Sometimes we forget that there are other markets to trade other than the three major US market indices.

Luckily as a Canadian, I can trade CFDs. Even though Canadian CFD traders mainly trade the S&P 500, the Nasdaq and the Dow Jones, we can trade a multitude of markets including the German Dax, the UK FTSE, the French CAC, the Spanish IBEX, the Italian 40, the Japanese Nikkei, the Hang Seng, and the Euro Stoxx 50.

These are normally available through many CFD brokers. Some ‘exotic’ CFDS could be the Australia 200, the Canadian TSX 60, the Norwegian OBX, the South African stock market, the dutch stock market, and the Singapore market. However, one ‘exotic’ foreign market has been making quite the impact on social media.

I am talking about India’s Nifty 50.

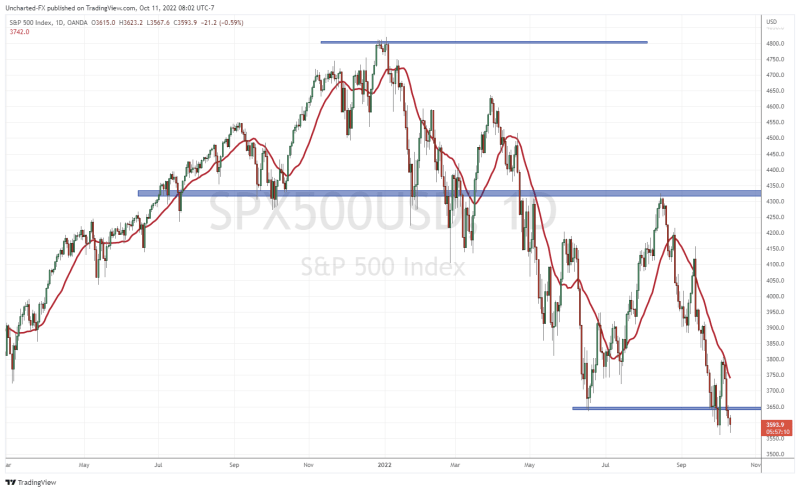

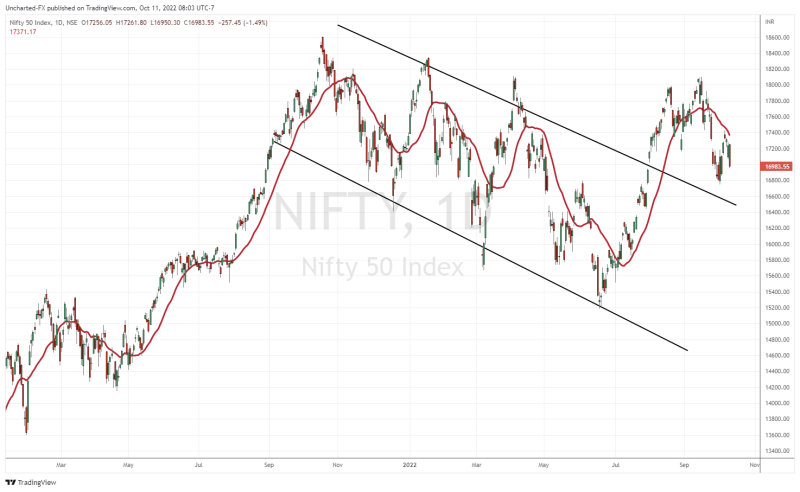

Compare the S&P 500 daily chart with the Nifty 50 daily chart and you may understand why:

