Azincourt Energy (AAZ.V) is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. Their core projects are in the clean energy space, with uranium exploration projects in the prolific Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru.

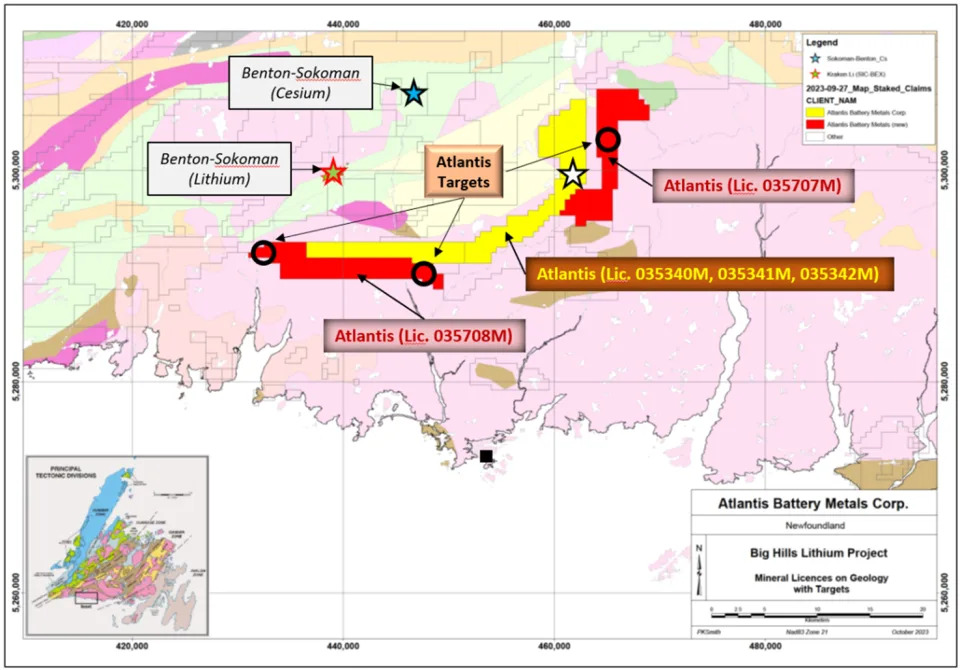

Today, the Company announced it has entered into a mineral property purchase and sale agreement, dated effective October 18, 2023 with Atlantis Battery Metals Corp., pursuant to which the Company will acquire additional ground adjacent to the Company’s Big Hill Lithium Project, located in southwestern Newfoundland, Canada.

The newly acquired ground consists of 2 mineral licenses consisting of 153 and 151 claims with each mineral claim covering 25 hectares. The combined lands package for these two licenses covers a total of 7,600 hectares, which will double the existing Big Hill project from 7,500 hectares to 15,100 hectares. The new licenses lie approximately 25km eastward and 6.5km south of the Benton/Sokoman Kraken Lithium discovery.

Pursuant to the terms of the Purchase Agreement, the aggregate purchase price payable by Azincourt to Atlantis consists of 5,000,000 common shares of the Company. The Company will also be issuing 500,000 common shares of the Company to an arms-length third-party as a finder’s fee in connection with the Acquisition.

“We’re pleased we will be able to double the size of Big Hill,” said president and CEO, Alex Klenman. “With the recent discovery of the previously unidentified pegmatite field we felt it was a good time to increase the size of the project ground. This is a significant exploration opportunity, in the right neighborhood, with compelling geological attributes. We’re excited to move forward with exploration plans and will announce the next phase of work shortly,” continued Mr. Klenman.

The Company recently announced the discovery of a significant pegmatite field at Big Hill which spans for ~400m trending NNE. The Big Hill claims are underexplored for lithium, and thanks to the highly impactful Kraken find, the Company feels the area is prospective for additional discoveries. The project has size, numerous priority targets, and the potential for many more. With year-round access, this project gives Azincourt the ability to be active throughout the year.

A recommended next phase exploration program (Phase I) would include any and all of the following: (a) additional helicopter supported prospecting, mapping, and sampling, (b) rapid analytical field analyses (portable XRF/spectrometer), and a Phase II program consisting of (c) till sampling for spodumene where cover masks the bedrock, (d) high-resolution drone-based geophysics including, but not limited to, radiometric and lidar surveys, (e) a high-resolution drone photographic survey, and (f) targeted trenching where lithium-bearing pegmatites are verified, followed by a Phase II limited diamond drill program (1,500 meters).

Azincourt Energy stock did break above the $0.045 zone but no momentum was achieved. The stock retested the breakout zone for days and even saw bulls step in to hammer a close above $0.045 when price dropped below intraday. With a close below $0.045 we now know that the $0.05 zone proved to be major resistance. The stock must hold above $0.03 for another chance to build momentum to the upside.