Listen, we don’t do buy/sell calls at Equity.Guru, because we’re not your financial advisor and we never want to be in a position where we need to apologize for a bad call. When you buy is down to you, your broker, your advisor, your significant other, your less significant other, and your venegeful god of choice.

But sometimes a stock does stupid things and ventures into a zone where you really need to think about making a call.

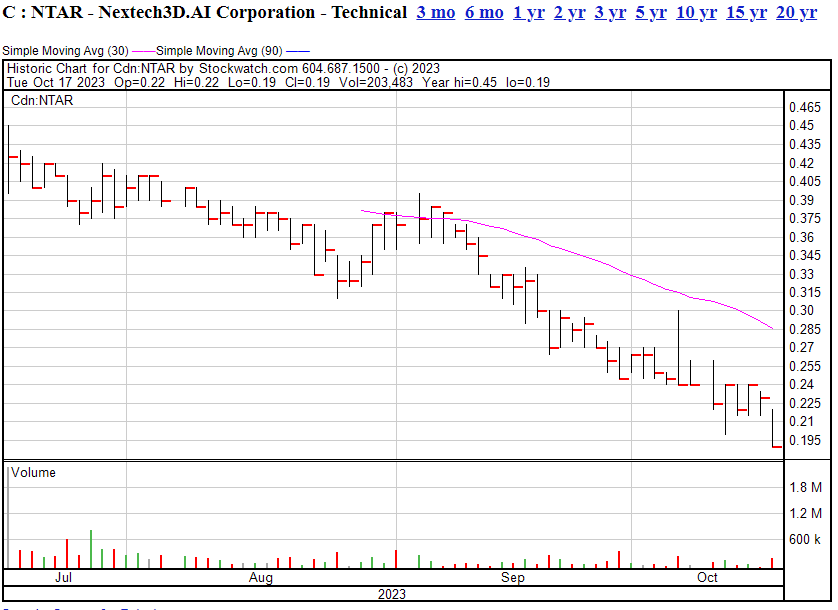

Nextech3D.AI is a tech company we’ve been watching for about four months, and in that time it’s done some quality things. Here’s how our Core Story article grocked it a few months back.

Yeah, that’s us pointing to $0.65 as where we think it made sense to be priced. At the time it was actually priced at $0.375.

Today, it’s down to $0.195, and that’s officially cheap.

Why is it getting beat up? Well, there are a few things.

- Investors are looking for ramped up sales numbers and, when you’re in the B2B business and dealing with Gigantor sized companies like Amazon, it’s worth noting that sales completions can drag on beyond expectations

- There’s some belief, justified in hindsight, that scything elements of the business off into spin-outs wasn’t a good move over the last year, with the markets weighed down as they are

- This, for mine, is the big one – some employer reviews on Glassdoor popped up, largely from India, from annoyed ex-employees accusing management of not having a consistent vision

That will happen when a section of your company is told it will be replaced by artificial intelligence, as NTAR’s India-based 3D design team appear to have been. I’m not in a position to tell if the Indian folks are on point or they’re pissed off that they’re not part of the ‘vision’, but the late August/early September emergence of their employer reviews on some social media platforms does coincide with the big fall off in share price.

Once a stock gains downward momentum, whether earned or not, it can become hard to slow things down until weak hands are done capitulating, and that appears to be what we’re seeing here. The company is putting out news and corporate updates reminding people what they’ve achieved, but that appears to have only slowed the gears for a few weeks until today when the line broke.

For those who don’t know what NTAR does:

- What They Do: Nextech3D.AI makes 3-D models using high-end tech like artificial intelligence (AI) for e-commerce, game development, wayfinding and augmented reality (AR)

- Big News: They’ve made over 60,000 of these 3-D models in 2023, which matters because online shopping companies like Amazon use them and have abundant scope to want a lot more going forward. Shopping with interactive 3-D models beats 2D images every time in terms of both increased sales and fewer returns

- Money Matters: Earnings are up, and looking healthier in the first half of 2023 than they did in the same time last year

