratory test kit and a lateral flow assay point-of-care device for rapid testing of long COVID.

- Link to Bucillamine Treatment: Revive Therapeutics will also explore the use of the long COVID test as a companion diagnostic tool to bucillamine, which is being investigated as a potential treatment for long COVID.

- Importance of Rapid Diagnosis: The rapid diagnostic test for long COVID is seen as crucial for identification and treatment. It aims to reduce unnecessary medical testing and healthcare expenditures. This development aligns with the current method of diagnosing long COVID, which involves a previous COVID-19 diagnosis and a clinical assessment.

- Intellectual Property Details: Revive Diagnostics has gained exclusive rights to the intellectual property for developing and commercializing these novel blood biomarkers. The intellectual property includes several patent applications and is managed by WORLDiscoveries, the commercialization office of Lawson and Western University.

For many, that would be enough to start a position in the company, even without Revive Therapeutics’ existing experience in navigating the FDA process, its proven ability to raise money, and its existing intellectual property in the space.

But there’s more.

Revive Therapeutics Ltd. has made a significant move in the field of medical countermeasures by partnering with Defence R&D Canada — Suffield Research Centre (DRDC), an agency of the Canadian Department of National Defence to evaluate bucillamine as a potential treatment for nerve agent exposure. The DRDC will fund the research project, which is expected to begin in early Q1 2024.

WAIT A SECOND.

You guys all sit around shitting on Revive Therapeutics because it’s 3c, while the CANADIAN MILITARY thinks enough of Bucillamine and its varied potential uses that it’s DOING THE RESEARCH ITSELF, at no cost to Revive.

If that research is successful, Revive gets to benefit from it financially.

If the research isn’t successful, it’s lost NOTHING.

And while you’re at it, consider this: If the military sees use for this drug in treating chemical nerve agent attacks, it won’t wait til Health Canada or the FDA is done playing with it, it’ll simply produce and distribute the stuff to the armed forces. The turnaround here would be lightning quick compared to a mainstream public trial process. Research is set to commence in Q1 2024, so, in a handful of weeks potentially.

THE DETAILS:

- Focus on Nerve Agent Exposure: The agreement is to evaluate bucillamine as a potential treatment for nerve agent exposure. Nerve agents are highly toxic chemicals that can cause severe harm, and finding effective treatments is crucial for both military and civilian protection.

- Funding and Timeline: DRDC will fund this research project, which is expected to start in early Q1 2024.

- Research Background: DRDC is investigating pharmacological compounds to mitigate brain injury caused by nerve agents. Recent studies have shown that antioxidants like n-acetylcysteine (NAC) can help limit seizure activity and improve the effectiveness of certain anti-convulsant drugs. Bucillamine is considered a more potent antioxidant than NAC.

- Advantages of Bucillamine: Bucillamine may offer increased efficacy against seizure activity caused by nerve agents, with fewer side effects. Specifically, it might limit the anticoagulant and bleeding risks associated with NAC.

- Potential for Wider Applications: If bucillamine shows promise in these studies, it could lead to further research and possibly Health Canada approval for its use in treating nerve agent or organophosphate pesticide poisoning. Additionally, it might be studied for efficacy against mild traumatic brain injury caused by concussive or explosive forces.

- Revive Therapeutics’ Role: Revive Therapeutics is excited about this collaboration as it aligns with their goal of validating novel uses and formulations of bucillamine for various public health emergencies, including pandemic influenza, emerging infectious diseases, and medical countermeasures for incidents and attacks.

BRO.

Pros: New research at no cost with the government being the approval process AND the buyer, and committing to working quickly.

Cons: None. No cost, no risk, and if it doesn’t work there’s no change in the company, period.

Look, you’re not going to have any trouble buying this stock for a cheap price for a while yet, so I’m not going to sell you on that whole usual ‘the train is leaving the station!’ routine. Buy it tomorrow, buy it Monday, buy it next week, you’re probably going to be able to get today’s good deal then.

But at the FIRST SIGN of progress on any of these deals above, on the first news release drop that indicates signs are good, I would expect that situation to have high potential for stock price change, and the reason for that is simple; it’s exactly what happened last time.

Last time out, folks complained Revive Therapeutics was a pretender until the stock was up 20%, 50%, 200%, or more.

Years later, it would drop, okay sure. That either indicates it’s done, peace out, never coming back, or that life is cyclical and you might just get another shot at the brass ring.

I’ve taken a position, on the off-chance this thing will catch another wave, because if Michael Frank has had success in one thing over the years, it’s been in outlasting a lot of his critiics.

And making others rich.

— Chris Parry

FULL DISCLOSURE: Equity.Guru has a position in RVV, and the company is now a marketing client.