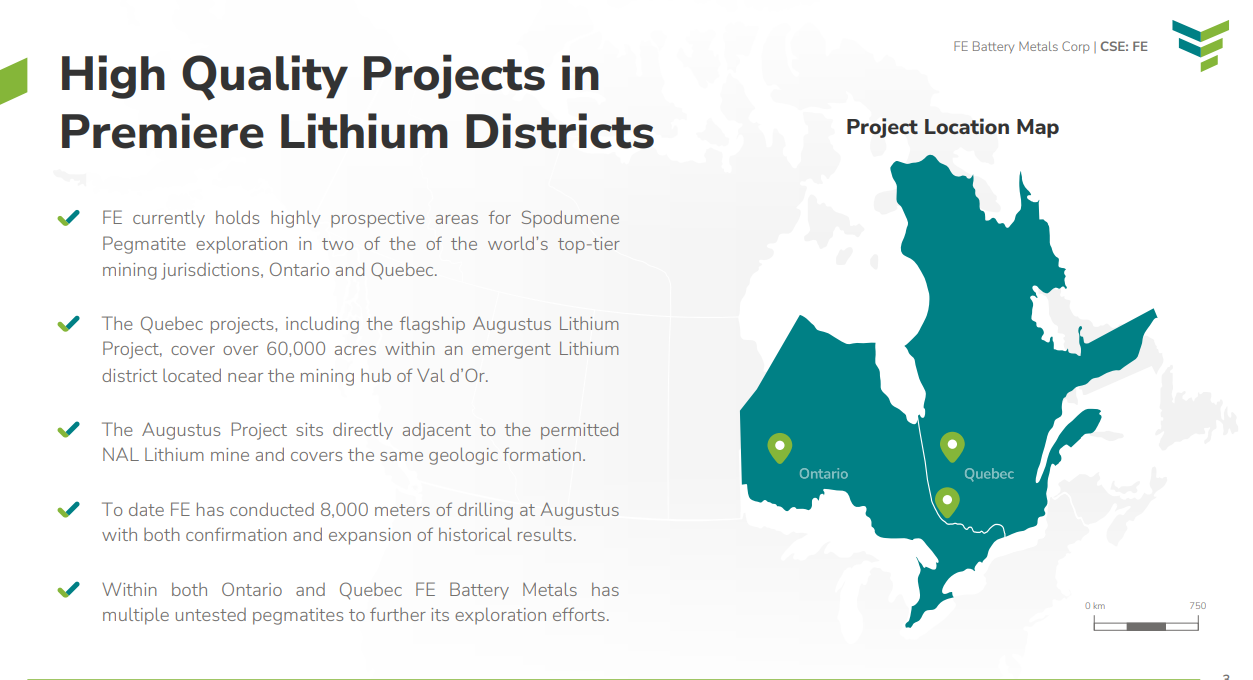

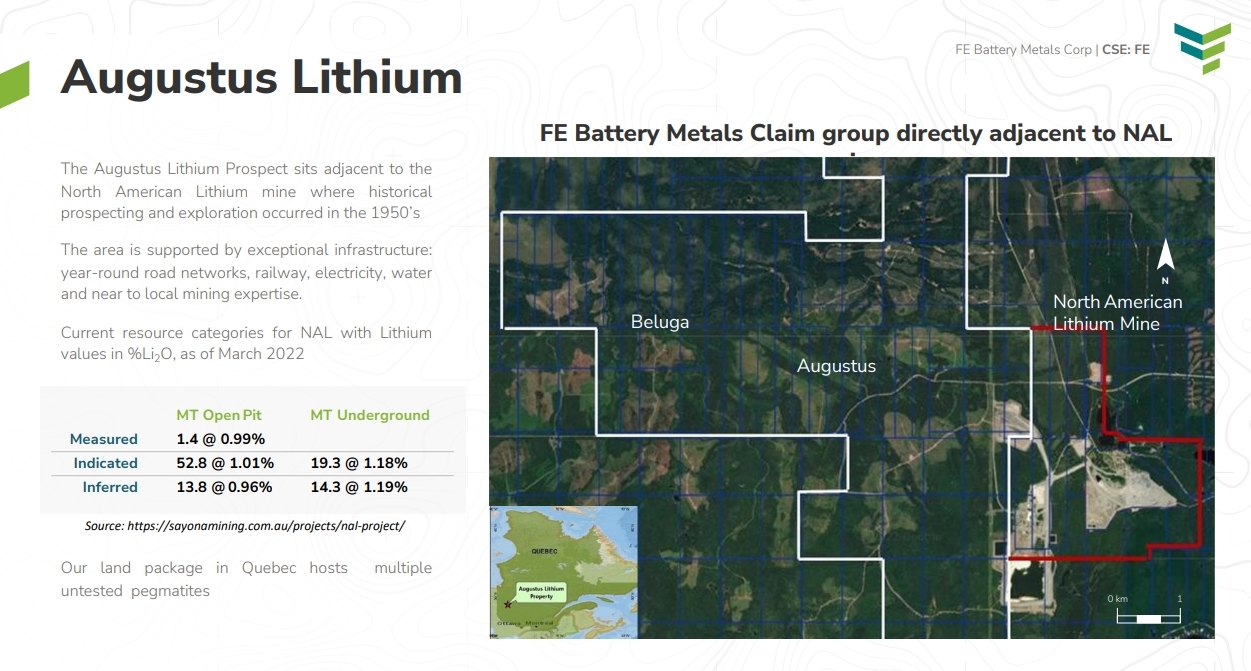

FE Battery Metals (FE.CN) is focused on identifying, exploring and advancing early-stage lithium pegmatite projects in Canada. The company owns assets in Quebec and Ontario with the flagship being the Augustus Lithium Property located in the immediate vicinity of Val d’Or Quebec where several historical prospects and a previously active lithium mine is located within a 10km radius from the property. North American Lithium mine (NAL) and the Authier Project are two notable projects in the area that highlight the potential of the Augustus Lithium Property.

Today, the Company announced results of Drill Hole LC23-50 from the current 2023 drill program at its flagship Augustus Lithium Property.

Drill hole LC23-50 intersected multiple sections of lithium mineralization, including a 17.45-metre-wide section of 1.19 percent lithium oxide (Li2O) at 82.4 m drilled depth.

This new drill hole was cored to test the eastward extension of LC21-16, which previously yielded results of 1.17% Li2O over 19m at a depth of 126m. The Company is planning both follow-up drilling and 3D modelling of the lithium-bearing rock units.

Gurminder Sangha, CEO & Director, stated, “We are very excited to see such promising drill results at Augustus and are currently endeavouring to define the size and shape of the high-grade zones. With Quebec now a hard rock lithium hotspot, this is a significant milestone for our company. We look forward to further unlocking the potential of Augustus, which is located just a few kilometres from the now-operational North American Lithium Mine.”

The stock is currently up over 26% at time of writing, with major volume, and sits at a market cap of over $24 million.

Just looking at the stock chart, you can clearly see that there has been a shift in trend. The double bottom pattern printed and triggered with the breakout on March 6th 2023, confirming a new uptrend. Now it is all about higher lows and higher highs.

The stock retested the breakout zone around $0.63 before moving higher. Today’s news has seen the recent range break and the stock has created a bullish gap above $0.75.

Major resistance comes in at $1.00. The stock did rally above this zone, but the close was below. For bulls, this is the next bullish trigger. A close above $1.00 for further upside momentum. The stock could pullback from here, but we remain bullish above $0.63.