In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

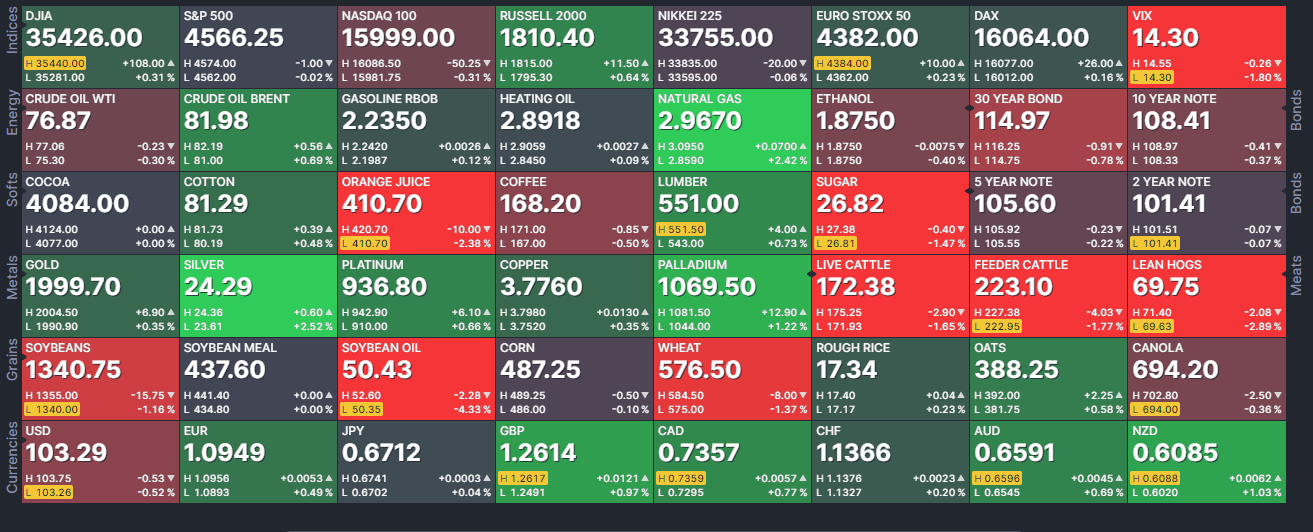

Here is a summary of the intraday action of assets:

Top 5 Gainers

Omai Gold Mines (OMG.V)

Market Cap ~ $19 million

Omai Gold Mines Corp. engages in the exploration and evaluation of mineral assets. It explores for gold and precious metals. The company holds a 100% interest in the Omai prospecting license that covers an area of 4,590 acres, including the past producing Omai Gold mine located in the Potaro mining district of Guyana, as well as adjoining Eastern flats mining permits.

The stock is up 25% on no news.

The stock is looking to breakout of a range and could trigger a reversal. Watch for a daily close above the $0.05 zone.

Abitibi Metals (AMQ.C)

Market Cap ~ $21 million

Abitibi Metals Corp. engages in the acquisition, exploration, and development of base and precious metal properties in Canada. The company primarily explores for gold deposits. Its flagship project is the 100% owned Beschefer project located in Quebec.

The stock is up 22% on no news. Yesterday, the Company unveiled a 2024 exploration strategy for the high grade B26 deposit.

The stock is continuing its uptrend with the stock breaking above recent highs and confirming its first higher low in an uptrend.

GR Silver Mining (GRSL.V)

Market Cap ~ $19 million

GR Silver Mining Ltd. engages in the acquisition, exploration, and development of mineral resource properties. The company explores for gold, silver, lead, and zinc deposits in Mexico and the United States.

The stock is up 16% on no news.

The stock broke out of the $0.05 range and has been in a breakout and new trend since then. Resistance comes in at $0.08.

Pacific Ridge Exploration (PEX.V)

Market Cap ~ $19 million

Pacific Ridge Exploration Ltd., an exploration stage company, acquires and explores for resource properties in Canada and the United States. The company primarily explores for gold and copper. Its flagship project is the Kliyul copper-gold project covering an area of approximately 6,000 hectares located in the northern Quesnel terrane, British Columbia.

The stock is up 16% on no news. Yesterday, the Company announced results from this year’s diamond drill campaign at the RDP copper-gold project located in northcentral British Columbia, 40 km west of the Company’s flagship Kliyul copper-gold project.

The stock has bounced at major support at $0.12. A double bottom pattern is in play. Watch for a close above the $0.16 zone.

