In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

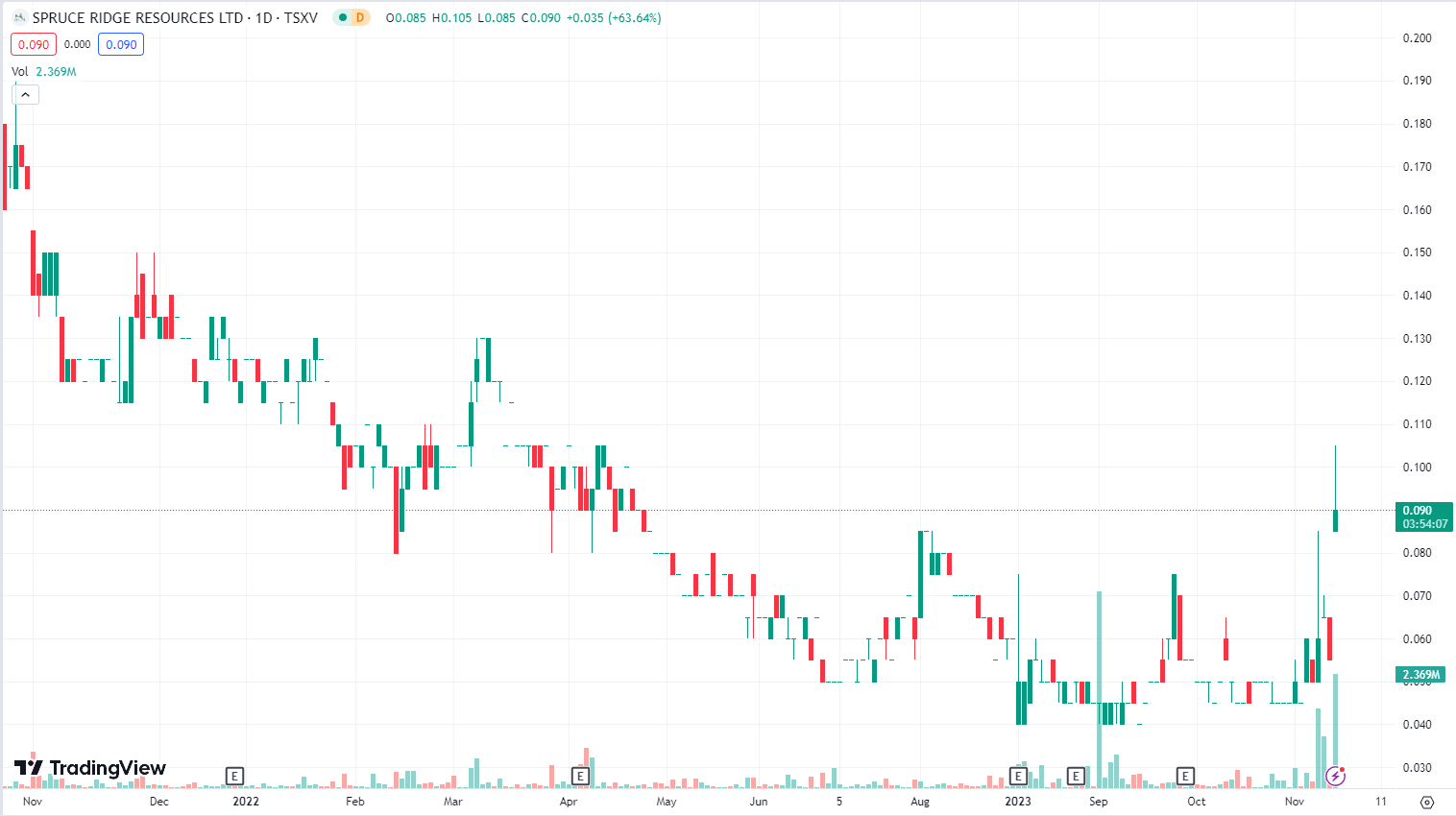

Spruce Ridge Resources (SHL.V)

Market Cap ~ $15.32 million

Spruce Ridge Resources is focused on the exploration and evaluation of gold and copper assets in Newfoundland, including the Great Burnt High-Grade Copper Resource, South Pond Copper Zone, South Pond Gold Zone, as well as the Foggy Pond Property.

The stock is up 63.6% on no news. On November 16th, 2023 the company announced that it had entered into a share purchase agreement with RAB Capital Holdings Limited for all the issued and outstanding shares in RFN Holdings, a holder of 80% interest in the Homeland Nickel Corporation, which holds a portfolio of mining claims in Oregon.

The stock is looking to breakout of a range and could trigger a reversal. Watch for a daily close above the $0.09 zone.

