Murchison Minerals (MUR.V) announced results analyzed by using portable x-ray fluorescence (pXRF) from their second diamond drillhole as part of their 2022 Summer Exploration Program. The results have the market excited as the company announced the best drillhole to date.

Further certified assaying of the core samples is still required to accurately determine the amount of mineralization of Nickel-Copper-Cobalt at their 100% owned Haut-Plateau de la Manicouagan Project (HPM) located in Quebec, Canada. However, Murchison has implemented rigorous procedures using a direct rock sampler to provide reasonably representative preliminary results. Here are the highlights:

BDF22-002 Highlights

- The hole was drilled to a depth of 452 m and intersected two broad zones of Ni-Cu-Co sulphide bearing mineralization totalling 175.15 m of composite thickness (Table 1) including:

- 121.20 m estimated at 1.39% pXRF Ni Eq. (123.80 to 245.0 m)

- Including 10.10 m at 2.75% pXRF Ni Eq. (134.1 to 144.20 m)

- Including 44.00 m at 2.18% pXRF Ni Eq. (152.00 to 196.00 m)

- Including 28.80 m at 3.03% pXRF Ni Eq. (152.00 to 180.80 m)

- Including 21.00 m at 3.43% pXRF Ni Eq. (152.5 to 173.5 m)

- Including 3.75 m at 3.43% pXRF Ni Eq. (177.05 to 180.8 m)

- Including 10.50 m at 1.97% pXRF Ni Eq. (207.5 to 218.0 m)

- 53.95 m disseminated sulphide zone estimated at 0.25% pXRF Ni Eq. (303.55 to 357.50 m)

- Best intersection drilled to date on the HPM Property

- The hole successfully confirmed mineralization downdip from DH-151-02, exceeding expectations. The hole also confirmed mineralization up dip of DH-151-05EX.

- The majority of the mineralization is outside of the previously modelled zone

CEO Troy Boisjoli had this to say:

“The objective of the 2022 drill program was to expand near-surface high-grade nickel, copper, cobalt mineralization at the Barre de Fer Zone and the holes to date are delivering on that objective. The pXRF results from BDF22-002 have exceeded our expectations in terms of estimated grade and thickness – 121.20 m estimated at 1.41% pXRF Ni Eq (or 4.14% Cu Eq) is a very significant nickel bearing magmatic sulphide intersection and I congratulate Murchison’s technical team. The 2022 drilling results will enable the Company to materially advance the Ni-Cu-Co HPM Project, at a time when the world is desperate for future supply of critical minerals.”

Vice-President of Exploration John Shmyr followed up on the excitement:

“The results from BDF22-002 are exceptional and further indicate the size and scale of the sulphide mineralizing system that is present at BDF. Our geologic understanding has grown significantly throughout the drill campaign. Our work further confirms BDF as magmatic chonolith type system and other chonolith type deposits like Voisey’s Bay are composed of multiple zones, which has the technical team excited about the exploration potential.”

The 2022 Summer Exploration Program included a total of 13 diamond drill holes comprising 4,316 metres. The drill core is currently undergoing processing and pXRF results are being determined. The next catalyst will be the results.

With the momentum, Murchison Minerals is progressing towards establishing a maiden resource on BDF by early Q1 2023. Barre de Fer (BDF) is a zone at the HPM project and is where the best drillhole was found (BDF22-002).

Murchison Minerals has a focus on critical energy metals such as copper, cobalt, nickel and zinc. As the world accelerates their efforts to reduce greenhouse emissions, investments in clean energy technologies is increasing at a fast pace. Clean energy technologies which require these metals, and hence will see a large demand increase.

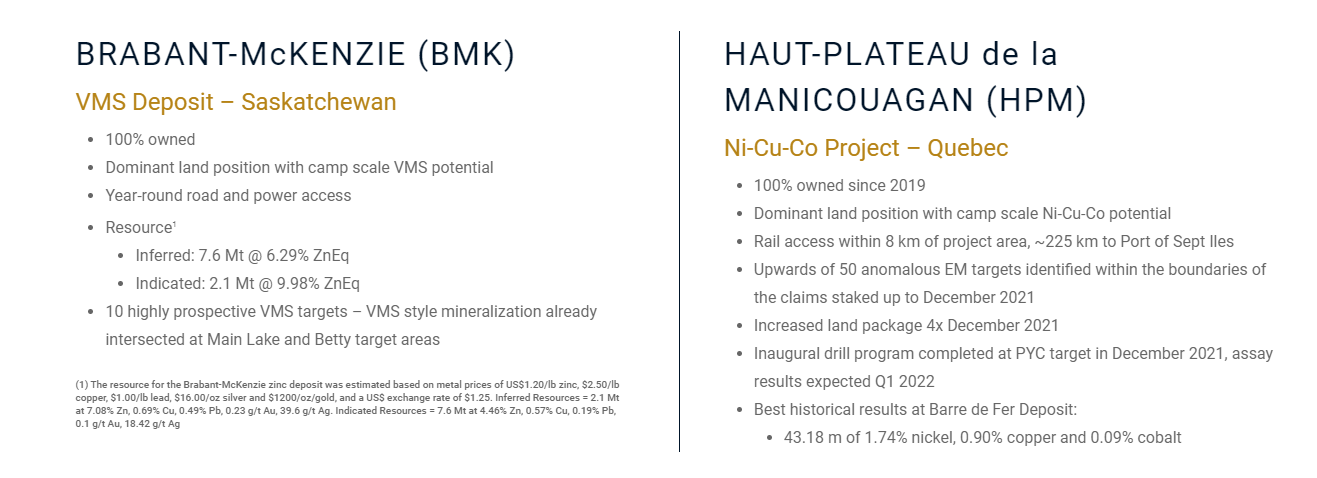

The company owns two projects:

The stock has confirmed a major breakout. Murchison has been in a downtrend and created a flag pattern. We actually closed above the flag on September 13th, just a day before the drill hole news was announced. The market loves the news with the stock currently up 41% with over 2.4 million shares traded.

The technical breakout has fundamental backing. A new trend could very well be beginning. Price could pullback to the $0.09 zone as traders take profits after this large move, but the uptrend remains intact as long as we hold above this zone. $0.09 is support.

To the upside, we have resistance at the $0.15 zone. This is the first target to the upside, and looking to the left of the chart, you can see that it has seen a reaction many times in the past. If we can manage to close above this level, then we are looking for a move to $0.20 and potential new record highs.