Fertilizer prices have hit record highs. Here on the Equity Guru Agriculture roundup, we have been warning readers of a fertilizer crisis coming this Spring planting season in North America. There was some fear in Canada that this would be exacerbated due to a CP rail strike. However, as of now, it looks like an agreement was reached and workers are returning to work.

Russia and Ukraine make up 30% of world wheat exports. I have broken down the numbers on previous roundups. Russia is a huge fertilizer/potash supplier. Markets are looking at rising energy costs, but soon people will be talking about rising food prices…and food shortages.

Prices of raw materials that constitute the fertilizer market like ammonia, nitrogen, nitrates, phosphates, potash and sulphates are up 30% since the beginning of the year.

In 2021, Russia was the world’s top exporter of nitrogen fertilizers and the second-largest supplier of both potassic and phosphorous fertilizers. Now Russia, which accounts for around 14% of global fertilizer exports, has temporarily suspended outgoing trade, which is expected to have a strong ripple effect across global food markets.

Some smart analysts have been warning that Putin not only controls energy, he controls food. The latter is more significant than the former.

Fertilizer prices last week were nearly 10% higher than the week before according to Green Markets North America Fertilizer Price Index, the highest price point ever recorded. Prices are now 40% higher than a month ago, before the invasion of Ukraine.

I remain bullish on agriculture stocks, and I suggest having some in your portfolio. Personally, I think we are still in the first innings of this major move.

Back in November, I warned readers of a potash/fertilizer shortage. In that agriculture sector roundup, I listed some companies to put on your fertilizer watchlist. In this roundup, I will go back to review those companies.

