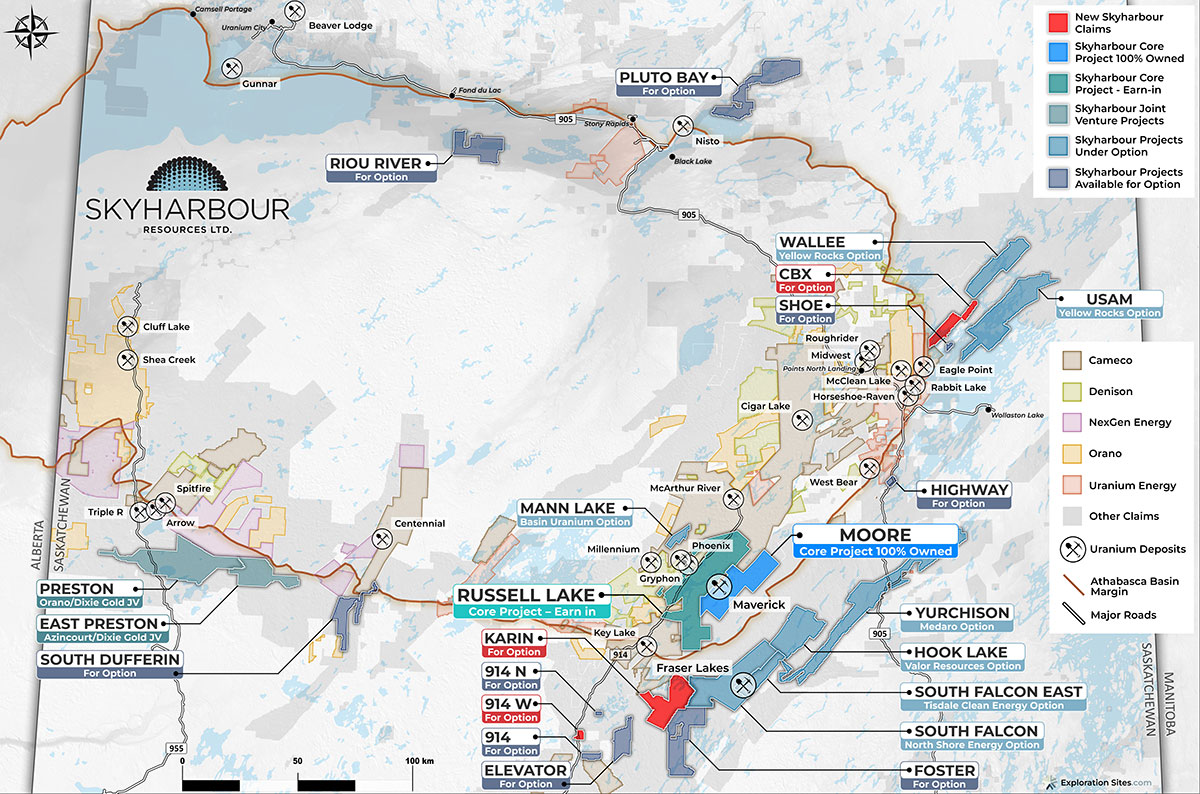

Skyharbour Resources (TSX-V: SYH), a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With twenty-four projects covering over 504,000 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

Today, Skyharbour Resources announced it has intersected a significant uranium mineralization in its inaugural drill program at the Russell Lake Project in the central core of the Eastern Athabasca Basin of northern Saskatchewan. Three phases of drilling were completed on the property this year with eight holes totalling 3,661.5 metres drilled at the Grayling Zone in Phase One, followed by Phase Two consisting of 2,730 metres in four holes at the Fox Trail target area, and returning to the Grayling Zone for Phase Three where an additional 3,203 metres was drilled in seven holes.

Uranium mineralization was intersected in the majority of holes at the Grayling Zone over a strike length exceeding one kilometre. Drill hole RSL23-01 intersected one of the best ever drill results from the project, returning a 5.9 metre wide intercept of 0.151% U3O8 at a depth of 338.4 metres, which includes 1.0 metres of 0.366% U3O8 at 343.3 metres depth.

