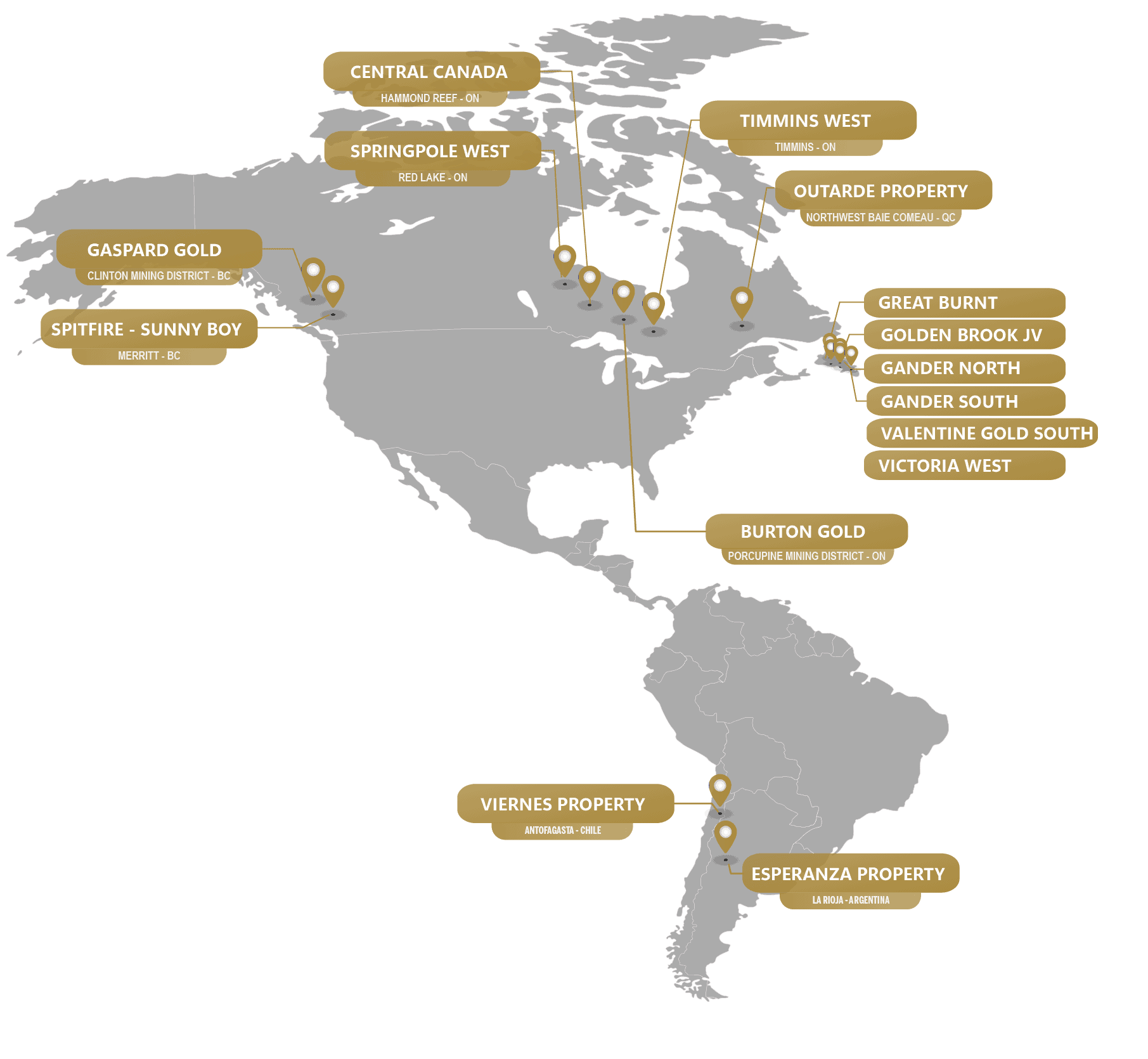

Falcon Gold (FG.V) is a junior explorer that acquires, explores, and advances quality mining projects in the Americas. Their assets are in Canada, Chile and Argentina with their flagship project being Central Canada and bordering Agnico Eagle Mines 4.6 million ounce Hammond Reef deposit.