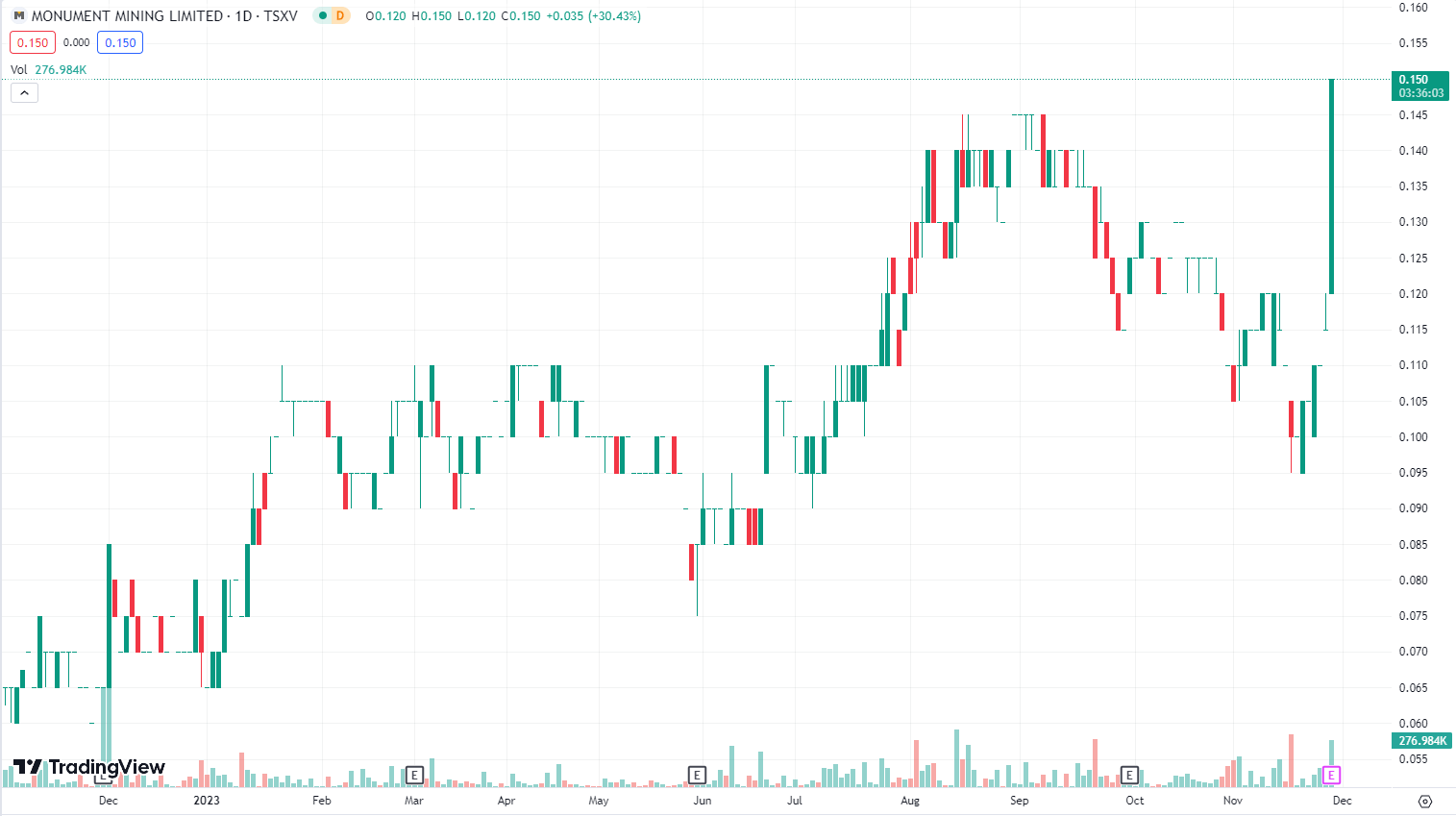

Monument Mining (MMY.V)

Market Cap ~ $47.44 million

Monument Mining is a gold explorer and producer with an exploration portfolio located in Western Australia as well as a producing asset in Malaysia which has produced 336,164 oz since 2010.

The stock is up 26.1% on no news. The company announced Q4 and fiscal 2023 results at the end of September with gross revenue of $12.39 million USD.

There is a bullish engulfing pattern at the end of the chart which could indicate an uptrend.

