Canadian billion dollar market cap gold miner IAMGOLD (IMG.TO) today sold off a chunk of their African assets. Moroccan mining company, Managem, has bought the assets of IAMGOLD in Senegal, Mali and Guinea for a total of $282 million. These assets are collectively known as the Bambouk assets, and the total resource portfolio exceeds 5 million ounces of gold.

Managem operates in 6 African countries and is controlled by the Royal Family holding company Al Mada. The fully integrated mining group has been developing and mining a balanced portfolio between gold and energy transition metals for more than 90 years.

Under the terms of the agreements, IAMGOLD will receive total cash payments of approximately $282 million as consideration for the shares and subsidiary/intercompany loans for the entities that hold the Company’s 90% interest in the Boto Gold Project in Senegal and 100% interest in each of: the Diakha-Siribaya Gold Project in Mali, Karita Gold Project and associated exploration properties in Guinea, and the early stage exploration properties of Boto West, Senala West, Daorala and the vested interest in the Senala Option Earn-in Joint Venture also in Senegal. The remaining 10% of Boto will continue to be held by the Government of Senegal.

Closing of various components of the transactions are expected to occur upon satisfaction of the applicable regulatory conditions, and are expected to close over the course of the second quarter into early third quarter of 2023.

Maryse Bélanger, Chair of the Board of IAMGOLD and Interim President and CEO, commented: “The sale of our Bambouk assets to Managem is the culmination of a comprehensive strategic review and sale process. We are pleased that ownership of the Bambouk assets will be assumed by Managem, which has decades of mining development and operating experience in Africa and intends to advance these assets responsibly, for the benefit of all stakeholders. IAMGOLD and Managem will work closely towards a smooth transition of ownership.

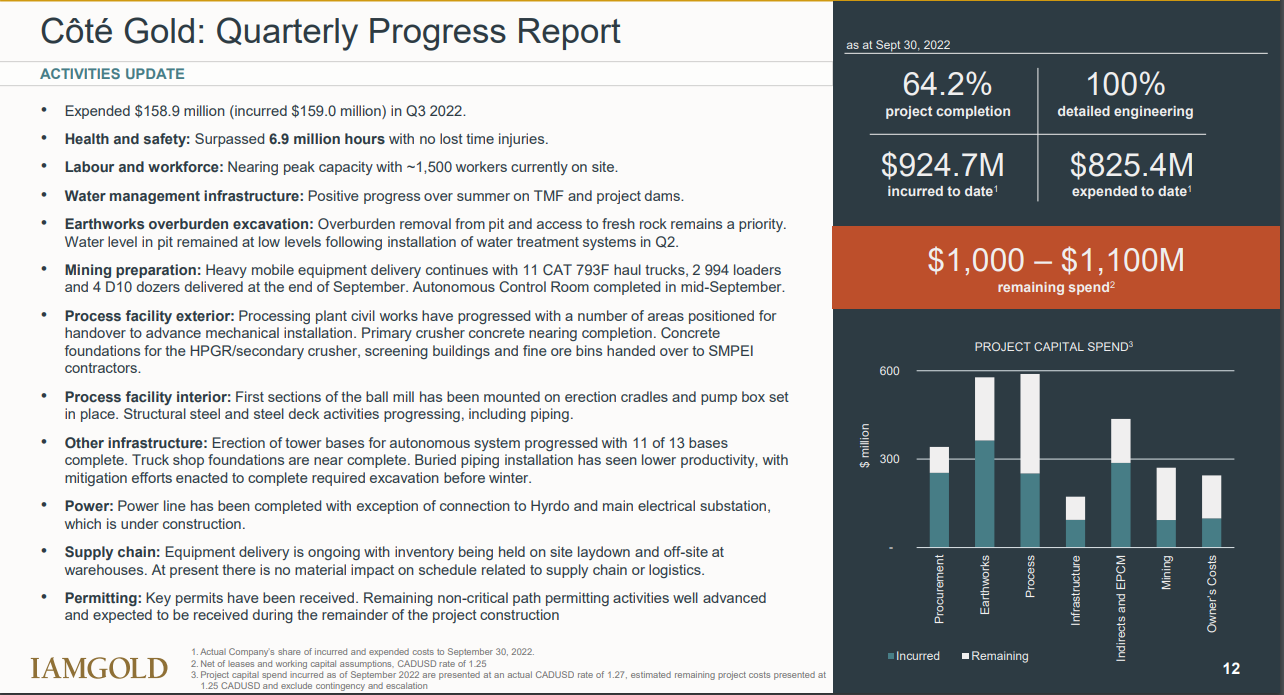

“The proceeds of the sales, coupled with the financing agreement with Sumitomo announced last night, meet the remaining funding requirements for completion of construction at the Côté Gold Project, which is approximately 70% complete and on track for production in early 2024.”

