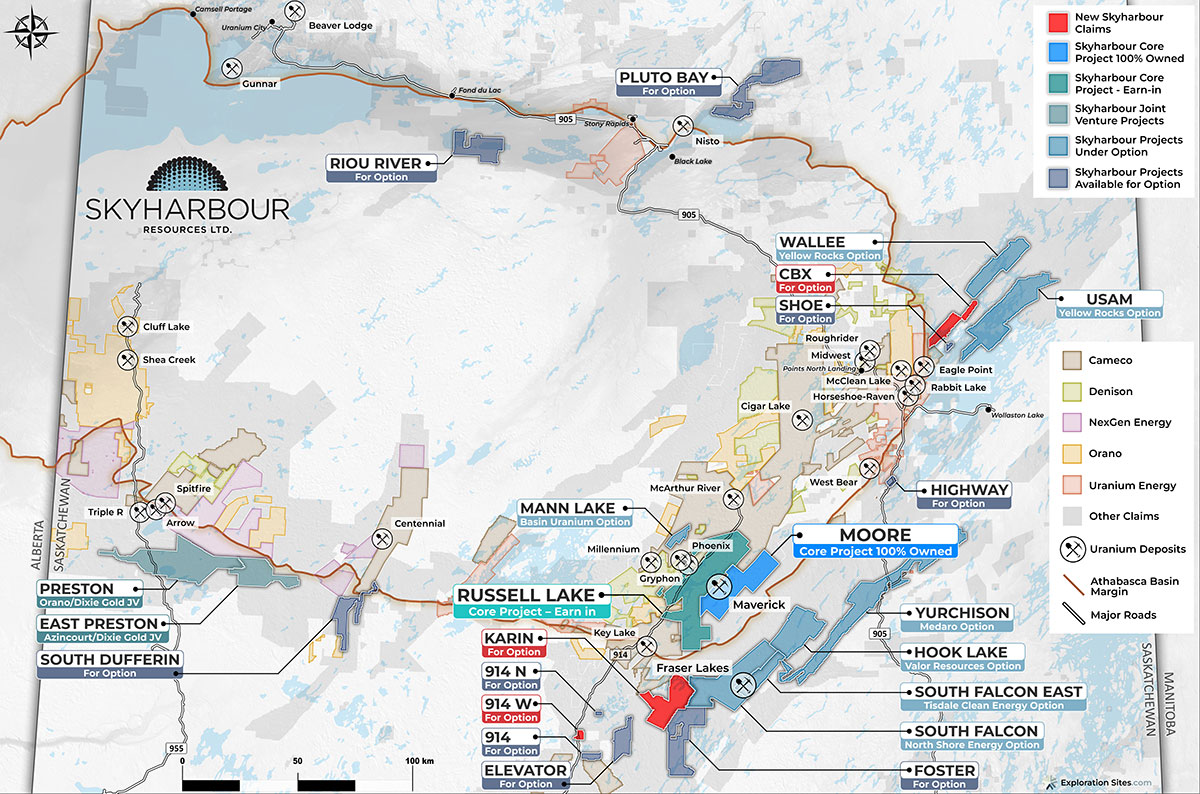

Skyharbour Resources (TSX-V: SYH), a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With twenty-four projects covering over 504,000 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