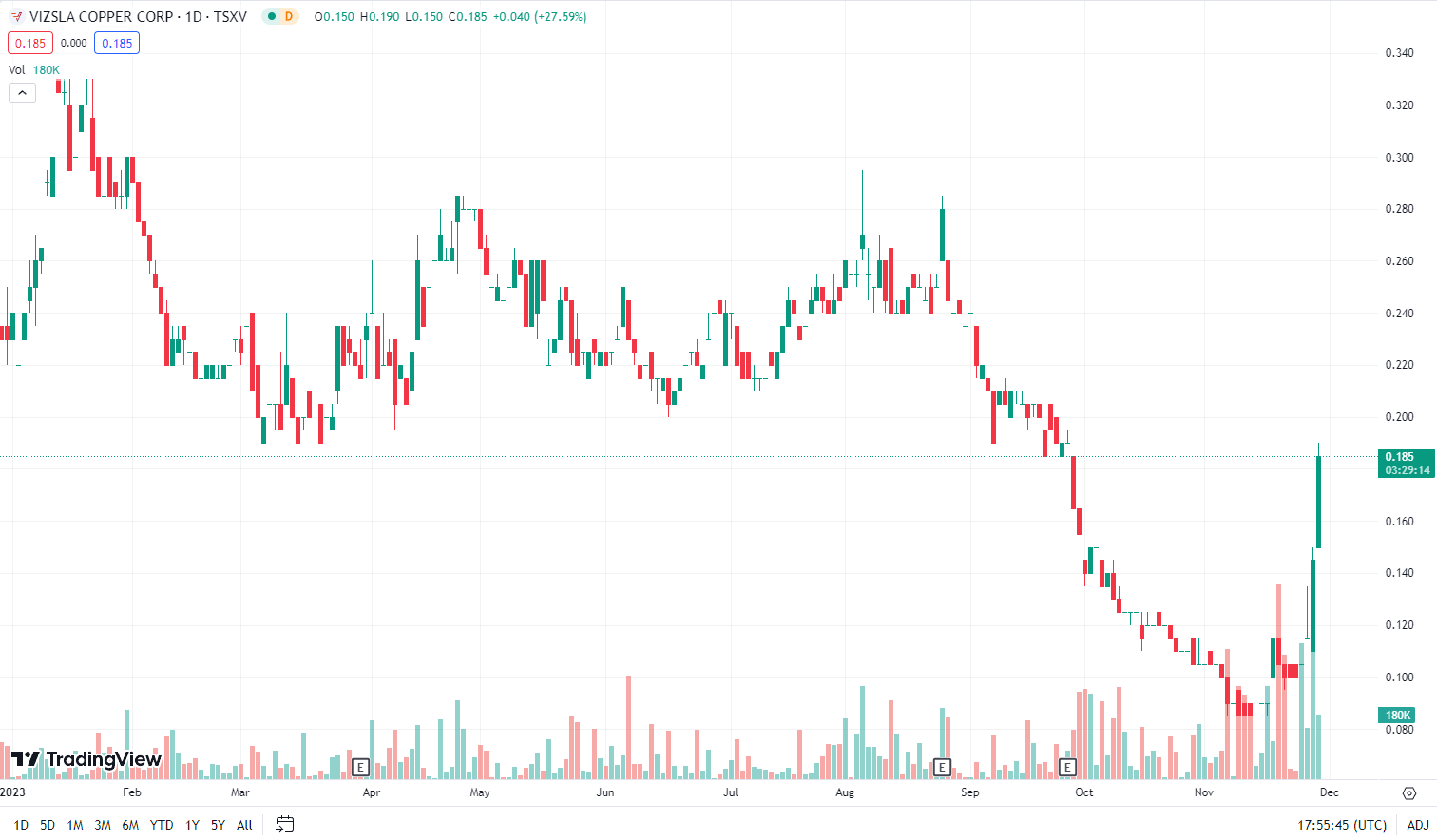

Vizsla Copper Corp (VCU.V)

Market Cap ~ $19.95 million

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada. The Company is primarily focused on its flagship Woodjam project, located within the prolific Quesnel Terrane, 55 kilometers east of the community of Williams Lake, British Columbia. It now has four additional copper exploration properties; Copperview, Redgold, Blueberry and Carruthers Pass, all well situated amongst significant infrastructure in British Columbia.

The stock is up 27.6% on no news. The company announced at the beginning of November that it had identified Copper-Gold target areas at the Copperview Property located in south-central BC.

Despite the sustained bearish sentiment, there is a potential reversal signaled by strong buying pressure.

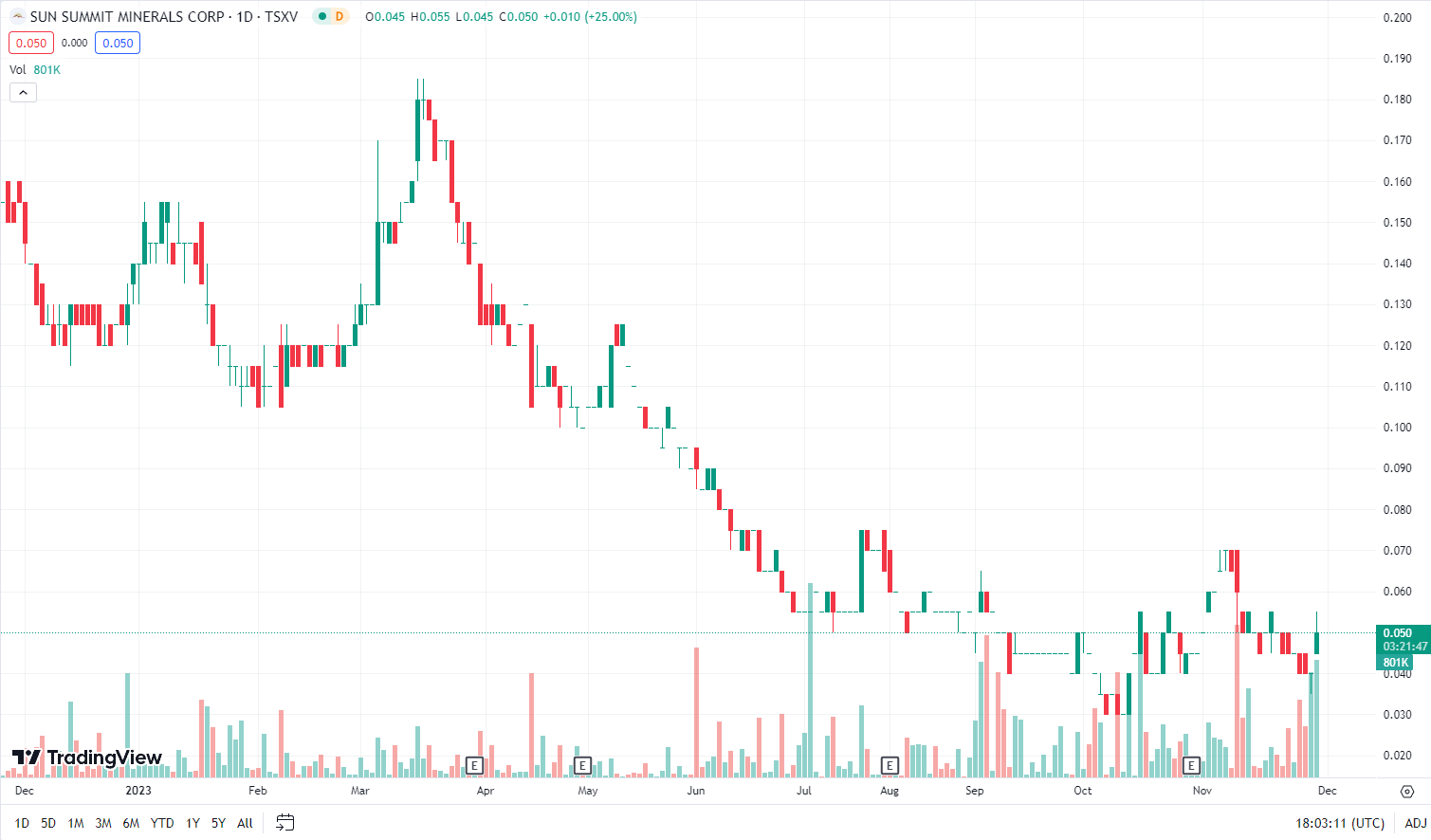

Sun Summit Minerals (SMN.V)