Yesterday, IAMGOLD announced a transaction with Sumitomo Metal Mining. An agreement to amend the Côté Gold Joint Venture Agreement with Sumitomo was announced. Beginning in January 2023, Sumitomo will contribute certain of IAMGOLD’s funding amounts to the Côté Gold Project that is expected to total around $340 million over the course of 2023.

“The financial support of Sumitomo demonstrates to all of our stakeholders the strong validation of the Côté Gold Project from our partner and our alignment to complete construction and commence production,” said Maryse Bélanger, Chair and interim President and CEO of IAMGOLD. “On behalf of the Board and IAMGOLD, I want to thank Sumitomo for their continued support and dedication as together we continue to build what will be Canada’s third largest gold mine by production.”

“The Côté Gold project remains on track for gold production in early 2024, in line with the updated schedule and cost to complete as outlined on our most recent project update at the end of last quarter. The successful construction and commissioning of the Côté Gold Project, together with our commitment to mine safely across all of our operations, is the most important strategic priority of IAMGOLD,” continued Ms. Bélanger.

Key terms of the deal can be seen here.

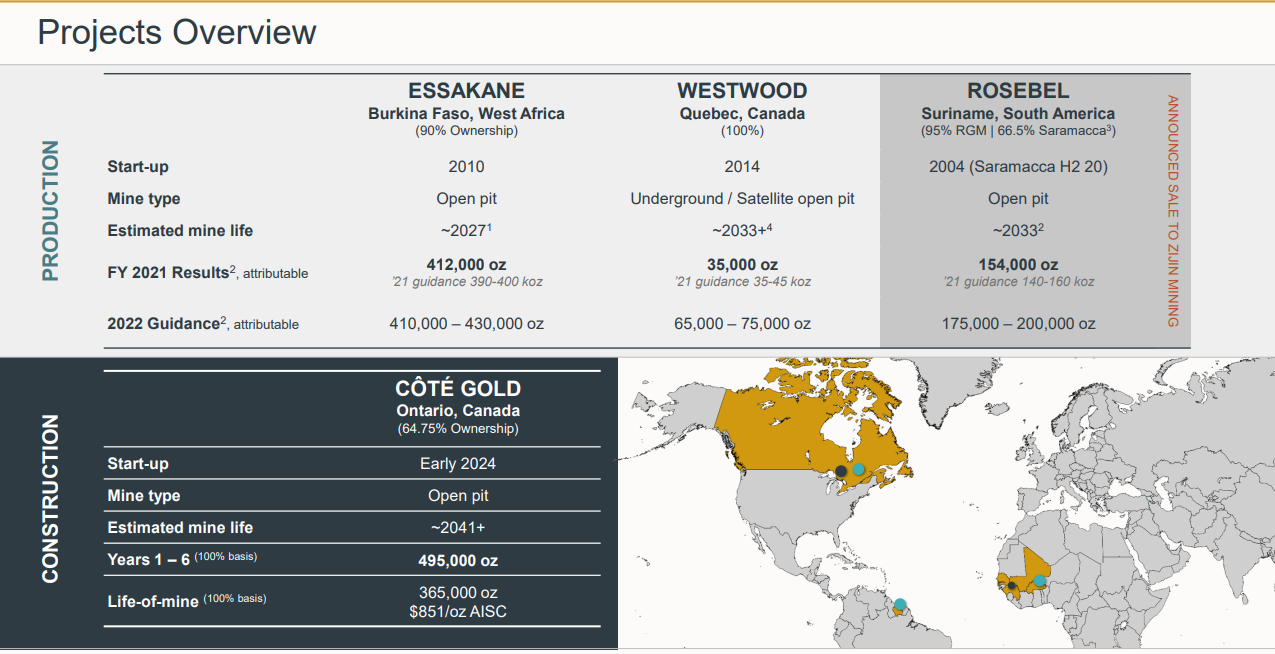

IAMGOLD is a mid tier gold mining company with three operating mines located in Burkina Faso, Suriname and Canada. In early 2024, a fourth operating mine located in Canada (the aforementioned Côté Gold project) is expected to be in production. The company still has assets in high potential mining districts in the Americas and West Africa with development and exploration potential.

At time of writing, the stock is up over 25% on the day with over 2,100,000 shares traded.

The technicals look prime. We began the new uptrend with a breakout above $1.80 triggering an inverse head and shoulders pattern. We have formed multiple higher low swings after the pullback retest.

The stock hit a major resistance zone at just under $3.00. As you can see the stock began falling from here as traders took profits at the resistance target.

Why did this zone act as resistance? It was where a major gap terminated. There is a gap between $3.60-$3.00. Gaps tend to be major support and resistance zones depending on the current trend. In this case, the gap acted as resistance.

With today’s news, the stock made a rip back above the $3.00 zone. If we can close above, then we have a foothold in the gap, and support comes in at $3.00. Meaning, as long as the stock remains above $3.00, we should expect the stock to move higher.

The next major zone is $3.60. If IAMGOLD can close above this, it would accomplish a major technical trigger. We would have filled the gap, and this would be SUPER BULLISH. A gap fill could easily propel the stock above $4.00.