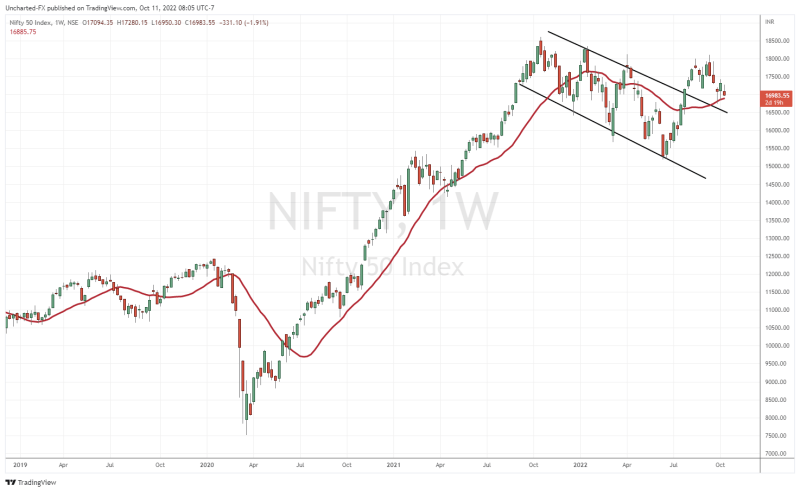

While US markets, and many other global markets, have been drifting downwards, and have triggered bearish technical patterns, India’s Nifty 50 has done the opposite. Yes, the market has broken down recently on the daily chart, but the weekly set up is intriguing.

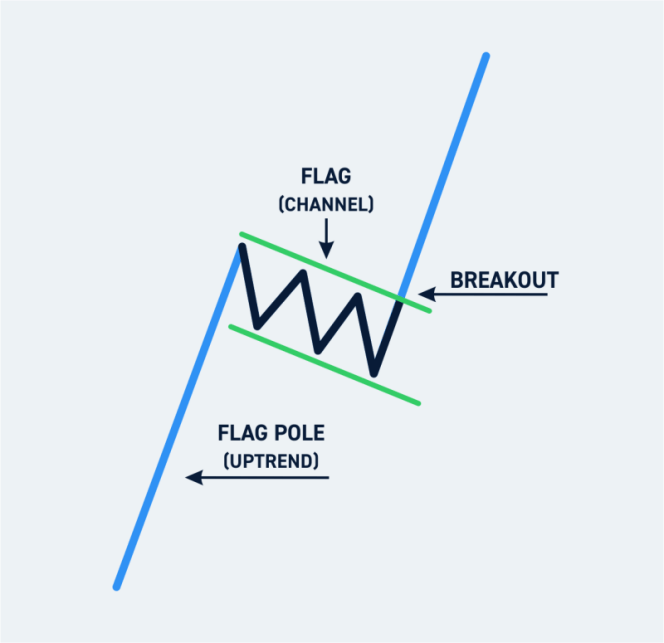

We had a weekly flag pattern break, and the Indian Nifty 50 is due to pullback to retest the breakout zone. Buyers are expected to step in as flag breakouts usually playout like this:

Now I am not saying the Indian Nifty will be making new record highs. Currently, the Indian market is experiencing a downturn as all markets are turning red after the IMF has cut India’s growth forecast for 2023. The IMF has warned that the “worst is yet to come” (reassuring words) and is forecasting lower global growth in 2023. I guess the positive would be that central banks will have to stop hiking interest rates right? I wouldn’t count on that just yet. It all depends on those inflation numbers.

India has been riding on some good news. The economy grew by over 8% in 2021, and is forecasted to grow 7% in 2022, making it one of the fastest growing economies. Just a few weeks ago, India overtook the UK to become the fifth largest economy in the world. With a large population, India could easily jump up a few more places if growth continues. I could see India overtaking Germany as the European manufacturing powerhouse might see its industrial production decline especially with rising electricity costs and potential forced energy blackouts this Winter.

When it comes to the recent state of geopolitics, India has remained in the middle. They have not joined in imposing western sanctions on Russia, much to the annoyance of western leaders. India has said that it puts its interest first. The nation has secured energy for cheap by buying Russian energy. In fact, India buys excess then sells it back to the Europeans. The supposedly smart people in Europe are now buying Russian energy from nations such as India, China and Saudi Arabia and are paying more for what was once cheap Russian energy. Russia makes money, India makes money, and the European consumer pays more for energy during a time when inflation is rising.

India is playing it smart, and I would really keep an eye on this nation. There are still some concerns such as political corruption and division. One must remember that India is a nation with many religions and people who speak different languages. Many of them have groups advocating for separation. This is something New Delhi will have to contend with, unlike China who has a dominant Han population… and a strong central government when it comes to the CCP.