Plurilock Security Inc (PLUR.V) is a Canadian identity-centric AI cybersecurity solutions company. The cybersecurity company provides multi-factor authentication (MFA) solutions using behavioral-biometric, environmental, and contextual technologies.

Today, Plurilock announced Q3 2023 financial results for three and nine months ended September 30th 2023. All figures are in Canadian Dollars.

Key Business Milestones

- Revenue increased to $48.0 million for the nine months ending September 30, 2023, as compared to $46.8 million over the same period in 2022, directly attributable to the strategic acquisitions of Integra and Atrion in 2022 along with increased software and professional services sales as the company strategically shifts to higher margin offers and away from low margin resell business.

- Gross margins increased to 10.3% for the nine months ending September 30, 2023, as compared to 6.7% over the same period in 2022; Plurilock produced three consecutive quarters of gross margins that improved substantially year-over-year since the beginning of 2023, driven primarily by the Company’s 2022 acquisitions, pricing strategy and its focus on securing high-margin software sales.

- High margin software sales and Professional Services for the nine months ending September 30, 2023 increased by 421% and 719%, respectively, year-over-year, totaling $2.8 million in revenue.

- Plurilock achieved $133,000 in cost savings for the nine-month period as of September 30, 2023 as a result of streamlining operations and unlocking new business synergies across all acquisitions as part of a plan that was enacted in August 2023.

“During the first nine months of fiscal 2023, we continued to produce significant revenues while optimizing for capital controls and efficiencies in all areas of our business,” said Ian L. Paterson, CEO of Plurilock. “While the economic outlook remains unclear, cybersecurity threats are on the rise and show no signs of slowing down. This growing global issue is one of the main drivers of our growing sales pipeline and resulted in three consecutive quarters of increased gross margins on a year-over-year basis.”

“Given the difficult macroeconomic market, our focus remains on reaching cash flow breakeven by securing additional high margin software sales and expanding the delivery of our cybersecurity services to existing and new customers.”

Third Quarter Fiscal 2023 Financial Highlights

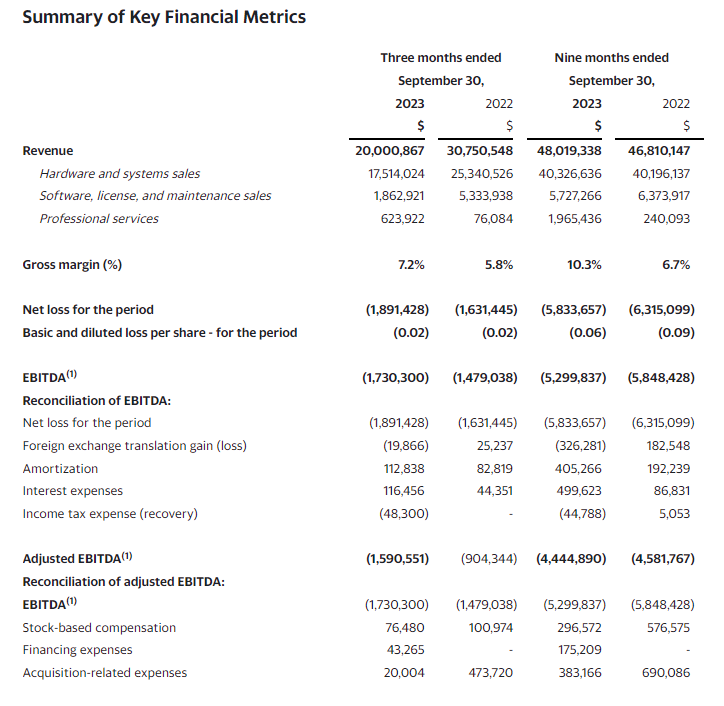

- Total revenue for the three and nine months ended September 30, 2023, was $20,000,867 and $48,019,338 respectively as compared to $30,750,548 and $46,810,147 for the same periods in the prior fiscal year ended September 30, 2022. Revenue for nine months ended September 30, 2023, is higher than the prior year period ended September 30, 2022, as a result of the acquisitions of the, as well as the asset acquisitions of Atrion and CloudCodes along with the increase in organic sales volume and cross selling amongst the Solutions and Technology Division.

