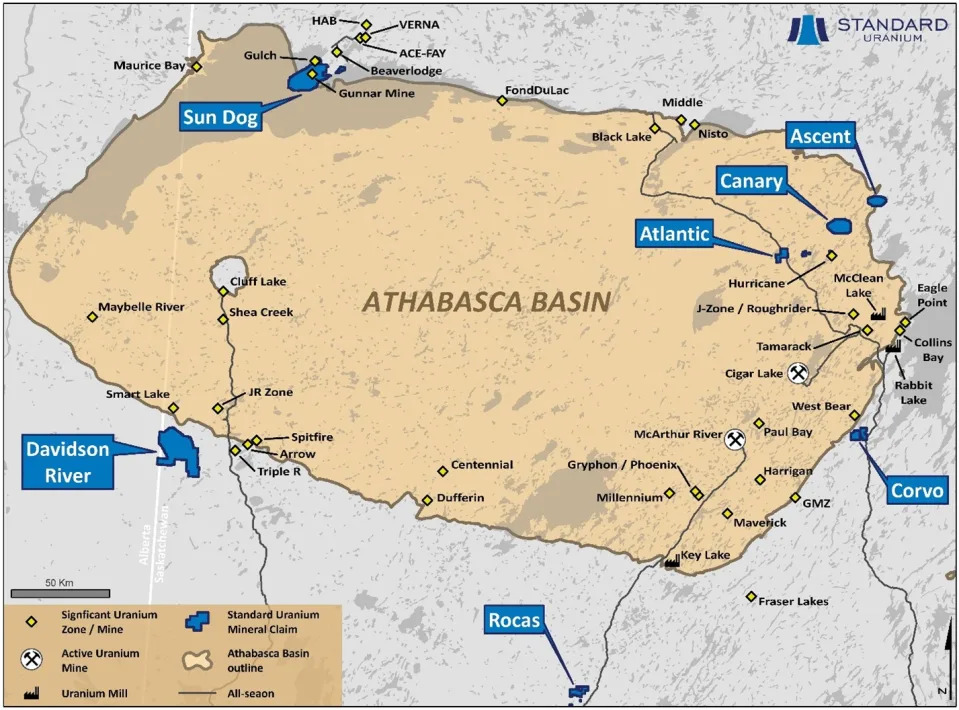

Standard Uranium (STND.V) is a junior uranium explorer operating in the Athabasca basin in Saskatchewan, Canada. The Company holds interest in over 187,542 acres (75,895 hectares) in the world’s richest uranium district.

The company truly represents a come back story. The share price was in a steep downtrend printing lower lows and eventually, new all time record lows at $0.02. But since bottoming at record lows, the stock has hit recent highs of $0.09. A 340% plus move in less than one month. This is indicating a reversal and investors finding renewed optimism on the fundamentals.

Just before the stock broke out of its range, Chris Parry wrote about Standard Uranium’s new revival. From changes in management representing a fresh perspective and a renewed energy, to news to strategic land expansion focusing on the expansion of the Sun Dog and Atlantic projects and the inclusion of the Corvo project. The company is gearing for a major comeback with a new pivot and the Company will be growing their eight projects (five of them in advanced stages) in the Athabasca Basin, the Saudi Arabia of Uranium, ensuring they provide the best returns to their shareholders, but also shift away from a single property, and spread their bets across a wider board.

CEO Jon Bey has said that the Company has strategically shifted to a hybrid model that combines project generation and exploration. The flagship project, Davidson River, is strategically positioned near NextGen Energy’s recent environmental permit approval and is slated for extensive exploration. Plans for 2024 include significant exploration activities after securing partners for the Sundog and Canary Projects. More news means more potential catalysts for the stock price.

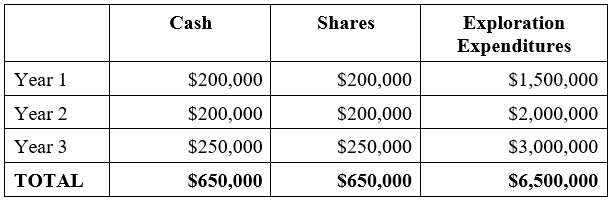

In recent news, Standard Uranium announced a strategic decision regarding the previously problematic Sun Dog Project. The company entered into a definitive option agreement with 1443904 B.C. Ltd, an arms length private firm, where the optionee has the ability to acquire up to 100% of the 19,603-hectare project by completing three years of exploration programs combined with a series of cash and equity payments. This agreement supersedes and nullifies the LOI with International Sustainable, which has been terminated. This move sets Standard Uranium up with a financial foundation for the upcoming years, while providing a commitment from 1443904 B.C. Ltd. for exploration.

