SOPerior Fertilizer (SOP-H.V) provided a corporate update further to its press release on March 28th 2022 where the company announced an exclusivity agreement with a counterparty with respect to a joint venture (JV) agreement.

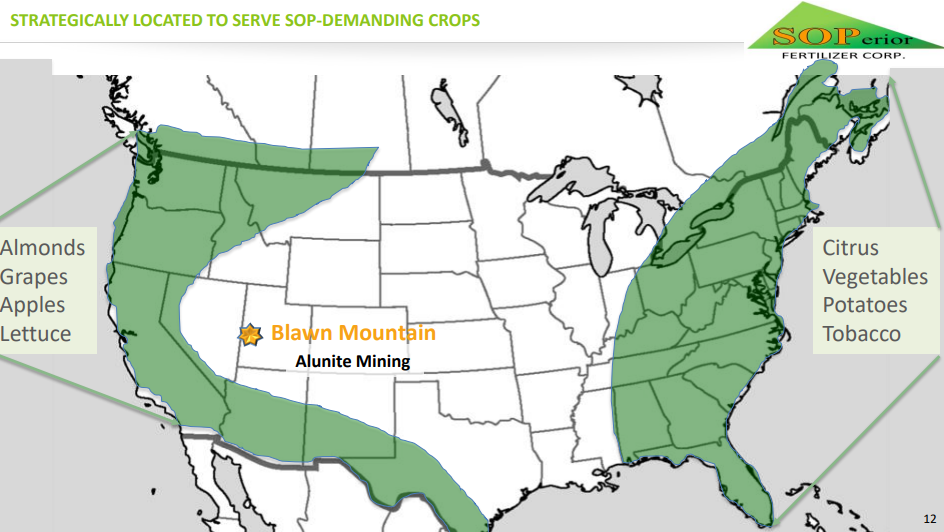

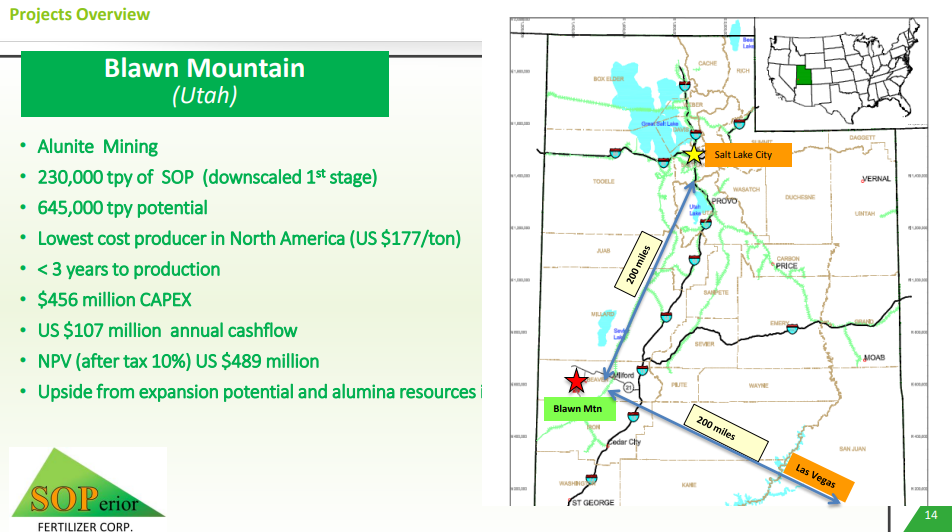

This JV agreement was for the development of SOPerior’s Blawn Mountain alunite asset. This massive near term producer of premium SOP (sulphate of potash), fertilizer, alumina and sulphuric acid is located in Utah. The asset has three valuable commodities being produced from processing a single ore stream which means the project has the potential to be the lowest cost producer in North America.

All product streams have strong domestic markets and the site has excellent rail access to east, west and gulf coast markets.

The news out today was that the counterparty has funded an additional $250,000. Of this balance, USD$35,000 was paid to extend the Exclusivity Agreement beyond the initial term which expired on June 30, 2022. The remaining USD$215,000 is an advance towards the JV transaction. Of these recently received funds from the counterparty, USD$215,000 will be applied to the debt outstanding to Lind Asset Management VIII LLC.

To-date, the counterparty has paid USD $703,950 towards SITLA fees, exclusivity extensions, and JV payments. The counterparty has proposed a funding schedule which provides for a USD$2,250,000 payment by Sept 9th, 2022 with the final payment and JV closing in October 2022.

The counterparty is currently engaging with engineering consultants to ensure that the process engineering work for the project will commence immediately upon the completion of the JV transaction.

Readers of my weekly agriculture sector roundup know about the current imbalances in the fertilizer markets. Supply chain disruptions and geopolitics means that securing domestic supply will be crucial for countries like Canada and the US. A project like SOPerior’s is definitely one to watch given how advanced the project is being a near term producer.

The stock has reacted well to the update. At time of writing, the stock is up over 16% for the day with 666,850 shares traded. It is worth noting that running up to the press release, the stock saw large volume traded on August 29th and the 30th. 1,122,800 shares were traded on August 30th and 1,832,800 shares were traded on August 29th.

When it comes to the technicals, the stock is attractive to range traders or bottom pickers. $0.02 has been a major support zone which has held since 2020. Buyers still are holding it, and we have seen a nice bounce from this support. The stock has broken out of a near term range with a close above $0.03 and had large volume to back it. Going forward, the stock has the potential to continue this new uptrend as long as price remains above $0.03.

To the upside, resistance comes in at $0.09. This is where the stock rallied on the initial news of an exclusivity agreement back in March 2022. A good target for those playing the bottoming and the range.