Falcon Gold (FG.V) today provided an update on its previously announced plan of arrangement furthering a press release on August 10th 2022. On September 8th 2022, Falcon Gold shareholders approved the spin-out and the company’s arrangement agreement with its wholly owned subsidiary Latamark Resources Corp.

CEO Karim Rayani reaffirmed his focus on creating value for shareholders with this spin-out. Falcon Gold will spin-out its rights, obligations and interest in the Esperanza Gold project in Argentina to Latamark Resources.

Shareholders of Falcon Gold will be entitled to receive one common share in Latamark for 5.8 shares held in the company as of the effective date of the arrangement. Falcon received a final order from the Supreme Court of British Columbia approving the transaction on September 14, 2022, and the Company intends to proceed with the Spin-Out pending final approval of the TSX Venture Exchange.

Further info will be provided regarding a record date and a closing date for the distribution of Latamark shares to Falcon shareholders. But it should be noted that there is no certainty that this spin-out will be completed on the current terms, or even completed at all.

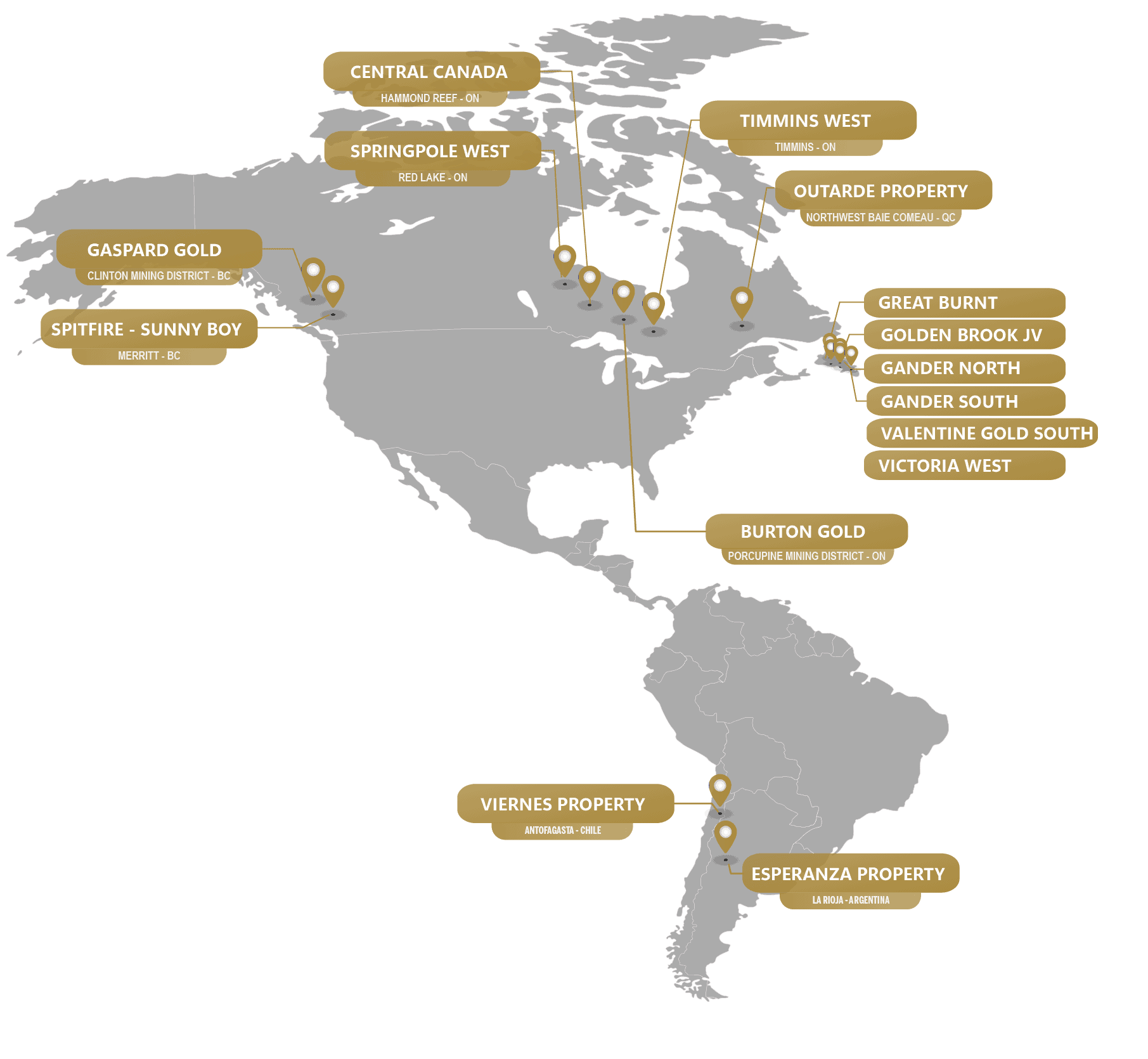

Falcon Gold (FG.V) is a junior explorer that acquires, explores, and advances quality mining projects in the Americas. Their assets are in Canada, Chile and Argentina.

The current focus of the company has been centered in the Province of Newfoundland and is one of the top 8% for landholders in the Canadian Province. Some of Falcon’s projects here show structure which is similar to those found in recent gold discoveries in Newfoundland including New Found Gold’s Queensway project located approximately 9km from Falcon’s project. “Close-ology” means the chances of discovery are higher as the vein and structure could extend into Falcon’s land holdings.

Transferring the Esperanza property to Latamark Resources allows Falcon Gold to focus on Canadian operations while Latamark would focus on opportunities and projects outside of North America.

The Esperanza gold-copper-silver property comprises seven mineral concessions covering an aggregate area of 11,072 hectares. High-grade gold mineralization was reportedly first discovered within the district around 1865 at the Callanas occurrences followed by limited mining conducted on a gold, silver, and copper zones.

The Japanese Agency (JICA) completed 900 metres of diamond drilling in the Callanas area during the 1990s. Two of the holes returned encouraging intercepts assaying one metre at 9.11 grams per tonne (g/t) gold and 28.59 g/t silver and 0.42 m at 24.3 g/t Au and 61.10 g/t Ag. More recently, Esperanza Resources had reported that the Callanas west zone has been mapped along a northwest-southeast strike for approximately 4,000 metres.

On Jan. 7, 2019, Falcon completed its first exploration work on the Esperanza property and reported on its findings. Falcon’s sampling included a 50 cm wide chip sample with visible gold that assayed 44.90 grams per tonne gold, 123.2 g/t silver and 0.73 per cent copper and another 50 cm chip sample that assayed 26.07 g/t gold, 424 g/t silver and 1.23 per cent copper.

On Feb. 9, 2021, the company was able to reinstate the property option for a reduction from the original agreement. The original terms were calling for escalating annual payments over a six-year term totalling $500,000 (U.S.) and the issuance of four million common shares with property expenditures of $1.74-million (U.S.) Falcon was successful in reworking the terms to share payments of 500,000 common shares plus 500,000 warrants to be paid to the vendors and by spending $350,000 (U.S.) in exploration expenditures to earn an 80-per-cent interest in the project. Upon completion of payments and expenditures, Falcon will hold an 80-per-cent interest and the vendors would retain 20-per-cent ownership in the property.

At time of writing, the stock is up 6.25% but with only a volume of 1000 shares traded. It is still early in the trading day, and the end of the day will provide better insight to what the market thinks of today’s news.

The stock remains within its long range. It is near support at $0.075 where one can expect buyers from a technical perspective. $0.125 remains the major resistance to the upside.