A Not So Distant Reality

I have played Cyberpunk 2077. So, I know what a future filled with robots looks like. From suicidal taxi cabs to existential vending machines, the game depicts robots and humans as one and the same in many cases. I have a mental breakdown at least once a day so I was truly able to sympathize with my metallic counterparts, albeit virtually. However, we still have a ways to go before we reach this robotic utopia, or dystopia, depending on how you feel about robots.

Back in 2020, the global robotics market was valued at USD$27.73 billion. By 2026, this market is expected to reach USD$74.1 billion, expanding at a compound annual growth rate (CAGR) of 17.45% from 2021 to 2026. While cyborgs and Gundams are really cool, four of the most lucrative segments of the robotics market are currently industrial, service, medical, and automotive. So, who dominates this market?

Looking forward, the Asia-Pacific region is projected to experience a significant growth rate as the adoption of robots continues to increase. In particular, South Korea and China are paving the way for the adoption of robotics due to their massive deployment in the electronics and automotive manufacturing industry. The growth of robotics in the Asia-Pacific region is further supported by initiatives to improve robotics infrastructure.

For example, on December 28, 2021, China announced a five-year plan for smart manufacturing with the hopes of large manufacturers achieving digitization by 2025. This initiative is intended to strengthen the technology and market competitiveness of the sector as the global demand for advanced manufacturing continues to grow. The plan itself was released by the Ministry of Industry and Information Technology (MIIT) and 14 other government departments and includes various goals.

Five-Year Plan Goals:

- achieve digitization of over 70% of large-scale Chinese enterprises by 2025

- construction of more than 500 demonstration facilities nationwide by 2025

- technical level and market competitiveness of intelligence manufacturing and equipment/industrial software to exceed 70% and 50%, respectively

Broadly speaking, this five-year plan is intended to improve China’s industrial innovation capabilities while bolstering its foundation for industrial development. In doing so, China will be able to increase the supply of high-end products, expand the depth and breadth of applications, and optimize the structure of industrial innovation. Needless to say, China is hellbent on becoming a major global supplier of robotics innovation.

Under the initiatives outlined by China’s five-year plan, the average annual growth rate of operating income associated with the robotics industry is expected to exceed 20%. It is worth noting that China is the global leader in the total number of robotics patents issued, according to a study published by the Center for Security and Emerging Technology (CSET). The CSET found that China accounted for more than 25,000, or almost 35% of the global robotics patents issued between 2005 and 2019.

To put things into perspective, that’s approximately three times the number of robotics patents granted by the United States (US) in the same period. In 2019 alone, China received 5,400 robotics patents, or a 43% share of the global robotics patents, whereas the US only achieved 2,100. In terms of sales, between 2009 and 2017, China’s unit sales of industrial robots increased from 60,000 to 381,000 annually, representing an impressive CAGR of 26%.

Rise of Service Robotics

Thus far, we have focused on China’s industrial robotics scene. However, following the onset of the COVID-19 pandemic, increased hygiene demands have created a new niche for service robots. According to the Chinese government’s 2020 Service Robot Industry Research Report, the nation’s service robot sector was the fastest growing in the world, representing more than 25% of the global service robot market in 2020.

As you would expect, the global pandemic accelerated the adoption of service robotics as many companies scrambled to find innovative ways to continue their operations. In particular, Beijing has been a substantial advocate for China’s robotics initiatives, standing behind the nation’s plan to invest an estimated USD$1.4 trillion over six years. Speaking of Beijing, China’s robotics industry experienced a substantial surge at the Beijing Winter Olympics.

$24.656M Market Capitalization

Since 2019, Beijing has hosted numerous evaluation contests for service robot innovation at the 2022 Winter Olympics. In fact, 84 robots manufactured by 47 companies, ranging from hotel check-in to food delivery robots, participated in this selection. One of the stars of the show includes ORION STAR’s Coffee Master, a robot capable of operating intricate movements including brewing, pouring, and serving coffee.

If that wasn’t impressive enough, Coffee Master also ensures taste quality via millions of data-level vision training and 3,000 hours of artificial intelligence (AI) learning. Sounds like a cracked-out version of a Nespresso. Taking up just three square meters of space, the Coffee Master is capable of pumping out 500 cups of hand-dripped coffee per day. If you’re looking for an investment opportunity, let’s take a look at a company with a significant presence in China.

