In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

Ophir Gold Corp (OPHR.V)

Market Cap ~ $18 million

Ophir Gold Corp. acquires, explores, and evaluates mineral property assets in the United States. The company explores for lithium, and precious and base metal deposits. It primarily holds 100% interest in the Breccia Gold property located in Lemhi County, Idaho; and the Radis Lithium property located in the James Bay region of Quebec, Canada.

The stock is up 26.6% on no news.

Reversal traders should keep an eye on this one. The stock seems to have found support at $0.15 and a potential double bottom is in play. The trigger for a reversal is a daily close above the $0.225 zone.

Shopify (SHOP.TO)

Market Cap ~ $104.47 billion

Shopify Inc., a commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company’s platform enables merchants to displays, manages, markets, and sells its products through various sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces; and enables to manage products and inventory, process orders and payments, fulfill and ship orders, new buyers and build customer relationships, source products, leverage analytics and reporting, manage cash, payments and transactions, and access financing.

The stock is up 20% on Q3 earnings beat and profit beating estimates. Revenue for the period came in at $1.71 billion, up about 25% year-over-year and beating the $1.68 billion average estimate of analysts surveyed by Bloomberg. Profit, excluding one-time items, was 24 cents a share, well above the 15 cents expectation.

The stock has gapped up on earnings and took out the lower high at $76. As long as the stock remains above this price level, the stock can continue higher.

Regency Silver Corp (RSMX.V)

Market Cap ~ $20 million

Regency Silver Corp., together with its subsidiaries, engages in the identification, evaluation, acquisition, and exploration of mineral properties in Mexico and Peru. The company explores for silver and gold projects. Its flagship property is the Dios Padre project located in Sonora, Mexico. The company also holds interest in the El Tule property that consists of 6 concessions covering an area of 10,000 hectares located in Northern Nayari, Mexico; and the La Libertad project located in the La Libertad mining district in north-central Peru.

The stock is up 20% on news that the Company intercepted 5.34 g/t gold over 54.65m including 7.36 g/t over 38m at its Dios Padre Project in Sonora, Mexico.

Another stock to watch for bottom/reversal players. The range pattern and inverse head and shoulders pattern indicates a reversal is coming. The trigger though is a break above the $0.25 zone.

Electrovaya Inc (ELVA.TO)

Market Cap ~ $139 million

Electrovaya Inc., together with its subsidiaries, engages in the designing, developing, and manufacturing lithium-ion advanced battery and battery systems in North America. It offers lithium-ion batteries and systems for materials handling electric vehicles, including warehouse forklifts and automated guided vehicles, as well as battery chargers to charge the batteries; electromotive power products for electric trucks, electric buses, and other transportation applications; industrial products for energy storage; and power solutions, such as building systems for third parties.

The stock is up 16.6% on news that the Company announced a three year strategic supply agreement with two leading affiliated OEM partners for material handling vehicles and other affiliates for the supply of battery systems.

A stock which appears to be forming its first higher low in a new uptrend. The stock is seeing bidders at breakout support at $3.60. Another swing looks likely with momentum from today’s news.

Dye & Durham Limited (DND.TO)

Market Cap ~ $558 million

Dye & Durham Limited, together with its subsidiaries, provides cloud-based software and technology solutions for law firms, financial service institutions, sole-practitioner law firms, and government organizations in Canada, Australia, South Africa, Ireland, and the United Kingdom. It offers Practice Management, a real estate workflow and practice management software that enables legal professionals to execute every transaction with reliability, security, and ease; Data Insights and Due Diligence, a software that aggregates proprietary data and public records into valuable insights; and Payments Infrastructure, a software that helps people pay their bills and taxes in real time, as well as enables digital mortgage processing, and an integrated information search and managed banking services.

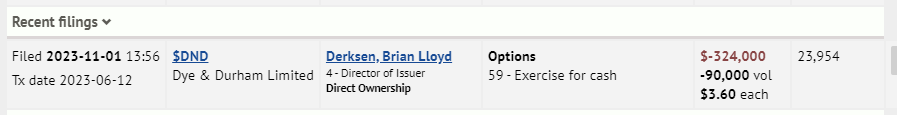

The stock is up 16.7% on no news but three days ago, the Company released Q1 2024 financial results. It was one of its best quarters on record in terms of revenue. There was also a SEDI filing today:

The stock recently printed new all time record lows, and is now popping after earnings. It appears the selling pressure has exhausted but the lower high and resistance comes in at $12. The stock must take this zone out to reverse the trend.

Top 5 Losers

Benton Resources (BEX.V)

Market Cap ~ $15 million

Benton Resources Inc. engages in the acquisition, exploration, and development of mineral properties. It explores for gold, silver, nickel, copper, platinum group elements, lithium, and cesium assets.

The stock is down 13% but it is not from the news regarding the Company receiving the Explorer of the Year award from the Canadian Institute of Mining.

Yesterday, the Company announced it had hit multiple high grade copper zones in its first two holes including 8.31% Cu over 13m at the Great Burnt Copper Gold project in Newfoundland.

The stock reacted to yesterday’s news and was a top gainer. Today, we are seeing the opposite with double digits percentage sell off. Profit taking as the stock was near the resistance zone of $0.15. The stock remains in a new uptrend as long as it remains above the $0.06 zone.

POET Technologies (PTK.V)

Market Cap ~ $107 million

POET Technologies Inc. designs, develops, manufactures, and sells discrete and integrated opto-electronic solutions in Canada, the United States, Singapore, and China. It offers integration solutions based on the POET Optical Interposer, a novel platform that allows the seamless integration of electronic and photonic devices into a single multi-chip module using advanced wafer-level semiconductor manufacturing techniques. It also develops photonic integrated components.

The stock is down 29% on news of an offering. The LIFE Offering will be conducted in all the provinces of Canada, except Québec, under the Exemption, for aggregate gross proceeds up to C$10,000,000.

The stock is breaking below a major support zone and needs to recover above $3.50 to turn things around. Support comes in around the $2.50 zone.

Nextech3D.ai (NTAR.C)

Market Cap ~ $14 million

Nextech3D.AI Corporation provides augmented reality technologies, wayfinding technologies, and 3D model services. It focuses on creating 3D WebAR photorealistic models for the prime ecommerce marketplace, as well as other online retailers.

The stock is down 23.5% on news of a $3.6 million private placement.

The stock broke below $0.24 and needed to confirm a close above it to turn things around. This did not happen, and the stock is now breaking below recent lows and is continuing the downtrend.

Lithium ION Energy (ION.V)

Market Cap ~ $5.5 million

Lithium ION Energy Ltd. explores for and develops lithium deposits in Asia. Its flagship property is the Baavhai-Uul lithium brine project that covers an area approximately 81,758 hectares located in Mongolia. The company also holds interest in the Urgakh Naran lithium brine project that covers an area of approximately 29,770 hectares located in Dornogovi Province, Mongolia.

The stock is down 22.7% on no news.

The stock is breaking below $0.12 support. The next support level comes in at $0.05.

Eskay Mining (ESK.V)

Market Cap ~ $63 million

Eskay Mining Corp., a natural resource company, engages in the acquisition and exploration of mineral properties, and precious and base metal deposits in British Columbia, Canada. It holds 100% interests in the ESKAY-Corey property located in northwestern British Columbia.

The stock is down 20.6% on news that it has received very encouraging assay results from its 2023 diamond drill and exploration campaign at its 100% controlled Consolidated Eskay Gold Project in the Golden Triangle of British Columbia.

The stock has broken below $0.50 and the next support comes in at $0.25.