Market Cap ~ $5.28 million

Sun Summit Minerals is a Canadian mineral exploration company focused on expansion and discovery of district scale gold and copper assets in central British Columbia.

The stock is up 25% on no news. The company announced intersecting 0.79 g/t gold equivalent over 41.5 metres, during a multi-stage exploration program at its 52,000 hectare Buck Project located in Central British Columbia.

There is an overall downtrend but multiple instances of price consolidation with volume spikes. There could be a breakout in the making if today closes above $0.055.

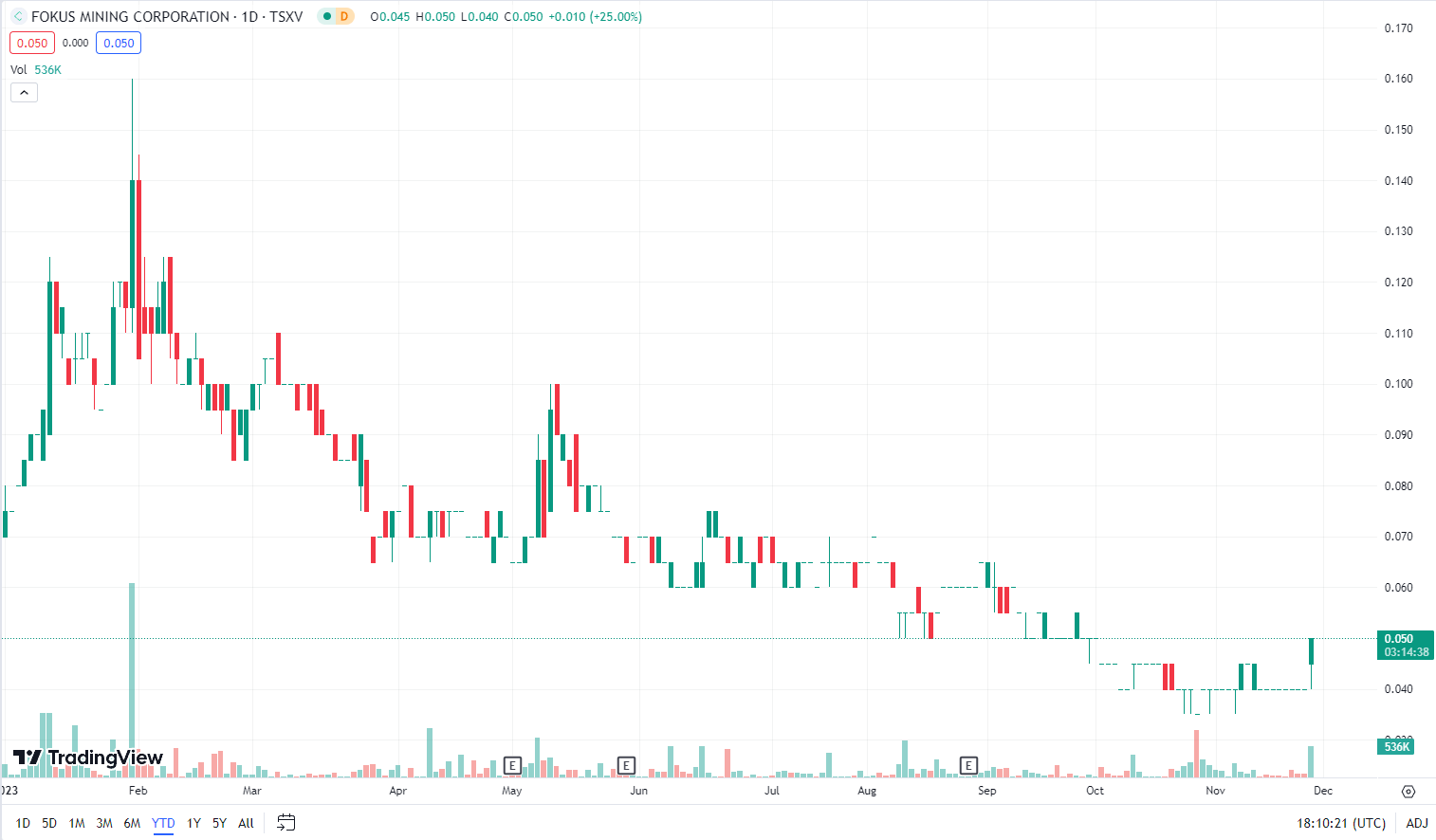

Fokus Mining Corporation (FKM.V)

Market Cap ~ $5.55 million

Fokus Mining Corporation is a mineral resource company dedicated to the acquisition and exploration of precious metals deposits in the province of Quebec, Canada.

The stock is up 25% on the company announced it had commenced its winter drilling program on the Galloway Project located in the Abitibi Region.