- Changing Things Up: They changed their name from Nextech AR Solutions to Nextech3D.AI to better show off what they’re all about, though some have seen that as chasing a hot sector – as devil’s advocate I’d say split the difference there

- Promo Moves: Evan Gappelberg (the CEO) and Hareesh Achi (the head of product operations) have been on the poromotion path

- Other Cool Stuff in 2023: They’re also getting into the gaming and manufacturing scene, and there’s long been talk of joining the big leagues with a spot on the Nasdaq. To be clear, this won’t happen at the current share price, not without a big rollback, and I can’t see that as an option currently

Map D (Owned by Nextech3D.AI):

- Event Tool: Map D is a wayfinding tool that presents a high-tech map for events and locations where users can see where they’re supposed to go, how to get there, and maybe even acquire easter eggs along the way

- Key Features: For live event planners, it’s got an interactive map, a booth booking system, and a mobile app that merges with ARway (another of Nextech’s cool tech offspring) – kind of like Pokémon Go, but for conferences

- Recent Wins: A lot of big event companies have signed up with Map D, including the likes of CannaCon, Jenks Productions, and American Tradeshow Services, which will not just bring in sales but good data for improvements going forward

- Revenue News: Map D earned more money in the first three quarters of 2023 than they did in all of 2022

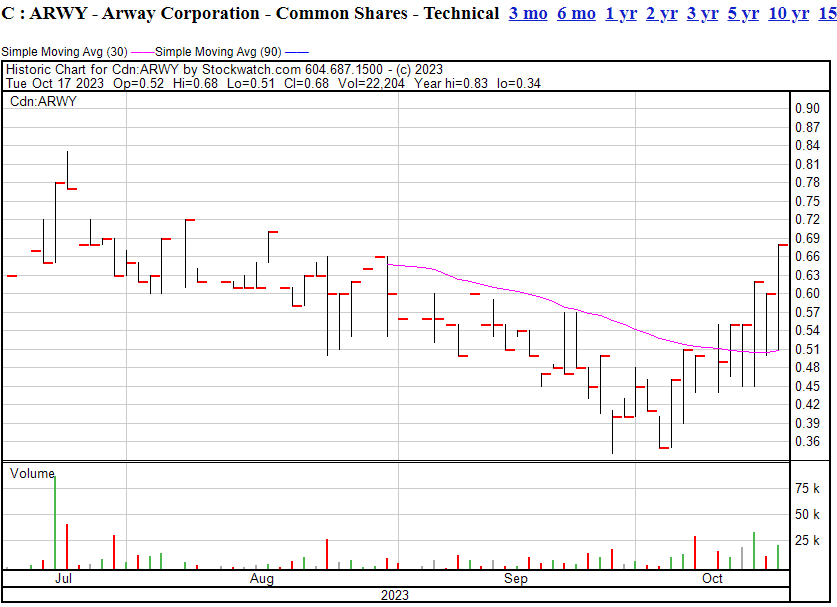

Map D sounds great, and it works with Nextech’s AR wayfinding spinout ARway (ARWY.C) nicely. The problem is, like the connective tissue between sister spin-out Toggle3D.AI and NTAR leaves things a little fuzzy when it comes to the common investor figuring out where one company begins and another ends.