Decade Resources (DEC.V)

Market Cap ~ $16.8 million

Decade Resources Ltd., an exploration stage company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada. The company holds a 65% interest in the Red Cliff property in north of Stewart, British Columbia; a 100% interest in the Goat property that consists of 8 claims totaling 1210.40 hectares located in British Columbia; and an option to earn a 100% interest in the Terrace property covering 48 contiguous mineral claims situated in British Columbia. It also holds an option agreement to acquire up to 75% interest in the Del Norte property comprising 5,830.16 hectares in 13 separate claims located in east British Columbia; and a 100% interest in the Grassy property that contains approximately 830.20 hectares in 2 separate claims situated in north of Stewart, British Columbia. In addition, the company holds interests in the Premier East property, which includes approximately 600 hectares in 7 separate claims located in British Columbia; and an option agreement to acquire up to 75% interest in the Lord Nelson property comprising of 2630 hectares in 6 separate claims situated in British Columbia.

The stock is up 11% on no news.

The stock is within a range and $0.20 is the upside resistance. A breakout would lead to the $0.25 zone.

Top 5 Losers

Eguana Technologies (EGT.V)

Market Cap ~ $11 million

Eguana Technologies Inc. designs and manufactures residential and commercial energy storage systems for fuel cell, photovoltaic, and battery applications in Canada, Asia, Australia, Europe, and the United States. The company provides its products under the Enduro, Evolve, and Elevate brand names.

The stock is down 28% on news of a business update and its intention to complete a non-brokered private placement offering.

The stock is printing new all time record lows and the stock continues its downtrend. A close above $0.06 would change things up.

Exploits Discovery (NFLD.C)

Market Cap ~ $10 million

Exploits Discovery Corp., a mineral exploration company, engages in the evaluating, acquiring, and exploring of mineral projects in Canada. The company primarily explores for gold deposits. It holds a portfolio of properties, including the Jonathan’s Pond, Dog Bay, Mount Peyton, True Grit, Middle Ridge, Valentine Lake Trend, Bullseye, True Grit, Great Bend, and Gazeebow projects covering an area of approximately 2,000 square kilometers of mineral tenements located in Newfoundland and Labrador.

The stock is down 11% on no news.

The stock is breaking down and printing new all time record lows. Watch for a close back above $0.10 for signs of a turn around.

Sun Summit Minerals (SMN.V)

Market Cap ~ $4.2 million

Sun Summit Minerals Corp. engages in the acquisition, exploration, and development of precious metal properties in Canada. It primarily explores for gold, silver, and zinc deposits. The company has an option to acquire a 100% interest in the Buck property covering an area of totaling approximately 43,000 hectares located in north-central British Columbia.

The stock is down 11% on no news.

The stock is range bound with resistance at $0.07. Support comes in at $0.03.

BeWhere Holdings (BEW.V)

Market Cap ~ $23 million

BeWhere Holdings Inc., an industrial Internet of Things (IIoT) solutions company, designs and sells hardware with sensors and software applications to track real-time information on fixed and movable assets. The company develops mobile applications, middle-ware, and cloud-based solutions that stand-alone or that can be integrated with existing software. It offers Mobile IoT (M-IOT) for the narrow band-IoT and long-term evolution for machines evolution of beacons, such as asset tracking, including mini USB rechargeable, ignition wired rechargeable, battery-powered, and rechargeable battery powered; environmental monitoring comprising M-IoT water pressure sensor solution, M-IoT weather station with leaf wetness sensor, M-IoT weather station with soil moisture sensor, M-IoT BeTen with soil moisture sensor, and M-IoT BeTen with water detection sensor; and asset tracking and environmental monitoring, including BeSol BLU Gateway for monitoring location, temperature zones, light exposure, and impact for goods in transit. The company also provides Bluetooth beacons and fixed Bluetooth/Wi-Fi gateways.

The stock is down 8% on no news. Three days ago, the Company announced Q3 2023 results.

Today’s price action seems to be a correction, or profit taking after a large move. $0.25 is the support zone and the higher low comes in at $0.23.

Arbor Metals (ABR.V)

Market Cap ~ $67 million.

Arbor Metals Corp. identifies, acquires, explores for, and develops natural resource properties in Canada. The company holds interests in the Jarnet Lithium Project, which comprises forty-seven map designated mineral claims covering an area of approximately 3,759 hectares located in the James Bay Region of Quebec. It also holds interest in the Miller Crossing lithium project comprising 192 claims covering an area of 3,800 acres located in Nevada, United States; and the Rakounga Gold Project located in Burkina Faso, West Africa.

The stock is down 7% on no news.

The stock has broken below a major support zone. There is a long way to go to the downside when it comes to the next support. However, the major psychological $1.00 zone should be watched.