Kootenay Silver (KTN.V) announced today the final batch of results from phase 4 drilling at the Columba high-grade silver project in Chihuahua State, Mexico.

Here are the highlights from the 11 drill holes:

Drill Highlights:

D Vein

CDH-22-125

- 34.45 meters of 540 gpt silver with 0.26 gpt gold, 0.37% lead and 1.56% zinc in a wide stockwork zone includes:

- 9.7 meters of 1,746 gpt silver, 0.88 gpt gold, 1.11 % lead and 5.2% zinc in D Vein with;

- 2.45 meters of 5,840 gpt silver, 3.0 gpt gold, 3.08% lead and 17.25% zinc, a project best intercept to date.

- Extends wide high grade 90 meters directly beneath previously announced high grade intercept (CDH-21-110) with 17.8 meters of 650 gpt silver, 0.98% lead and 2.2% zinc within 29 meters of 453 gpt silver, 0.6% lead and 1.43% zinc.

- Total vertical extent of D Vein mineralization now 300 meters.

CDH-22-127

- 0.98 meters of 788 gpt silver, 0.64% lead and 1.33% zinc.

CDH-22-128

- 2.0. meters of 520 gpt silver within 20 meters of 136 gpt silver.

CDH-22-131

- 4.86 meters of 311 gpt Silver within 150 gpt silver over 16 meters.

- Extends D Vein 100 meters along strike to the southeast from previous drilling.

- Marks high-level expression of mineralized system at D Vein, an interpreted high-grade horizon preserved at depth.

B Vein

CDH-22-134

- Intersected broad zone of mineralization though the B Vein corridor including 1.5 meters of 251 gpt silver, 0.1% lead and 0.15% zinc

- Extends B Vein to the southeast, provides a test of the upper levels of the interpreted epithermal system.

- Lower grade expected as hole was drilled to confirm dips with a shallow test above expected high grade zone.

Kootenay Silver’s President and CEO Mr. James McDonald stated “The intersection in hole 125 confirms D Vein as a significant structure at Columba. Drilling since 2019 has returned high grade silver hits over excellent widths from veins across the property and we are eager to further advance the project with an aggressively expanded drilling program in the near future. Having traced the vein system over an area of three-by-four kilometers and seeing continuity of high grades and widths in areas like the D Vein underscore for us the potential for 100 plus million ounces of silver”

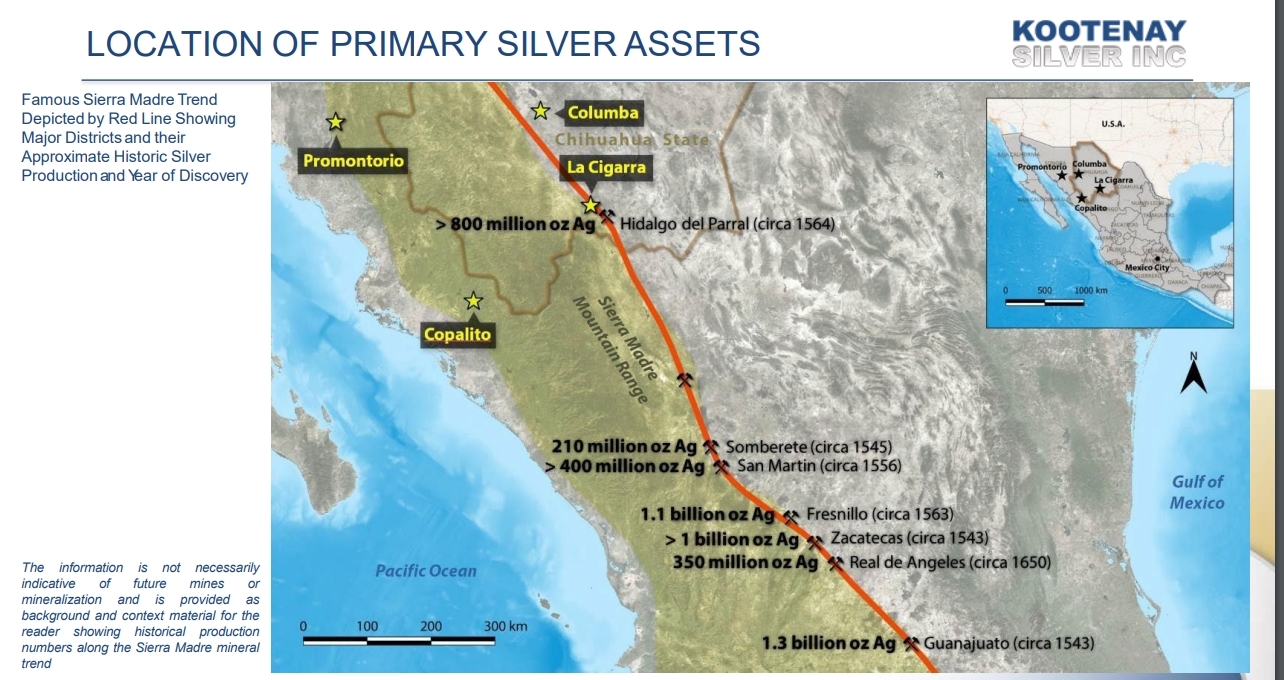

Kootenay is developing an expanded drilling program to prioritize and continue to expand the mineralized footprint at Columba. This project was a past producing silver mine around 1900-1910, and historic mine records indicate grades of 600-900 g/t silver. The company has found high grade discoveries at Columba as well as the Copalito Silver-Gold Property.

Kootenay Silver also holds properties with a resource bay. The Promontorio and La Cigarra Projects account for 136 million ounces silver equivalent and 35 million ounces silver equivalent inferred.

Key shareholders of Kootenay Silver include Eric Sprott. Couer Mining, Agnico Eagle and Pan American Silver are majors who have also invested.

If you are someone who is bullish on silver, then Kootenay Silver provides excellent leverage to silver.

At time of writing, the stock is up over 18% with 268,400 shares traded.

From a technical perspective, the chart looks very promising. We should first note that the stock has been in a long downtrend. You can tell this is the case by just looking at my trendline.

However, recently we tested lows at $0.10 and did not break below. Instead we bounced and this is meeting the criteria to create a double bottom reversal pattern. Think of a bottoming pattern with the shape of a “W”.

The gap up on the drill results news is also bullish for the stock. So what next? Well, I would really like to see the stock close above $0.13. This is a near term resistance Kootenay Silver must clear in order to sustain momentum. Then, we turn our attention to the downward sloping trendline and the $0.175 zone.

The trendline has been resistance for the stock. If it can close above the trendline, it makes a strong case for the downtrend being over. Finally, $0.175 is the major resistance zone the stock has held this Summer. A double bottom reversal really gets going when we close above this resistance level.