On the day of writing we are seeing a pan sell off. Equities, agricultural commodities, metals, oil and cryptocurrencies are all red. Bonds and the US Dollar are green indicating a risk off asset. Fear and uncertainty rules the day.

As a technical analyst, I am used to people saying that the charts don’t matter and that it is all about headlines. My take is show me the chart, and I will tell you the news. As a technical analyst, all these moves were predicted. Equity markets still need to close above a major resistance zone, and oil recently broke below a major support that needs to be reclaimed to nullify more downside. You can take a look at my Market Moment articles where all of these signals were covered. Readers were notified well in advance.

On June 10th, I warned about bearish signals on agricultural commodities. In this special Canada Day/4th of July edition, I will take a look at what the major agricultural commodities are showing.

But before we do, some headlines.

I want you to do me a favor. Open a new tab and search “fertilizer shortage”. You will see articles about shortages in African countries, and most recently, in Nepal. Reuters also put out an article talking about global crop problems, which includes a global fertilizer shortage. Higher food prices are going to be here for some time.

But don’t fret, I have you covered. This past week, I highlighted three agriculture companies that are doing their part in alleviating the upcoming food crisis. One deals with cooking oil which saw a price increase of 30%, the highest ever. The second deals with fertilizers. The third deals with indoor farming.

You can actually listen to the investor roundtable serenade praise for these companies:

Interesting developments in Europe as Dutch farmers are protesting against emissions targets. Even threatening to protest at airports!

Farmers are protesting across the country as lawmakers voted on proposals to slash emissions of damaging pollutants, a plan that will likely force farmers to cut their livestock herds or stop work altogether.

The government says emissions of nitrogen oxide and ammonia, which livestock produce, must be drastically reduced close to nature areas that are part of a network of protected habitats for endangered plants and wildlife stretching across the 27-nation European Union. Livestock produce ammonia in their urine and feces. The government in the past has called on farmers to use feed for their animals that contains less protein as a way of reducing ammonia emissions.

The ruling coalition wants to cut emissions of pollutants, predominantly nitrogen oxide and ammonia, by 50% nationwide by 2030. Ministers call the proposal an “unavoidable transition” that aims to improve air, land and water quality. They warn that farmers will have to adapt or face the prospect of shuttering their businesses.

The response? Some 40,000 farmers gathered last week in the central Netherlands’ agricultural heartland to protest the government’s plans. Many arrived by tractor, snarling traffic around the country. Farmers took their protests to highways and dumped hay bales on the roads, and even at town halls and city halls. Some groups even lit them on fire starting bonfires outside the buildings.

Farmers argue that they are being unfairly targeted as polluters while other industries, such as aviation, construction and transport, also are contributing to emissions and face less far-reaching rules. They also say the government is not giving them a clear picture of their futures amid the proposed reforms.

We shall watch the developments. Agriculture is a significant part of the Dutch economy. According to a national farming lobby group, there are nearly 54,000 agricultural businesses in the Netherland with exports totaling 94.5 billion euros.

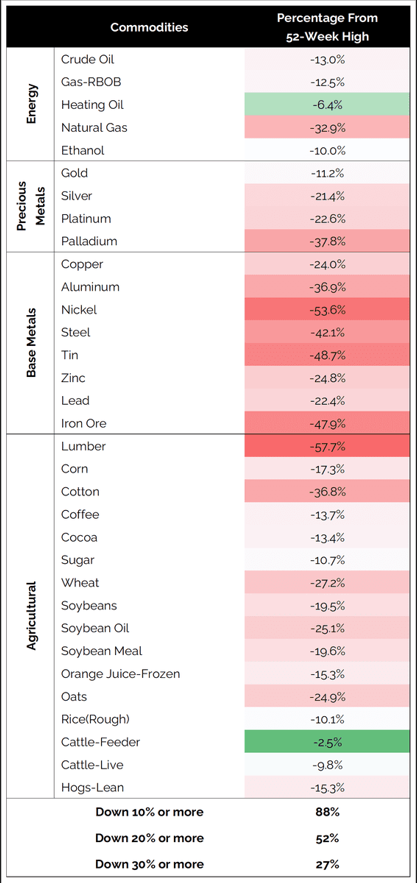

On the market front, many agricultural commodities have now entered a bear market falling 20% from their highs.

