Uranium is not just popular with the retail crowd but with the institutional crowd as well. It really does seem like a no brainer investment given nuclear energy being the solution for base load energy with CO2 free emissions, and the current supply and demand uranium set up.

Things get more interesting as the European Union ban on Russian crude oil goes live on December 5th. There are some issues with the price gap, but this has the potential to send crude oil prices higher! But for uranium investors, this begs the question: will Russian uranium be next? In previous weekly uranium sector roundups, I have written about banks such as Citi being bullish uranium because they see a ban or sanctions on Russian uranium coming. Kazakhstan’s Kazatomprom is also looking at alternative routes to deliver uranium rather than through St Petersburg in case sanctions or a ban is placed on Russian uranium.

Sashi Davies, an internationally acclaimed nuclear power/uranium expert who has been involved with the uranium market and uranium sales for more than 35 years, believes the uranium market is poised for a big breakout which will see uranium prices take out previous highs.

She compares the current set up to that of the early 2000s:

“Today I think we are where we were at the beginning of the big move like back in the early 2000s (spot uranium prices peaked at $US140/lb in 2007). It has the same feel to it,” Davies said.

“Everyone knows that there is something happening. But because there is some structural change, as well as market movement, it is hard to tell how quickly and when it is going to move.

“Looking at demand, the uncertainty now is how much more demand are we going to have in the near term, as well as how far out it will go.

“On the supply side, it is a case of whether we are actually going to be able to bring production on quickly enough to meet that gap.

“And if you look at inventory, I have never seen so much inventory sucked out of the market as I have seen in the last 3-5 years.

“Over the next 12 months, it is a market where there are several catalysts, and if just one of those changes, I think the price could go above its last high.”

She also believes that sanctions on Russian uranium could be that catalyst for a market move to the upside. In the long term, the catalyst is policy backing nuclear power in its role for global decarbonization and baseload nuclear power being the only way to achieve this.

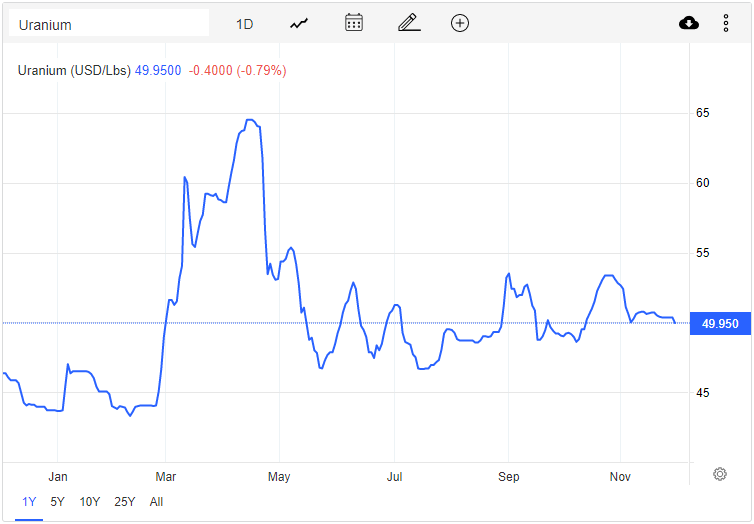

Uranium is still up 7% for the year, but has given back a large chunk of its 2022 gains. Ever since the pullback, uranium price has just been ranging between $46.70 to the downside and $53.50 to the upside. Those are our range levels, and we were very close to breaking out above $53.50 at the end of October 2022. Instead, we sold off and remain in the range.

A catalyst is required for that breakout, but a range provides a great opportunity for uranium bulls to enter positions in anticipation for the breakout and the move higher.