- Hardware and systems sales revenue for the three and nine months ended September 30, 2023 totalled $17,514,024 and $40,326,636 respectively compared to $25,340,526 and $40,196,137 in the prior year for the same periods. Software, license and maintenance sales revenue for the three and nine months ended September 30, 2023 was $1,862,921 and $5,727,266 respectively compared to $5,333,938 and $6,373,917 respectively in the prior year for the same periods. Professional services revenue was $623,922 and $1,965,436 respectively for the three and nine months ended September 30, 2023 compared to $76,084 and $240,093 respectively in the prior year for the same periods.

- Hardware and systems sales revenues for the three and nine months ended September 30, 2023 accounted for 87.6% and 84.0% respectively of total revenues compared to 82.4% and 85.9% for the three and nine months ended September 30, 2022. Software, license and maintenance sales revenues for the three and nine months ended September 30, 2023 accounted for 9.3% and 11.9% respectively compared to 17.3% and 13.6% for the three and nine months ended September 30, 2022. Professional services revenue for the three and nine months ended September 30, 2023 accounted for 3.1% and 4.1% respectively of total revenues, compared to 0.2% and 0.5% for the three and nine months ended September 30, 2022.

- Gross margin for the three and nine months ended September 30, 2023 was 7.2% and 9.4% respectively compared to 5.8% and 6.7% in the prior year for the same periods.

- Adjusted EBITDA for the three and nine months ended September 30, 2023 was $(1,590,551) and $(4,444,890) respectively compared to $(904,344) and $(4,581,767) in the prior year for the same periods.

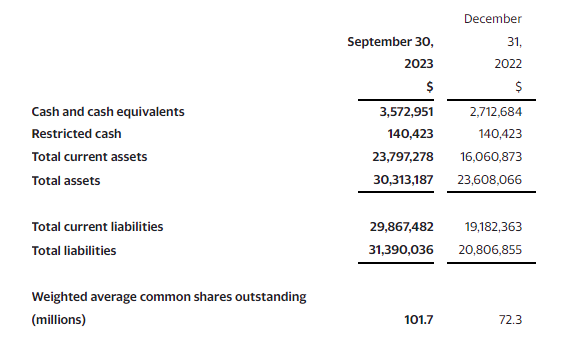

- Cash and cash equivalents and restricted cash on September 30, 2023, was $3,713,374 compared to $2,853,107 on December 31, 2022.

- During the three and nine months ended September 30, 2023, the Company used $2,457,065 and $1,627,839 respectively of cash in operating activities compared to $87,247 and $6,217,459 of cash used respectively in the prior year for the same periods.

Third Quarter Fiscal 2023 Operational Highlights

- On July 12, 2023, the Company announced and accepted one additional subscription for 100,000 units at a subscription price of $0.145 per unit, for aggregate gross proceeds to the Company of $14,500.

- On July 11, 2023, the TSX.V approved the repricing of 12,536,538 non-brokered private placement warrants and 765,000 convertible debenture warrants ranging from original exercise price of $0.25-$0.40 to $0.20.

- On August 31, 2023, the Company announced that it has established an Information Security Advisory Council, which is comprised of leading cybersecurity industry experts and academics, to provide expert guidance to the Company on advancing its business development strategy and scaling its AI-focused technology offering portfolio.

- On September 6, 2023, the Company announced the first sale of Plurilock AI PromptGuard to an exclusive financial services firm based in the Northeastern United States seeking to establish additional guardrails around AI use.

- On September 7, 2023, the Company announced the successful novation of a contract with the State of South Carolina, which was won after an open bidding process by Atrion Communications, whose assets Plurilock successfully acquired in September 2022.

In terms of forward guidance, Plurilock remains committed to reaching cash flow breakeven by increasing its high-margin software sales and delivering more professional services as well as identifying more opportunities to achieve financial and operational efficiencies across all business units. At the end of August 2023, Plurilock enacted a plan in accordance with this strategy and expects to realize approximately $2.0 million in savings on an annualized basis.

Plurilock intends to continue advancing its technology portfolio by innovating new ground-breaking AI-driven solutions with an emphasis on zero-trust policy and securing the workforce.

Quite significant price action on the announcement of earnings with a large green candle. The stock did print all time record lows hitting $0.06, but a range has developed indicating the exhaustion of selling pressure. Watch for a close above $0.08 to break this range and then the retaking of $0.10.