Uranium explorer Skyharbour Resources (SYH.V) today announced that the TSX Venture Exchange has granted conditional acceptance for the option agreement previously entered with Tisdale Clean Energy Corp, Skyharbour’s partner company, pursuant to which Tisdale has been granted the right to acquire up to a 75% interest in the South Falcon East Property.

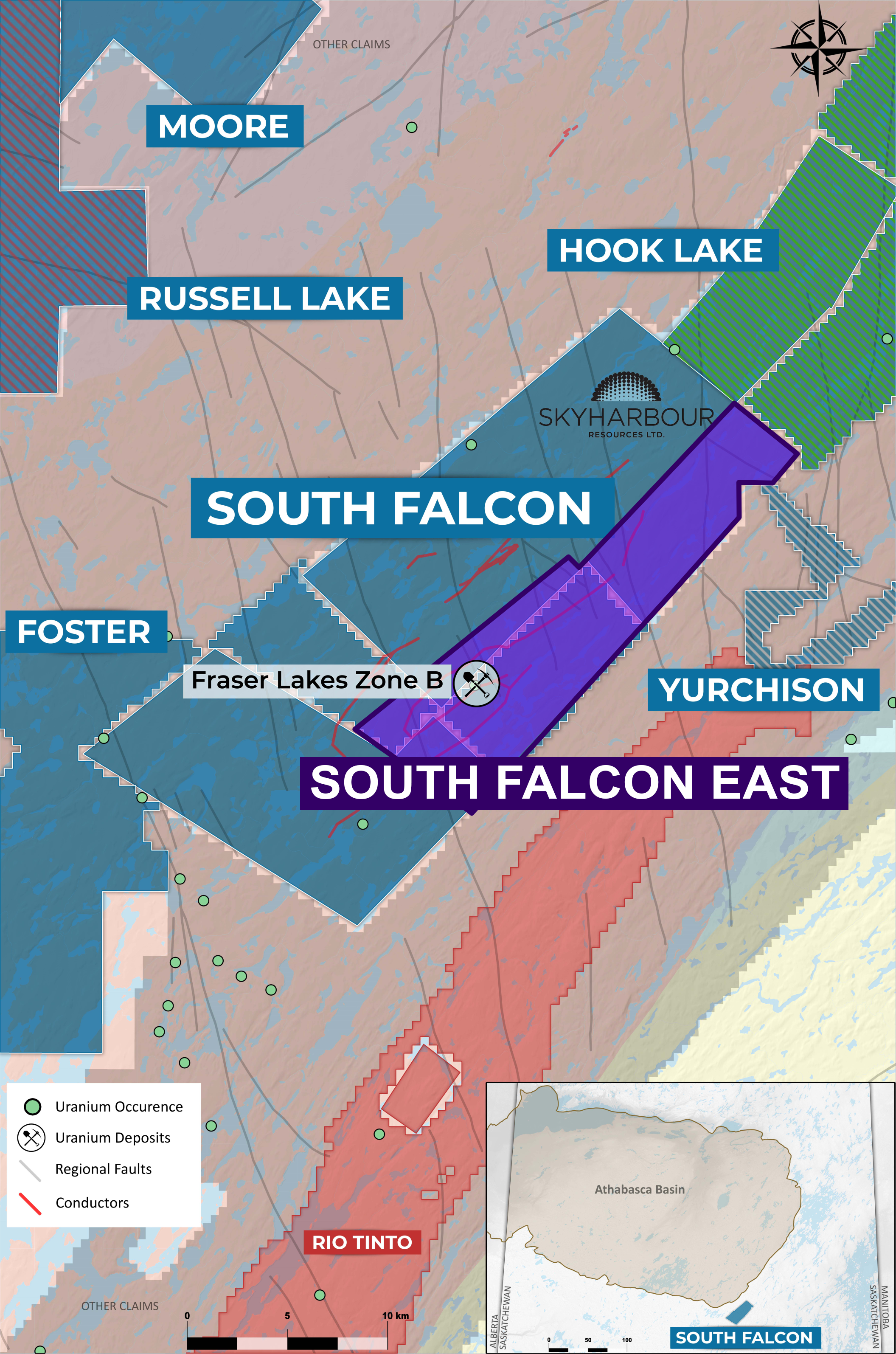

The property consists of mineral claims totaling 12,770 hectares and is located in the Athabasca Basin in Northern Saskatchewan. Historical exploration of this property has identified an area of uranium mineralization at the Frazer Lakes Zone B which is seen on the image below.

If the option is earned, Tisdale will issue Skyharbour 1,111,111 Tisdale shares upfront, fund exploration expenditures totaling CAD $10,500,000, and pay Skyharbour CAD $11,100,000 in cash of which $6,500,000 can be settled for shares in the capital of Tisdale over the five-year earn-in period.

Terms of the option agreement are in two phases. The first allows Tisdale to acquire 51% interest in the property by completing the following payments and incurring the following exploration expenditures on the property:

1. On the closing date (“Closing”), paying CAD $350,000 (paid) and issuing 1,111,111 Shares to Skyharbour upfront;

2. By the eighteen-month anniversary of Closing, completing at least $1,250,000 in exploration expenditures, and paying Skyharbour $1,450,000, of which up to $1,000,000 may be paid in Shares based on the 20-day volume-weighted average closing price calculated on the day of issuance (“VWAP”), at the election of Tisdale;

3. By the second anniversary of Closing, completing an additional $1,750,000 in exploration expenditures, and paying Skyharbour $1,800,000, of which up to $1,000,000 may be paid in Shares based on the VWAP, at the election of Tisdale;

4. By the third anniversary of Closing, completing an additional $2,500,000 in exploration expenditures, and paying Skyharbour $2,500,000, of which up to $1,500,000 may be paid in Shares based on the VWAP, at the election of Tisdale.

After acquiring 51%, Tisdale can then increase its interest to 75% by:

Completing a payment of $5,000,000 to Skyharbour by the fourth anniversary of Closing, of which up to $3,000,000 may be satisfied in Shares based on the VWAP, at the election of Tisdale, and incurring exploration expenditures on the Property of an additional $2,500,000 in each of the fourth and fifth anniversaries of Closing.

A small portion of the Property is subject to an existing 2% net smelter returns royalty owing to a former owner, and Tisdale has agreed to grant a further 2% royalty to Skyharbour. One-half of the royalty, being 1%, to be granted to Skyharbour can be purchased at any time by completing a one-time cash payment of $1,000,000.

Skyharbour is currently up over 1% on today’s news.

The company also released a press release yesterday announcing the beginning of their 2023 Winter drill program at the Russell Lake Uranium Project.

For technical analysts, an important breakout was confirmed yesterday. The stock ended up closing above my major resistance zone at $0.425. This has triggered the double bottom pattern. This pattern tends to highlight a reversal in the trend, which means we should expect a new uptrend taking us to the next resistance zone around $0.60 as long as price holds above $0.425.