Here is what happened with Athabasca uranium stocks this week:

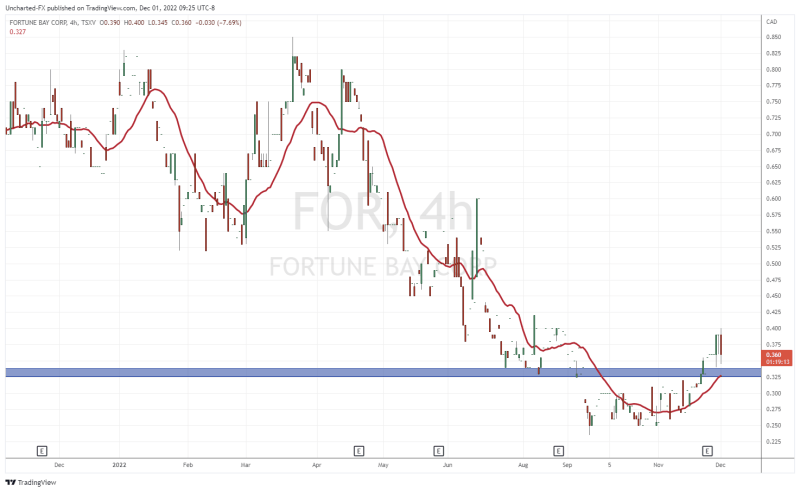

Fortune Bay Corp (FOR.V)

This week, Fortune Bay announced an agreement with Ya’ thi Néné Lands and Resources (“YNLR”), Hatchet Lake Denesułiné First Nation, Black Lake Denesułiné First Nation, Fond du Lac Denesułiné First Nation (the “Athabasca First Nations”) and the Northern Hamlet of Stony Rapids, the Northern Settlement of Uranium City, the Northern Settlement of Wollaston Lake and the Northern Settlement of Camsell Portage (the “Athabasca Municipalities”, and together with the Athabasca First Nations, the “Basin Communities”).

As many of you know about junior mining, having these relationships with the first nations is crucial. Fortune Bay now has established a progressive basis for Fortune Bay, YNLR and the Basin Communities to work together to ensure that the Activities are conducted in a sustainable manner and with respect for the Aboriginal and treaty rights, title and interests of the Athabasca First Nations and protection for their traditional lands. The Agreement provides a framework for information-sharing and environmental protection and monitoring, establishes permitting review processes, facilitates the Basin Communities’ meaningful participation in the Activities by providing economic, employment and training opportunities and benefits to support community development initiatives, and confirms the Basin Communities’ consent and support.

The stock itself looks interesting. It appears as if a bottoming pattern has been confirmed and a new uptrend is in the works with the breakout. As long as the stock remains above $0.325, more highs can come. Next resistance comes in at $0.50.

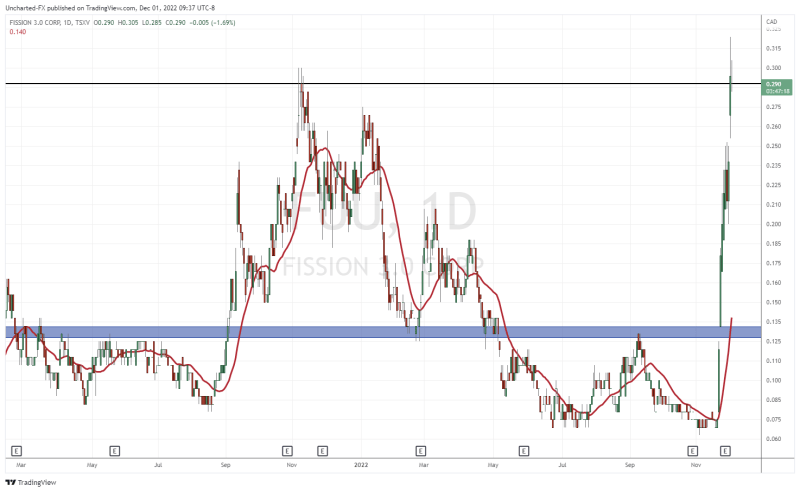

Fission 3.0 (FUU.V)

It has been a huge few weeks for Fission 3.0. After the news of a new discovery, Fission is right back at it with two press releases this week.

The first press release announced follow up drilling of the new high grade discovery has begun. Fission 3.0 currently has two diamond drills on the property and will be drilling a total of up to 7 holes prior to the Christmas break.

Here are the highlights from the PLN22-035 discovery:

- 15.0 m total composite mineralization >300 cps over a 15.5 m interval (between 257.0 m to 272.5 m), including

- 5.62 m of total composite mineralization >10,000 cps over a 6.3 m interval (between 259.0 m and 265.3 m including

- 1.5 m of total off scale radioactivity (>65,000 cps) over a 2.0 m interval (between 262.0 m and 264.0 m)

- 5.62 m of total composite mineralization >10,000 cps over a 6.3 m interval (between 259.0 m and 265.3 m including

The second press release has to do with the first follow up drill intersecting 3.48 m of total composite mineralization with greater than 10,000 cps including 2.5 m of total off-scale radioactivity (>65,535 cps).

