Australian-based Tempus Resources (TMRR.V, TMR.AX) is evaluating and exploring projects in British Columbia and Ecuador. In recent months, Tempus has had a focus on the flagship Elizabeth Gold Project in British Columbia. On September 21, 2023, Tempus announced the acquisition of an option over the White Rabbit and Cormorant lithium exploration projects located in Central Manitoba.

Today, Tempus Resources announced the results from its Mineral Resource Estimate (MRE) at its 100% owned 11,500 hectare Elizabeth Gold Project.

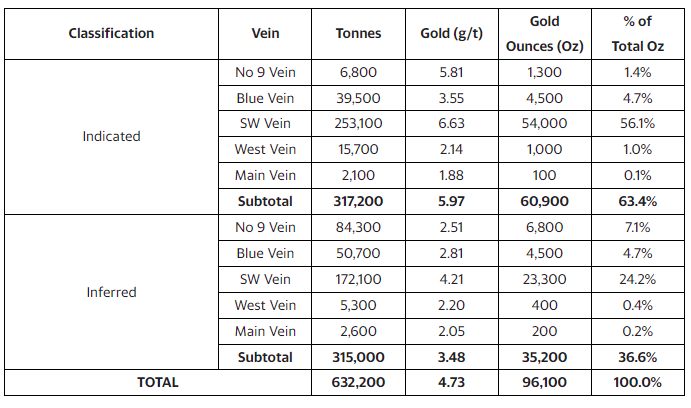

- 60,900 ounces of gold Indicated, plus 35,200 ounces of gold Inferred

- 63% of the MRE gold ounces in the higher confidence Indicated classification: 317,200 tonnes at 5.97g/t for 60,900 gold ounces

- Indicated and Inferred Resources estimated across 5 main vein groups with the Southwest Vein group containing 67% of the total resource tonnes: 253,100 tonnes at 6.63 g/t for 54,000 ounces of gold Indicated plus 172,100 tonnes at 4.21 g/t for 23,300 ounces of gold Inferred

- Average gold grade of Indicated MRE is 4 times higher than the cut-off grade demonstrating excellent potential for future economic extraction

- This MRE is based on potential underground extraction

Tempus Resources President and CEO, Jason Bahnsen, commented, “The updated MRE highlights the potential for the Elizabeth Project with over 63% of resource gold ounces being in the Indicated category across five key vein groups that remain open at depth and along strike. Opportunities for expansion of the resource are excellent with fourteen separate veins identified within the Elizabeth Main area with the potential for additional mineralised vein sets at the Elizabeth East and Elizabeth Northwest zones.”

Models were developed for each vein using the drill core field logs and assays, and represent continuous gold constrained with a nominal grade of 1.5 g/t gold to a minimum thickness of 0.15 m drill core length. The 3-D constraining domain wireframes were treated separately for the purposes of rock coding, statistical analysis, compositing limits, and definition of the extent of potentially economic mineralization.

The Mineral Resource was classified as either Indicated or Inferred based on the drill hole spacing, geological interpretation, and variogram performance. Indicated Mineral Resources were classified within the veins using at least two holes within a spacing of 30 m or less. Inferred Mineral Resources were classified for vein blocks using at least two drill holes at drilling densities between 30 m and 100 m. The Elizabeth Project mineralisation is considered to be potentially amenable to underground mining methods, and the Mineral Resource Estimate reported herein is based on a gold cut-off of 1.5 g/t.

The reader is cautioned that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The stock has broken down below major support at $0.04. And the stock has printed new all time record lows at $0.015. Since then, the stock developed a range here with the upside resistance being $0.04. A break of this range would take us back to retest the broken support now turned resistance at $0.04. A close back above this zone would be key for a reversal. The resource estimate could be the upcoming catalyst for the recovery.

The stock continues to sell off and respect the downtrend line. A close above this downtrend line would be a good beginning technical breakout for a retest of $0.04.