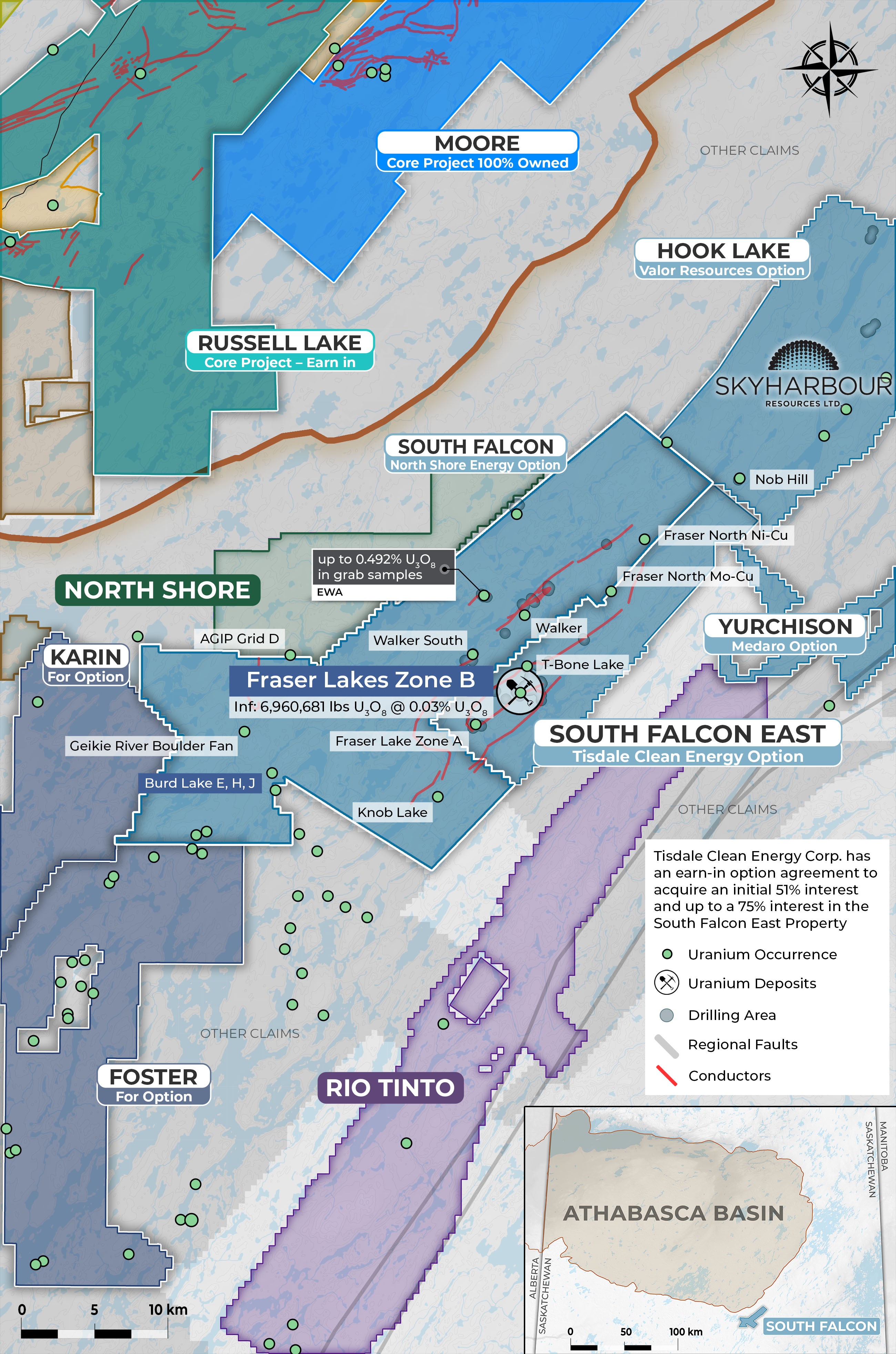

Today, Skyharbour Resources announced that partner Company, Tisdale Clean Energy Corp, plans to begin exploration at the South Falcon East Uranium Project (see above) which hosts the Fraser Lakes Zone B uranium deposit. The South Falcon East Project lies 18 km outside the edge of the Athabasca Basin, approximately 50 km east of the Key Lake uranium mill and former mine.

Tisdale entered into an option agreement that was finalized earlier this year whereby Tisdale can earn up to a 75% interest in the South Falcon East project. Under the Option Agreement and assuming the 75% interest is earned, Tisdale will have issued Skyharbour 1,111,111 Tisdale shares upfront, and will fund exploration expenditures totaling CAD $10,500,000, as well as pay Skyharbour CAD $11,100,000 in cash of which $6,500,000 can be settled for shares in the capital of Tisdale over the five-year earn-in period. Find full details below.

