Plurilock Security Inc (PLUR.V) is a Canadian identity-centric AI cybersecurity solutions company. The cybersecurity company provides multi-factor authentication (MFA) solutions using behavioral-biometric, environmental, and contextual technologies.

Today, the Company reported its financial results for the three and six months ended June 30th 2023. All figures are in Canadian dollars.

An increase of revenue to $28 million for the six months ended June 30th 2023 compared to $16.1 million over the same period the year prior. This is attributable to the strategic acquisitions of Integra and Atrion in 2022. Gross margins increased to over 12.5% for the six months ended June 30th 2023 compared to 8.6% over the same period in the year prior. This is driven primarily by the Company’s 2022 acquisitions, pricing strategy and its focus on securing high-margin software sales.

These high margin software sales increased by approximately 445% year over year. A total of 26 sale orders and contract renewals were announced as of June 30th 2023 since January 1st 2023 including a cross-sale purchase order with a Fortune 500 customer for the Company’s Plurilock AI platform.

“During the second quarter of 2023, Plurilock saw significant growth in the business with respect to its revenue and gross margin, highlighted by our record total revenue of $28.0 million for the six-month period, increasing by 74% year-over-year,” said Ian L. Paterson, CEO of Plurilock. “Throughout this quarter, our software sales continued to trend upwards, as we look to continue improving our overall gross margins while generating substantial revenues. Our priority remains to execute on our strategy to achieve cost savings and reach profitability through unlocking operational efficiencies and securing more high-margin contracts.”

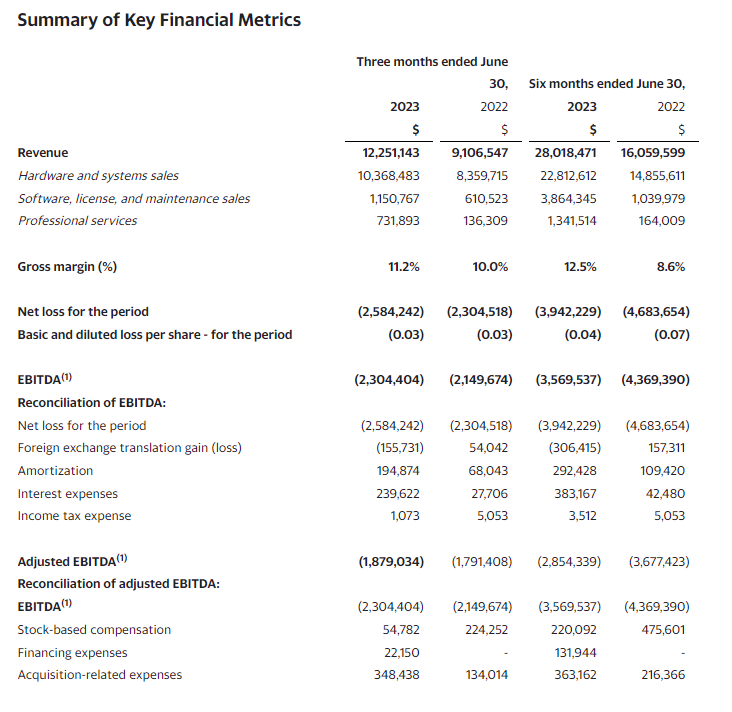

Total revenue for the three and six months ended June 30, 2023, was $12,251,143 and $28,018,471 respectively as compared to $9,106,547 and $16,059,599 for the same periods in the prior fiscal year ended June 30, 2022. Revenue for the three months ended June 30, 2023, is higher than the prior year and attributed to key strategic acquisitions along with an increase in organic sales volume and cross selling amongst the Solutions and Technology Division.

Hardware and systems sales revenue for the three and six months ended June 30, 2023 totalled $10,368,483 and $22,812,612 respectively compared to $8,359,715 and $14,855,611 in the prior year for the same periods. Software, license and maintenance sales revenue for the three and six months ended June 30, 2023 was $1,150,767 and $3,864,345 respectively compared to $610,523 and $1,039,979 respectively in the prior year. Professional services revenue was $731,893 and $1,341,514 respectively for the three and six months ended June 30, 2023 compared to $136,309 and $164,009 respectively in the prior year.

Hardware and systems sales revenues for the three and six months ended June 30, 2023 accounted for 84.6% and 81.4% respectively of total revenues compared to 91.8% and 92.5% for the three and six months ended June 30, 2022. Software, license and maintenance sales revenues for the three and six months ended June 30, 2023 accounted for 9.4% and 13.8% respectively compared to 6.7% and 6.5% for the three and six months ended June 30, 2022. Professional services revenue for the three and six months ended June 30, 2023 accounted for 6.0% and 4.8% respectively of total revenues, compared to 1.5% and 1.0% for the three and six months ended June 30, 2022.

Gross margin for the three and six months ended June 30, 2023 was 11.2% and 12.5% respectively compared to 10.0% and 8.6% in the prior year for the same periods.

Adjusted EBITDA for the three and six months ended June 30, 2023 was $(1,879,034) and $(2,854,339) respectively compared to $(1,791,408) and $(3,677,423) in the prior year for the same periods.

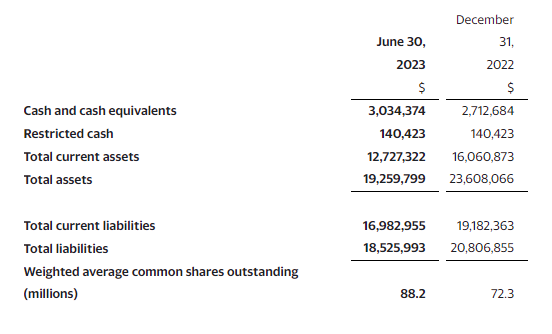

The cash position on June 30th 2023 was $3,174,797 compared to $2,853,107 on December 31st 2022.

During the three and six months ended June 30, 2023, the Company used $870,734 and generated $829,226 respectively of cash from operating activities compared to $1,628,613 and $6,130,212 of cash used respectively in the prior year.

The growth outlook for 2023 looks positive. With a client network of over 400 and the launch of the Plurilock AI platform, Plurilock intends to increase high-margin software sales by securing contracts with new and existing customers for its technology offerings. The Company also intends to streamline operations by unlocking operational synergies between Plurilock and its previous acquisitions as well as reducing the headcount to achieve substantial cost savings. At the end of August 2023, Plurilock has enacted a plan in accordance with this strategy and expects to realize approximately $2 million in savings on an annualized basis.

Plurilock looks to expand its AI-focused product suite and release additional products that are tailored to protect the workforce of organizations across various industry verticals against the threats of using generative AI tools. As a result, the Company aims to file new patent applications to strengthen its technology portfolio.

After bouncing at the major support zone at $0.125, Plurilock gained strength and momentum backed on the news that the Company is announcing a strategic focus on addressing the growing AI cybersecurity threats on July 18th 2023. Further momentum followed with a major 15% green day on July 19th 2023.

The stock saw a technical pattern breakout confirmed with a close above a downtrend line on July 20th 2023, the day when Plurilock announced its new SaaS product, PromptGuard. The stock recently hit highs just above $0.16 before selling off.

However, the stock did not gain any momentum and is currently retesting a major support zone at $0.12-$0.125. Bulls would want to see the stock close above $0.135 which would also lead to a close above the downtrend line.