How things have changed post NFP. The December nonfarm payrolls report showed that the U.S. economy added 223,000 jobs last month, slightly higher than the expected 200,000 jobs economists polled by the Dow Jones expected.

Markets reacted in a way which surprised traders. Instead of selling off due to strong labor markets which would lead to the Fed remaining hawkish (raising interest rates), stock markets popped hard.

The reason? Wages grew slower than anticipated, increasing 0.3% on the month where economists expected 0.4%. Believe it or not, but this 0.1% has got stock markets soaring. With wage growth slowing, the markets see this as a sign that inflation is turning.

“All investors care about is that the data suggests inflation is moving towards the Fed’s target,” said Michael Arone, chief investment strategist at State Street Global Advisors. “That’s all investors care about and average hourly earnings suggest inflation continues to slow. They are excited about that.”

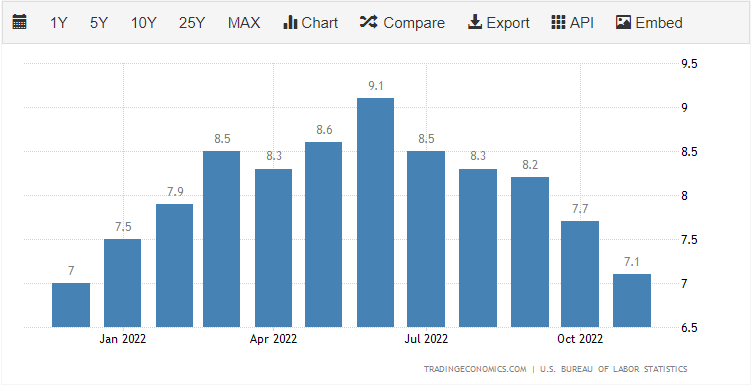

And with the CPI chart above, investors and traders do have a point.

The big test will be this week’s CPI inflation data which will be released on Thursday January 12th 2022. Another data report coming in lower than expected will see markets continue this rally.

Markets are now betting on a Fed pivot. A pivot recently has been the Fed slowing the pace of rate hikes. It now seems that markets believe the Fed is near its terminal point, where they will pause raising rates. I say this because of the action in the bond markets:

Both the 2 year yield and the 10 year yield are dropping. And these are pretty big moves when it comes to the debt markets. Markets are now literally betting against the Fed. The last Fed press conference saw Powell say rates will head higher and stay high for a long time. The bond markets are saying something different.

This sets up a very interesting next few months. The Fed is expected to raise interest rates in February. 25 basis points is expected, but this could change to 50 if certain data prints don’t go the way the markets expect.

But the big factor remains Powell and the Fed. They have been adamant that interest rates will need to head higher and stay high for a long time. But the markets are saying something different. Will the Fed capitulate and follow the markets in order to prevent a major volatile move? Or will the Fed not care about the stock markets and continue their hawkish tone and remain the course, even if it means upsetting the markets and causing a major volatility move. Technically the Fed is not supposed to care about the action in the stock markets. Their dual mandate is to maximize employment and ensure stable prices. Or put it another way, keep inflation low. If the Fed adheres to this dual mandate, it shouldn’t come as a surprise if the Fed shuns market expectations.

It isn’t just the bond markets showing a market expectation of a Fed pivot, but the US dollar as well. The dollar is currently breaking below major support. A weaker dollar with falling bond yields is very stock market positive.

If the Fed surprises and maintains a hawkish tone, we would expect the dollar to reverse back to the upside.

But currently, with the dollar dropping and yields dropping, it provides bullish set ups for US stock markets.

All US markets broke below their major support back in December 2022. However, holiday liquidity meant that there was no follow through. Instead, we ranged for weeks. Usually an indicator that markets are not going to sustain the breakdown (or breakout if to the upside) momentum.

The Dow Jones is the chart I highlight first because we actually closed above the 33,400 resistance zone on Friday. Technically, the threat of a downtrend with lower highs and lower lows is over. Now, it is all about taking out recent highs at 34,600.

The S&P 500 could be the second major US market to join in with the Dow Jones. A major recovery and close above a major resistance could be confirmed by the end of the trading day today. Watch for a strong close and break.

The Nasdaq still has some ways to go, but the set up is different. Tech stocks take the biggest hit when interest rates are rising or expected to rise. With yields dropping and a potential Fed pivot on the cards, the Nasdaq could be the one to provide big returns.

The Nasdaq was in a precarious zone as it was testing major support at around 10,650. In fact, we actually could have made new all time lows for the year 2022 right at the end of the year. But instead, we have ranged and are bouncing. Things are looking positive with even an engulfing candle printing at this major support. However, I still want to see the Nasdaq take out 11,600.

I can definitely see traders going long due to the engulfing candle and placing their stop loss below 10,666.

In summary, the dollar and yields falling are positive for stock markets. A bear trap has now turned into a bullish breakout as markets expect falling inflation to trigger a Fed pivot. However, it all comes down to the Fed and if they will maintain that rates will need to remain higher for longer. And if they will stay the course. Will the Fed listen to the markets? Or will they disappoint, triggering a major volatility move?