A variety of commodities are covered in the image above. A lot of red, and 52% of the list are in a bear market. Many see this as a sign of an impending recession. I wrote about an impending recession, and the commodity I follow for this is copper. Also known as Dr Copper. A recession means falling demand, which tilts the supply-demand mechanism to the supply side of things. More supply, less demand and prices fall. In fact, demand killing will be great to tame those inflation numbers. For dealing with non-monetary inflation.

As mentioned earlier, in a recent agriculture sector roundup I warned of reversal signs on the top three agricultural commodities: wheat, soybeans and corn. For those that don’t trade futures or cfds, you can trade or invest in them through Teucrium’s agricultural ETFs specifically tailored for each commodity. But as a general investor, I think this information is important to know.

Before I jump into the charts, why are we seeing a big drop in agricultural commodities?

JP Morgan recently projected high upside for ag commodities due to hot and dry weather. However those forecasts have now changed and growing recession fears are also impacting these markets.

More favourable weather forecasts drove the prices of ag commodities lower:

“We saw a shift in the weather model,” says Joe Vaclavik of Standard Grain. “NOAA’s Global Forecast System (GFS) introduced quite a bit more rain for the western two-thirds of the Corn Belt, which includes Iowa, Minnesota, Nebraska and the Dakotas. But, a lot of the eastern Corn Belt is still dry through that timeframe based on what I’ve seen in the weather models, at least for Illinois, Indiana, Ohio and places farther south.”

On recession fears:

“Commodity markets do not perform well during recessions, whether it’s crude oil, corn, soybeans,” says Vaclavik. “If you’re a large speculator sitting on a big long position in the grain markets or in the crude oil market, and you’re convinced that we’re headed toward a recession, you may think twice about that position. You may be selling out of that long position. I think that’s an additional negative factor here on Thursday.”

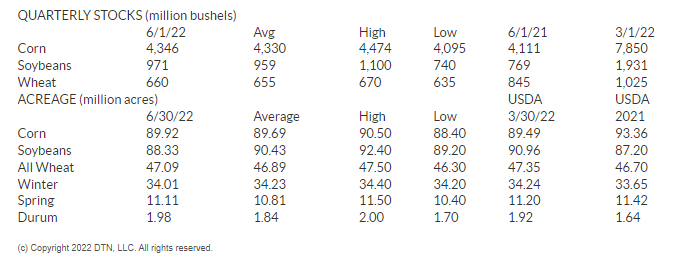

The Quarterly Grain Stocks report also just came out on the day of writing. Farmers planted 89.9 million acres of corn in 2022 and 88.3 million acres of soybeans. The corn estimate is higher than USDA’s March estimate, while soybean acreage is lower. Both are within the range of pre-report estimates.

According to DTN Lead Analyst Todd Hultman, USDA’s new planting estimates are neutral for new-crop corn and wheat, and a little bullish for new-crop soybeans.

When looking at the futures charts, it tells me traders are factoring in recession more than the grain stocks data.

Wheat futures broke a major support level. The breakdown below 1000 was the trigger. I would be selling any pullbacks as long as we remain below 1000. And that is exactly what traders are doing. The next support level comes in at 800. From there, we will have to see if wheat can begin to bottom, or if we take another leg lower.

In terms of the best opportunity currently, I would say it has to be short soybeans. A major break has broken to the downside. A failed upside break in early June of this year increases the bearishness. Soybeans hit 1500 before pulling back to retest the breakdown zone of 1600. Sellers are piling in as expected of typical breakout or breakdown price action. Prices tend to pullback to retest their breakout zone which allows for traders who missed the initial run to jump in. My next support comes in lower at 1400.

Now THAT’S a reversal pattern. Corn has printed and confirmed a head and shoulders pattern. I warned about this in my earlier article on June 10th. The support, or neckline, broke and we have already declined further without a retest. Prices gapped down which indicates trading reaction to the Quarterly Grains report. I wouldn’t be surprised for a move lower to under 600.

In summary, recession fears are impacting ag commodities. Downtrends have initiated and the top three commodities are all in bear markets. It is now all about how severe this recession will be. Yes, lower prices and demand will help tame non-monetary inflation, but let’s not forget about the outcome of the harvesting season. Weather forecasts look favourable now, but they are known to change on a whim.