Northstar Clean Technologies (ROOF.V) announced today that it has received its first truckload of previously bound asphalt shingles at the company’s asphalt shingle reprocessing facility in Delta, British Columbia.

Northstar has already been producing saleable liquid asphalt from its on-site shingle inventory after receiving its brokering license from Metro Vancouver. The processing of the first truck of asphalt shingles means the shingle collection process is operational. The Company expects to work with local partners to ramp up collection activities at the Empower Pilot Facility.

Mr. Aidan Mills, President & CEO and Director of Northstar, stated “This is an exciting milestone for Northstar and our stakeholders, as it marks the start of diverting discarded asphalt shingles from the Vancouver landfill to our Empower Pilot Facility, allowing them to enter the circular economy and reduce greenhouse gas emissions from liquid asphalt production. We will work with our industry partners to increase shingle collection at the Empower Pilot Facility. This is an important step for our business model, as it will mark our ability to collect tipping fees, an important revenue stream for the business.”

Northstar Clean Technologies Inc. is a Canadian-based clean technology company focused on the sustainable recovery and reprocessing of asphalt shingles. Northstar has developed a proprietary design process for taking discarded asphalt shingles, otherwise destined for already over-crowded landfills, and extracting the liquid asphalt for usage in new hot mix asphalt, shingle manufacturing and asphalt flat roof systems, and aggregate and fiber for usage in construction products and other industrial applications.

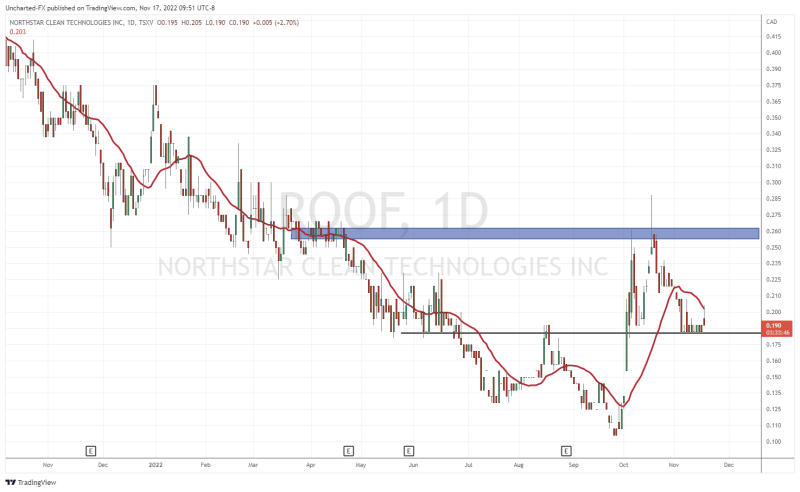

The stock is up over 2.7% on today’s news at time of writing.

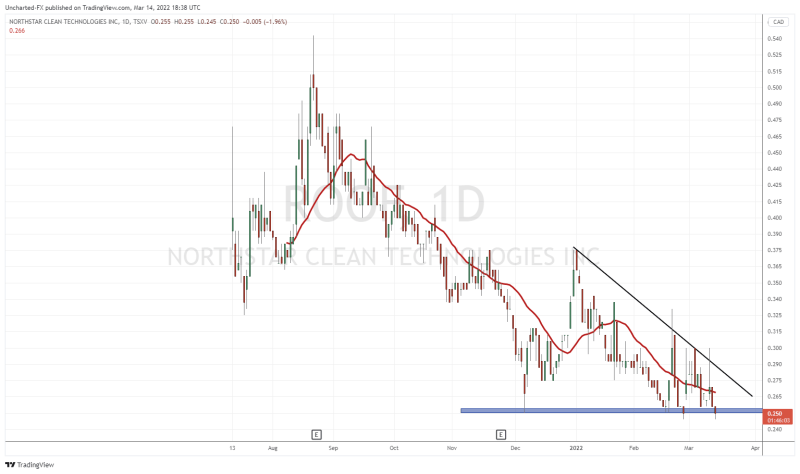

The stock took off on October 4th 2022 when news came out that Renewable U Energy Inc announced a strategic partnership with Northstar to fully fund Northstar’s phase 1 expansion program through financing of over CAD $43.5 million.

Resistance comes in around $0.25-$0.26, and the stock is finding support at around the $0.185 zone. If we close below $0.185, we would pull back to the $0.135 zone.