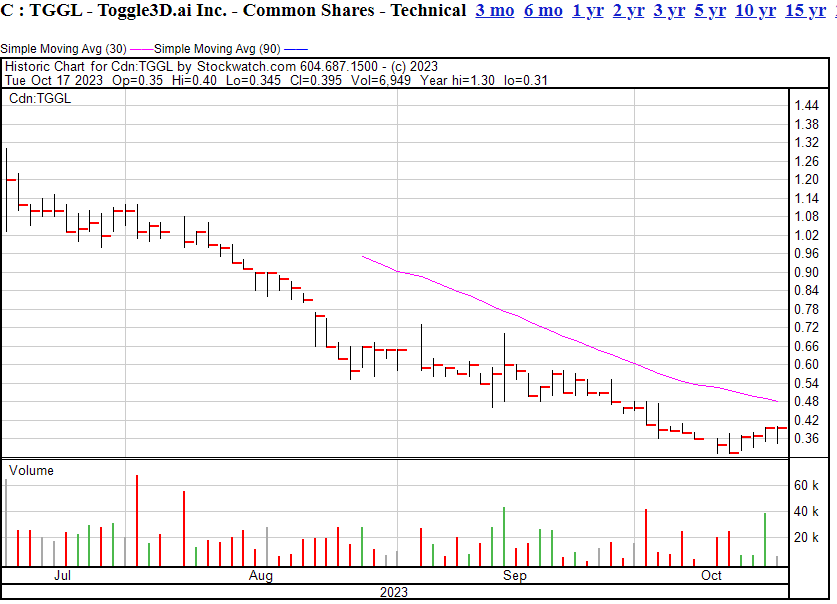

Toggle3D.AI (TGGL.C) is a tool that I personally thiink is great, if you’re dealing with a load of Computer-Assisted Drawing (CAD) files that you’d like to turn into 3D imagery. I’ve used it with no training, it takes seconds, and it’s the kind of tool one could build a real tech company out of – BUT – NTAR also converts files into 3D as its main service, presumably using this tool, so does a sale get registered to both companies or one?

This isn’t, in and of itself, a bad thing, but when one company becomes three, and then starts talking about a potential four (Map D), for mine, I think y0u need more standalone strength on each company than what investors are seeing here. I don’t hate that a sale by NTAR may benefit TGGL or ARWY, but how much do each of those outfits bring back to NTAR?

And if NTAR drifts, does it drag the whole spinout suite down? CEO Evan Gappelberg is an interesting cat and has certainly built this company out to a place where it can do good business, but I’d bet he wakes up some days wishing he only had one ticker symbol to worry about.

Unlocking a company’s value by spinning out non-core assets is not a new markets move, especially if you’re looking to sell off one of those assets without having to sell everything else attached to it.. but that’s not this.

When the spinoffs happened, NTAR was doing nicely enough and saw a chance to capitalize on upward trade winds. Since then, everyone has slowed down, and stories that require a little investor education are the hardest ones to lift.

So where does that leave us?

Well, TGGL has shared NTAR’s decline over the last six weeks, but has seen a really solid lift in the last week, from $0.32 to $0.40, which may point to a sign the whole suite of companies has found a base to bounce up from. TGGL has no reported revenue in the most recent financials, but has three quarters of cash runway to show its moxie. Long term trend is down, short term trend is up, sand at no point in the last three months have we seen a rise as consistent.

ARWY’s chart is even better, shifting from $0.35 to $0.68 in the first half of this month, on the back of news that it’s including playable games in its wayfinding suite, meaning the next time you show up at a sports arena, not only will ARWY potentially show you where your seat is, and show you a lit pathway on your phone as you walk there, but it can also include discount codes for food and rink, and now something to keep you busy during the national anthem.

That’s a tasty a meat-a-ball!

For mine, NTAR is more likely to get dragged up by these wins than the spinouts are to get dragged down by NTAR, because all the sister subsidiary spinoffs do business with NTAR. If they’re winning, so is the hoss.

I don’t love EVERYTHING about NTAR, as you’ve already read. I think it’s been a struggle for those spinouts to find an agreeable investor base because it’s not until the sales started to happen that people really understood what they were buying into, but we’ve long said when that pickup happens, the gains will be significant, and we’re seeing that with ARWY and TGGL now.

If NTAR can turn the corner and start shifting up too, the momentum could be fast and hard in the upward direction for all three.

Again, we don’t tell people to buy or sell. That’s for you to deciee based on the information presented.

But at $0.19, with the other companies on the move, my bet would be that the fall-away might be due to level off, and that makes an NTAR entry interesting.

We believe in that $0.65 valuation once a quarter or two of wins have been posted, and from here that would be a real win. Gappelberg, having bought in on the public markets over the summer according to insider trade documentation, clearly does too.

Again, speak to your favourite vengeful god and make an informed decision, but don’t wait too long.

— Chris Parry

FULL DISCLOSURE: Nextech3D.AI is an Equity.Guru marketing client and we may buy stock at any time.