Guardforce AI Co. Ltd.

Guardforce AI Co. Ltd. (GFAI.Q) is a globally integrated security solutions provider focused on the development of robotic solutions and information security services. The Company’s solutions and services are intended to compliment Guardforce’s established secured logistics business. By integrating multiple functionalities of its products, the Company has rolled out robotics as a service (RaaS) solutions for numerous service industries, including public health, education, and hospitality, to name just a few.

Currently, Guardforce has partners in Singapore, Malaysia, Thailand, Hong Kong, and Macau. The Company’s GFAI Intelligent Cloud Platform (ICP) provides businesses with access to an intelligent, convenient, and safe robotic management system. In addition to robot management, ICP also offers cloud advertising, data management, and statistics. Regarding the Company’s robotic product offering, Guardforce offers its Concierge Robots, Spray Robots, Air Disinfection Robots, and Delivery Robots.

Robotics as a Service

the Robotics as a Service (RaaS) business model allows customers to access robotic automation without the heavy investment required for robotic hardware. In other words, customers pay a monthly or yearly fee to use RaaS solutions in exchange for a provider’s services, in this case, Guardforce. The provider is then responsible for ensuring a customer has access to its service, as well as conducting robotic installation and maintenance.

As a whole, the RaaS market is quite profitable, with ABI Research predicting that there will be 1.3 million installations by 2026, generating $34 billion in revenue. Guardforce’s recently closed Direct Offering has spooked many investors, however, the Company’s expansion looks promising. In addition to announcing its initial robotics solutions rollout in the US, Guardforce announced on May 4, 2022, that it has surpassed 4,800 robot deployments worldwide.

“In just February of this year, we announced we had surpassed 1,400 robot deployments. I am pleased to announce we have now surpassed 4,800 robot deployments worldwide…We anticipate our robot deployments will continue to grow rapidly and should exceed 10,000 deployments by year-end,” said Terence Yap, Chairman of Guardforce.

Guardforce’s rollout strategy includes offering initial pilot programs to customers, allowing the Company to gather important customer feedback and potentially upsell new features and applications. Guardforce’s milestone of 4,800 robot deployments globally indicates that the Company’s strategy is working effectively. Furthermore, Guardforce recently entered into an agreement with Blue Pin, a leading software provider specializing in hotel automation technologies.

In terms of Guardforce’s presence in China, on March 21, 2022, the Company announced that it will purchase up to 36 of the Kewei Group’s subsidiaries in China. It is worth noting that many of the Kewei Group’s companies are already well-established suppliers of robotic sales and rental services, serving clients in the hospitality, healthcare, government, and property management segments. With this in mind, Guardforce is positioned firmly in China’s booming robotics industry. If you’d like to know more about Guardforce, check out this article!

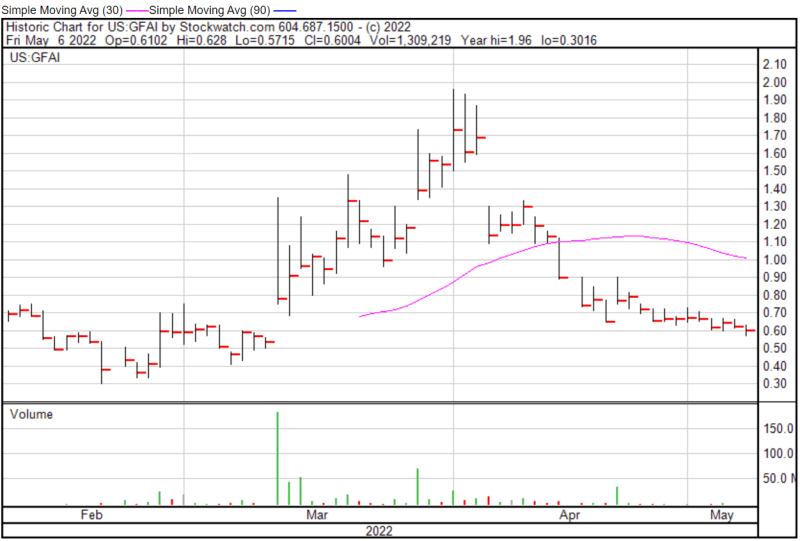

Guardforce’s share price opened at $0.6102 today, down from a previous close of $0.6231. The Company’s shares were down -3.64% and were trading at $0.6004 as of 1:27 PM EST.