Standard will also retain a two percent net smelter returns royalty on the Sun Dog Project, half of which may be purchased back at any time prior to commercial production for a one-time cash payment of $1.0 million.

This option agreement for Sun Dog lays out a payment schedule as follows:

Chris Parry emphasized the significance of this development, highlighting how the Sun Dog project, which initially posed challenges, became a cornerstone for Standard Uranium’s resurgence. The company’s resilient comeback is testament to the leadership of Jon Bey, who, according to Parry, has established himself as a figure who will tirelessly fight for his shareholders.

Standard Uranium also announced a non-brokered private placement for gross proceeds of up to CAD $2 million from the sale of any combination of units of the Company at a price of C$0.05 per Unit, flow-through units of the Company at a price of C$0.06 per FT Unit, charity flow-through units of the Company, and collectively with the Units and FT Units, at a price of C$0.075 per Charity FT Unit.

Each Unit will consist of one common share of the Company and one half of one common share purchase warrant. Each Warrant shall entitle the holder to purchase one common share of the Company at a price of C$0.09 at any time on or before that date which is twenty-four months after the closing date of the Offering. The Offering is scheduled to close on or around December 11, 2023.

The net proceeds raised from the Offering will be used for the exploration of the Company’s projects in Saskatchewan and for working capital purposes.

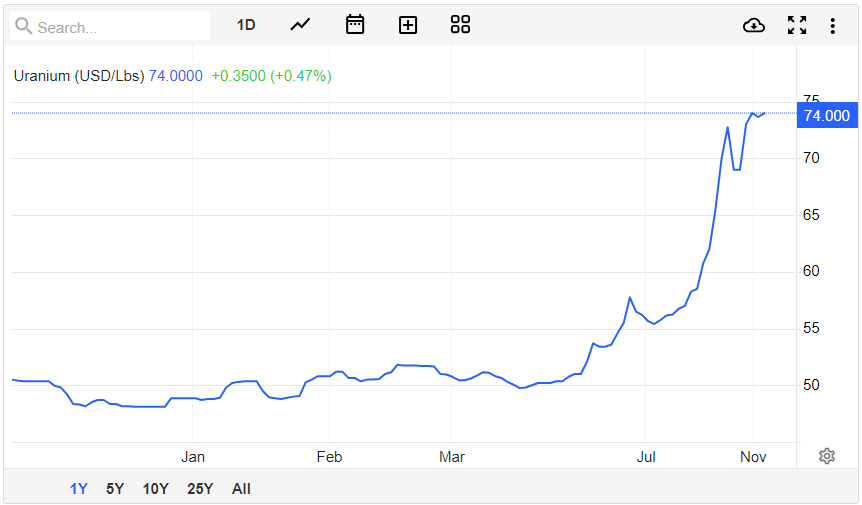

Before looking at the chart of Standard Uranium, let’s take a quick peek at the uranium spot price:

Yup that’s bullish.

Zooming out shows us that uranium spot price is testing an important resistance zone around the $73.50 zone. In fact, we are above this zone but the monthly close will be important and would trigger the breakout.

This points to a uranium bull market, and when the spot price rises, you can bet that the junior uranium stocks will follow along and provide incredible gains for those bullish on uranium.

Standard Uranium stock broke above the major resistance zone around $0.03 which I told readers would be the bullish trigger. The stock then pulled back to retest the $0.03 zone which saw new buyers step in. This is just a typical and expected breakout and continuation of the market structure. The rising prices in the energy sector, including spot uranium, is playing a big role in this reversal together with the comeback story. From the retest to recent highs of $0.09, the stock has ripped over 155% in less than two weeks!

Standard Uranium stock has also closed above the first resistance level at $0.06. As long as the stock remains above this price zone, the uptrend can continue. Recent price action is showing a range and it appears the stock could be stalling on momentum. A pullback and retest to the $0.06 zone is possible, and is playing out currently. We can see that buyers are stepping in at $0.06 and using it as support as evident by the large wick on the daily candle. If the uptrend continues, the next resistance zone comes in at $0.10.

The stock is in a new trend with lower highs and lower lows turning into higher lows and higher highs. But for those not sold on the reversal of the market structure, then perhaps this bullish reversal pattern will convince you. It appears like an inverse head and shoulders pattern in playing out with the right shoulder being formed right now. A close above this trendline triggers the pattern.