Jordan Trimble, President and CEO of Skyharbour Resources, stated: “We are very pleased with the inaugural drilling program at the Russell Lake Uranium Project. Numerous holes at the Grayling target area intersected significant zones of uranium mineralization including hole RSL23-01 which represents one of the best drill results at the project. Skyharbour has also expanded the extent of the known mineralized zones to over a kilometre at Grayling. Most of the drilling at the project historically has been widespread exploratory drilling and we are even more confident in the discovery potential and exploration upside at Russell Lake given this program along with the many highly prospective target areas hosting the geological ingredients necessary for high-grade uranium deposition. Planning is well underway for an upcoming, fully-funded winter drilling program with the project accessible all year round with road access, powerlines and an exploration camp.”

“Skyharbour is also excited to have additional news flow and catalysts from its prospect generator business consisting of numerous partner companies advancing some of our other projects throughout the Athabasca Basin. Over the next year, the Company is anticipating continued drilling and exploration programs at its co-flagship projects of Russell and Moore, as well as at its partner-funded projects of Preston, East Preston, Mann Lake, Yurchison, South Falcon East, and South Falcon.”

Highlights:

- Hole RSL23-01 intersected a 5.9 metre intercept of 0.151% U3O8 beginning at 338.4 metres, including 1.0 metres of 0.366% U3O8 at 343.3 metres. The mineralization begins near the base of a basement thrust wedge, and extends into the strongly clay altered sandstone and uppermost basement, and is accompanied by anomalous pathfinder geochemistry including As (≤1960 ppm) Ni (≤2760 ppm), and V (≤381 ppm).

- Hole RSL23-02 intersected 1.0 metre of uranium mineralization grading 0.224% U3O8 at the unconformity, accompanied by major sandstone and basement faulting, significant clay alteration, and highly anomalous As (≤1110 ppm), Cu (≤427 ppm), Ni (≤2760 ppm), V (≤811 ppm) and Zn (≤602 ppm).

- Most of the holes drilled at the Grayling Zone that successfully reached their intended targets intersected uranium mineralization.

- The Grayling Zone and its attendant thrust wedge has now been confirmed over a strike length of 1,000 m. The uranium mineralization at the Grayling Zone is accompanied by significant faulting, strong clay alteration of the sandstone and basement graphitic pelitic gneisses, and highly anomalous pathfinder geochemistry, including anomalous B, Ni, Cu, Pb and As in addition to uranium.

- Drilling on the Fox Lake Trail conductors confirmed the presence of highly prospective graphitic pelitic gneiss packages in conjunction with prospective quartzite ridges and other favourable host lithologies. Both the sandstone and basement rocks in the Fox Trail area are frequently enriched in uranium and pathfinder elements including B, V, Ni, Co, Cu and As.

- Substantial portions of the Grayling and Fox Lake Trail target areas have yet to be systematically drill tested leaving robust discovery potential. There is also more than 35 kilometres of largely untested prospective conductors in areas of low magnetic intensity on the Property.

- Given the success of the inaugural drill program carried out by the Company at Russell Lake, a follow-up program is being planned. The program will consist of 4,000 m – 5,000 m of drilling and is slated to commence this upcoming winter.

A total of 9,595 metres of drilling in nineteen holes was drilled in three phases during 2023. The first phase of drilling consisted of a total of 3,662 metres in eight completed holes at the Grayling Zone, while an additional four holes totaling 2,730 metres were drilled in the Fox Lake Trail Zone during the second phase. The recently completed third phase of drilling was comprised of 3,203 metres in seven holes on additional targets at the Grayling Zone.

Given the success of the inaugural drill program carried out by the Company at Russell Lake, a follow-up program is being planned. The fully-funded program will consist of 4,000 m – 5,000 m of drilling and is slated to commence this winter with additional details on the program forthcoming.

The stock has been on a tear in this uranium bull market. Readers of Equity Guru have been told that the technical breakout began way back when the stock was ranging near the $0.35 zone. We called the breakout and the retest which has led to a 75% plus move from the retest to the recent highs printed at $0.64. All within one month and a few days.

The stock is currently finding resistance and ranging at our resistance zone at the $0.58-$0.60 zone. Bulls want to see a nice strong daily close above this zone to trigger the next leg up with resistance coming in at around $0.75.

For near term support, investors should watch the $0.50 zone and the reaction there if price retraces to this important psychological price zone. From a technical perspective, Skyharbour Resources stock remains in an uptrend as long as the stock remains above $0.425. This price zone is the current higher low, and according to market structure, the uptrend remains intact as long as price remains above this higher low. This means any drops from here should be regarded as a pullback or retracement.