Okay, everybody shush now and pay attention, because the markets are crap and your portfolio has been hurting and we’re just bloody sick of all that. It’s time to make some money on a runner and your old pal spotted one a month ago that has been buying daddy a lot of steak..

Emerita Resources (EMO.V) recent exploration updates and stock activity have prompted a lot of discussion at Casa Guru, mostly among the doughboys in the back room that didn’t believe me when I suggested EMO was a good bet in the short AND long term.

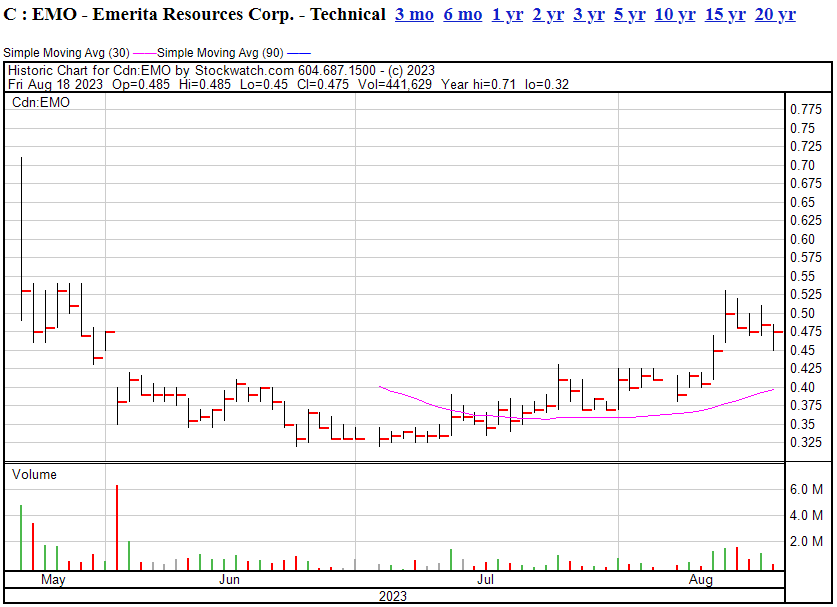

Emerita saw it’s stock price flop earlier in the year because of a court issue in Spain, which is expected to be resolved in the company’s favor, but not til 2025. That news came right as Emerita was prepping for a financing so the downward pressure couldn’t have landed at a better time to cause more downward pressure still.

That was May 2023. If you were in EMO at that time, sorry boss, nothing to be done about it now other than to sit.

But if you’re one of those who read what we said about it, and came away thinking, “Yes, Mr Parry, I agree this is a big time slice of potential and I’m in,” then you owe me a Coke because you’re up from low $0.030’s to high $0.40’s just a month later.

YOU’RE GOD DAMNED WELCOME.

Despite those early year challenges, the company managed to secure its financing and has since seen a gradual increase in its stock price. Management’s decision to secure funds helped stabilize the situation, and the stock has been recovering steadily. This is a good thing, clearly.

THE SHORT TERM:

Emerita Resources’ main focus currently is the Iberian Belt West (IBW) project, which includes two significant areas: La Romanera and La Infanta. The associated NI 43-101 report reveals substantial indicated and inferred mineral resources in terms of tons and concentrations of zinc, lead, copper, silver, and gold.

The company received results from two new drill holes just recently, LR152 and LR153, which were meant to explore deeper parts of the La Romanera deposit.

- In drill hole LR152, they hit a zone of minerals that’s about 68.5 metres grading 1.0% copper, 0.2% zinc, 0.28 gram per tonne gold and 5.9 grams per tonne silver, including 11.7 metres grading 2.9% copper. In a different part of the same hole, they found decent copper, zinc, gold, and silver, over a length of about 8.7 meters with the copper hitting 2.5%.

- In drill hole LR153, they found a zone of minerals around 52.1 metres grading 0.4% copper, 0.1% zinc, 0.13 gram per tonne gold and 3.2 grams per tonne silver, including 2.9 metres grading 1.4% copper.

These findings are exciting because they show numbers higher than you find in the existing 43-101, and the drilling also went really deep – the deepest hole, LR153, reached 750 meters below the surface, which is much deeper than earlier drilling. Another ongoing drill, LR157, is expected to go even deeper.

This points to that 43-101 ultimately being something that can grow on a second go-round; the perfect situation for Emerita in the short term.

And while that’s nice, there’s a potential bonanza just over the horizon.

THE LONG TERM:

Emerita is engaged in a legal battle concerning the Aznalcollar mine in Spain and, while the company stock price has taken hits over how long it takes to lawyer the everloving crap out of alleged embezzlers in Spain, things are looking good for those who can stomach a wait until 2025. The company’s bid for the Los Frailes mine was initially, several years ago, not accepted by the government pointyheads, even though it was by far the highest bid. But due to alleged corruption in the bidding process, which turns out to be obvious enough that permission to go to trial has been granted, Emerita could potentially secure the project by default if the purported winning bid, which is now in question, is thrown out, as it will need to be if corruption is proven.

The Aznalcollar project holds considerable promise and historical mineral resources, making it a potential game-changer for the company. And all indications, right now, suggest the company is in good shape in their legal pursuit.

How big is it? Sometimes pictures are better than words…

This is, as the kids say, a BFD.

If you want to dive into the technicals on this project, Doc Jones has done the work and the word billions is tossed around pretty often in his findings. A $16 price target applied a few years ago on the back of 16.75 Million ozs of AUEQ @ 6.13g/t AUEQ is worth thinking hard about.

In conclusion, Emerita Resources’ recent activities and prospects suggest a promising trajectory. Despite short-term stock fluctuations due to factors like down round financing and legal delays, the company’s core projects and potential blue-sky wins down the road (being awarded the mine would only be the start of things) have garnered attention from analysts and investors alike.

NOW:

Emerita is running on the markets because they’re doing the work – both fighting the good fight in court, and on the ground at the IBW project. There’s no argument to be had, in my opinion, that the current work is getting somwhere interesting, even if you completely ignore the potential of Aznalcollar, which it appears a lot of former investors did when the delays were announced.

I love that the market is getting back in on this thing, as it tells me folks are either happy to trust management and be in it for a while, or they genuinely like the IBW Project.

Me? I’m both.

— Chris Parry

FULL DISCLOSURE: Not an Equity.Guru marketing client, but I’m buying on dips.