I first heard of Niocorp Developments several years ago when I started looking into niobium as a possible investment thesis. Since 88%+ of all of the niobium mined in the world comes from my birthplace of Brazil, I instantly understood that having a resource outside this region could be worth a lot, regardless of geopolitical stability or turmoil. If you’re in procurement and your job is to source niobium, you should welcome the opportunity to have two suppliers instead of one in case something goes awry.

You see, niobium is used in MRI machines, aviation, and is being development for use in super-fast-charging EV batteries (ask Toshiba). And they have tons and tons of it. However, Niocorp also has a very healthy dose of Scandium, which is also used in aviation, rail hopper cars, among other important infrastructure. Their titanium could be used in many different applications from tooth implants to bike frames to paint.

And if that wasn’t enough, they have plenty of magnetic rare earth elements, which you see in engines, electronics and in wind power generators.

Since first finding them, they have come very far, so let’s recap the Niocorp story:

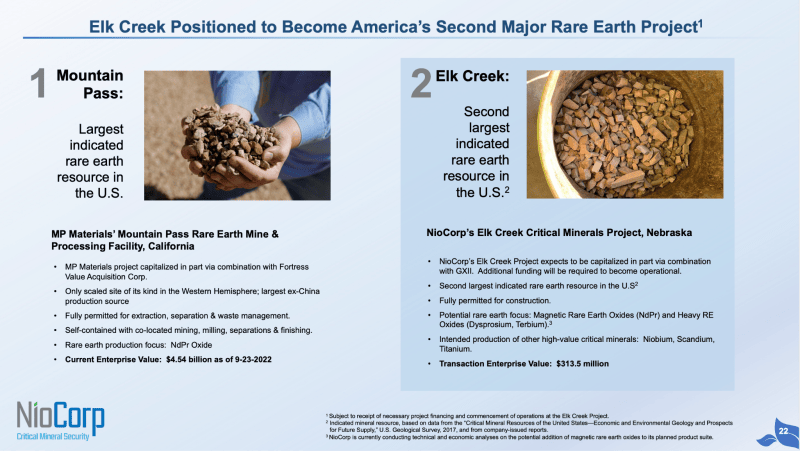

- NioCorp is developing the Elk Creek Critical Minerals Project to produce Niobium, Scandium, and Titanium. It is the highest-grade Niobium deposit under development in N.A. and the 2nd largest indicated rare earth resource in the U.S.

- Their Feasibility Study points to a Net Present Value of $2.8B worth of goodies, not including other rare earth elements.

In short, they are sitting on a mountain of mineral wealth and need to raise the financing to move the project forward. Because this is a tad more exotic than gold and copper, it’s expected to take a bit more work. Mark A Smith, the company’s Chairman and CEO, is a former director of Companhia Brasileira de Metalurgia e Mineracao Ltd. (“CBMM”), the quasi-monopoly niobium producer in Brazil, which gives the company a welcome level of experience and hopefully higher chance of production success.

But what I really like and will be watching is the following:

- 75% of planned Niobium production in the 1st 10 years has been pre-sold, and ~12% of planned Scandium production in the 1st 10 years has been pre-sold.

- NioCorp and GX Acquisition Corp. II propose to join forces in a business combination to support the Elk Creek Project, this is due to go through early 2023.

- Key federal, state, and local permits secured to allow start of construction. Project is sited on private land with agreements in place with local landowners. NioCorp owns the primary land parcel.

This last one is massive, considering a lot of these elements aren’t produced at all in the USA, and I can only imagine the hurdles of getting such permits.

What I would like to see moving forward:

- The M&A with Nasdaq listed SPAC GXII once approved, could bring lots of liquidity and naturally cash into the company. Bullish.

- Their demonstration plant has achieved good results on Phase I, I’d be curious to see how phases 2 and 3 are going.

I’m going to leave you with one slide from the company’s investor presentation, so you can compare yourself the type of value creation this company might see by looking at comparable projects in North America.

This definitely ticks the boxes for a compelling story and deserves a second look if you’re into a contrarian bet with excellent management and resource.

–Fabi Lara