There is a clear descending trend since the start of the year, but the stock seems to have found a support level. If it can close above that level, there may be a reversal in store.

Top 5 Losers

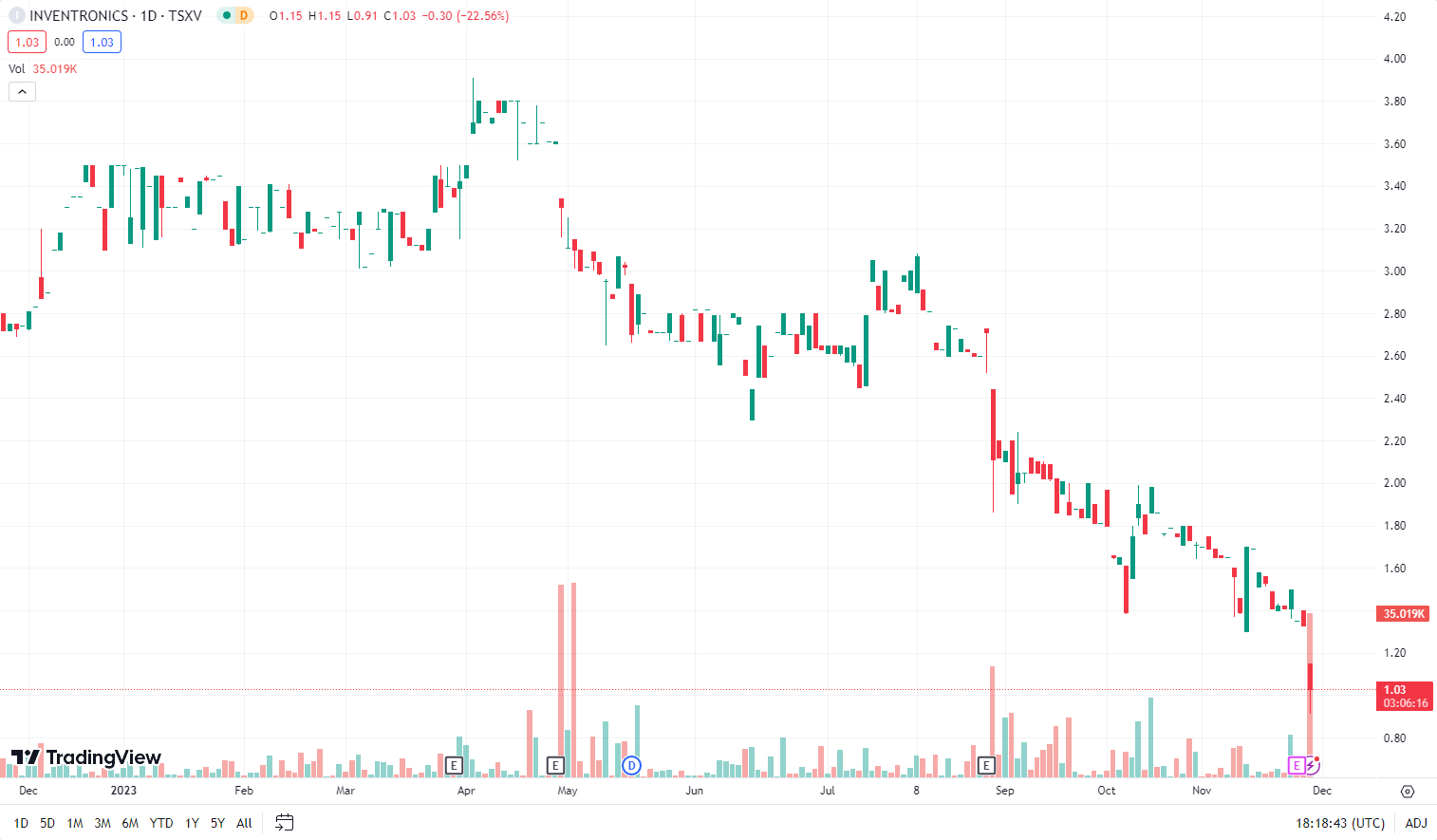

Inventronics Limited (IVX.V)

Market Cap ~ $5.02 million

Inventronics Limited has been designing and manufacturing enclosure solutions since 1970.

The stock is down 22.6% on the company announcing its Q3 2023 financial results where it reported a net loss of $94,000, or 1.9 cents per share.

There is a pronounced downward trend as well as a support breakdown which may indicate the pain isn’t over.