Drilling from the first follow up hole highlights are:

PLN22-038 (line 00N)

- 12.5 m total composite mineralization >300 cps over a 13.0 m interval (between 239.0 m to 252.0 m), including

- 3.48 m of total composite mineralization >10,000 cps over a 7.15 m interval (between 243.85 m and 250.7 m including

- 2.5 m of total off scale radioactivity (>65,535 cps) over a 3.0 m interval (between 244.0 m and 247.0 m)

- 3.48 m of total composite mineralization >10,000 cps over a 7.15 m interval (between 243.85 m and 250.7 m including

- the hole is still in progress.

We called that double bottom reversal pattern which triggered with a breakout above $0.135. Our resistance target at $0.29 has been hit. Now comes the fun part. We either see a pullback from here, which I believe will be bought by buyers and form a higher low, or we close above this resistance zone and continue to rally higher.

With a large percentage move in less than two weeks, I would expect to see some profit taking. Pullbacks are normal, and the stock remains in a new uptrend as long as price remains above $0.135. This is one of those stocks that has both positive fundamentals and technicals behind it. A winning combo.

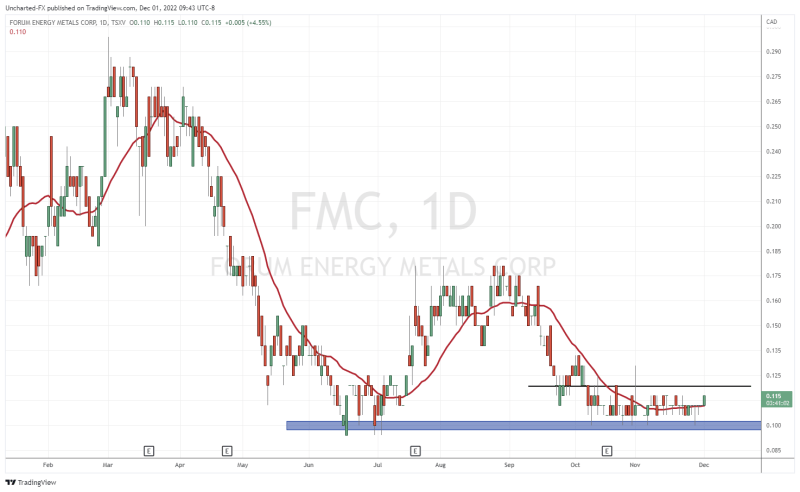

Forum Energy Metals (FMC.V)

Forum Energy Metals announced that drilling has started on its 100% owned Wollaston uranium project, located 10km south of Cameco’s Rabbit Lake Uranium Mill and 30km south of Orano/Denison’s McClean Lake Uranium Mill in the northeastern Athabasca Basin.

The goal is to drill approximately 1000m before Christmas, then continue the program into the new year with a minimum of another 2,000 metres, testing priority targets developed by the recent airborne magnetic/electromagnetic survey.

Now this could be the best looking technical set up. Talk about being based. After a downtrend, the stock is now ranging, and is awaiting a breakout above $0.12 to confirm a new uptrend. First targets would come in at $0.185.

With drilling on-going for the next few months, results could be the catalyst to trigger this breakout. I am keeping this high on my personal watchlist.

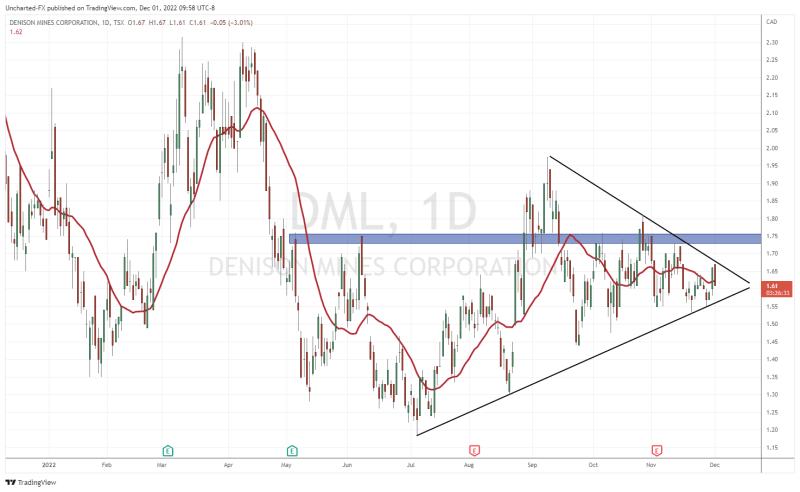

Denison Mines (DML.TO)

