While many people would say the biggest news on Sunday was the Will Smith slap at the Oscars, I beg to differ. Maybe the contrarian in me. A major trigger occurred on the crypto markets. Bitcoin confirmed a breakout which sees a new uptrend begin.

Last week on March 23rd 2022, I wrote an article explaining the breakout triggers for Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Dogecoin. If you did take entries from my analysis, you are one happy camper. Very big moves in Ethereum and Bitcoin, with the breakout in the latter possibly confirming a bull cycle for cryptocurrencies.

In my previous article, I spoke about the world’s largest hedge fund, Bridgewater Associates, setting up to invest in Bitcoin. Institutional money getting involved will be bullish. Yes, this does mean regulations on cryptocurrency exchanges are likely to be implemented. But as I have said, more institutional money getting involved is bullish. However, the trade off is that Bitcoin can be influenced by big government, big banks, and big corporations. One of the main reasons for investing in Bitcoin in the first place was to be far away from those big groups. So the hardcore OG Bitcoin bulls might not be too happy with this. They probably will move a lot of their assets to DeFi.

Another major news came out which may speed up the move to regulate cryptos in the US. Russia made a huge announcement last week when they said that ‘unfriendly’ nations would have to settle payments for their energy in Rubles. Putin initiated a battle against the PetroDollar. Some even dubbing the Ruble the Gas-Ruble now. But there are rumors that Russia may be considering something else for their energy. That something else is Bitcoin.

According to a high ranking law maker named Pavel Zavalny, Russia is considering accepting Bitcoin as payment for its oil and gas exports. “Friendly” countries could be allowed to pay in the cryptocurrency or in their local currencies.

Some see this as adding more risk as Bitcoin has moved 30% this year whereas the dollar 5%. Furthermore, not much transactions in Bitcoin would happen anyways due to the fact China, one of Russia’s allies, has banned Bitcoin:

“Clearly accepting Bitcoin, compared with other traditional currencies, introduces considerably more risk in the trade of natural gas,” Mr Broadstock said.

“Moreover, one of the major ‘friendly’ trade partners for Russia is China, and cryptocurrency is banned for use in China,” he added. “This clearly limits potential for payment using Bitcoin.”

If news comes out that Russia is now accepting Bitcoin, it is likely the Biden administration could speed up on regulating Bitcoin. They have a good reason now with the Russians getting involved in the markets. Hopefully it is just regulations and nothing worse. Bitcoin and the crypto space in general will be interesting to watch in the next few weeks.

My readers know that I consider Bitcoin and other crypto’s as risk on assets. They are not acting like risk off/safety assets. I have found crypto’s move in positive correlation with US stock markets. When stock markets move up, cryptos move up. When stock markets move down, cryptos move down. Keep this in mind as it appears that markets may pullback this week, and could mean the crypto breakouts do the same to confirm a retest at the breakout zone.

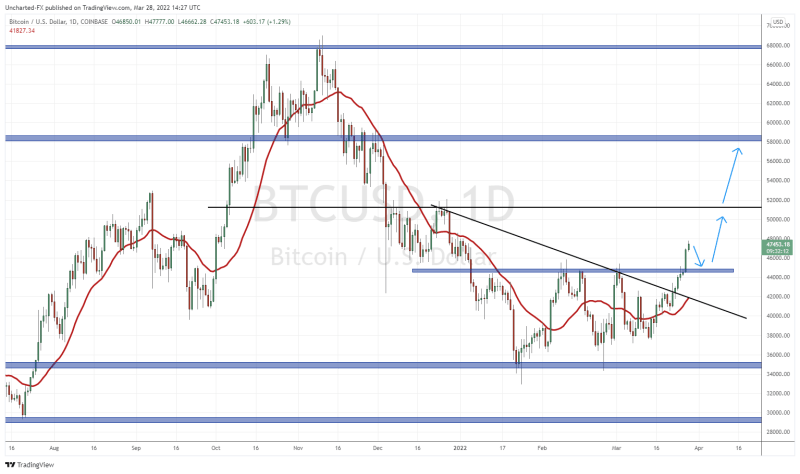

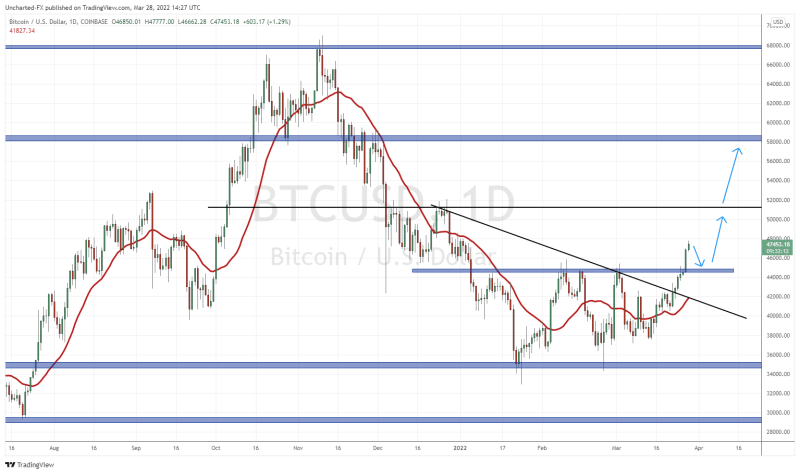

Bitcoin for example confirmed a breakout above our $45,000 resistance zone. This level is now new support, and we could pullback for a retest. This would give buyers a second chance to enter, and form a higher low swing taking us to $50,000 and beyond. If Bitcoin closes below $45k, we then have a false breakout or fake out. Bulls would be trapped, and the bears would take back control.

What gets me to believe there will be a pullback is the fact that Bitcoin has had 6 green candle days in a row. It is due to a pullback.

Depending on the retest, I would then be looking at a swing trade all the way up to $58,000. The technicals look absolutely prime for Bitcoin and other cryptocurrencies.