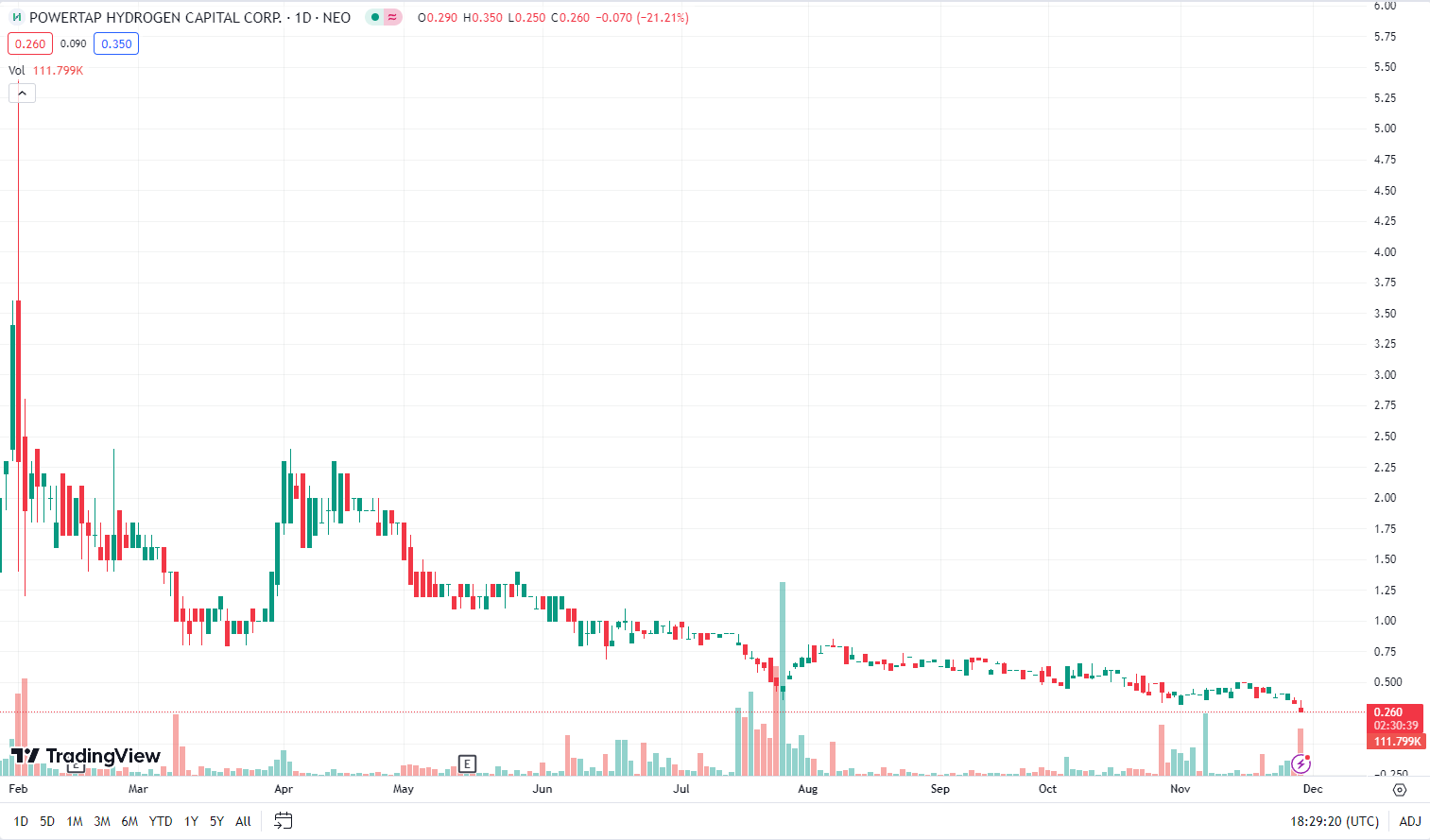

PowerTap Hydrogen Capital Corp (MOVE.NEO)

Market Cap ~ $6.14 million

PowerTap Hydrogen Capital Corp has developed the technology solution, PowerTap® which generates hydrogen on-site by converting natural gas and city water into high-purity hydrogen directly at the point of use.

The stock is down 21.2% on no news. The company announced late filing of its annual financial statements as well as a management cease trade order at the end of September.

There is a sustained downward trend with a series of lower highs and lower lows and even though there seems to be a leveling off to a support level, there is no real indication the downward trend is over.

