Evoke Pharma is a specialty pharmaceutical company focused primarily on the development of drugs to treat GI disorders and diseases. The company developed, commercialized and markets GIMOTI, a nasal spray formulation of metoclopramide, for the relief of symptoms associated with acute and recurrent diabetic gastroparesis in adults.

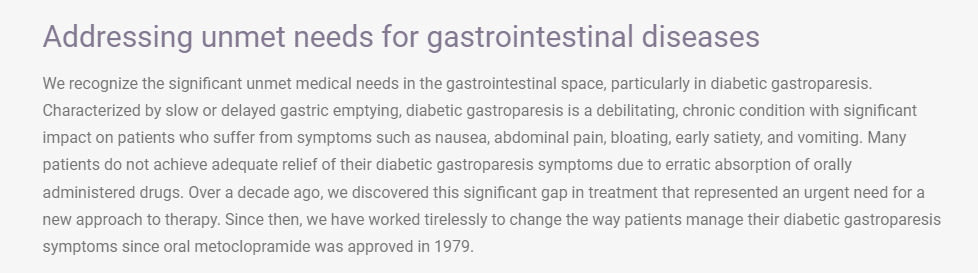

Diabetic gastroparesis is a GI disorder affecting millions of patients worldwide, in which the stomach takes too long to empty its contents resulting in serious GI symptoms as well as other systemic complications. The gastric delay caused by gastroparesis can compromise absorption of orally administered medications. Prior to FDA approval to commercially market GIMOTI, metoclopramide was only available in oral and injectable formulations and remains the only drug currently approved in the United States to treat gastroparesis.

In terms of the product line, there is one for now. GIMOTI nasal spray , the first and only FDA-approved nasal delivery treatment for the relief of symptoms in

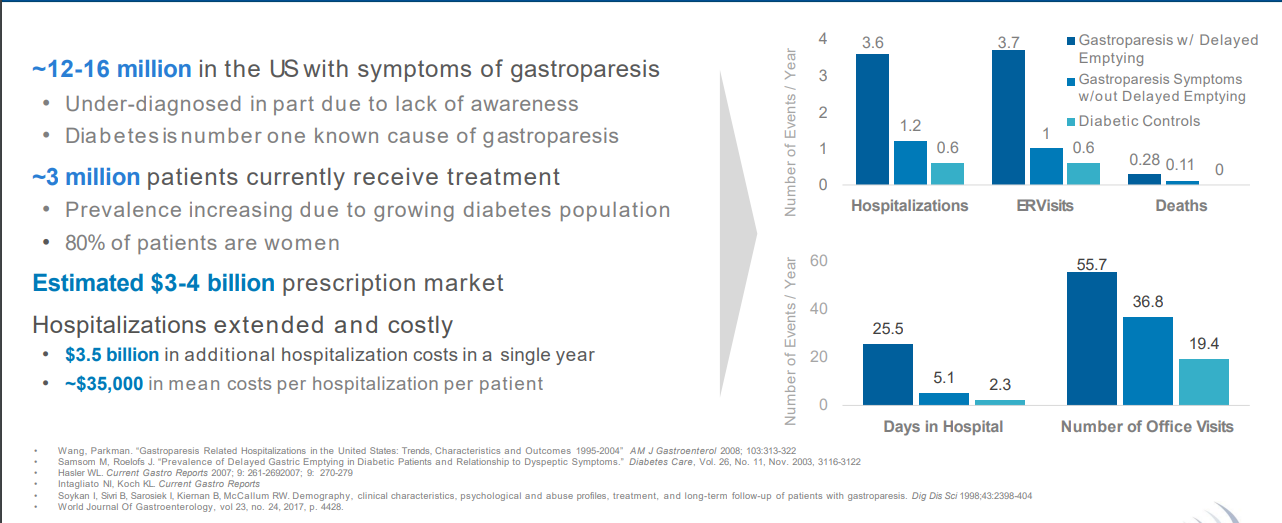

adults with acute and recurrent diabetic gastroparesis, which was successfully launched in 2020. This product addresses a large and growing market in the US, estimated between $3-$4 Billion.

The big news which has the stock popping over 150% at the time of writing, is that Evoke Pharma has been granted FDA market exclusivity for GITMOTI. Evoke now has exclusive marketing rights over a period of three (3) years from the original date of approval under the Hatch-Waxman Act to protect the product from generic drug competition.

In addition to the market exclusivity, Evoke maintains a robust patent estate, with currently two Orange book-listed patents entitled “Nasal Formulations of Metoclopramide,” U.S. Patent No. 11,020,361, and U.S. Patent No. 8,334,281, that expire in 2029 and 2030, respectively. The Company has also been granted gender-specific patents in the E.U., Japan, and Mexico with coverage until 2032. Furthermore, the Company has other pending patent applications with individual expiration dates of 2032, 2037, and 2038, if approved.

“Receiving marketing exclusivity rights from the FDA for GIMOTI further establishes our proprietary concept of delivering an effective medication through the nasal pathway for the treatment of symptoms associated with diabetic gastroparesis. We are excited to continue our mission of getting GIMOTI to patients who are in need of a non-oral treatment for gastroparesis and capitalize on this large and growing market opportunity in the U.S.,” commented Matt D’Onofrio, MBA, Evoke Pharma Chief Business Officer.

The stock saw a monster rally with monster volume. Average volume on the stock is 102,560. Today’s volume has seen 119,,082,186 and we are still early in the trading day!

The stock gapped up hard and hit our major resistance at $1.50. Going forward, Evoke will need to confirm a daily close above this resistance to begin the next major leg higher. As I am writing this, the stock price is currently testing a major psychological zone. The $1.00 of course. If Evoke can confirm a close above this level by the end of the day, it sets things up nicely for another potential retest of $1.50.

Keep in mind that there will probably be a lot of selling pressure as long time holders take profits. You can understand why they would with the stock moving over 100% in a day.

I have drawn out support at the $0.65 zone. The stock could pullback to this level before being met with more buyers. Technically, the stock remains bullish above $0.40. This is because we have a huge gap from $0.40 to the current share price. Gaps tend to be very bullish and supportive. If a stock ever ‘fills the gap’, it means it has given back the entire gap up pop move. If this is the case with Evoke and we close back below $0.40, then the upwards momentum is killed.

I don’t think that will be the case though as the company put out big news, and their recent presentation shows a cash position of just over $9 million USD. There is another upcoming catalyst which could sway the stock price to levels I have mentioned in this Market Moment. We have earnings due out sometime between May 10th 2022- May 16th 2022. The numbers will be important, but I would focus on that cash position. The company will probably want to do some sort of financing to take advantage of this news and stock price. The amount we see in that cash position can be a good indication of how soon this will occur.