A big move in Roblox (RBLX) stock today as the company saw their biggest jump in 5 months. The pop has occurred due to Roblox forecasting a significant jump in September bookings as users spent more time on its games.

Here are the numbers from the 2022 metrics report:

- Daily active users were 57.8 million, up 23% year over year.

- Hours engaged were 4 billion, up 16% year over year.

Roblox has also said that bookings are expected to be $212 million and $219 million which amounts to values up as much as 15% from a year earlier. That figure includes revenue, deferred revenue and other adjustments, and defied a stronger US dollar.

Mandeep Singh, an analyst at Bloomberg Intelligence had this to say on the increase in bookings:

“The company’s advantage with user-generated content should help expand its user base beyond the core 9-13-year-old group faster than larger rival Meta, which saw a decline in user engagement for its Horizon Worlds offering.”

The number of daily active users decreased from Roblox’s August 2022 report, when the company reported 59.9 million users. The number of hours engaged in September also decreased from 4.7 billion in August, and Roblox’s bookings in September fell from the $233 million and $237 million estimated bookings reported in August. The drop may have occurred as kids who play the game returned to school.

Analysts remain bullish on the company as it has many opportunities to increase monetization such as advertising and 3D immersive shopping.

The stock is currently up over 21% with over 48 million shares traded at time of writing.

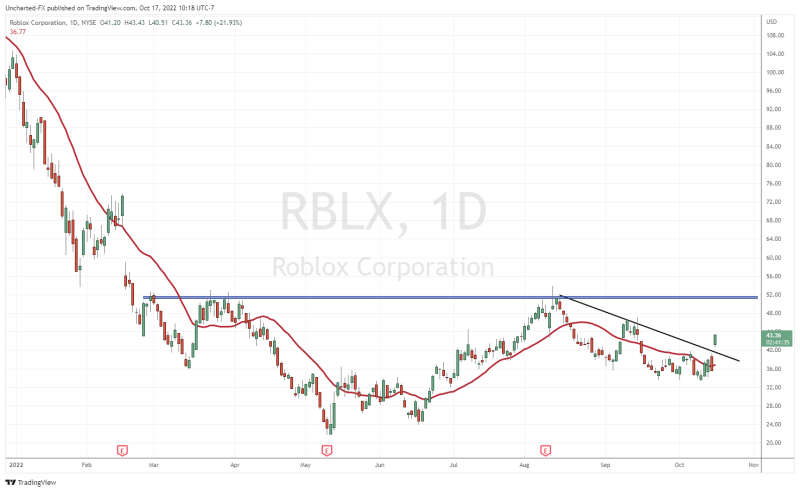

A technical breakout is also being confirmed with the stock breaking above a downtrend line which has acted as resistance for the stock. The next major resistance zone for the stock comes in just below $52. A breakout above this level will get the stock really going as it attempts to regain the 65% loss from its all time highs.

Roblox stock could very well first pull back to the $40 zone, retesting the trendline breakout, before continuing higher. This would be typical breakout price action. Alternatively, the stock could carry on the momentum from today and make a major push up to the $52 resistance zone. A lot of this will depend on the overall stock markets as we enter earnings seasons, but inflation and geopolitics still weigh in on investor’s minds.