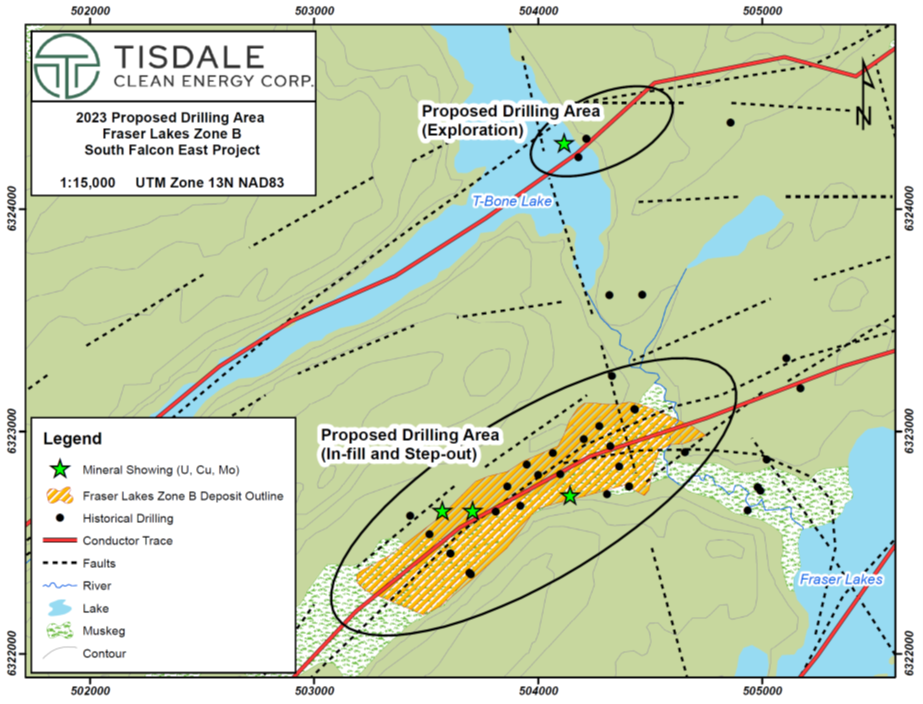

Tisdale is planning an extensive preliminary drill program to commence in early 2024. The program will consist of approximately 2,000 metres of drilling. The priority will be to confirm and expand the existing mineralization associated with the Fraser Lakes Zone B uranium deposit. Initial focus will be on extending mineralization along strike and down dip into the basement rocks. Infill drilling will confirm the presence and continuity of existing mineralization in preparation for an updated resource estimate and model in the future. Step out drilling will endeavor to expand the footprint of the deposit, as the current mineralization is open in all directions.

A secondary priority will be to begin regional exploration by following up on promising anomalies located in the T-Bone Lake area. Regional drilling will focus on the effort to discover additional mineralized zones and deposits along the folded structural package that hosts the Fraser Lakes B deposit.

Tisdale CEO, Alex Klenman, stated: “We have a great opportunity to build value here. As we deploy capital into the project, we’ll earn credit for the pounds in the ground. We believe we can increase both the size and the overall grade of the asset. With current optimism in the sector, we feel we’re entering the earn-in with Skyharbour at the best possible time.”

Terms of the Option Agreement:

Pursuant to the Option Agreement, Tisdale may acquire up to a 75% interest in the Property, in two phases. Initially, Tisdale can acquire a 51% interest in the Property by completing the following payments and incurring the following exploration expenditures on the Property:

- On the closing date, paying CAD $350,000 and issuing 1,111,111 Shares to Skyharbour upfront;

- By the eighteen-month anniversary of Closing, completing at least $1,250,000 in exploration expenditures, and paying Skyharbour $1,450,000, of which up to $1,000,000 may be paid in Shares based on the 20-day volume-weighted average closing price calculated on the day of issuance, at the election of Tisdale;

- By the second anniversary of Closing, completing an additional $1,750,000 in exploration expenditures, and paying Skyharbour $1,800,000, of which up to $1,000,000 may be paid in Shares based on the VWAP, at the election of Tisdale;

- By the third anniversary of Closing, completing an additional $2,500,000 in exploration expenditures, and paying Skyharbour $2,500,000, of which up to $1,500,000 may be paid in Shares based on the VWAP, at the election of Tisdale.

After acquiring a 51% interest, Tisdale may increase its interest in the Property to 75% by:

- Completing a payment of $5,000,000 to Skyharbour by the fourth anniversary of Closing, of which up to $3,000,000 may be satisfied in Shares based on the VWAP, at the election of Tisdale, and incurring exploration expenditures on the Property of an additional $2,500,000 in each of the fourth and fifth anniversaries of Closing.

For a deeper dive on Skyharbour Resources, be sure to check out Chris Parry’s recent article here, and his interview with Skyharbour Resources CEO Jordan Trimble:

The stock has been on a tear in this uranium bull market. Readers of Equity Guru have been told that the technical breakout began way back when the stock was ranging near the $0.35 zone. We called the breakout and the retest which has led to a 75% plus move from the retest to the recent highs printed at $0.64. All within one month and a few days.

The stock is currently finding resistance and ranging at our resistance zone at the $0.58-$0.60 zone. Bulls want to see a nice strong daily close above this zone to trigger the next leg up with resistance coming in at around $0.75.

For near term support, investors should watch the $0.50 zone and the reaction there if price retraces to this important psychological price zone. From a technical perspective, Skyharbour Resources stock remains in an uptrend as long as the stock remains above $0.425. This price zone is the current higher low, and according to market structure, the uptrend remains intact as long as price remains above this higher low. This means any drops from here should be regarded as a pullback or retracement.

Tisdale Clean Energy is in a bottoming pattern after a long downtrend. This range indicates that selling pressure has exhausted, however to confirm a trend reversal, the stock needs to see a daily candle close above $0.19. One to keep an eye on for bottom pickers.