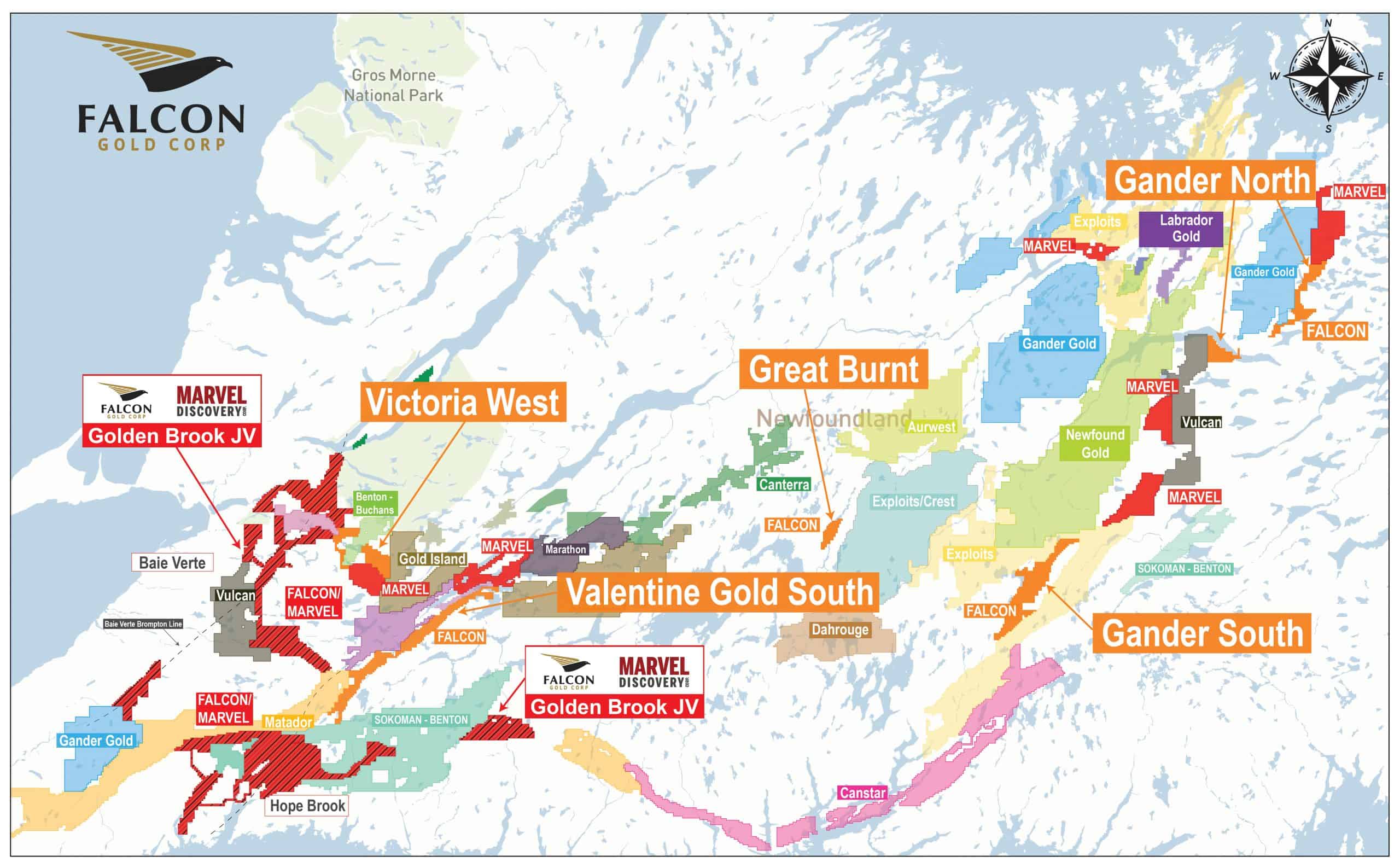

The company has recently been focused on Newfoundland.

Falcon’s Newfoundland property portfolio (shown above) is immense. Falcon has acquired and currently holds over 140,000 hectares of ground in Central Newfoundland tied on to Major Structures. This puts Falcon Gold in the top 8% for landholders in the Province. Most of their assets in Newfoundland are owned 100% with no property payments or net smelter royalties. This puts Falcon in a prime position to succeed as new discoveries are made.

We have used the term “close-ology”. With Falcon’s holdings near major structures (and even producing or past producing mines in other Provinces), the chances of discovery are higher as the vein could extend into Falcon’s land holdings. It is up to Falcon to drill, discover, de-risk and then find a buyer.

On August 2nd 2022, Falcon Gold provided a corporate update and CEO Karim Rayani, reaffirmed his focus on creating value for shareholders. One thing which will be beneficial for shareholders is the plan of a spin out. Falcon Gold intends to spin-out its rights, obligations and interest in the Esperanza Gold project in Argentina to Falcon’s wholly owned subsidiary Latamark Resources Corp.

The transaction is being completed by way of a plan of arrangement. Pursuant to the arrangement shareholders of Falcon will be entitled to receive one common share in Latamark for 5.8 shares held in the company as of the effective date of the arrangement. The record date is estimated for early September 2022.

I recently went over the technicals of Falcon Gold. The analysis from that article still stands. Major resistance remains at $0.125 and major support comes in at $0.075. The stock has been in a range between $0.09-$0.10 for the last 11 trading days. We await a breakout or breakdown to give us direction.

The stock opened the week popping 11% at the highs of the day. At time of writing, the stock has given up half of those gains but remains within the 1 cent range. Is the catalyst going to be the spin off? Or are gold prices going to buoy the juniors?

Gold has had a strong day (silver even stronger!). Markets are awaiting the inflation data for August which comes out on September 13th. Markets are expecting inflation to come in lower which is seeing the US dollar drop lower. A weaker dollar is helping out the commodities, especially the precious metals.

Gold approached the major $1680 support zone in the last few trading days. This zone is one for you to mark on your own charts. If gold closes below this, then we are looking for a major downside.

But good news for gold bulls, the precious metal is bouncing after ranging near support for a few trading days. Going further, we must see how gold reacts to US CPI data and the Federal Reserve interest rate decision next week.

In terms of technicals, a close above $1740 would be a good start to confirm a reversal. The actual confirmation comes with a close above $1760 as this is the lower high in the current downtrend.