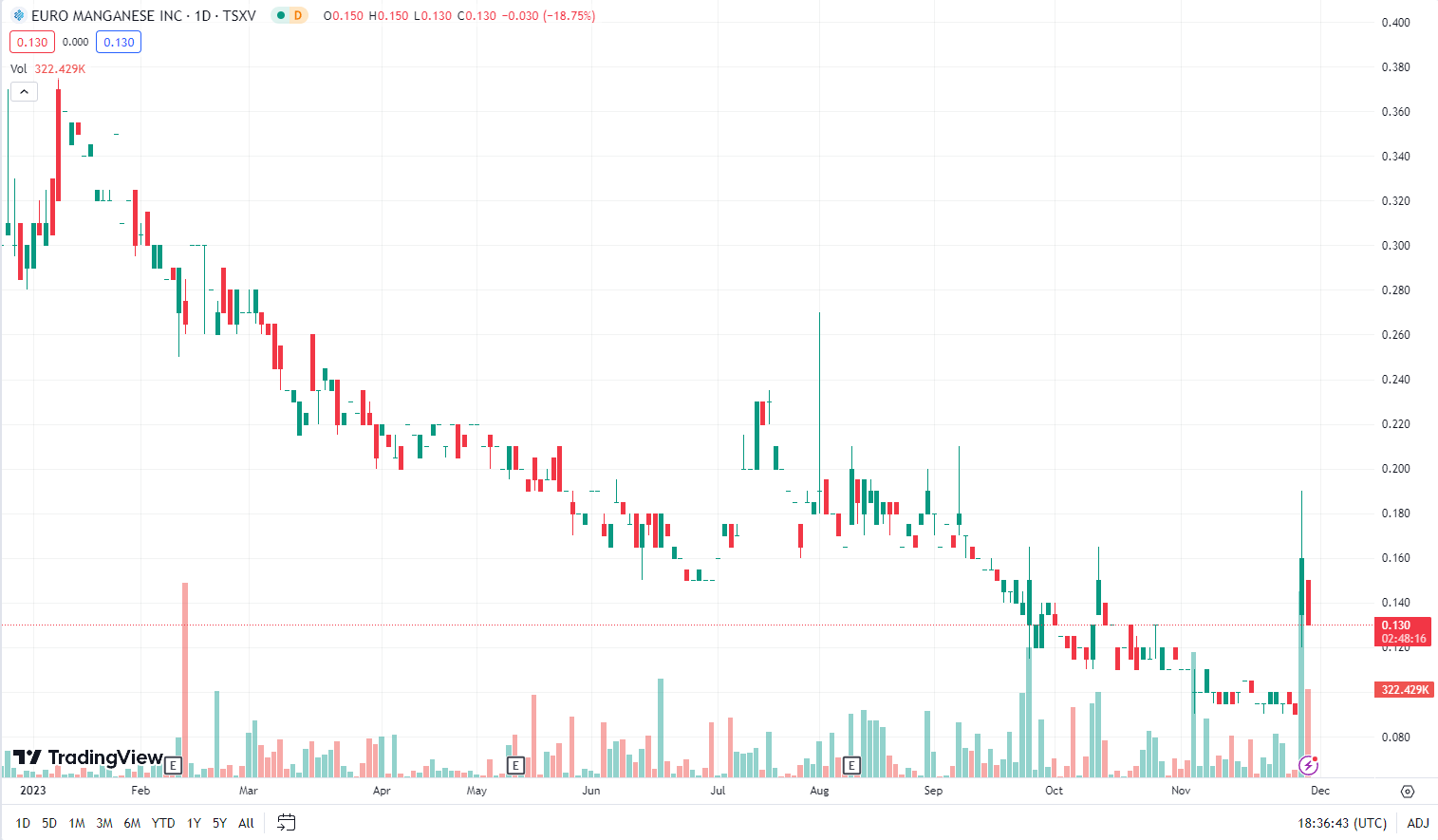

Euro Manganese (EMN.V)

Market Cap ~ $52.35 million

Euro Manganese is a battery materials company focused on becoming a leading producer of high-purity manganese for the electric vehicle industry. The Company is advancing development of the Chvaletice Project in the Czech Republic and exploring an early-stage opportunity to produce battery-grade manganese products in Bécancour, Québec.

The stock is down 18.8% on no news. The company announced two days ago that Orion Resource Support Partners Group had signed a definitive agreement for $100 USD non-dilutive financing to advance the development of Chvaletice Manganese Project in the Czech Republic.

There is a prolonged downward trend with decreasing volume trends and even though the stock seems to be testing support levels, there are no clear reversal patterns as yet.

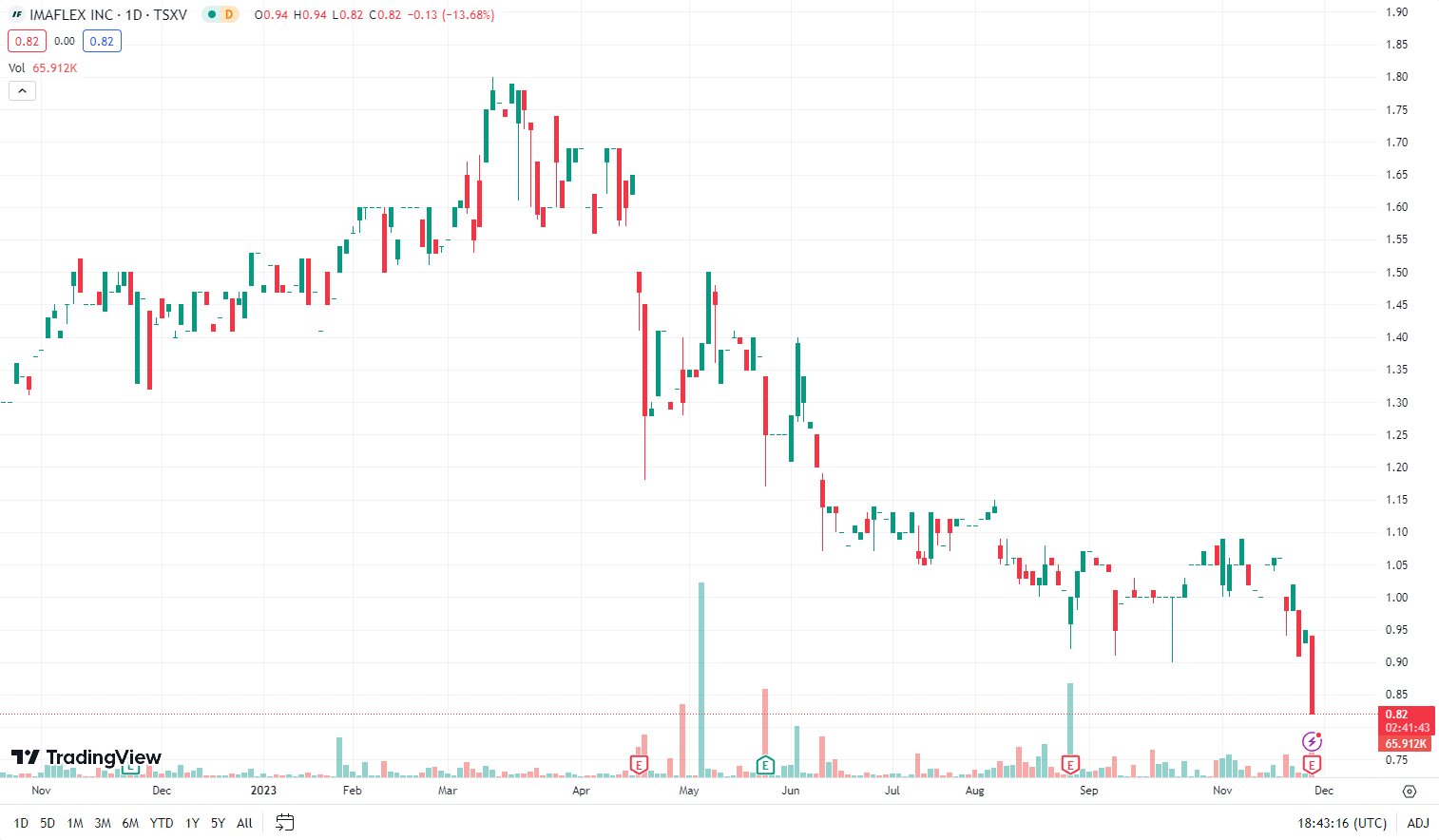

Imaflex Inc. (IFX.V)

Market Cap ~ $42.63 million

IMAFLEX is focused on the development and manufacturing of innovative solutions for the flexible packaging and agriculture markets.