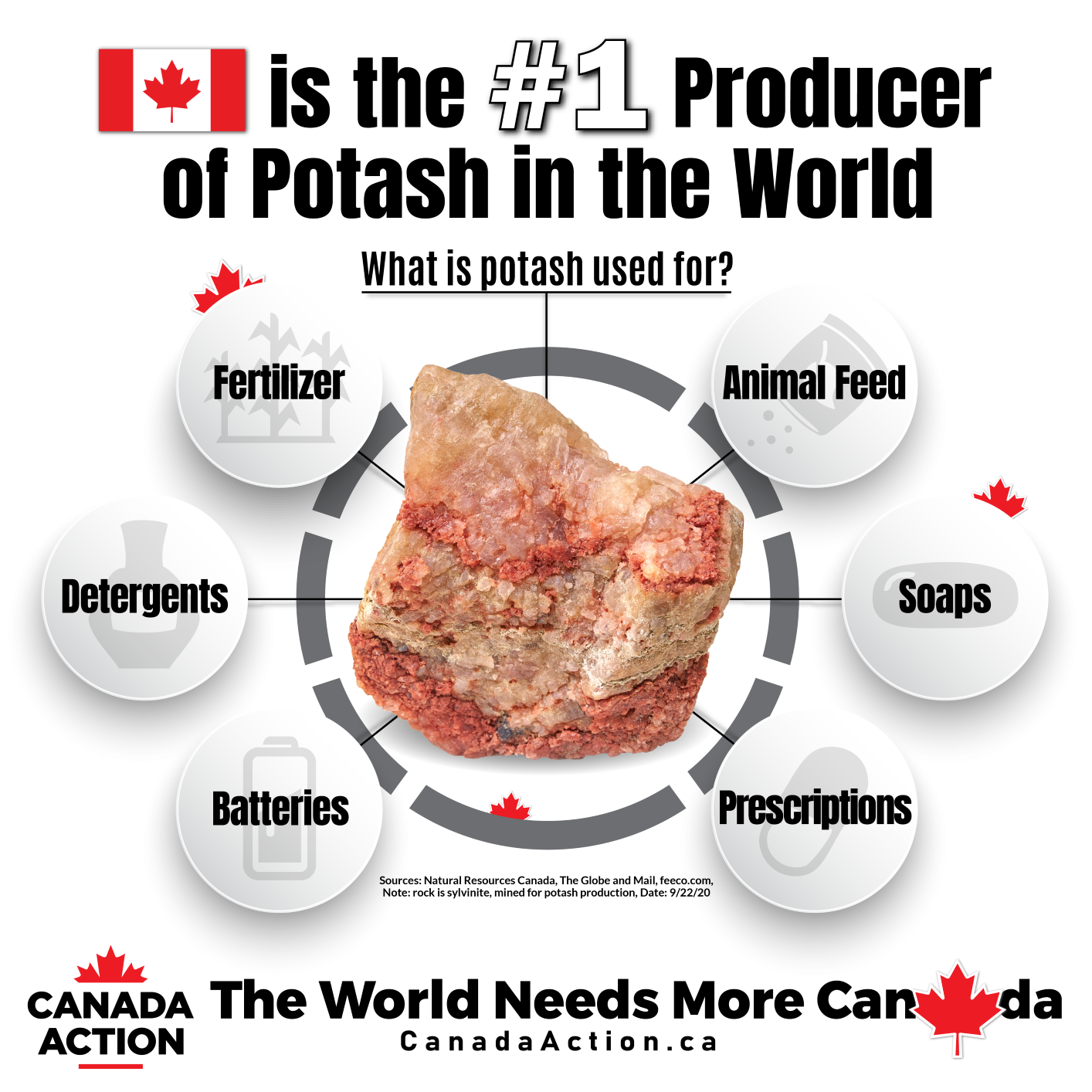

Before we begin looking at charts, I want to highlight that Canada will be making investor headlines soon. Why? We are the number 1 producer of potash in the world, and nations will look to use to make up for Russian supply. Potash is a key input required for producing nitrogen-containing fertilizers, and Russia and Belarus are the world’s second- and third-largest producers of the commodity after Canada.

Nutrien (NTR, NTR.TO)

Nutrien is the largest US farm supplier. They are the big guys in Potash. The company offers potash, nitrogen, phosphate, and sulfate products; and financial solutions. It also distributes crop nutrients, crop protection products, seeds, and merchandise products through approximately 2,000 retail locations in the United States, Canada, South America, and Australia.

The stock has rallied 59% in 6 months. Due to recent events in Eastern Europe, Nutrien is set to increase potash production due to supply worries. It plans to increase potash output by nearly 1 million tonnes this year to about 15 million tonnes. Nutrien said the additional volume of potash is expected to be produced in the second half of the year.

The chart is of the TSX listing (.TO). The stock has been on a tear. In fact, yesterday we printed new record all time highs! These guys are like the Aramco or the Kazatomprom of Potash. Nutrien will be the first company to come to mind on Wall Street. The value investors love it. With the stock paying a dividend AND increasing production to meet demand for a commodity that is increasing in prices…forward guidance looks very positive.

Currently in the higher low sits at $92.50. Major support comes in all the way at $77.50. The major psychological support comes in at the big $100 zone. It would be interesting to see how we react when pullback to retest $100.

Western Resources (WRX.TO)

Western Resources Corp is constructing Canada’s newest and most innovative, environmentally friendly and capital-efficient potash mine in Saskatchewan. This will be the first potash mine in the world that will leave no salt tailings at the surface, thereby reducing the water consumption by half as well as significantly improved energy efficiency.

Back in November 2021, I gave the WRX chart the BASED stamp of approval. It met all of my criteria. We got the range break and the retest which led us to new higher highs. Technically, the uptrend remains as long as we remain above $0.225.

In February 2022, we got news that Western Resources signed a subscription agreement in which Vantage Chance Limited committed to make a strategic equity investment of CAD $80,000,000 in Western Potash and its Milestone Potash Project.

Upon approval by Western’s shareholders, and prior to the completion of the transactions contemplated in the Subscription Agreement, Western will transfer its 100% equity interest in WPC (134,017,653 common shares) to WPHC in exchange for an equivalent number of WPHC common shares, which will represent 100% of the issued and outstanding shares of WPHC.

Closing is expected to occur on or around May 31, 2022. The Investment proceeds raised from the Investment Transaction will be used in the completion of the Milestone Potash Project construction.

Verde Agritech (NPK.TO)

A popular company among my readers, and one of our biggest winners. Verde is an agricultural technology company that develops and produces fertilizers. They hold properties, and are based out of Brazil. The company produces and sells K Forte, a multinutrient potassium fertilizer; and Super Greensand, a fertilizer and a soil conditioner.

The company is putting out stellar earnings and forward guidance, as well as having access to Banco do Brasil financing. Verde is increasing fertilizer output, and has the ability to use financing to increase growth and production. Tons of positives for the company and the share price reflects all this positive news!