Billion dollar market cap company Denison Mines announced the completion of a conformity review of the draft Environmental Impact Statement (“EIS”) submitted for the proposed in-situ recovery (“ISR”) uranium mine and processing plant planned for Denison’s 95% owned Wheeler River project.

The Canadian Nuclear Safety Commission (“CNSC”) determined that the draft EIS met the requirements for the advancement of the Environmental Assessment (“EA”) process. Denison also announced that the federal technical review of the EIS, which is being completed under the provisions of the Canadian Environmental Assessment Act, 2012 has now commenced.

Kevin Himbeault, Denison’s Vice President of Plant Operations & Regulatory Affairs, commented, “Clearing the CNSC conformity review and commencing the formal technical review phase is an important initial achievement as part of the EIS review for Wheeler River – ensuring the continued progression of the regulatory process for what is proposed as Canada’s first ISR uranium mining operation. Our team looks forward to showcasing the superior standard of environmental sustainability assessed for the Project, as we work with the regulatory technical review teams in the coming months.“

Wheeler River is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region, in northern Saskatchewan – including combined Indicated Mineral Resources of 132.1 million pounds U3O8 (1,809,000 tonnes at an average grade of 3.3% U3O8), plus combined Inferred Mineral Resources of 3.0 million pounds U3O8 (82,000 tonnes at an average grade of 1.7% U3O8). The project is host to the high-grade Phoenix and Gryphon uranium deposits, discovered by Denison in 2008 and 2014, respectively, and is a joint venture between Denison (operator) and JCU (Canada) Exploration Company Limited (“JCU”).

Just as the uranium price is ranging, so is Denison Mines. In fact, we have quite the long term triangle here in play. All that is required is the break in either direction. Bulls want to see the upside break, but there is some resistance at $1.75 which I would like to see taken out as well.

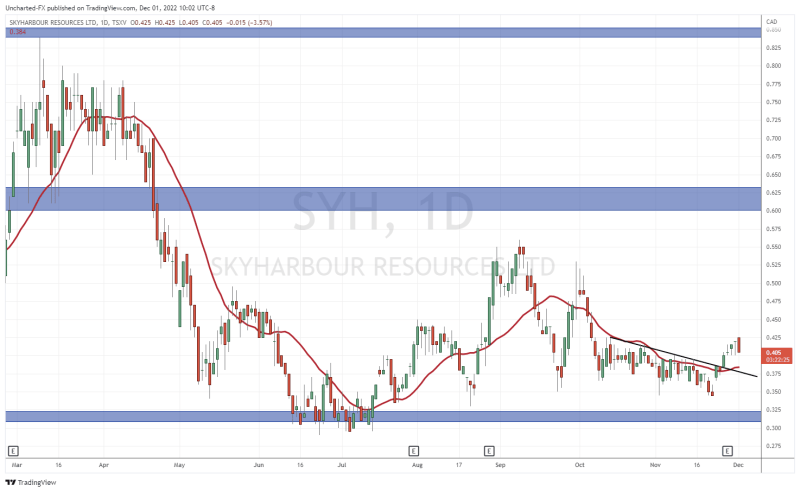

Skyharbour Resources (SYH.V)

Skyharbour Resources (SYH.V) announced that partner company Basin Uranium Corp., has completed 2022 drilling at its Mann Lake Project located 25 km southwest of the McArthur River Mine and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit.

In total 6,279 metres were drilled 2022 over two phases of drilling. Phase two consisted of 2,776 metres of diamond drilling over four holes which followed up on targets from phase one drilling and geophysical programs completed earlier in the year. All core samples have been submitted to the Saskatchewan Research Council (SRC) for analysis and the assays are pending and will be released once received.