The stock is down 13.7% on the company announcing Q3 2023 financial results with a net income of $0.2 million compared to $3.1 million for the same period last year.

There continues to be strong selling pressure on the back of a sustained downward trend with no indication of reversal.

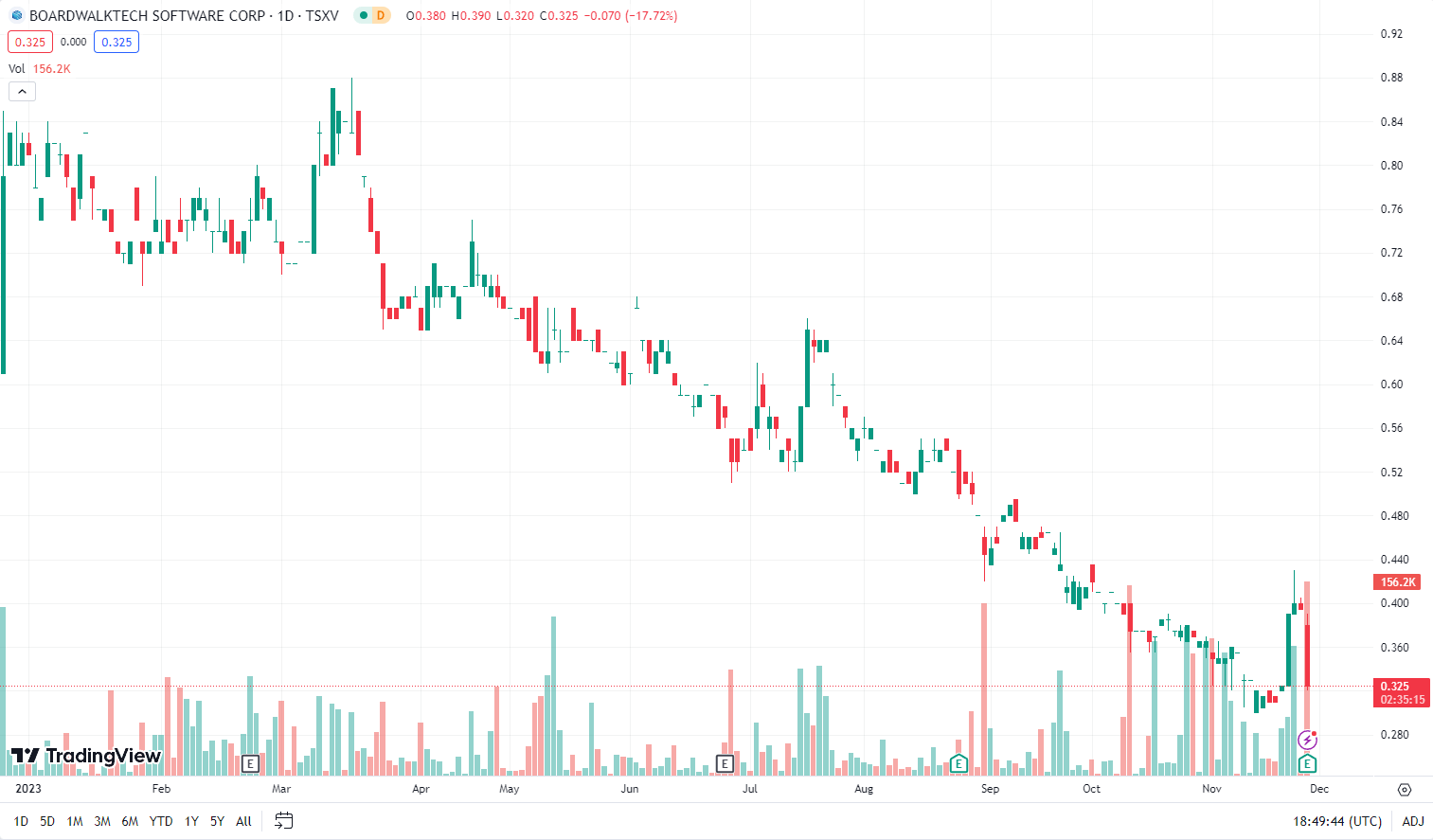

Boardwalktech Software Corp. (BWLK.V)

Market Cap ~ $15.53 million.

Boardwalktech Software Corp is a developer of transformational enterprise information management technology solutions. It has developed a Digital Ledger database technology designed specifically for collaborative, multi-party enterprise applications making both structured and unstructured data actionable for the enterprise.

The stock is down 17.7% on the company announced Q2 2024 financial results with a net loss of $0.7 million or $0.01 per share.

Strong volume on the downward moves indicate continued bearish sentiment, but even though several candles have long wicks, buyers were able to drive the price back up after sellers had their way. SP seems to have found a support level though.