This week, Verde released financial results for Q4 2021 and year ended December 31 2021. Here are highlights:

- evenue increased by 391% in Q4 2021, to $10,851,000 compared to $2,209,000 in Q4 2020.

- Revenue in Brazilian Real (“R$“) increased by 450% in Q4 2021, to R$46,723,000 compared to R$8,489,000 in Q4 2020.

- Sales by volume increased by 137% in Q4 2021, to 134,350 tonnes sold compared to 56,585 tonnes sold in Q4 2020.

- Gross margin increased to 75% in Q4 2021, compared to 59% in Q4 2020.

- Operating profit before non-cash events increased by 6786% in Q4 2021, to $2,452,000 compared to $36,000 in Q4 2020.

- Net profit increased to $1,878,000 in Q4 2021, compared to a net loss $192,000 in Q4 2020.

Just look at that stock chart. We called the breakout way back around $1.50 when we were in a range. We took out previous record highs at $6.00, and since then, have been printing new record highs. I want to focus your attention on the retest of $6.00. Look at the large wick indicating buyers stepped in. Just our typical breakout and retest.

I am now watching to see if we can get a daily candle close above $9.20. That would set us up for more record highs. I would also watch the $10.00 zone as this is the key psychological resistance zone.

Karnalyte Resources (KRN.TO)

Karnalyte Resources Inc. explores for and develops agricultural and industrial potash, nitrogen, and magnesium products in Canada. Karnalyte owns the construction ready Wynyard Potash Project, with planned phase 1 production of 625,000 tonnes per year of high grade granular potash, and two subsequent phases of 750,000 TPY each, taking total production up to 2.125 million TPY.

The company announced third quarter results which included an update of capital cost summaries, operating cost summaries, and an update of the market and economic analysis way back in November of 2021.

Because of the move, it is better to look at Karnalyte on the weekly timeframe. Our major daily resistance from November 2021 at $0.315 was taken out with ease. We got the pullback and retest and then boom! Lift off!

We took out $0.50 very quickly and now have crossed over $1.00! Notice the range between $0.80-$1.20. We are now looking for a weekly close above $1.20 to signal a breakout and the next run higher. $0.50 is the higher low we are working with for the uptrend to remain intact.

Gensource Potash (GSP.V)

Gensource is a fertilizer development company based in Saskatoon, Saskatchewan and is on track to become the next fertilizer production company in that province. With a modular and environmentally leading approach to potash production, Gensource believes its technical and business model will be the future of the industry. Gensource operates under a business plan that has two key components: (1) vertical integration with the market to ensure that all production capacity built is directed, and pre-sold, to a specific market, eliminating market-side risk; and (2) technical innovation which will allow for a small and economic potash production facility, that demonstrates environmental leadership within the industry by using significantly less water per tonne compared to conventional solution mining operations, producing no salt tailings, therefore eliminating decommissioning risk, and requiring no surface brine ponds, thereby removing the single largest negative environmental impact of potash mining.

Their Tugaske project in Saskatchewan is shovel ready, has debt financing secured, and initial activities such as team formation and ramp up have begun.

Gensource Potash also printed new all time record highs since the last time I looked at the stock. $0.25 was the previous record highs. This is another smaller cap play still in the early stages. There seems to be an interim uptrend here with multiple higher lows and higher highs.

The Mosaic Company (MOS)

Another one of the big boys that will attract Wall Street and Institutional money as this fertilizer play develops. The Mosaic Company produces and markets concentrated phosphate and potash crop nutrients in North America and internationally. The company operates through three segments: Phosphates, Potash, and Mosaic Fertilizantes. It owns and operates mines, which produce concentrated phosphate crop nutrients, such as diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products; and phosphate-based animal feed ingredients primarily under the Biofos and Nexfos brand names, as well as produces a double sulfate of potash magnesia product under K-Mag brand name. The company also produces and sells potash for use in the manufacturing of mixed crop nutrients and animal feed ingredients, and for industrial use; and for use in the de-icing and as a water softener regenerant.

The stock has nearly doubled since my November 2021 post when the stock was retesting a breakout.

Now, we are on the verge of confirming a weekly candle breakout if we can close above $64 by the end of Friday! A massive few weeks of rally just like Nutrien. The stock also pays a dividend but it is significantly smaller than Nutrien.