Here are highlights from phase 2 drilling:

- Holes MN22007 and MN22008 targeted an interpreted basement conductor (2022 MT resistivity survey), magnetic low (interpreted metasediment basement) within a gravity low anomaly which was interpreted as a basement fault structure and successfully intersected uranium dominant, anomalous radioactive intervals in the basement rocks as well as just above the unconformity.

- Hole MN22007 intersected graphite enriched psammite throughout the entirety of the basement rocks. Two major fault structures with abundant graphite mineralization were intercepted in the basement.

- Hole MN22008 intersected abundant blue-grey dravite clay above the unconformity. The mineralization was focused predominantly along fracture surfaces. Potential graphite could be present in the dravite due to the blue-grey colour of the clay.

Skyharbour entered into an option agreement with Basin Uranium Corp whereby Basin Uranium has an earn-in option to acquire 75% interest in the Mann Lake Uranium Project. Basin Uranium will contribute cash and exploration expenditure consideration totaling CAD $4,850,000 over a three-year period. Of the Project Consideration, $850,000 will be in cash payments to Skyharbour and $4,000,000 will be in exploration expenditures on the project. Basin Uranium Corp will also issue to Skyharbour the equivalent value of CAD $1,750,000 in shares of Basin Uranium over the three-year earn-in period to complete the earn-in.

The stock has recently broken above a near term downtrend line, however, the stock remains in its nearly two months range. $0.425 remains the key top portion of this range, but this trendline break could trigger momentum to get us the breakout.

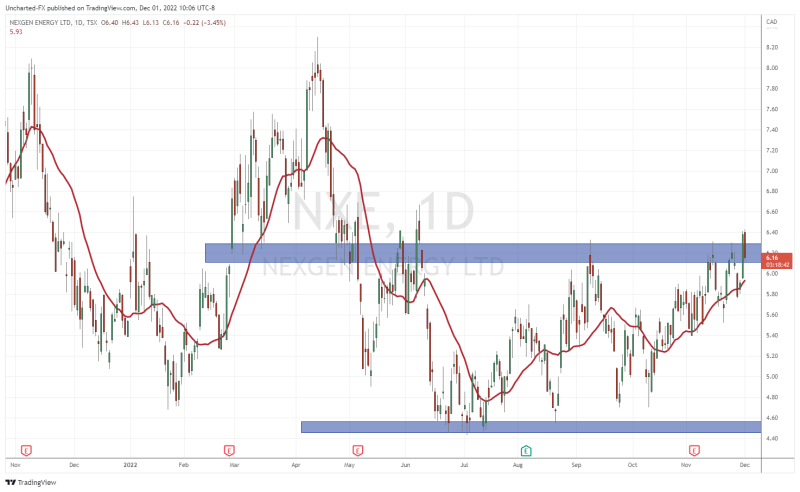

NexGen Energy (NXE.TO)

Another billion dollar market cap company (2 billion that is!) NexGen Energy (NXE.TO) announced a significant milestone in the advancement of regulatory approvals for the 100% owned Rook I Project with the receipt of Federal technical and public review comments and Provincial technical review comments on the Rook I draft Environmental Impact Statement (“EIS”).

With receipt of the Federal (technical and public) and Provincial (technical) review comments, NexGen has commenced a review of comments and response activities and preparation of the final EIS for submission to the ENV and CNSC in Q1 2023. NexGen has scheduled submission of the remaining final, complete license application documents to the CNSC in December 2022.

The Rook I Project is supported by a NI 43-101 compliant Feasibility Study which outlines elite environmental performance as well as industry leading economics. Rook I hosts the Arrow Deposit that hosts Measured Mineral Resources of 209.6 M lbs of U3O8 contained in 2.18 M tonnes grading 4.35% U3O8, Indicated Mineral Resources of 47.1 M lbs of U3O8 contained in 1.57 M tonnes grading 1.36% U3O8, and Inferred Mineral Resources of 80.7 M lbs of U3O8 contained in 4.40 M tonnes grading 0.83% U3O8.

The stock is at a critical point. We did close above a resistance zone this week, and currently are undergoing the retest. Bulls want to see buyers step in here to support the price. If we close back below this break out zone, we would then have a false breakout. As of now, the stock could be ready to make a run up to $8.00.