Everyone is talking about Silicon Valley Bank and Signature Bank. What might not be known is that these banks both have ties to the crypto industry. With government intervention, deposits at both institutions will be guaranteed, and more backstops and safety nets have been put into play from the Federal Reserve and the Treasury to ensure the safety of the banking system.

Interestingly, the moves in Silicon Valley Bank and Signature Bank followed the failure of Silvergate Capital, a main bank in the crypto industry. In 2013, this California-based community bank pivoted into cryptocurrencies to offer traditional financial services to crypto companies, including exchanges like FTX. This was before any other banks were thinking about crypto, inevitably making Silvergate an essential part to the entire crypto industry.

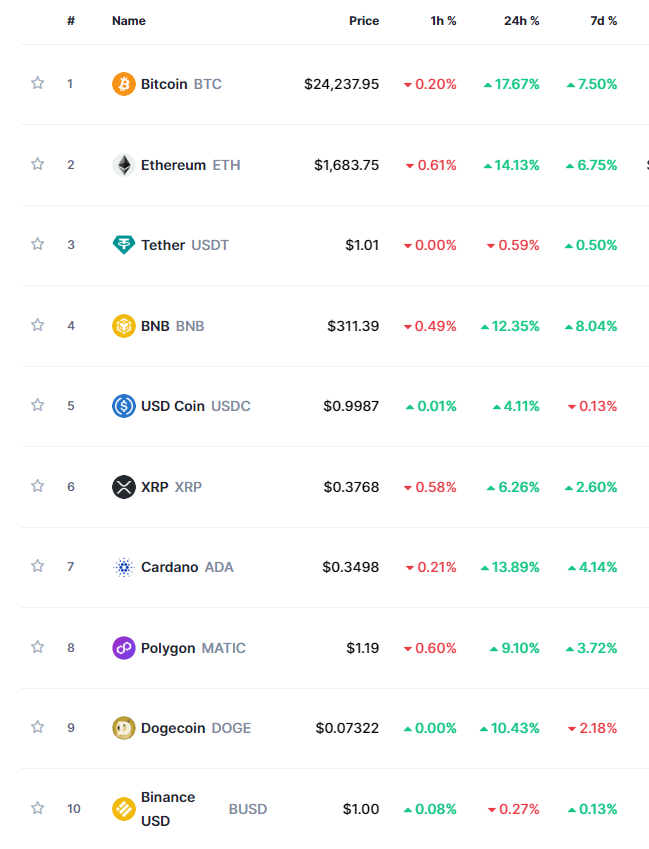

Cryptos are spiking on Monday after government intervention in securing deposits:

The total crypto market capitalization rose 6.47% in the past 24 hours to US$1.01 trillion. Total trading volume over the last 24 hours was down 34.52% to US$60.19 billion.

Late last week, I spoke about the recent crypto breakdowns. I spoke about major resistance levels needing to be taken out to end the current downtrend:

Well with today’s pop, we are set to close above resistance and end the current downtrend. I have also said before that cryptos act as risk on assets, meaning they move just like the stock markets. Stock markets are currently green, which also speaks volume to general fear dissipating… and the markets beginning to price in the Fed not doing any rate hikes given we almost had a systematic collapse of the banking system. This is good for stock markets, and will thus be positive for bitcoin and cryptos.

We have a very strong bitcoin candle today, but look at Sunday’s candle close. A close which occurred with the US government and regulators announcing measures to guarantee deposits. That was the catalyst to see us close back above resistance at the $21,500 level and end the current downtrend.

All eyes are now once again on the $25,000-$25,250 zone. We get a strong candle close above this zone, and bitcoin has space to run up to $32,000.

A daily close is great, but I would go up to the weekly chart and wait for a WEEKLY candle close above this upcoming resistance zone. That would be a real bullish trigger.

The same can be said about Ethereum. We bounced at the $1400 support zone, and are now testing the major resistance zone. Just looking to the left, and you can see Ethereum has recently always struggled to break above this zone. There is a possibility we begin to range again. But if the likelihood of a Fed pause and possible capitulation increases, then this could be the catalyst for a major breakout which could see Ethereum climb over $2000.

XRP did not react as other cryptos on the news. Both on the Silvergate and government intervention news. It continues to range in this flag, and a break is still needed for direction. One to keep an eye on if you are a trader.

A lot of eyes are on Solana. Unlike the other major cryptocurrencies, Solana has yet to close above its resistance zone. Today’s candle close will be significant. At time of writing, you can see from the chart we are seeing some selling pressure at resistance. This hints at a retest rejection and a move down further.