For a technical trader, XRP has provided great signals. The debate whether to invest in cryptocurrency for the long term will carry on, but one cannot deny that technicals work really well with crypto markets.

XRP had amazing double digit moves last week, and many are hoping that this trend continues.

From a fundamental perspective, the pop was due to investors and traders seeing a favorable outcome of the SEC vs Ripple case. That optimism has now waned. The case looks like it will end soon, but whether it ends favorably for Ripple, I couldn’t tell you. I don’t have a crystal ball. But I rely on technicals which have a funny way of forecasting future events as big money takes positions.

I really like the market structure I see on XRP. When I see a chart that was in a downtrend and then beginning to range, it catches my attention. Any Stan Weinstein Secrets of a Bull and Bear Market out there?

The buy trigger signal actually came on September 20th 2022, a day before the SEC/Ripple headlines started to hit the mainstream.

For a technical trader, that was the breakout of the range, and was a signal to enter long. You would have been handsomely rewarded with a 41% popper in following days. The breakout also saw a pullback the next day which is the type of price action we expect to see after a breakout. Price tends to pullback to retest the breakout zone before continuing higher.

Profits were taken at $0.55. Was it fundamentals and investor sentiment failing? Perhaps. But I just see it as a normal place to take profits. This area is a major resistance zone and you can see this by looking to the past price action. Support and resistance levels tend to be where traders enter and/or exit their positions.

So the question is what now?

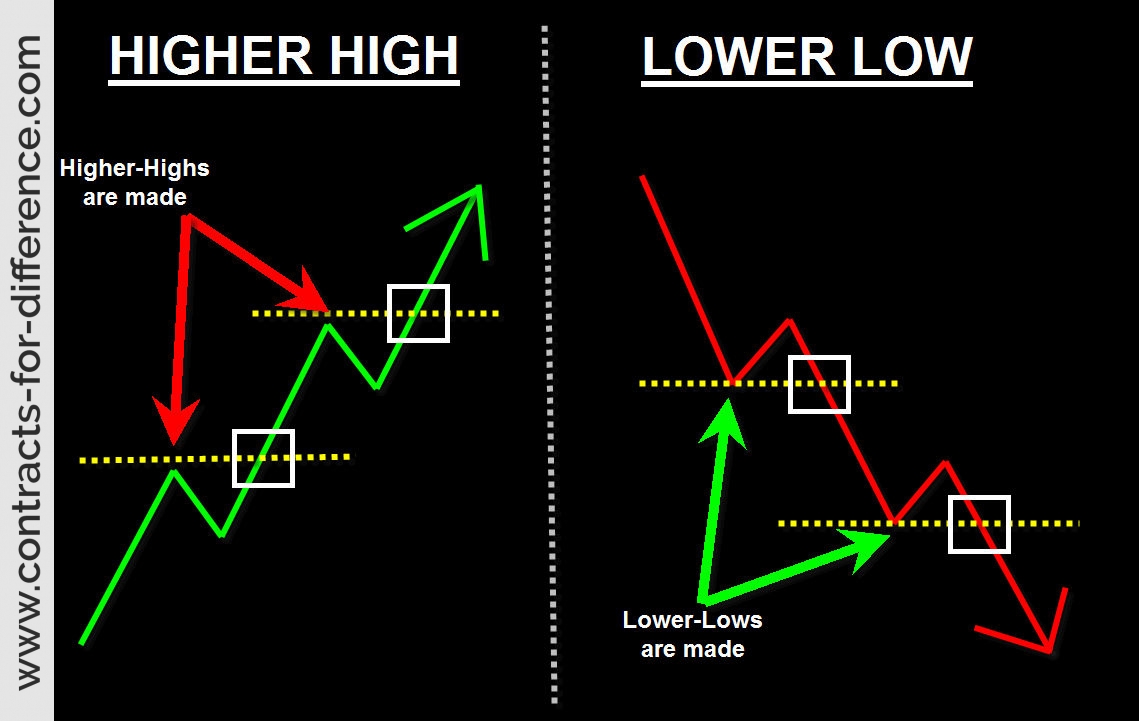

Technically, with the break above $0.40, XRP is in a new uptrend. We can expect higher lows.

$0.40 is the key support. If XRP breaks and closes below $0.40 then the uptrend momentum is over. As a retest zone, we should expect to see a wall of buyers there, and with yesterday’s daily candle having a decent sized wick, we can say that some buyers are already stepping in (and perhaps placing their stop loss below the $0.40 zone).

One can either enter now or around the $0.40 zone expecting a higher low to form. This will give you a good risk vs reward set up, but the probabilities of success won’t be as high.

What do I mean by this? Well, the more safe way to play a higher low is await the break of recent highs. In this case, this means a close above the $0.55 zone. Sure, you may have missed out on some of the move but your probability for gains increases as a higher low confirmation sets the stage for more momentum higher. Remember, trading is a business of probabilities! We add up confluences to increase our probabilities for success and then take the trade.

On that break, we would be targeting XRP levels above $0.80.

Closing thoughts about cryptos. Bitcoin and other cryptos are acting as risk on assets, meaning they follow the stock markets. When stock markets sell off, Bitcoin and cryptos sell off. When stock markets rise, Bitcoin and cryptos rise. Keep this in mind as stock markets are currently grinding at their major support zones.

XRP could be diverging from cryptos due to the fundamental SEC vs Ripple news. However, if investors begin to fade that story, then expect XRP to act as a risk on asset.