CF Industries Holdings (CF)

CF Industries Holdings, Inc. manufactures and sells hydrogen and nitrogen products for clean energy, fertilizer, emissions abatement, and other industrial applications worldwide. Its principal products include anhydrous ammonia, granular urea, urea ammonium nitrate, and ammonium nitrate products. The company also offers diesel exhaust fluid, urea liquor, nitric acid, and aqua ammonia products; and compound fertilizer products with nitrogen, phosphorus, and potassium.

The company has also boosted US fertilizer shipments, is making 52 week highs, and will be attracting big money.

Just like the other bigger companies, CF has been ripping. Printing new record all time highs. We have also crossed the important $100 level. This price level becomes new support, and we remain in an uptrend as long as price holds above the $88 higher low.

Itafos (IFOS.V)

Another Canadian company that has appeared in multiple sector roundups in the past. Itafos operates as a phosphate and specialty fertilizer platform company. It operates through Conda, Arraias, and Development and Exploration segments. The company produces and sells monoammonium phosphate (MAP), MAP with micronutrients, superphosphoric acid, merchant grade phosphoric acid, single superphosphate (SSP), SSP with micronutrients, and ammonium polyphosphate.

Backing out to the weekly chart, and we have an interesting weekly resistance zone. $1.60 was a huge breakout zone. If the weekly candle can close above $2.80, we get another breakout and a move up to test previous record highs.

SOPerior Fertilizer (SOP-H.V)

SOPerior Fertilizer Corp. engages in the exploration, evaluation, and development of mineral properties and related projects in the United States and Canada. The company explores for alunite deposits to produce sulphate of potash, sulphuric acid, and alumina. Its principal mineral project is the Blawn Mountain project covering an area of approximately 15,404 acres of land located in Beaver County, Utah.

Soperior is one of the stocks that has not broken out since that November post. We still remain based and the potential remains. I really like set ups with a long range. But the breakout is the trigger. There is a chance that by the time you are reading this article, Soperior is breaking out. We just need a daily close confirmed above $0.08. VERY BIG volume too yesterday with 7,250,163 shares traded. The most volume since December 20th 2021.

Intrepid Potash (IPI)

Intrepid Potash, Inc. produces and sells potash and langbeinite products in the United States and internationally. It operates through three segments: Potash, Trio, and Oilfield Solutions. The Potash segment offers muriate of potash or potassium chloride for use as a fertilizer input in the agricultural market; as a component in drilling and fracturing fluids for oil and gas wells, as well as an input to other industrial processes in the industrial market; and as a nutrient supplement in the animal feed market. The Trio segment provides Trio, a specialty fertilizer that delivers potassium, sulfate, and magnesium in a single particle.

Intrepid released financial results for Q4 and full year 2021. Here are highlights:

- Net income of $223.9 million and $249.8 million in the fourth quarter and full year 2021, respectively, which includes the release of $215.9 million of valuation allowance for deferred tax assets

- Adjusted net income(1) of $8.0 million and $21.8 million in the fourth quarter and full year 2021, respectively. Recorded $7.0 million of tax expense in the fourth quarter and full-year 2021 as a result of the release of the valuation allowance against the deferred tax assets

- Adjusted EBITDA(1) of $24.8 million for the fourth quarter, bringing full year adjusted EBITDA to $67.6 million

- Cash flow from operations of $19.6 million in the fourth quarter, increasing full year cash from operations to $79.1 million

- Cash on hand of approximately $60 million as of March 7, 2022

A very nice weekly chart set up. We broke out above $50 just three weeks ago. We did pullback, not exactly all the way to $50, but close enough and buyers did step in. This is evident by the large wicks. If we can close above the previous weekly candles by the end of Friday, we do have a breakout. It does look like Intrepid wants $110, which is the next major resistance zone I see on the chart.

EarthRenew (ERTH.CN)

EarthRenew Inc. produces and sells organic fertilizers from livestock waste in North America and Europe. It also produces electricity from natural gas using an industrial-sized gas turbine and supplies to the electrical grid and cryptocurrency miners. The company sells it fertilizers under GrowER and GrowER Biochar names.

I have talked about my love for this company fundamentally and technically. For more detail, check this article out.

Have been a fan since the stock broke out above $0.20. This type of set up and market structure is what I trade in a heartbeat. The retest saw massive buying at $0.20. I remain bullish above this level, and expect to see more multiple higher highs and higher lows.